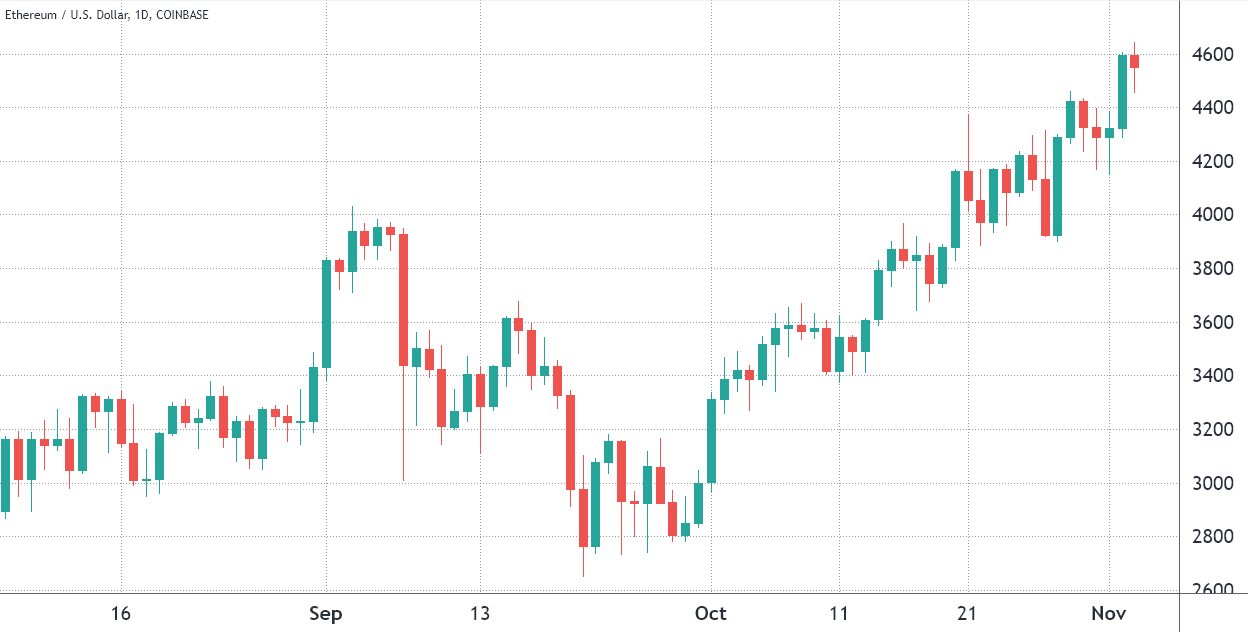

Bulls of Ether (ETH) are certainly quite pleased with the 368 percent gains made thus far in 2021, as it appears as though not a single day passes without the altcoin setting a new all-time high.

Even with Ether on track to reach $5,000, there are still plenty of concerns about the network’s ability to handle the high demand from the decentralized finance (DeFi) and non-fungible token (NFT) sectors.

Another potential roadblock is the United States Treasury’s November 1 report on stablecoin regulation. Congress must „ensure appropriate federal prudential oversight on a consistent and comprehensive basis,“ the report stated.

Additionally, competing networks that offer compatibility with major DeFi projects have grown in popularity, both in terms of total value locked (TVL) and market share for smart contracts. For instance, Solana (SOL) soared to a new record high of $236 this week, surpassing Cardano (ADA) to become the fourth-largest cryptocurrency.

According to CryptoSlam data, secondary sales of Solana NFT markets exceeded $495 million in the last three months, but the Ethereum blockchain remains the most popular, with NFT secondary sales exceeding $1.76 billion in October.

By staying ahead of the competition and laying the groundwork for resolving the scalability issue via a proof of stake network, Ethereum has attracted some serious investors. Among them are Mark Cuban, owner of the Dallas Mavericks, the Houston Firefighters‘ Relief and Retirement Fund, and billionaire Barry Sternlicht.

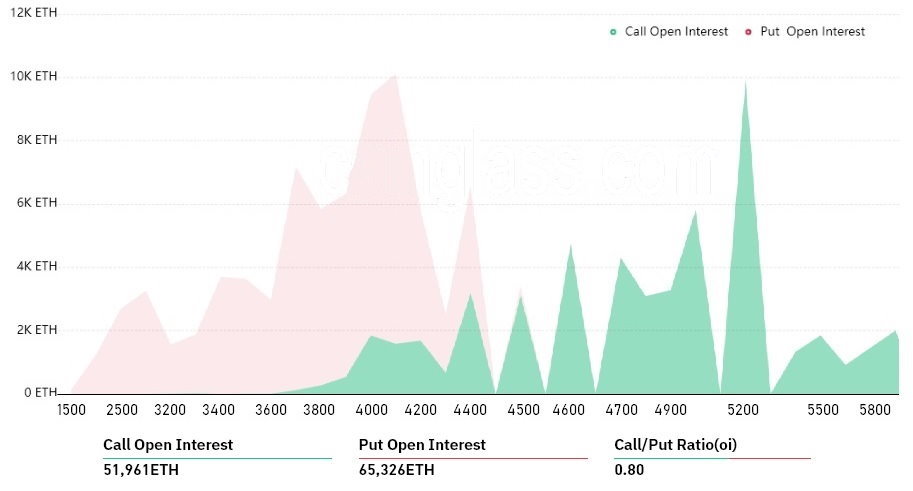

While the November 5 $540 million Ether options expiration may appear to be an undisputed success for bulls, this was not the case just a couple weeks ago.

At first glance, the $300 billion put (sell) options appear to have a 20% lead over the $240 billion call (buy) options. Nonetheless, the 0.80 call-to-put ratio is misleading, as the recent recovery is anticipated to wipe off the majority of bearish bets.

For instance, if the price of Ether remains above $4,500 at 8:00 a.m. UTC on Nov 5, just $1.5 million worth of those put (sell) options will remain available at expiration. A right to sell Ether at $4,500 is worthless if it is trading above that price.

Bulls are comfortable above $4,500

The following are the four most likely possibilities for the Nov. 5 expiration of the $540 million. The possible profit is represented by the imbalance favoring either side. In other words, the number of call (buy) and put (sell) contracts that become active fluctuates according to the expiry price:

- Between $4,300 and $4,400: 6,870 calls vs. 6,000 puts. The net result is balanced between bulls and bears.

- Between $4,400 and $4,600: 13,750 calls vs. 350 puts. The net result is $60 million favoring the call (bull) instruments.

- Between $4,600 and $4,700: 18,500 calls vs. 50 puts. The net result is $85 million favoring the call (bull) instruments.

- Above $4,700: 22,800 calls vs. 0 puts. The net result is complete dominance, with bulls profiting $107 million.

This imprecise estimate assumes that call options are utilized solely in bullish transactions and put options are used primarily in neutral-to-bearish trades.

This oversimplification, however, leaves out more nuanced investment techniques.

For example, a trader may have sold a put option, so acquiring positive exposure to Bitcoin above a predetermined price.

However, there is no clear way to quantify this effect.

Bears need a 6% price correction to reduce their loss

Bears‘ only hope of avoiding a loss on Friday’s expiration is to force Ether’s price below $4,400 on Nov. 5, down 6% from its current level of $4,660. Thus, unless significant news or events occur before to the weekly options deadline, bulls are expected to profit by $85 million or more.

Additionally, traders must consider that during bull runs, the amount of effort required to influence the market is enormous and frequently ineffective. At the moment, data from the options markets indicates a significant advantage for call (buy) options, which fuels optimistic wagers on Ether and raises hopes of a climb to $5,000.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.