After hitting an all-time high of roughly $4,867 on Nov. 10, Ethereum’s native token Ether (ETH) is presently trading near $3,900.

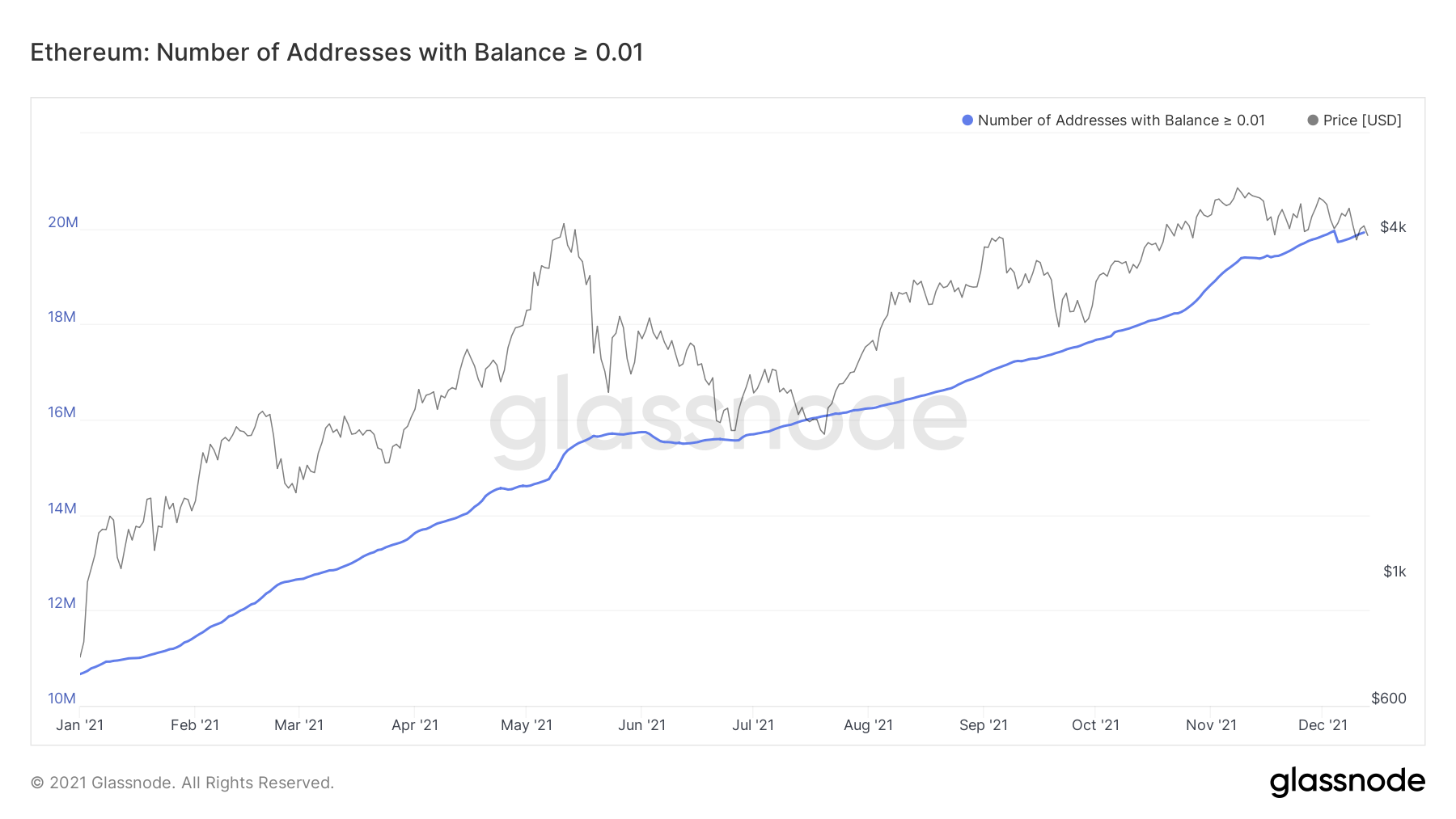

Nonetheless, the collapse has not discouraged small-scale investors from purchasing the token.

According to Glassnode — a blockchain analytics company — the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high of 19.95 million on Dec. 4, the day ETH fell as low as $3,575 per coin (data from Coinbase).

Meanwhile, despite Ether’s drop from $4,867 to $3,575, the number of Ethereum wallets with a balance of at least 0.1 ETH continued to grow, finally reaching a new all-time high of 6.37 million on Dec. 12.

As a result, on Dec. 12, the number of Ether addresses having a non-zero balance increased to a new record high of approximately 70 million.

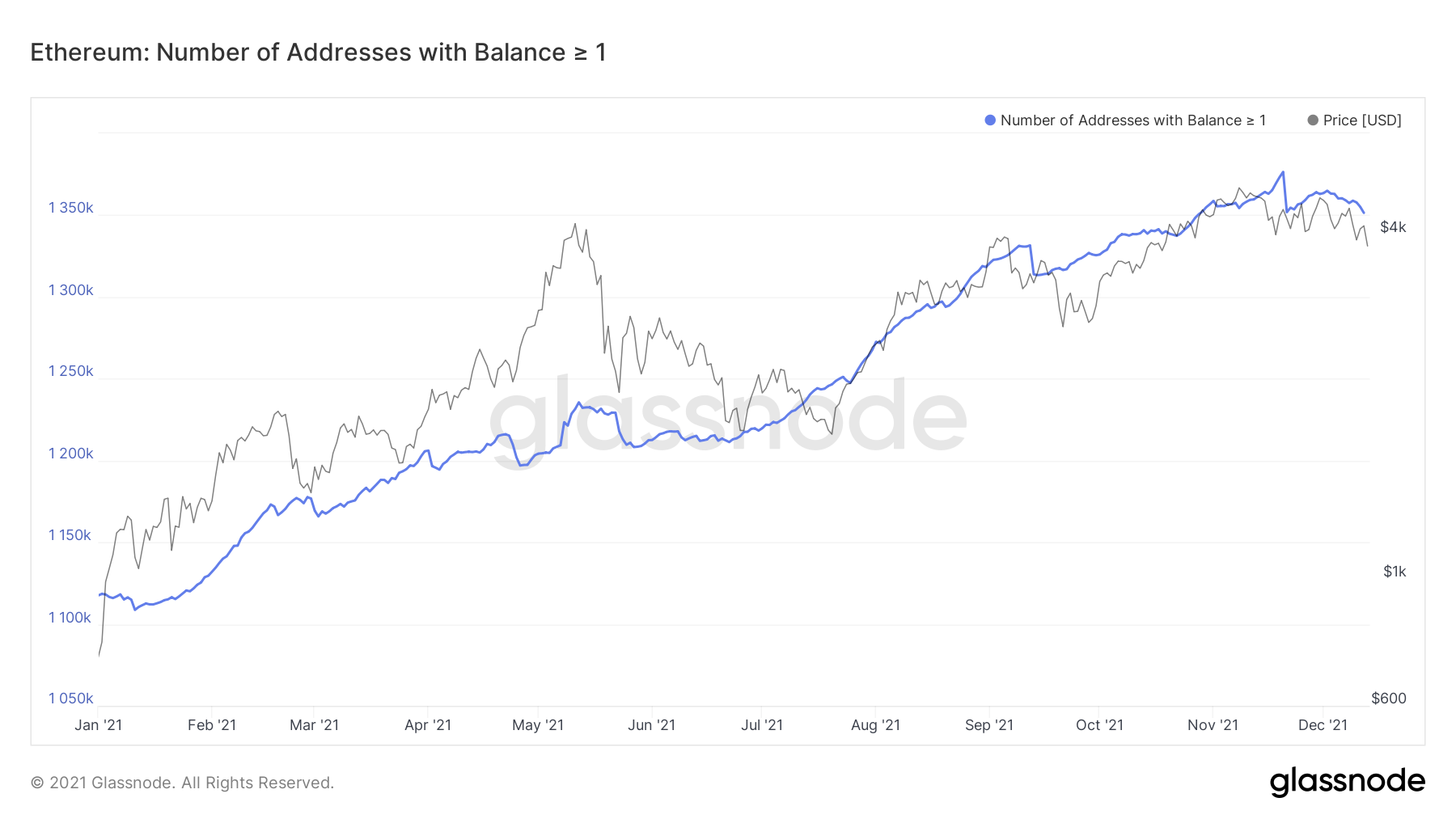

In comparison, addresses owning less than or equal to 1 ETH decreased in lockstep with prices, indicating that they were less interested in purchasing Ether during sessional drops.

Bounce ahead?

As the ETH price falls approaching a support confluence, the army of ordinary investors buying Ether in modest quantities marches on.

Notably, Ether fell over 5% to roughly $3,900 on Monday as a result of comparable corrections across the cryptocurrency industry.

Nonetheless, the price of ETH has reached a level that has been attracting purchasers recently.

The initial support came from the descending channel pattern’s bottom trendline — the blackened range on the chart above.

Meanwhile, as has been the case since Oct. 20, the purpled 100-day simple moving average (100-day SMA) and the red retreat area increased Ether’s possibility for a near-term upward retracement.

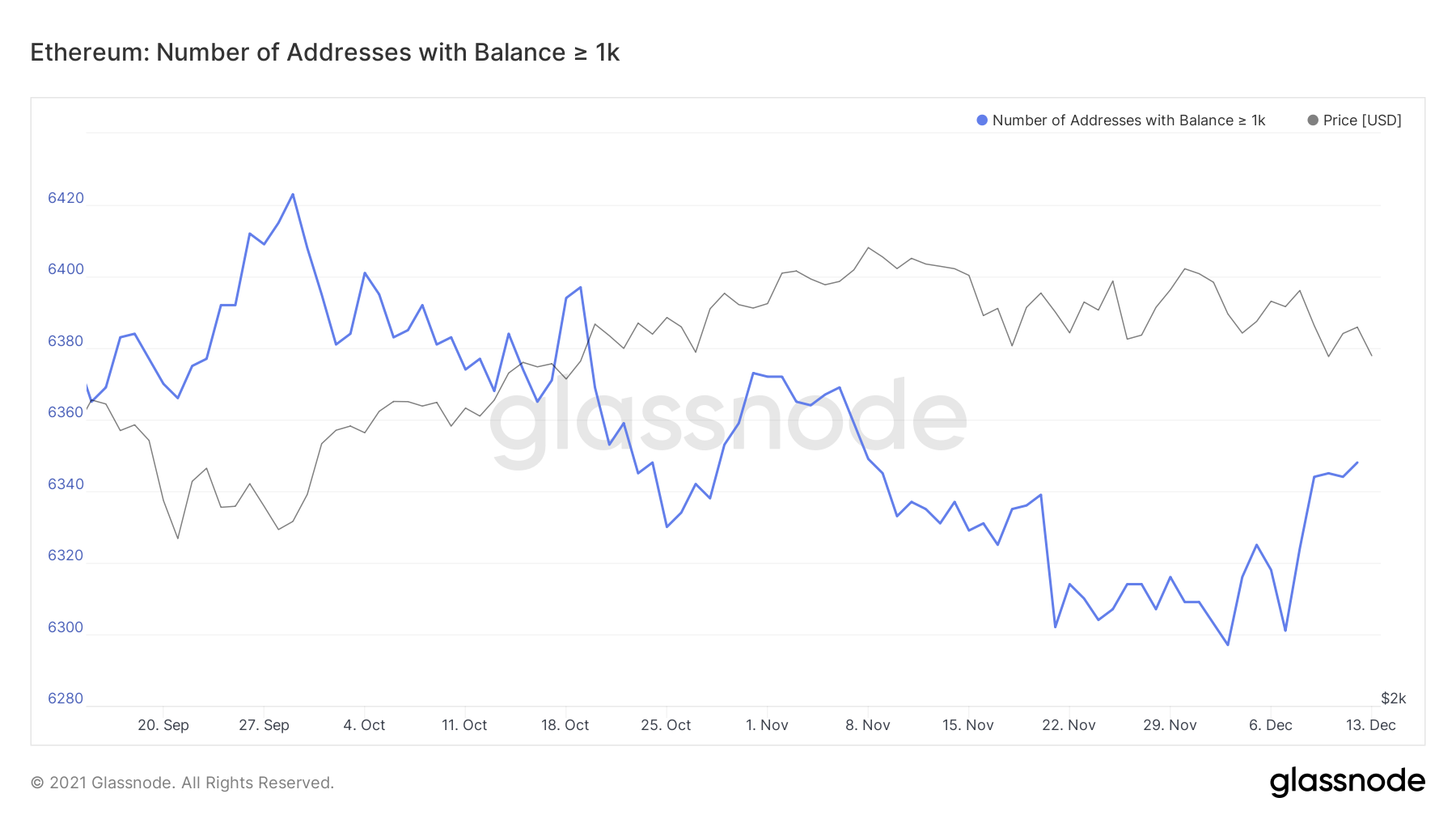

While smaller retail investors appear to be amassing Ether, their larger counterparts appear to be torn.

For example, according to Glassnode data, Ethereum wallets with balances of at least 1,000 ETH have experienced a small recovery in their purchasing interest.

Nonetheless, their overall numbers have decreased from from 7,200 in 2011 to less than 6,350 in 2021.

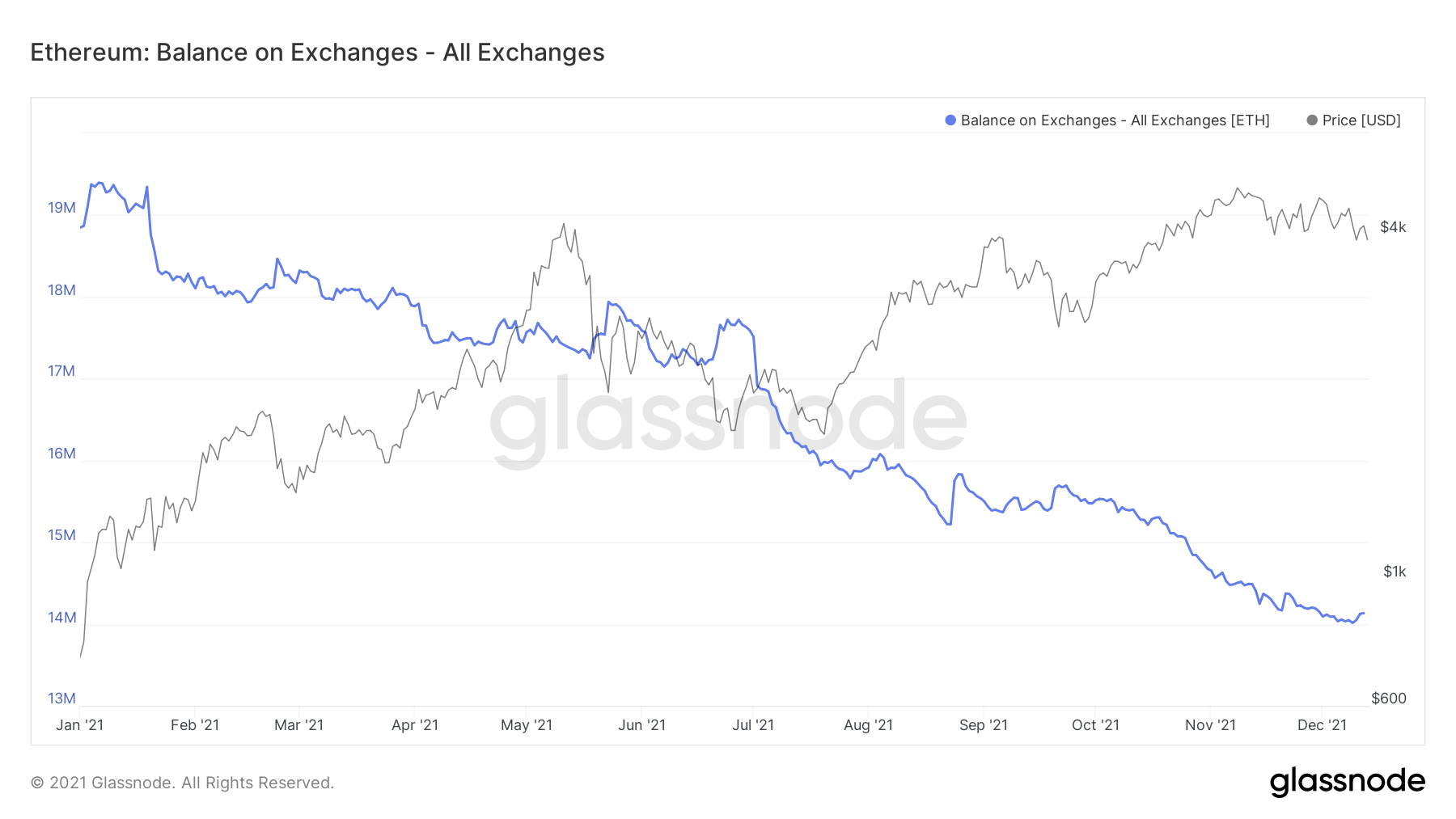

Exchanges‘ Ether balances

Ether’s falling balances across all cryptocurrency exchanges provide additional positive signals.

Because of an over 10.50 percent price decline on December 9, the amount of coins held by exchanges has recovered from nearly 14 million ETH to 14.13 million ETH; nonetheless, the long-term trend continues to be biased to the downward.

When the total amount of ETH traded across exchanges is lower, it indicates that traders intend to hold their coins or stake them in the pools of decentralized finance (DeFi) projects in order to generate returns rather than trading them for other assets.

Related: Data shows pro traders are currently more bullish on Ethereum than Bitcoin

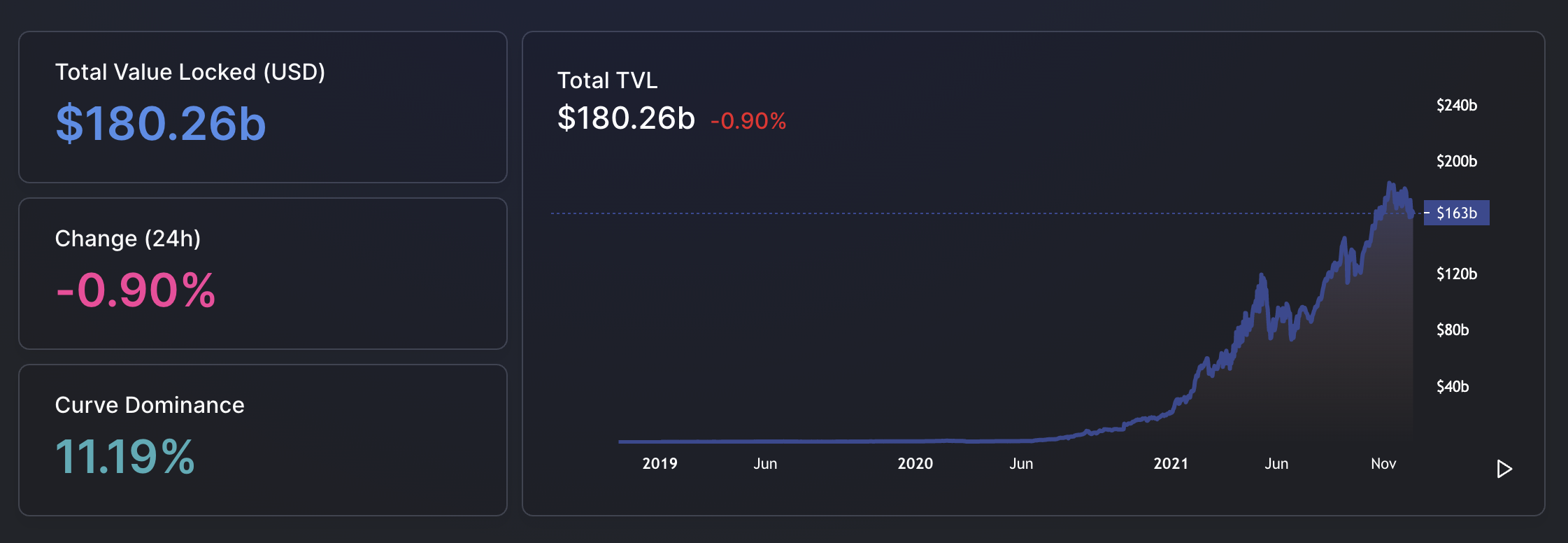

According to data given by Defi Llama, DeFi’s total value locked (TVL) has reached a new all-time high of more than $250 billion, with Ethereum’s TVL coming in at more than $180 billion, setting a new all-time high.

„However, Ethereum’s dominance over DeFi activity has taken a big hit in H2 2021,“ reminded Delphi Digital, a crypto-focused investment firm, adding that:

„As the multi-chain narrative plays out, capital has moved to ecosystems like Solana, Terra and Avalanche.“

The high cost of gas fees has been the primary motivator for investors looking for possible „Ethereum killers.“

For example, a decentralized exchange swap costs $70 on Ethereum but only $1 on Terra and Solana, despite the fact that some analysts believe that Ethereum’s full transition from proof-of-work to proof-of-stake will be completed next year, thereby alleviating the high gas problem in the cryptocurrency.

As highlighted by Tom Higgins, CEO of asset management platform Gold-i, „Ethereum’s price will climb at a considerably faster rate than Bitcoin’s price as a result of the transition to proof-of-stake.“

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.