Since Sept. 3, Ethereum’s native token, Ether (ETH), has been losing value against its primary crypto rival, Bitcoin (BTC).

Ether’s value against Bitcoin has fallen over 25% since peaking in September at 0.07955 BTC. As the leading cryptocurrency fell, it left a trail of smaller highs and lows, producing a downward channel.

Later that day, ETH/BTC broke above the channel, raising hopes for a strong extended recovery trend. However, a selloff on Sunday and the current session prompted traders to look for support at the channel’s resistance trendline.

The price charts for ETH indicate a bullish divergence

The emotion increased Ether’s chances of re-entering the dropping range, as illustrated in the chart below.

Simultaneously, the emergence of higher highs in the daily commodities channel indicator (CCI) of ETH/BTC indicated a hidden divergence from the pair’s decline. CCI is a momentum oscillator that examines an instrument’s deviations from its statistical mean in order to identify potential reversals.

„A concealed divergence is always a sign of a potential trend reversal,“ remarked Stefan Krecher, a market strategist based in Germany, adding that ETH/BTC may rebound in the coming sessions as the pair’s daily relative strength index (RSI) is „not overbought.“

Krecher expected that Ether will reach its monthly pivot point around 0.071586 BTC, or about 8% of current values. The upside goal also coincided with the 0.618 Fibonacci retracement level (0.071505 BTC) in the chart above.

On the other hand, reentering the declining channel range might drive ETH/BTC back to its range support trendline near 0.058238 BTC.

Ether price against the dollar

The optimistic ETH/BTC price forecast was confirmed Monday, as Ether held a strong support level of $4,000 while rebounding over 2.6 percent. Meanwhile, Bitcoin’s price has retraced nearly 3.5 percent following the establishment of a similarly robust price floor near $60,000.

As a result, ETH/BTC appeared weaker simply because Bitcoin gained more strongly against the US dollar than Ether did. Nonetheless, as previously reported by Cointelegraph, the Ethereum token’s prospects appeared bullish, aided by the ascending triangle configuration illustrated below.

On the daily timescale, Ether broke out of the pattern, although with little trading volume, indicating price trend weakness.

The cryptocurrency is currently attempting to break through the triangle’s upper trendline in search of bullish confirmation. If a comeback occurs, the price might seek new all-time highs above $4,384, with the triangle setup’s goal near $6,500.

ETH supply crunch

Additionally, since the Ethereum network’s London hard fork, the supply of Ether coins has been dropping. Specifically, the Ethereum Improvement Proposal 1559, which became operational following the upgrade, began burning ETH that had previously been paid to miners.

According to data compiled by WatchTheBurn, the Ethereum network has burned about $2.25 billion worth of Ether coins since the start of the London hard fork.

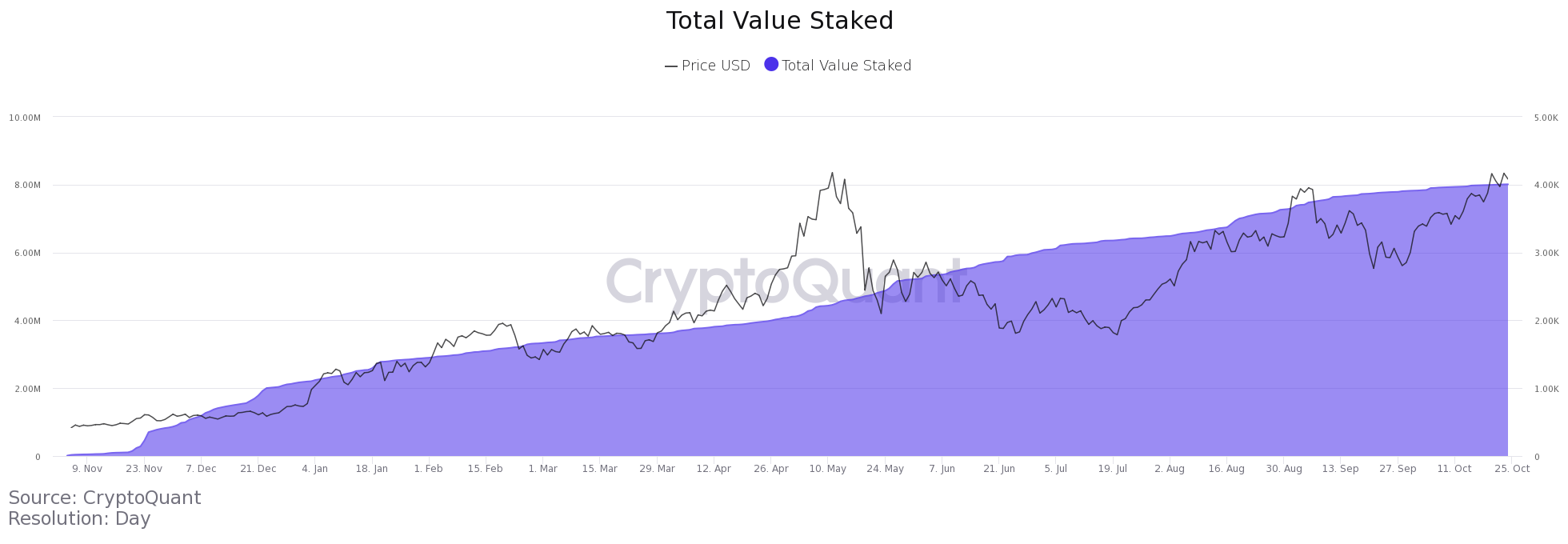

Furthermore, the Ethereum 2.0 deposit contract has attracted over 8 million ETH, withdrawing them from circulation for at least a year.

Additionally, institutional investors boosted their Ether holdings from 2.43 million ETH in November 2020 to 4.08 million ETH today, indicating growing institutional demand.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.