Bitcoin (BTC) has maintained a price above $54,000 for the last few days, but this has not resulted in investor excitement. According to Google Trends, interest in Bitcoin has not increased in recent days and is approaching one-year lows. According to some observers, this is a hint that only the strongest hands are accumulating.

Additionally, according to a recent report from CoinShares, institutional investors invested more than $226 million in Bitcoin-related goods for the week ending Oct. 8. According to the analysis business, institutional crypto products‘ total assets under management have risen to $66.7 billion, just 5% behind the peak established in May.

Additionally, according to Glassnode data, long-term holders‘ Bitcoin wallets contain 13.3 million Bitcoin, accounting for 70% of the total Bitcoin supply. Over the last seven months, long-term holders have not sold their holdings and have added more than 2.37 million Bitcoin to their wallets. The analysis said that long-term whales‘ purchases of bitcoin outnumber newly produced coins by a factor of 12.7.

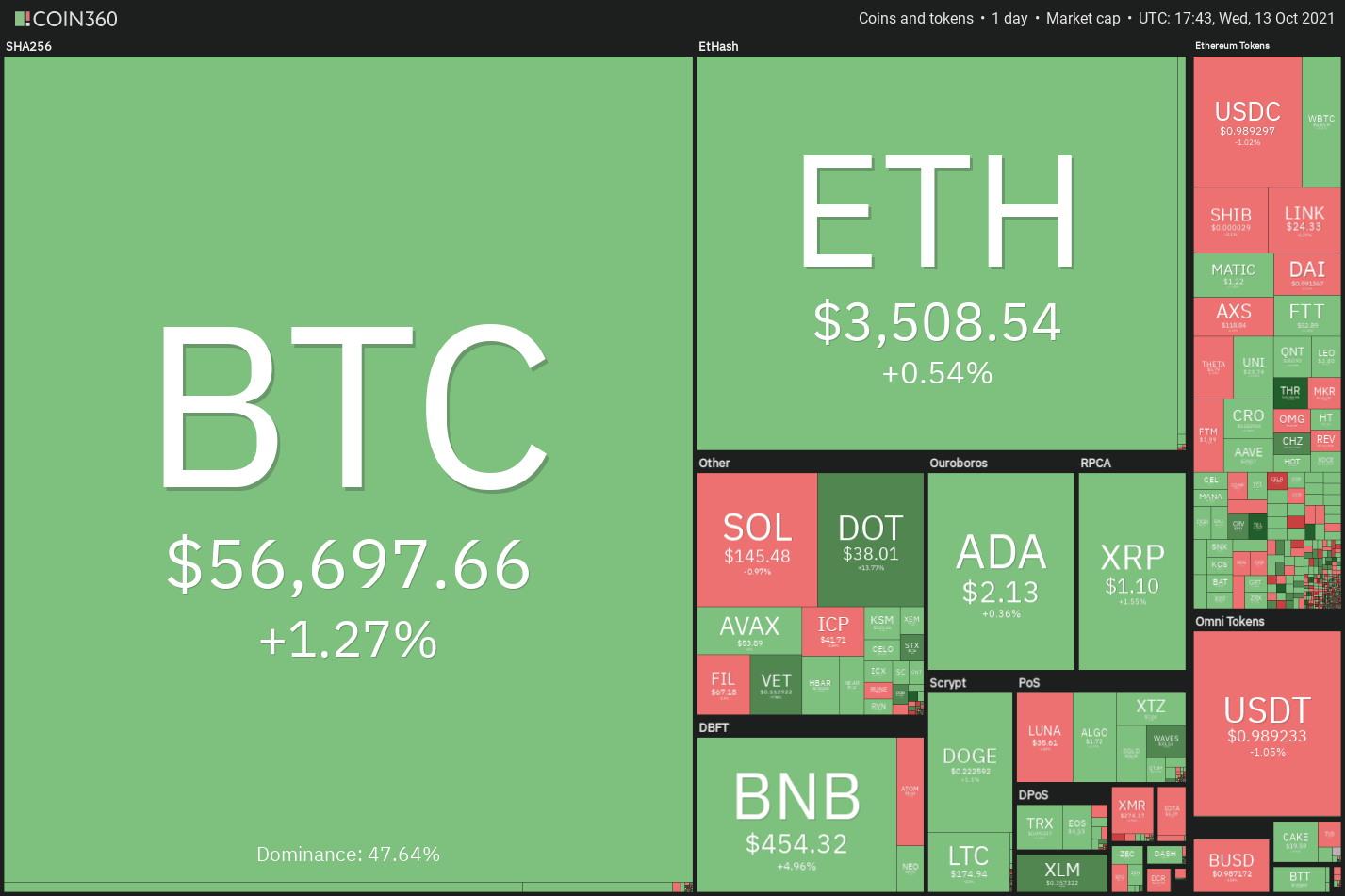

Is Bitcoin poised to continue its upward trajectory, or is it time for a few days of consolidation? To learn more, let’s examine the charts of the top ten cryptocurrencies.

BTC/USDT

Bitcoin fell from $57,680 on Oct. 12 to $55,680 on Oct. 13, but the lengthy tail on the day’s candlestick shows that investors should purchase on dips. The bears attempted to push the price below the breakout level of $52,920 once more, but the extended tail on the day’s candlestick suggests that the bulls are not about to give up the fight.

The rising 20-day exponential moving average (EMA) ($51,338), as well as the relative strength index (RSI) in the positive zone, signal that buyers are in a better position right now. If bulls are able to push the price above $57,839.04, the Bitcoin/USDT pair has the potential to climb to $60,000.

However, if bulls are able to push the price above this level, the pair may be able to revisit the all-time high of $64,854, which was reached in August. If bulls manage to overcome this stumbling block, the bullish trend may accelerate.

On the downside, the breakthrough level at $52,920 continues to be the most important support to keep an eye on. A break below this level and the 20-day exponential moving average (EMA) will be the first indication that bulls are losing their hold on the market.

ETH/USDT

For the past three days, Ether (ETH) has recovered from the 20-day exponential moving average ($3,390), signalling that bulls are piling in on declines. The bulls will now attempt to push the price of gold to the neckline of the inverted head and shoulders (H&S) pattern, which has formed.

If the price of gold breaks out above the neckline and closes above it, the bullish setup will be complete, with a target of $4,657 as its ultimate goal. The gradually increasing 20-day exponential moving average (EMA) and the RSI reading above 55 imply a little advantage for the bulls.

ETH/USDT, on the other hand, may not be able to continue its upward trajectory indefinitely because of severe resistance around $4,027.88 and later at $4,372.72.

Alternatively, if the price declines from the current level or the neckline and breaks below the moving averages, the ETH/USDT pair might fall to $3,160, and then to the psychological support level of $3000.

BNB/USDT

On October 10, Binance Coin (BNB) broke and closed below the 20-day exponential moving average ($417), but the bears were unable to capitalise on their gains. On Oct. 11, the bulls successfully defended the psychological support level of $400 and drove the price back over the 20-day exponential moving average.

Although bears dragged the price below $400 on Oct. 12, the move appears to have been a bear trap, as the BNB/USDT pair swiftly recovered and reclaimed the neckline. On Oct. 13, buyers drove the price over the neckline.

If the pair closes above the neckline, the bullish inverse H&S pattern will be completed. This setup may signal the commencement of an upward advance to $519.90, where stiff resistance is expected.

A break and close above this level might accelerate the pair toward the pattern target of $554. To gain the upper hand, the bears will need to push the price below $392.20.

ADA/USDT

On October 12, the cryptocurrency Cardano (ADA) broke and closed below the support line of the symmetrical triangle. This means that the bears have won the battle against the uncertainty that has characterised the preceding few days.

Bulls will attempt to push the price over the 20-day exponential moving average ($2.21), but if they fail, the ADA/USDT pair might fall below $1.87. This is an important level to observe because if it falls, the drop might extend all the way to $1.63.

The 20-day EMA has begun to decline and the RSI has fallen below 44, indicating a bearish bias. This bearish view will be invalidated if bulls push and sustain the pair above the triangle’s resistance line.

XRP/USDT

The price of Ripple (XRP) rallied off the 20-day exponential moving average ($1.06) on October 12, but bulls are finding it tough to keep the price above the 50-day simple moving average ($1.08). This means that there aren’t enough buyers at the upper tiers.

If bears continue to plunge the price below the 20-day exponential moving average, the XRP/USDT pair might fall to psychological support at $1. A break and closing below this level could exacerbate selling and push the pair as low as $0.85.

If, on the other hand, the price rises from its current level, the bulls will make another attempt to push the price over the overhead resistance level of $1.24.

If they succeed, the pair may climb to $1.41.

SOL/USDT

Solana (SOL) fell below its 50-day simple moving average ($144) on October 12, but bears were unable to take advantage of the dip. The bulls pounced on the dip and drove the price back up to the 20-day moving average ($151) on the same day it was purchased.

The SOL/USDT pair gained moderately above the 20-day exponential moving average (EMA) today, but bearish trading has sent the price back below the 50-day SMA. If bears plunge the price below the 50-day simple moving average, the decline might extend to $116.

This bearish perspective will become invalid if the price reverses and breaks above the downtrend line. The pair could then ascend to the Fibonacci retracement level of 61.8 percent at $177.80. A break and closing above this level may open the door to a rally to $200.

DOGE/USDT

On October 10, Dogecoin (DOGE) fell below the 20-day exponential moving average ($0.23), and the bulls have been unable to retake the level since then. This shows that bears are putting up a strong fight at the 20-day exponential moving average.

The DOGE/USDT pair might fall as low as $0.21, and if this support level is breached, the pair could drop as low as $0.19. This level has served as a solid support on the previous two times; therefore, bulls are likely to defend it with determination in the future.

However, if the price rises from its current level and crosses over the 20-day moving average, the pair may rally to its downtrend line, which is contrary to this notion. An upward break and closing above this resistance level will signal the possible conclusion of the downtrend.

DOT/USDT

A bounce off the 20-day exponential moving average ($33.02) occurred on October 12, showing that investor sentiment is favourable and that traders are buying on dips. After that, the bulls will attempt to push prices over the overhead resistance level of $38.77, where the bears are expected to put up strong opposition.

If the price declines from $38.77, the DOT/USDT pair may test the moving averages once more. This is a critical support level for bulls to maintain, as a breach below the 50-day SMA ($31.37) could signal a slide to $25.50.

Alternatively, if the price continues to rise above $38.77 from its current level, the uptrend may resume. On the upside, the initial objective is the all-time high at $49.78, followed by the pattern target at $52.04.

LUNA/USDT

On Oct. 12, Terra protocol’s LUNA token fell to the 50-day SMA ($35.87), but bulls took advantage of the fall, as evidenced by the lengthy tail on the day’s candlestick. On Oct. 13, buyers attempted but failed to push the price back above the 20-day EMA ($39.15).

The 20-day exponential moving average has begun to decline, and the relative strength index (RSI) has fallen below the midway, indicating that bulls may be losing their grip on the market. If bears are able to keep the price below the 50-day simple moving average, the LUNA/USDT pair might fall as low as $32.50.

This level might serve as a significant support, but if it is breached, the selling could get more intense, and the pair could go as low as $25.

The bulls may be able to drive the pair up to $45.01 if the price bounces off the present level and gets over the 20-day exponential moving average.

UNI/USDT

In the week of October 12, Uniswap (UNI) rose off of firm support at $22 and bulls were successful in pushing the price above the moving averages the next day.

The lengthy wick on the day’s candlestick, on the other hand, implies that selling will occur at greater levels.

The 20-day exponential moving average ($24.29) is flat, and the relative strength index (RSI) is just below the midpoint, indicating that supply and demand are in balance. A break and closing below $22 might tip the scales in favour of bears and give them the upper hand. After that, the UNI/USDT pair might fall to $18.

As an alternative, if the price rises from its current level and breaks over the neckline of an inverted H&S pattern, the bullish momentum may begin to gain speed again. In the short term, the pair might rally to $31.41 before continuing its march toward the pattern target of $36.98.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research. Market data is provided by HitBTC exchange.