It is been a brutal earlier 24 several hours for Bitcoin.

Just after attempting to protected $10,000 as support on June 10th, the cryptocurrency failed to do so, diving as a substitute of rallying as most investors ended up expecting.

The weak spot culminated in a $1,000 fall lower on June 11th that took spot over the training course of roughly 8 several hours. In the course of the fall, about $80 million worth of positions on BitMEX by itself have been liquidated, crushed as the $9,500 assist was quickly dropped.

The bull case is getting a powerful boost with the news that a get wall has appeared on Bitfinex, nevertheless.

Bitcoin Buy Partitions Show up, Boosting Bull Situation

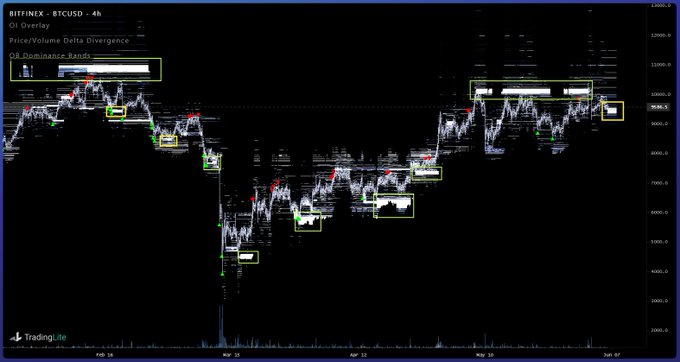

A trader shared the chart under on June 11th, demonstrating that according to the Order E book Dominance Bands indicator, a enormous block of purchase orders have appeared from $8,600 to $9,000 for BTC.

Even though this may well suggest that the cryptocurrency has space to drop from the latest rate of $9,300, this kind of a massive confluence of acquire orders demonstrates that potential buyers consider there is upside in advance of Bitcoin.

As indicated down below, whenever there has been solid buy guidance in excess of the past handful of months, the cryptocurrency has rallied. In addition, every time there was a confluence of sell-side orders, the craze topped.

Related Reading through: Ethereum Is “Coiling” for a Breakout as ETH 2. Nears: Here’s What Analysts Are Stating

Weak Inventory Market place Could Crush Bull Narrative

The bull scenario may nonetheless be in engage in, but a tumbling stock sector could transform the narrative.

Bitcoin’s weak spot on June 11th arrived as the S&P 500 and Dow Jones noticed their even worse performances considering the fact that the serious weak point found in March and April, equally falling around 6%.

As Avi Felman of BlockTower Capital noticed, “the tick for tick with the SPX is back again child.” This comment was referring to analyses from March and April that discovered Bitcoin and the S&P 500 were being trading in tandem, with selling prices going jointly down to the moment.

Tick for tick with the SPX is again baby ????????

— Avi IS Proper (@AviFelman) June 11, 2020

Most analysts feel to be bullish on the industry, inspite of the 6% drop.

However the fundamental economy is painting distinct symptoms: as reported by Bloomberg, the World Bank is now projecting the even worse economic decline due to the fact Environment War 2, an yearly GDP fall of 5.2%.

It is not very clear if the stimulus from governments will be more than enough to stave off a stock industry decrease associated to the bad macroeconomic knowledge.

Should stocks plunge still again, Bitcoin is unlikely to gain. As Arthur Hayes of BitMEX explained:

“Bitcoin will be owned unlevered. Could the value retest $3,000? Completely. As the SPX rolls over and assessments 2,000 assume all asset lessons to puke once again. As violent as the Q1 collapse in asset values was, we have just about 100 many years of imbalances to unwind the ancien régime.”

Highlighted Picture from Shutterstock Price tag tags: xbtusd, btcusd, btcusdt Enormous Bitcoin Buy Partitions Surface in the Very low-$9,000s in Crucial Get for Bulls