After the most recent Bitcoin price recovery came to a halt near $59,000 on Nov. 30, the cryptocurrency’s support levels rose once more.

RSI sees „bullish engulfing“

Bitstamp data showed that the bitcoin/dollar exchange rate reversed overnight, reaching a low of $55,920.

The pair then recovered to a level around $56,500 at the time of writing, with experts maintaining their belief in the strength of the upper timeframes.

A well-known Twitter personality TechDev reported that Bitcoin’s stochastic relative strength index (Stoch RSI) had „reset“ to levels that mirrored the price of bitcoin against the dollar at $44,000 — just before the surge culminated in all-time highs.

„„Bullish engulfing printed on stochastic RSI cross with RSI reset to 44K levels,“ he said accompanying a 3-day chart, which he included as a summary.

Bitcoin’s late gain on Monday coincided with a return to normalcy in the macro-economy and the announcement that Twitter CEO Jack Dorsey had resigned from the firm in order to devote his time exclusively to Bitcoin operations.

While bulls were unable to break the $60,000 level, there were hints of a significant shift in sentiment everywhere.

„The structure of the Bitcoin high timeframe is bullish. The ability to be aware of one’s surroundings when cycling is essential „It was included in a separate post by TechDev.

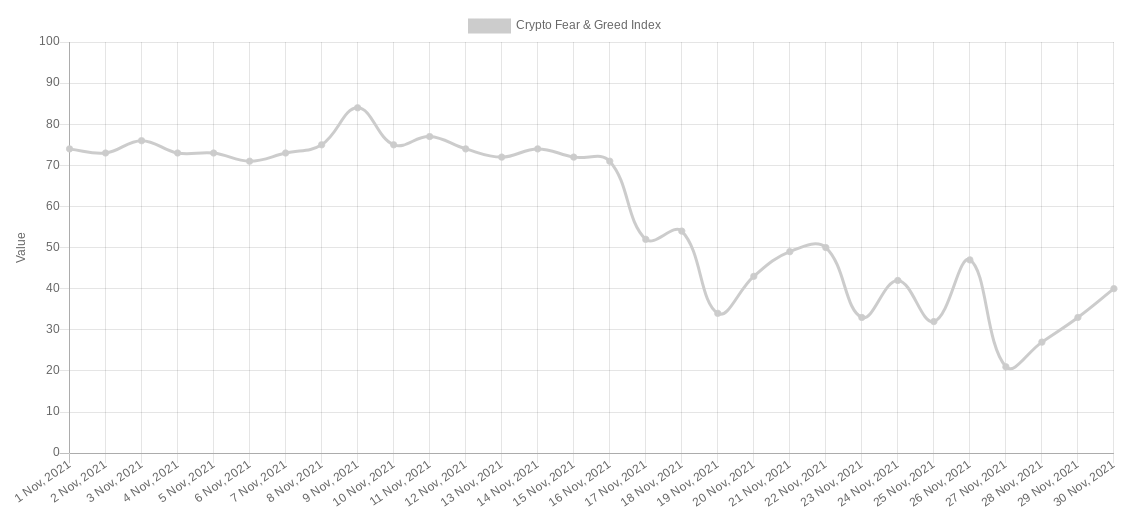

With a score of 40/100 on Tuesday, the Crypto Dread & Greed Index, which had been in „severe fear“ area just days before, appeared to be on the verge of entering the „neutral“ zone.

Ethereum avoids breakout against BTC

When it came to the comparison of Ether (ETH) and Bitcoin, the results were varied.

As altcoins experienced essentially flat performance over the past 24 hours, trader Crypto Ed identified a rising wedge pattern on the 4-hour timeframes for Ethereum/Bitcoin, which he called „a bullish signal.“ The weekly chart produced results that were comparable to the monthly chart.

ETHBTC

Still in that rising wedge and no break out imo.

Bullish sign is the break of that RSI down trend overnight.As said in previous tweets: it may break out, but as long as it doesn’t, I’m not bullish yet. pic.twitter.com/Mcty5cTmYy

— Crypto_Ed_NL (@Crypto_Ed_NL) November 30, 2021

Because of their proclivity to break to the downside, rising wedge patterns are sometimes seen as possible bear flags.

ETH/USD was trading at $4,400 at the time of writing, representing a gain of 7.3 percent over the previous week.