Are you envious of those that purchased bitcoin a year, two years, or a few years ago?

Are you envious of those that purchased bitcoin a year, two years, or a few years ago?

Accept it without fear.

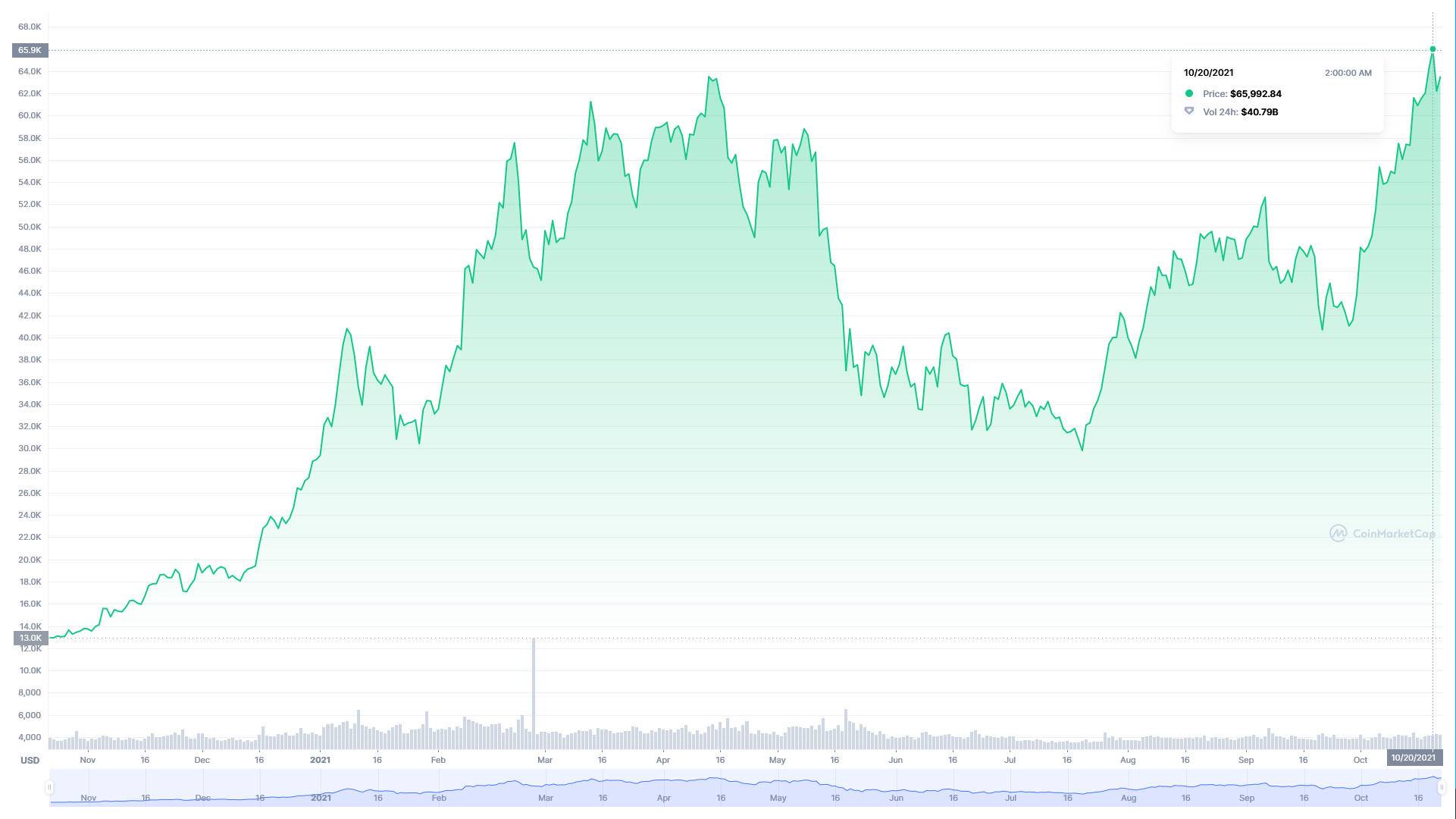

Those who entered the market early typically find themselves with a pocket full of cash as bitcoin continues to reach new all-time highs.

Bitcoin’s new all-time high of $67,000 on Wednesday has many believing the benchmark cryptocurrency is on its way to $100,000, as several analysts, including those from JP Morgan, Bloomberg, and PlanB, have projected.

A new wave of investors can now obtain exposure to bitcoin through holding, ETF trading, and futures trading, among other methods.

If you’ve been considering joining the boom, there is no such thing as „too late.“

However, before investing in bitcoin, there are a few points to consider.

1. What is the best way to invest in bitcoin?

There is no one-size-fits-all solution; it is entirely dependent on your risk tolerance, capital, and expectations.

The most typical method is to hold bitcoin, which is good if you intend to stay in the game for the long run.

Investors are unconcerned about price swings, and this is one of the simplest methods.

Generally, individuals purchase bitcoin and put it in a cold wallet.

Investors are increasingly storing their bitcoin in interest-bearing wallets in order to earn additional bitcoin.

Annualized interest rates can range from 1% to 21%.

Futures trading is preferred by more adventurous and risk-taking investors.

By betting on the price of bitcoin, futures trading enables investors to gain money in a variety of ways.

Numerous platforms offer leverage of 25x, 50x, or 100x.

Leverage allows you to enhance your exposure and generate more money.

However, exercise caution as this may result in an increase in your loss.

Therefore, always remember to maintain control of your position and establish a stop-loss.

2. Is your chosen exchange suitable for you?

An exchange is not only a broker looking to profit from you, but a partner in your financial success.

A good exchange is one that allows you to trade easily and safely while concentrating only on trading.

To determine which one is best for you, you need conduct study.

It is critical to consider factors such as history, cost structure, demo account, and customer support.

A faulty exchange may not only give you problems, but may also deprive you of money.

For instance, the typical cost for the majority of trading platforms on the market is between 0.1 and 0.2 percent.

And other sites charge up to 8% in transaction fees.

If you trade on a platform that charges an unjustified fee or does not disclose the fee properly, you risk losing a lot of money.

3. Can you devote time and energy to learning to trade?

This question divides individuals who profit from chance from those who achieve their aims on their own.

There is a learning curve associated with every new skill; for Bitcoin futures trading, it takes only ten minutes to grasp the process, but it may take several days to develop your tactics following real-world trading attempts.

It’s typical for newcomers to become disoriented by a plethora of novel concepts, and mastering the ins and outs of an exchange and trading engine can be challenging.

Therefore, if you are new to cryptocurrency trading, it is recommended that you begin by practicing with a trading simulator.

Additionally, do not be afraid to consult help centers when trading on exchanges.

Related: Is it possible to retire early with crypto? HODL, investment, trading?