According to one expert, Ethereum’s Ether token (ETH) is poised to unleash a „parabolic“ attack on Bitcoin (BTC) in order to surpass all-time highs.

2-week predicts “crazy” ETH move

According to data from Cointelegraph Markets Pro and TradingView, the Ethereum/Bitcoin exchange rate is nearing three-year highs – but the next move should be even more explosive.

ETH/BTC is one of the few optimistic themes in the short-term crypto markets this month, and it is one of the few in the long-term markets as well.

On December 3, popular Twitter account Galaxy reaffirmed positive expectations for the largest altcoin, even stating that ETH/BTC is on the verge of surpassing its already impressive performance with a vertical move.

In a post on Twitter, he said, „I’ve been waiting and openly charting ETH/BTC on the large picture for years, and today we’ve finally arrived.“ He also shared a prediction chart with his followers.

“$ETH is about to start going into parabolic mode. Just wait and see how crazy things are about to get.”

This Monday, the Ethereum/Bitcoin exchange rate reached 0.085, the highest level since a brief rise in May of this year. On top of that, only the year 2018 stands in the way of new all-time highs, with some exchanges having set a substantially higher ceiling of up to 0.15 on their respective exchanges.

In terms of dollars in the United States, the situation is similar, with Ether having established multiple new milestones in early November and remaining within 20 percent of $5,000 since then, according to CoinDesk.

„This in theory should be the portion where, assuming strength continues, we see that powerful run based on structure,“ fellow trader Pentoshi wrote in a second tweet on Ether Friday, as part of a series of remarks on the cryptocurrency.

While not everything indicates that the $5,000 mark will be breached, the price of ETH/USD was trading at roughly $4,550 at the time of publication.

Bitcoin old hands tweak bull case

In the meanwhile, the sentiment toward Bitcoin remains cautious.

Analysts are beginning to give more attention to „bearish“ theses on bitcoin after several weeks of disappointing price performance. At the same time, they are apparently maintaining positive on the cryptocurrency.

Bull case:

– OC supply dynamics: illiquid supply, LTH supply, HODL waves, etc.

– OC oscillators never reached exuberance/reset over summer

– Summer included OC behaviors that resemble bear market

– Funds have fresh PnLs in January, hunger to take on risk

– Macro uncertainty

— Will Clemente (@WClementeIII) December 2, 2021

The published on-chain indicators also show little cause for alarm, but tiny cues such as long-term holder selling activity indicate that confidence is eroding in the cryptocurrency market.

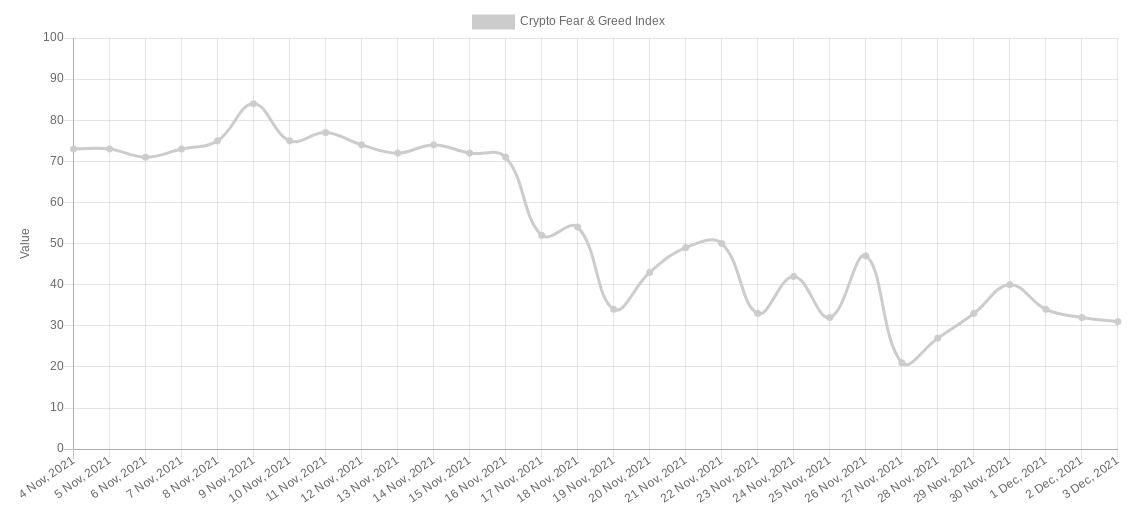

The Crypto Fear & Greed Index measures 31 out of 100, indicating that sentiment has returned to „fear“ area after briefly reaching „neutral“ earlier this week.