As 2021 draws to a conclusion, the DeFi landscape’s primary lineup is dominated by synthetic asset platforms (SAPs). A SAP is any platform that enables users to create synthetics, which are derivatives whose values are continuously tied to the values of underlying assets. As long as oracles provide a trustworthy price feed, synthetics can represent and take on the price of any asset in the world, whether it is a stock, commodity, or cryptocurrency.

As such, SAPs finally bridge the divide between emerging DeFi platforms and traditional finance, enabling investors to wager on any asset, anywhere, from the comfort of their preferred blockchain ecosystem. SAPs, which are decentralized and run on Ethereum’s layer one, appear to be the next significant growth stimulus for cryptocurrency. However, unlike with sound money and verifiable artwork, decentralization and secure ownership only account for half of the equation in the world of collateralized lending.

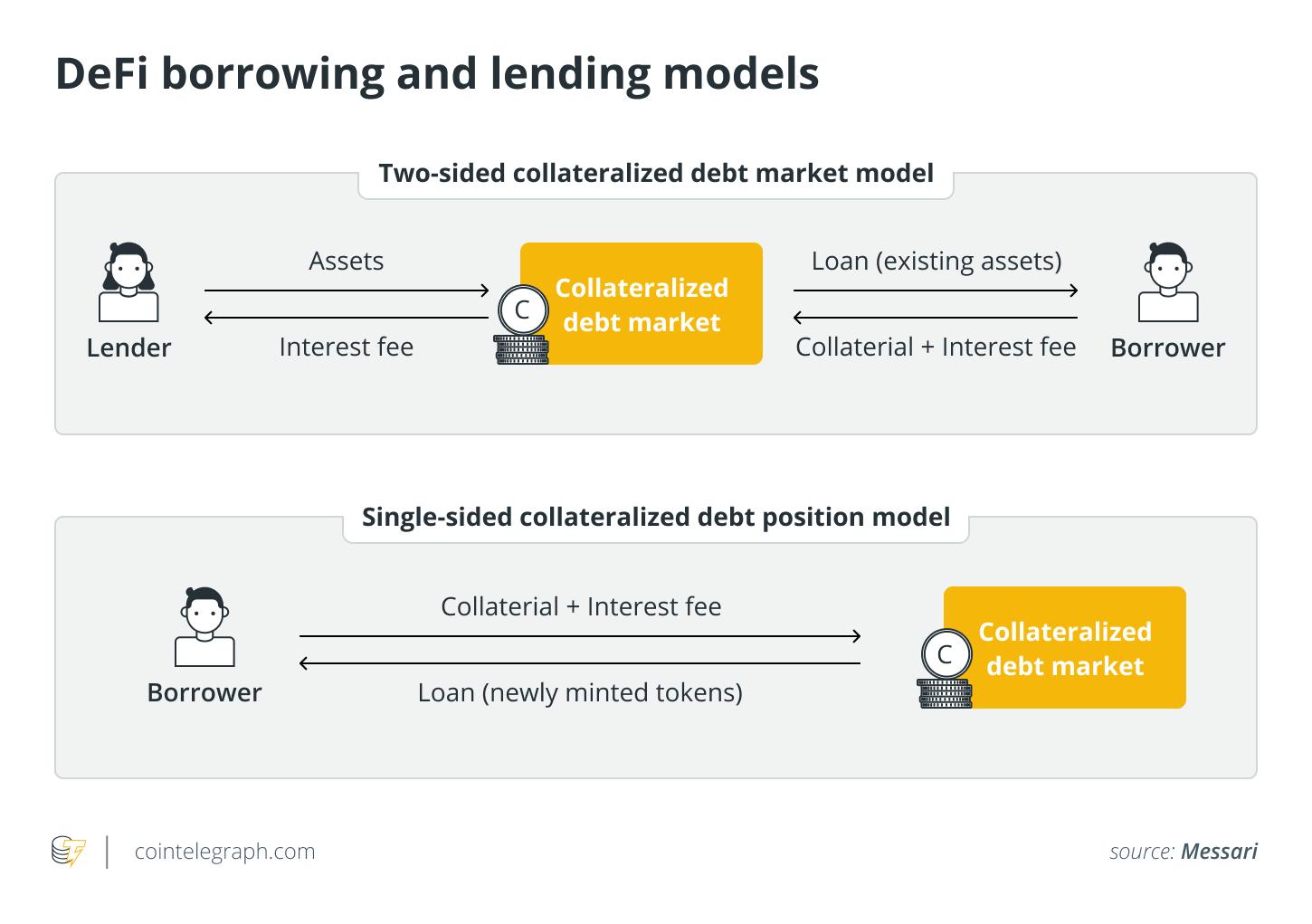

DeFi Collateralized debt

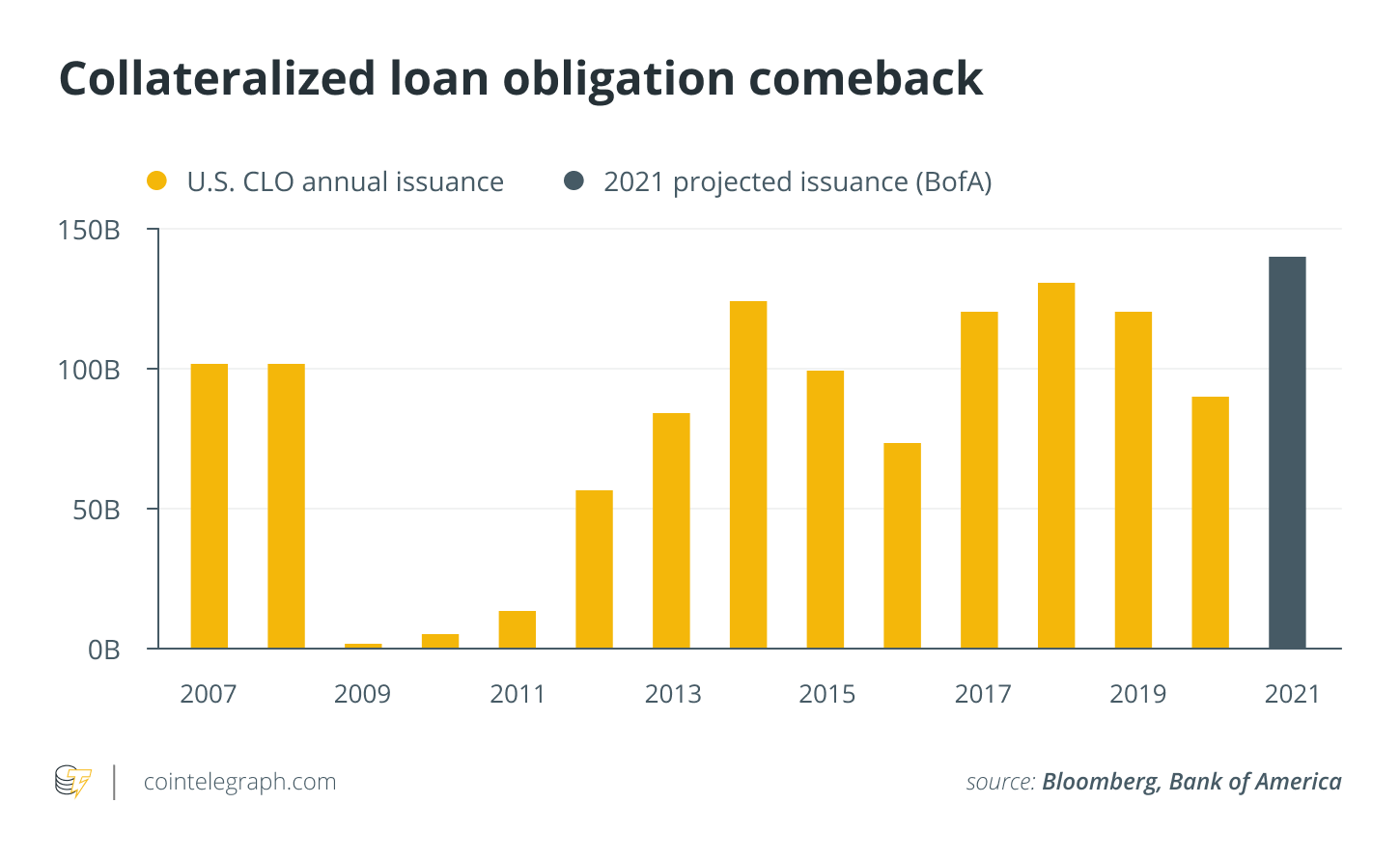

In conventional finance, collateralized debt obligations rank among the world’s most valuable financial assets, with a cumulative value of about $1 trillion.

The majority of people are familiar with them as mortgages — a term whose origin dates all the way back to thirteenth-century France and literally translates as „death pledge.“ Perhaps morbid or dramatic to the average person, but to the many millions who lost their retirement accounts, life savings, homes, and livelihoods in the aftermath of the 2008 financial crisis, the terms „death pledge“ and „collateral damage“ are not only appropriate, but necessary in conveying the anguish and agony that await those who engage in collateralized lending without first understanding the risks and ramifications.

The following is the gut-wrenching part: To obtain a loan, a debtor must provide collateral that becomes contractually secured with the creditor, who has the right to claim the collateral if the debtor becomes unable to service the debt. Unfortunately, repaying collateralized debt is not as straightforward as making timely interest payments, as the value of the underlying collateral can fluctuate dramatically in response to market volatility — such as the unexpected collapse of the United States‘ subprime housing industry. If the value of a debtor’s collateral falls below a preset level, the creditor — whether a bulge-bracket bank or a decentralized protocol — has the authority to seize and liquidate the collateral at market value in order to reclaim the outstanding loan principle. If the term „death vow“ is too much for you, you might as well call it the lifetime rug pull.

Whether collateralized financial products are produced on Wall Street or on the Ethereum blockchain, the risks associated with them cannot simply be decentralized. Liquidation triggers are inherently tied to exposure to the volatility of the broader macroeconomic environment, which neither developers nor financiers have control over.

MakerDAO’s lesson for DeFi space – a time bomb

Consider MakerDAO, a highly decentralized SAP whose collateralized stablecoin DAI is rigorously tied to the US dollar. On the surface, Maker appeared to be an attractive proposition for investors, who could risk their otherwise inactive crypto holdings in order to generate a synthetic dollar. While DAI is a stable asset, it is backed by some of the world’s most volatile assets – particularly, Ether (ETH) and Bitcoin (BTC) (BTC).

To avoid widespread liquidations during crypto market downturns, the Maker protocol demands 150 percent over-collateralization. In other words, consumers receive just two-thirds of the dollar value of what they inject into the protocol, a paradigm that neither appeals to traders nor promotes adequate capital efficiency in the ecosystem. To add insult to injury, the ever-volatile crypto market demonstrated that Maker’s stringent collateral requirements were insufficient in March 2020, when a 70% drawdown resulted in losses reaching over $6 million for all Maker users.

As a result of Maker’s tribulations, other large SAPs have implemented additional safeguards to avoid catastrophic mass liquidations on their platforms. Or, more precisely, they’ve multiplied the same metric: Mirror Protocol asks users to collateralize up to 250 percent, while Synthetix requires an audacious 500 percent. Of course, this level of over-collateralization is insufficient to compete with traditional finance, where centralized brokerages consistently deliver superior metrics. However, there is another issue.

To crypto traders who are put off by high collateralization requirements and liquidity hazards, it makes more sense to avoid SAPs altogether and instead purchase synthetic equities and commodities in secondary markets. As a result of the shift in demand, significant pricing premiums for many synthetics have persisted, eroding the real-world parity they were designed to maintain and once again driving users back to traditional finance, where they can purchase the assets they desire at a fraction of the crypto markup.

The need for change – time is ticking

DeFi has reached a stalemate and is stagnating at this point. To make meaningful progress, a radical tokenomic model of collateral management is required, one that recasts the link between capital efficiency and risk exposure. As Albert Einstein succinctly stated nearly a century ago:

”No problem can be solved by thinking at the same level of consciousness that created it.”

On this note, SAPs are currently focused on upgrading and enhancing collateralization models — in other words, maximizing what is already in place. Nobody is willing to venture into the region of fundamental transformation.

As the year 2022 begins, a novel collateralization strategy will take DeFi by storm. Rather of tying up surplus collateral in a contract, users will be able to burn collateral in an equitable ratio to mint synthetics. This ensures that users receive exactly what they put in — dollar for dollar, sat for sat, one-to-one — and will never be liquidated or have their margin called.

A native token with an elastic supply is the critical component of such a paradigm. When a user burns a SAP native token in order to mint synthetics, there is little perceived gain. However, when the same user burns synthetics in order to re-mint native tokens on the way out, SAP’s burn-and-mint protocol takes effect. Any discrepancies between the user’s original burned collateral and the minted synthetics will be handled by the protocol, which will adjust the supply of the native token to compensate.

The burn-and-mint collateral model is a radical new paradigm that eliminates the disadvantages of liquidations and margin calls without jeopardizing the capital efficiency or price parity that give synthetics their potency in the first place. As degens and number crunchers of all faiths continue their quest for yields in the coming year, the capital of the crypto mass market will transfer to platforms that implement various versions of burn-and-mint procedures.

As the DeFi ecosystem transitions to its next phase, all attention will be on liquidity management. Deep liquidity is a vital component that will enable SAPs to support large-volume withdrawals from their ecosystems while maintaining an acceptable level of volatility. Liquidity management will differentiate DeFi’s next generation of blue-chip SAPs from those that do not make the cut on DeFi systems where collateral management has always been a challenge.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.