- Bitcoin is at danger of plunging to $9,000 on a unfavorable outlook for the S&P 500 index.

- Wall Street company BTIG LLC has warned that the U.S. benchmark could suitable in the direction of the decrease end of its existing buying and selling range.

- The draw back go in the index could direct traders to offset their losses by selling Bitcoin and other profiting property.

Bitcoin plunged in early Wednesday buying and selling session after failing to protected a robust foothold higher than $9,700 previously this week.

The benchmark cryptocurrency was trading 1.15 per cent lessen at circa $9,512 as of 1017 UTC. The drop arrived as a section of a corrective pullback from $9,792-resistance, proven on Monday. Traders perceived the rate leading as their cue to exit their bullish positions for compact earnings.

Bitcoin cost chart on TradingView.com showing its draw back correction from its weekly large around $9,800. Supply: TradingView.com

The bearish correction, meanwhile, is seeking to increase alone further more. Part of the purpose is Bitcoin’s volatility, which has fallen to its 8-month low, according to readings from Bollinger Bands. Also, the daily trade quantity on BTC/USD charts seems meager enough to validate an upside continuation.

Much more Losses Ahead

Bitcoin’s uncanny optimistic correlation with the S&P 500 also points towards further more losses.

Ahead of the Wednesday open, futures tied to the U.S. benchmark index edged decreased by .87 %. The draw back sentiment appeared as buyers assessed concerning signals from the economic system, like a resurgence in virus bacterial infections in pieces of the U.S., Europe, and China.

Julian Emanuel, the main equity and derivatives strategist at New York-centered expenditure organization BTIG LCC, famous that the S&P 500 could slide even further in the coming session.

The veteran explained in a observe to traders that the U.S. benchmark’s escalating disconnect with its fellow American index, the Nasdaq Composite, could guide it decrease towards the reduce close of its trading variety.

The Nasdaq reached a report high on Tuesday, leaving the S&P 500, as effectively as the Dow Jones driving.

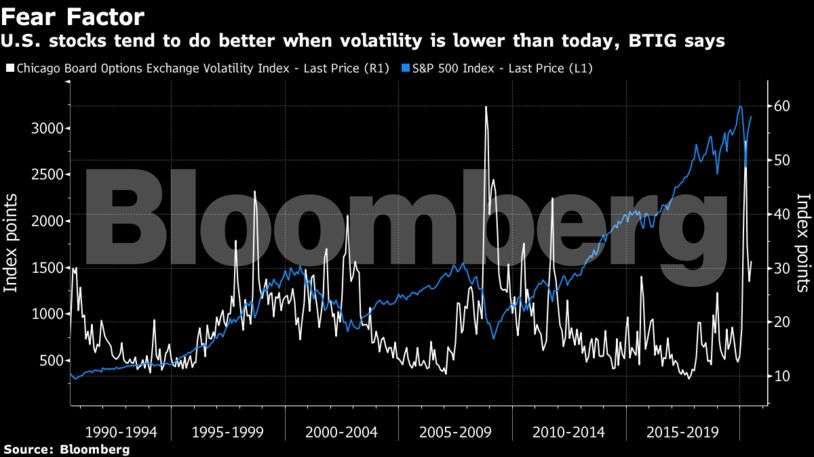

A rise in VIX, which signifies volatility, could lead to a enormous downside correction in the S&P 500 marketplace. Source: Bloomberg

In the meantime, Mr. Emanuel also famous that if the Cboe Volatility Index (VIX) moves above 45, it would lead the index in the direction of its June 15 very low at 2,965.

In the former scenarios, VIX ranges involving 25 and 45 have resulted in broader declines in the S&P 500.

The CFA Institute, a group that comprises of veteran world-wide financial investment management industry experts, also described that only 10 per cent of their 13,300 members see a V-shaped restoration.

Several discovered the existing inventory marketplace rally divorced by the financial fact, pushed merely by a vast plan reaction from central banking companies and governments.

“You have a separation in between the real economic climate and marketplaces ideal now and you are hoping it doesn’t get also big right before a correction can take location,” Olivier Fines, the writer of the CFA report, instructed FT. “At some position markets will have to have anything to do with the genuine economic climate.”

Crimson Indicators for Bitcoin

A crash in the S&P 500 could generate Bitcoin decreased along with. Traders wanting to deal with their margin calls would promote the most financially rewarding asset of their portfolio initially to seek out hard cash liquidity. That may direct the bitcoin, one of the finest-executing assets of 2020, down.

The subsequent cryptocurrency plunge could be a lot more significant, but technical analysts come across $8,600-9,000 a protected draw back goal.

I would favor not to see a revisit to under $9k if not we could see a fall close to $8600.

In any other case, I’m observing positive signs and leaning additional in direction of a relief bounce early on nowadays up to $9300 area.

— NebraskanGooner???? (@nebraskangooner) June 15, 2020

On a brighter observe, the marketplace now has better income liquidity than it experienced in the course of the March 2020 crash. It may possibly also assist in restricting Bitcoin’s draw back bias to a sure extent, earning the cryptocurrency as a protected-haven like Gold against a slipping S&P 500 market place.