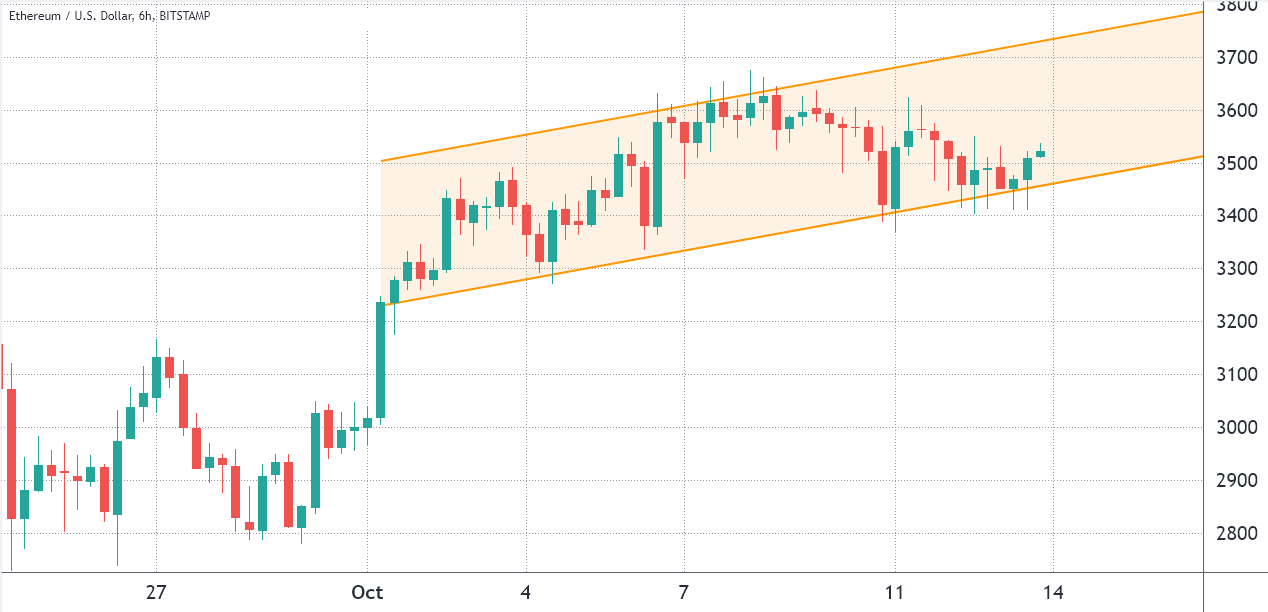

This month, Ether (ETH) entered a slightly bullish channel, and the price is currently marching toward the $3,800 mark. Despite recent volatility, Ether bulls are on track to earn $53 million on Friday’s weekly options expiration.

Investors also appear unconcerned by Ether’s recent underperformance against Bitcoin (BTC), as the altcoin has gained 265 percent to date. If Ether is able to maintain a price over $3,600 on Friday, 99 percent of the $180 million in put (sell) options will expire worthless.

Despite the fact that Ethereum smart contract competitors continue to put pressure on the leading network, Ethereum’s average gas rates remain above $20 at the time of writing. Polkadot (DOT) is scheduled to begin its sidechain auctions on November 11, and this will support new token launches, decentralised finance (DeFi) applications, and Internet of Things (IoT) solutions, all of which will pass through trustless cross-network bridges. Polkadot (DOT) is a cryptocurrency that is based on the Ethereum blockchain.

In a recent announcement, Binance Smart Chain stated that it intends to offer a $1 billion fund to drive adoption throughout the entire cryptocurrency industry.

Investors typically view future incubation events backed by blockchain projects as positive for their respective native assets, and the price of bitcoin has risen by at least 30 percent since the announcement was made.

Bears were not expecting prices above $3,300

On the basis of recent somewhat negative newsflow, it’s easy to see why bears placed 88 percent of their bets below $3,300. Bulls may have dominated Friday’s $365 million expiration if they were a little less greedy.

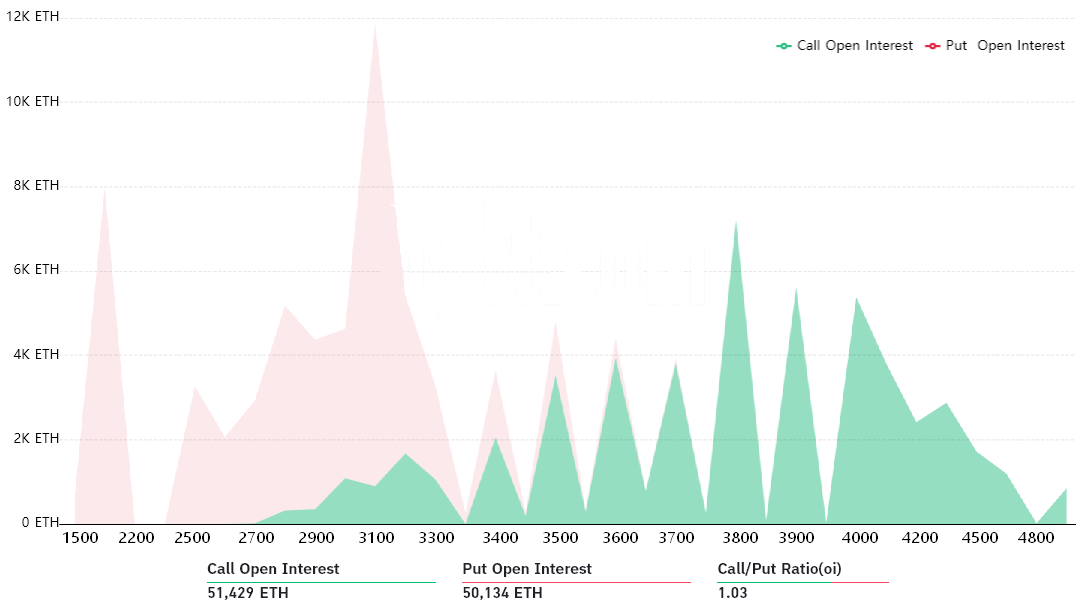

According to the long-to-short ratio, the Oct. 15 expiration is precisely balanced between call (buy) and put (sell) options. Nonetheless, this bird’s eye perspective requires further detail, depending on the expiration price.

According to the 1.03 call-to-put ratio, both sides held around $180 million worth of Ether options at the time of this writing.

However, this metric is misleading because the current rebound in Ether will almost certainly wipe out the majority of their negative bets. Example: If the price of Ether remains above $3,500 at 8:00 am UTC on Friday, only $6.6 million of the put (sell) options will be accessible to investors.

Bulls are comfortable at $3,600

Any expiry price greater than $3,500 is a bear trap, albeit a $32 million advantage should not be sufficient to inflict significant harm. Just to put things in context, the monthly options expiry for Ether now has over $800 million in open interest.

In light of current price levels, the following are the four most likely scenarios to play out, with the imbalance favouring either side representing the potential theoretical profit from the expiry of the contract.

The data shows how many contracts will be available on Oct. 15 for both bulls (call) and bears (put) instruments, as well as how many contracts will be available on Oct. 15.

- Between $3,300 and $3,500: 7,450 calls vs. 3,550 puts. The net result favors bulls by $13 million;

- Between $3,500 and $3,600: 11,150 calls vs. 1,900 puts. The net result favors bulls by $32 million;

- Between $3,600 and $3,800: 15,400 calls vs. 600 puts. Bulls profit increases to $74 million.

- Above $3,800: 27,450 calls vs. 0 puts. Bulls dominate by profiting $104 million.

This rough estimate takes call (buy) options into account when bullish strategies are utilised and put (sell) options into account when neutral-to-bearish trades are made. However, a trader may have sold a put option, acquiring positive exposure to Ether above a predetermined price. However, there is no clear way to quantify this effect.

Bears need sub-$3,500 to balance the scales

With Ethereum trading above $3,800, the bulls‘ profit jumps to $104 million, a $30 million increase over the current expected gain of $74 million. On the other hand, the bear stands to make $61 million by forcing the price below $3,500, as the above calculation indicates.

With less than a day until the Oct. 15 expiration, the bears will have a difficult job halting the current bull run. Regardless of the competition the Ethereum network confronts and the high gas fees, investors‘ demand for decentralised financing (DeFi) and network-based transactions (NFTs) appears to be sufficient to keep Ether on the rise.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.