To quite a few, determining which direction Bitcoin tendencies from below is a coin toss. One trader shared the image below with the caption: “You fellas still trading this rubbish? I’m not accomplishing something until eventually one particular of these lines receives hit.”

Which is to say, the analyst isn’t having a buying and selling posture in Bitcoin for the reason that he has no thought the place it will go 1st.

BTC array chart shared by chartist/technician Byzantine Basic (@Byzgeneral on Twitter). Chart from TradingView.com

However for bulls, the evidence is commencing to soften that a correction is more most likely than a rally.

Bitcoin Could Be Subject matter to a Steep Correction, Indicator Exhibits

Bitcoin’s cost motion has efficiently been flat more than the past eight weeks. But a important indicator implies that a bearish undercurrent has shaped as BTC has consolidated all around $9,000.

A trader shared the below chart on July 3rd, displaying that BTC is forming a bearish development as for every the Tom Demark Sequential. The TD Sequential is a time-based indicator that alerts tendencies and inflection factors in an asset’s rallies or corrections.

“With a few much more days remaining in the weekly candle, Bitcoin is on a Pink 2 underneath a Red 1 which would sign a small trade on a weekly timeframe, all in the context right after a perfected Eco-friendly TD9 the first 7 days of June.”

They included that Bitcoin final appeared like this per the TD Sequential in early March, prior to the crash to $3,700.

Bitcoin price tag chart shared by crypto trader "Big Chonis" (@Bigchonis on twitter). Chart from TradingView.com

The bearish sign poised to be registered by the TD Sequential isn’t the only sign tying Bitcoin’s latest cost motion to the February leading.

Not the Only Bearish Sign

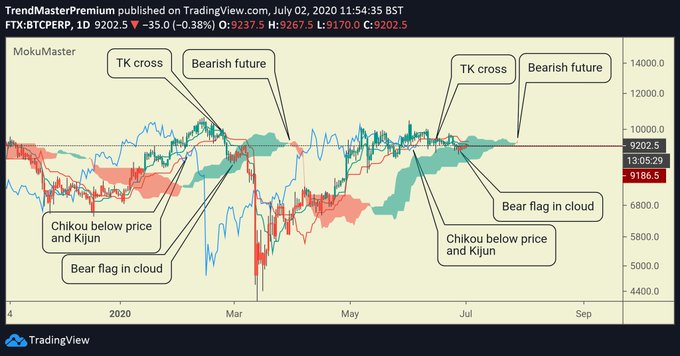

Below is a chart from an Ichimoku Cloud professional demonstrating that Bitcoin is hunting structurally comparable to how it looked prior to the March crash.

As the trader annotated on the chart underneath, 4 Ichimoku Cloud alerts that had been present then are current now.

Bitcoin Ichimoku Cloud analysis by trader "Ichimoku Scholar" (@Ichimokuscholar on Twitter). Chart from TradingView.com

Taking into consideration the confluence, it is no marvel that institutional traders involved with Bitcoin are being very careful.

As described by NewsBTC beforehand, CME futures details exhibits that establishments have been making a internet limited place in Bitcoin. Just one trader shared the impression beneath at the close of June, exhibiting that “institutional traders” on the CME are cumulatively shorting 2,038 contracts.

The final time institutional traders ended up as bearish as they are now was in February, prior to the crash to $3,700.

BTC price chart with CME's Motivation of Traders report facts. Chart from TradingView.com designed by Byzantine Standard (@Byzgeneral on Twitter).

Showcased Image from Shutterstock Price tag tags: xbtusd, btcusd, btcusdt Charts from TradingView.com A Signal Final Seen Prior to Bitcoin Plunged to $3,700 Is About to Return