I discovered recently Marc Andreessen’s 2014 piece on Bitcoin (BTC). It is, in many ways, visionary (no surprise). I’ve been in the sector for four years, with a primary focus on blockchain’s social impact. It’s astounding to me that Andreessen was able to explain the future economic and social implications of Bitcoin in 2014, before to the establishment of any institutional presence — or, indeed, a widespread awareness of this new technology.

I’d want to address one of the issues raised in his piece over eight years after he penned them: micropayments. I will discuss how blockchain technology may help alter micropayments, enabling not just the monetization of specific areas of enterprises in need of a solution, but also the assistance of society’s most vulnerable members.

Micropayments

Micropayments are a well-established idea. Micropayments have gained varying degrees of popularity since the mid-1990s. Micropayments are defined as transactions with a value less than a certain threshold. Notably, below that threshold, the transaction charge becomes a considerable fraction of the total transaction value, rendering the transaction inefficient. Another critical point is that, due to the small monetary quantities involved, micropayments are limited to digital transactions involving non-tangible commodities. Any additional handling and shipping costs may result in a hundredfold rise in the value of the initial transaction, rendering it completely meaningless.

Credit card issuers give merchants a variety of fee structures. These plans often charge a flat fee each transaction and deduct a percentage from it.

As expected, this information is not publicly available from the card providers; rather, it is supplied by third parties who compare these rates on behalf of retailers. Within that framework, consider the fee that a merchant would pay for a micropayment.

We make the following assumptions:

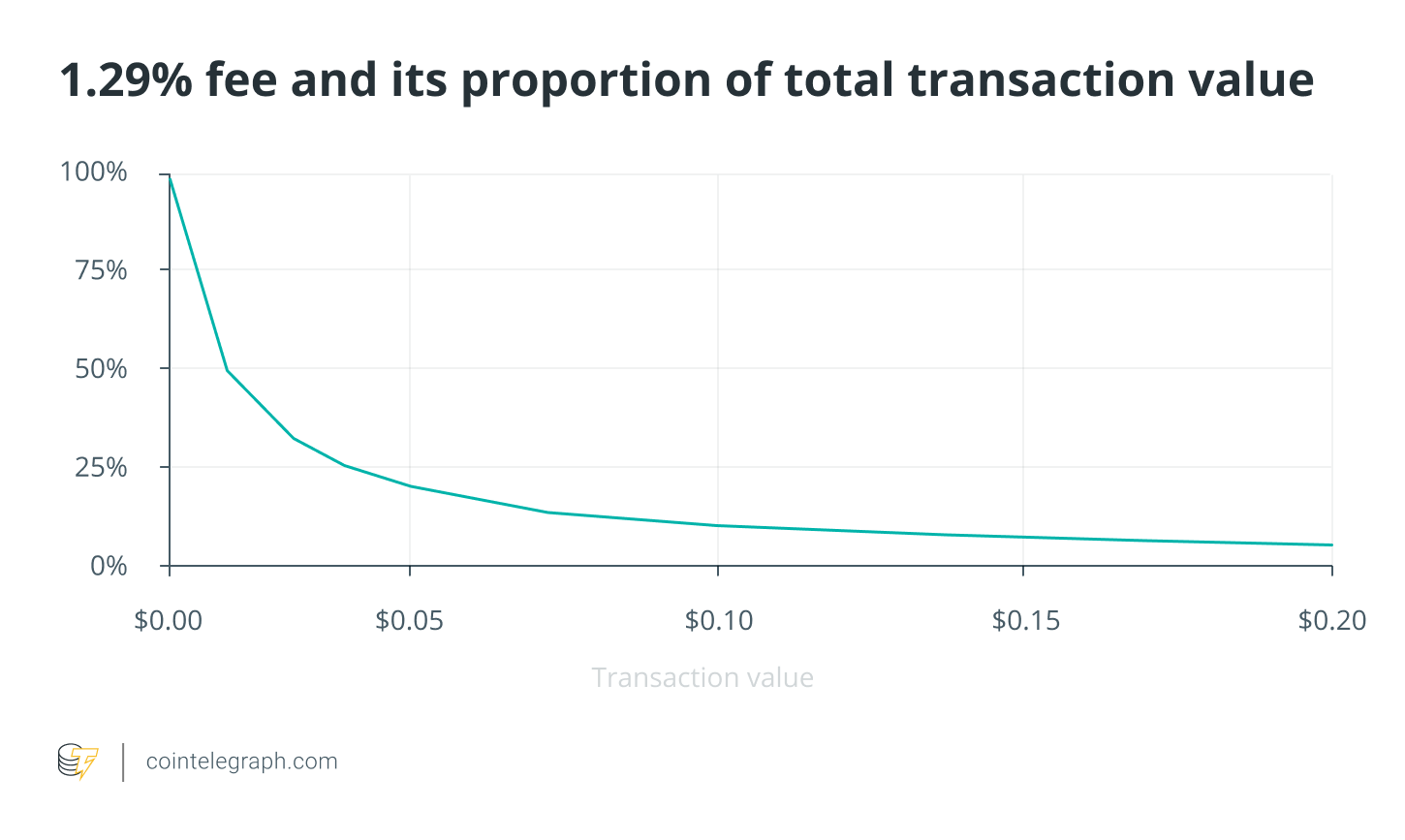

● The lowest fee we uncovered was 1.29% of the transaction value, and no lump sum fee was charged.

● Since the smallest building block of (most) fiat currencies is 1/100 of the whole — i.e., $0.01 — this would be the minimum fee the credit card company charges, regardless of if it is higher than 1.29%.

The chart below illustrates the proportion of the transaction fee as a function of the transaction value. For example, a $0.01 transaction will incur a cost of 100%, whereas a $0.10 transaction will incur a fee of „just“ 10%. Naturally, this demonstrates the absurdity of micropayment transactions conducted through these payment networks.

Blockchain has a solution

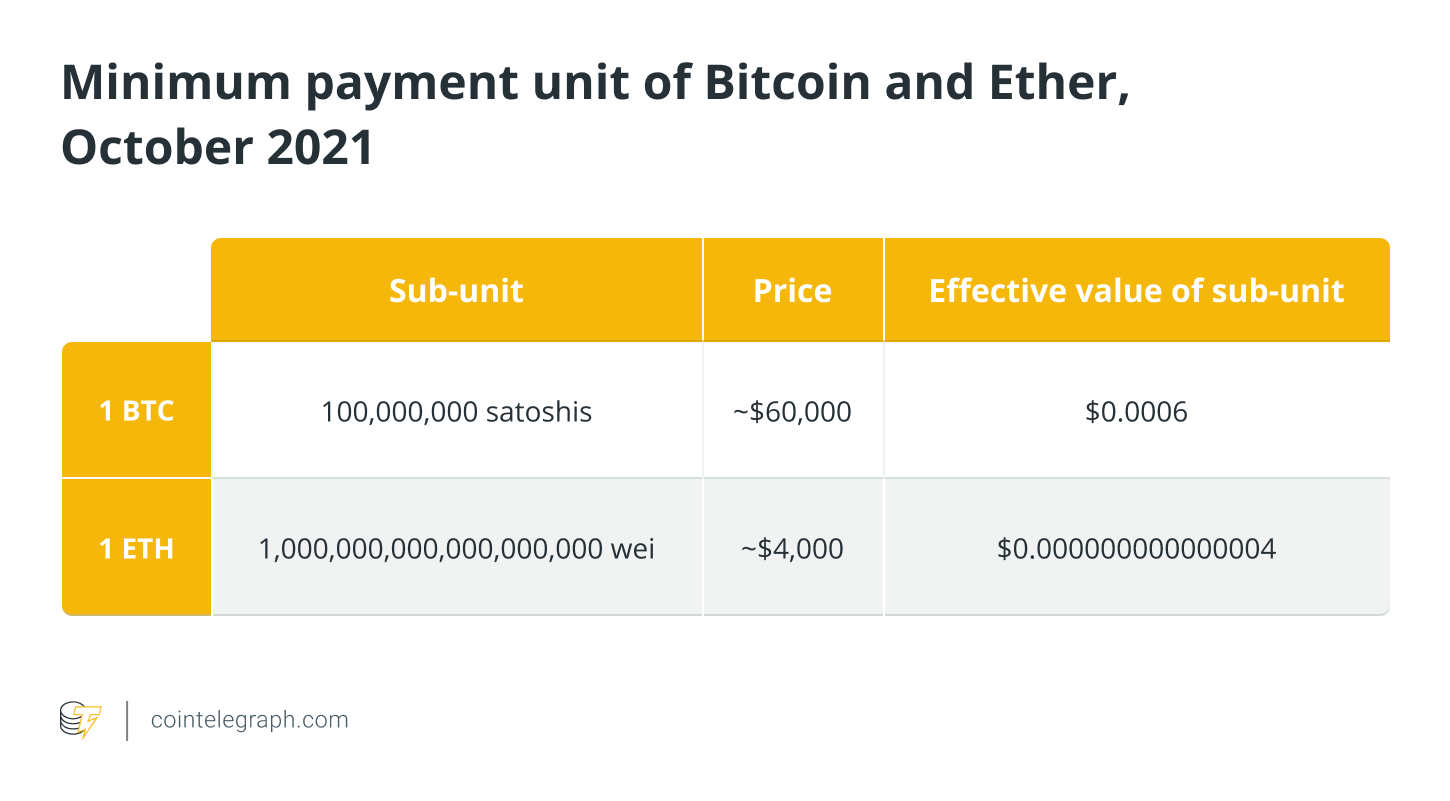

However, an alternative now exists. For a variety of reasons, blockchain technology is ideal for micropayments. It enables increasingly quick digital payments, and critically, the minimum payment unit for both Bitcoin and Ether (ETH) is exceedingly small, as illustrated in the table below:

Additionally, crypto wallets may be easily integrated into any digital device, including a smartphone, laptop, or any Internet of Things device.

And, while rates vary significantly between networks and circumstances, many protocols have no fees and may charge as little as a fraction of a cent.

Finally, but probably not least, is the issue of user privacy.

Due to the asymmetric encryption used by the blockchain, the payer reveals only their public address when making a payment, which provides virtually little information to someone attempting to hack their wallets.

Unfortunately, this is not true for credit card transactions, which require the payer to give their complete credit card details and trust that the payment platform is appropriately secured.

Real use cases for micropayments

After dealing with the technology component, there is only one remaining question: Can I obtain anything for a millionth of a dollar? I’m not sure about a millionth, but micropayments have a plethora of applications. Here are a few examples:

Alternative to the subscription model: It is pointless to reiterate the economic rationale for the subscription model of online content consumption and its recent success, whether it be video content, music, or newspapers. While this approach offers a number of advantages, it is far from ideal and does have certain limitations. For instance, what if someone wishes to purchase a single item rather than subscribe to a service? Assume Alice is a subscriber to two online periodicals and comes across an intriguing article on a third. She will not purchase a third subscription, despite the fact that she is willing to pay for only that article. The article is already there, so why not charge for it? Alice and the publication both benefit economically from micropayments.

Digital copyrights, royalties and referrals: As in the last example, no explanation of copyrights, royalties, or referrals is necessary. In comparison to the intricate methods already in place, micropayments provide a reasonably simple mechanism for the instant settlements involved, with virtually no minimum price per item.

IoT transactions: This use case is quite forward-thinking, yet it is likely to become as commonplace and trivial as a light switch sooner rather than later. To date, the Internet of Things has only reached a fraction of its enormous potential. One explanation for this delay could be the absence of a straightforward, easy-to-implement monetization mechanism. Micropayments via the blockchain may be the solution. Consider the amount of data that your car may acquire, from road conditions to traffic and more. Sharing data obtained in real time by large numbers of users could be extremely beneficial for traffic planning and road maintenance. And with that in mind, why not pay for it? The added value of blockchain is an enhanced method for data anonymization and user privacy protection – another winning combination. Naturally, this could be used to any other Internet of Things device, from smart meters to home appliances and beyond.

Social impact: This is the simplest use case on this list (and, obviously, my favorite). Micropayments on the blockchain have the potential to be transformative in two ways. The first advantage is that gift receivers can easily establish funds-receiving accounts, which will enable donors to donate directly to them, eliminating any intermediaries and overhead fees. Having said that, it is vital to recognize that this feature is a double-edged sword that could prove to be the product’s primary weakness. It would be just as simple for fraudsters to create bogus accounts and solicit donations. There will be a need for rating and auditing, similar to the existing internet services that grade charities on a variety of criteria (e.g., Charity Navigator, Smart Giving, Council of Nonprofits, and others), to ensure and increase donor awareness. Additionally, because a minimum payment size would no longer be required, we may see micro-donations. The World Bank classifies a country as „low income“ if its gross national income per capita is less than $1,025 per year. In other words, this equates to a daily wage of less than $3. There are 27 low-income countries as of 2020. Micropayments have the potential to be an effective tool for donating monies to individuals in need in those nations, but they must be carefully regulated for fraud. You can see how, if done correctly, this could result in more efficient donations and a more direct impact.

Micropayments have lost some of their early luster during the last few years. While the notion was revolutionary at the time, technology lagged behind and prevented it from becoming a reality. Andreessen was correct and revolutionary in emphasizing how blockchain technology has the potential to alter micropayments. I’ve only scraped the surface here in terms of use cases and potential.

Businesses could improve their efficiency and monetise a greater portion of their services. Without an intermediary, entire communities can be transformed or lifted out of economic depression by direct and personal help. Congratulations to Andreessen for his vision eight years ago – blockchain technology has the potential to be the breath of fresh air the world has been waiting for.