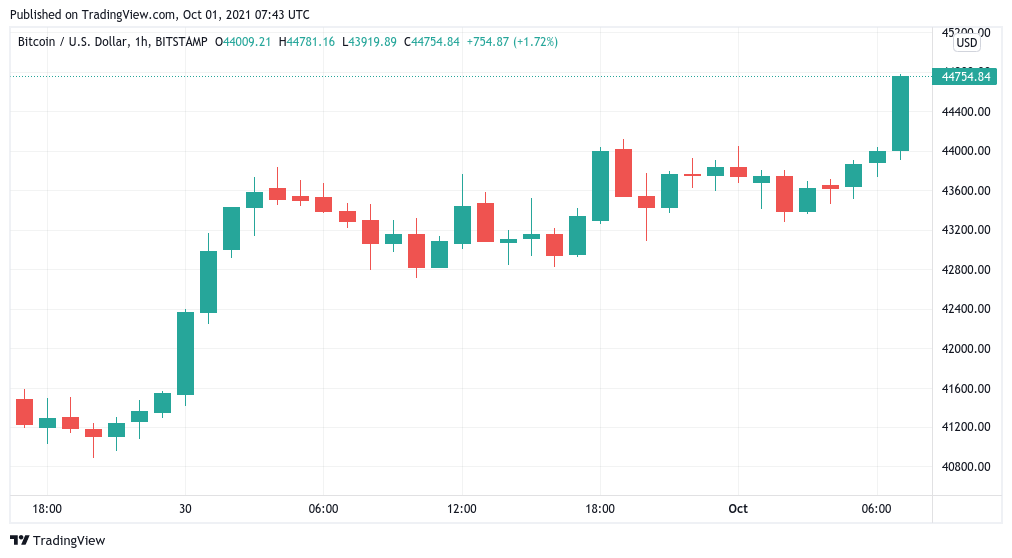

Bitcoin (BTC) was determined to maintain its $44,000 level on Oct. 1, as the monthly closure spurred a late show of strength in the cryptocurrency.

BTC monthly close matches PlanB prediction

TradingView data tracked the Bitcoin/USD pair as it first recovered to the $44,000 mark on Thursday, then tested lower levels before accelerating to even higher heights.

Even though Bitcoin is still unable to break through barriers at $45,000 and above, the cryptocurrency did not disappoint with its end-of-month performance, which was virtually exactly in line with expectations from the stock-to-flow model provider PlanB for the second month in a row.

Aug>47k✅

Sep>43k✅

Next targets: Oct>63k, Nov>98k, Dec>135k pic.twitter.com/C45nfQkQSC— PlanB (@100trillionUSD) October 1, 2021

As of October, Bitcoin was predicted to hit $63,000, fueling optimism that the cryptocurrency would make up for lost ground going into the fourth quarter of the year.

„September was a particularly difficult month. October is a particularly pleasant month. The month of November is a beautiful month.“ The month of December was described by Cointelegraph contributor Michal van de Poppe, who encouraged his Twitter followers to „buy the f*cking dip“.

Van de Poppe stressed historical performance over performance in other months of the year, which previously reported as showing that September was a „boring“ month to spend the most of one’s time in, according to CoinNewsDaily.

Others, on the other hand, were more careful in their statements. QCP Capital, a cryptocurrency trading firm, announced in its most recent market update that it would maintain a cautious stance to the market as a whole and that it would continue to monitor the situation closely.

„Faced with the headwinds of the macroeconomic and financial markets, we are finding it difficult to form any sort of directional confidence. In the fourth quarter, we want to retain a pretty neutral and nimble position. We’ll see how it goes“a synopsis of the executive committee.

Among the most relevant macro factors were the reiteration of China’s crypto crackdown, as well as two concerns relative to the United States: legislation and the possibility of the licensing of a Bitcoin exchange-traded fund (ETF).

Earlier this month, it was decided to postpone a vote on the government’s infrastructure plan until after the midterm elections, which will take place in November. This week’s vote was originally slated to take place on Monday, but it was postponed for a second time on Friday due to scheduling conflicts.

Ethereum returns to $3,000

On the other hand, altcoins saw another day of slight to no movement, lead once again by Binance Coin (BNB), which gained 6% on the day.

At the time of writing, however, all of the top 10 cryptocurrencies by market capitalization were trading in the green, providing a welcome respite from the recent volatility.

Ether (ETH), the largest altcoin by market capitalization, soared above $3,000 on the basis of a 3 percent gain.