Over the past several days, Bitcoin (BTC) and other major cryptocurrencies have been consolidating as investors look for a trigger that would herald the beginning of the next large directional rise. A growing amount of inflation in the United States, according to some observers, will be positive for Bitcoin in the long run.

Investing in “equity, real estate, bitcoin, and other forms of digital currency” is the greatest way to protect oneself in the current environment, according to Anthony „Pomp“ Pompliano, in a statement to customers.

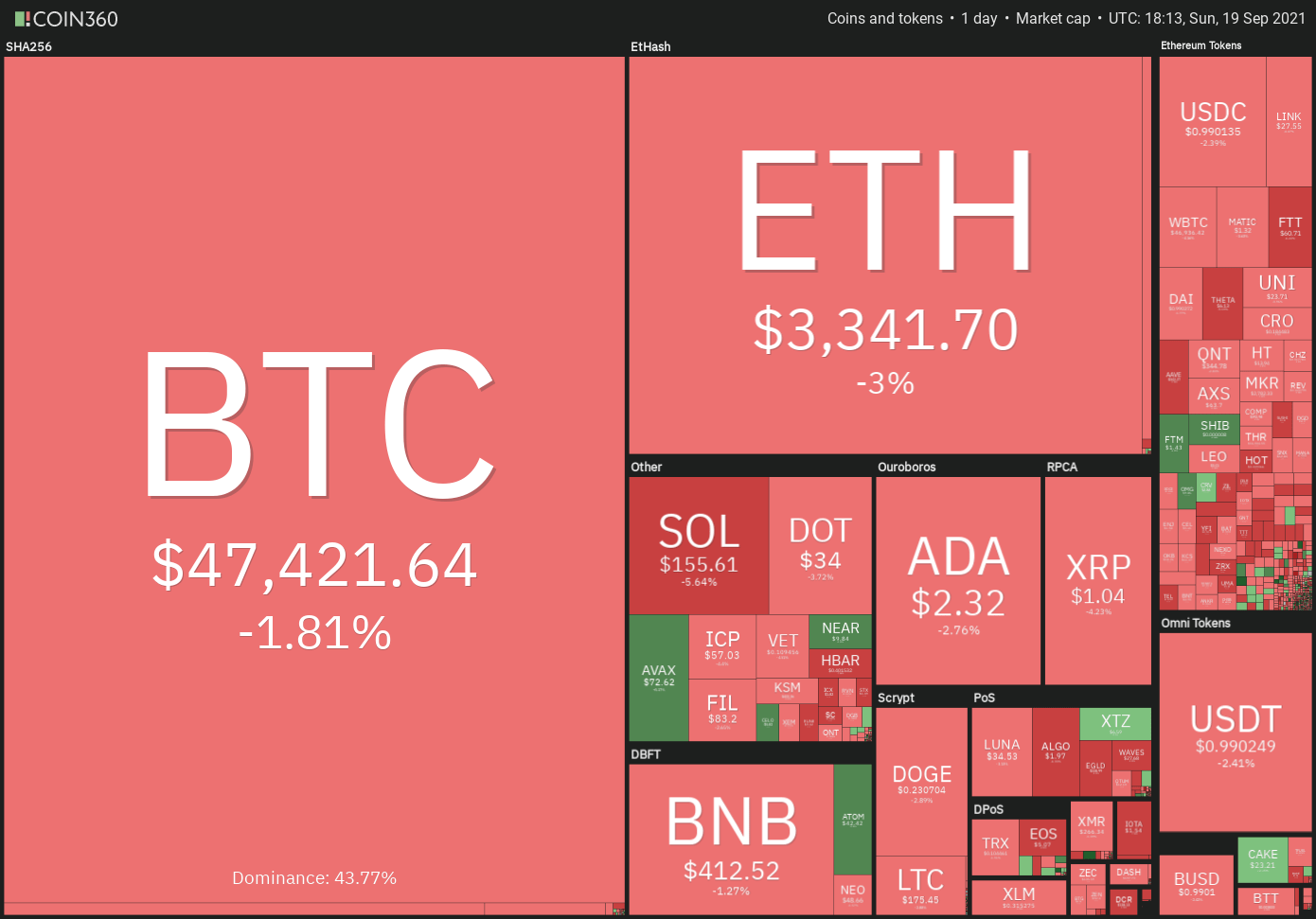

Cryptocurrency market dominance has rebounded from approximately 40.66 percent on September 12 to 43.75 percent on September 18; this suggests that traders may be taking profits in altcoins and buying bitcoin to reinvest. The outcome of the two-day Federal Open Market Committee meeting next week could serve as a catalyst for the next directional move in Bitcoin..

Investigate the charts of the top-5 cryptocurrencies to see which ones are likely to outperform in the short term.

BTC/USDT

When Bitcoin is trading near the 20-day exponential moving average ($47,362), it is witnessing a fierce battle between bulls and bears.

Despite the fact that the price bounced off this support on September 18, the bulls were unable to maintain the higher levels.

The flat 20-day exponential moving average (EMA) and the relative strength index (RSI) at the midpoint suggest that supply and demand are in balance. Alternatively, if bears are able to push the price below the 50-day simple moving average ($46,489), the BTC/USDT pair could fall as low as $44,000 and then as high as $42,451.67, the breakout level.

On the other side, if the Bitcoin price bounces back off the 50-day simple moving average, the bulls will attempt to resume the uptrend. It is possible that a break over $48,843.20 will pave the way for a move to the overhead resistance zone of $50,500 to $52,920 in the near future.

It is possible that the bulls will have difficulty crossing this zone since the bears will put up a strong fight. It’s possible that the pair may remain range-bound for a couple of days if the price falls from this area. But a breach above the zone might clear the way for a rally that could take the price as high as $60,000.

Despite the fact that bulls were able to push the pair above the overhead resistance level of $48,557, bears were able to rapidly pull the price back below the level. There is no evidence to suggest that bears have given up their fight just yet.

The bulls are aiming to defend the 50-second moving average (SMA). If they are successful in pushing the price above the overhead resistance zone of $48,557 to $48,843.20, the pair might begin its northward march toward $50,500, where the bears may once again stage a strong counter-movement.

This bullish outlook will be rendered meaningless in the short term if the price continues to fall and breaks below the 50-day moving average.

DOT/USDT

Polkadot (DOT) rallied off the 20-day exponential moving average ($32.39) on September 18, however the bulls were unable to capitalize on the rally. That bears are more active at higher elevations is suggested by this.

The rising moving averages signal that buyers are gaining an advantage, but the negative divergence on the RSI indicates that the bullish momentum may be fading. Breaking down and closing below the 20-day exponential moving average (EMA) might exacerbate the selling and push the price down to the breakout mark at $28.00 or lower.

Due to the proximity of the 50-day simple moving average ($27.07) to this level, it is critical for the bulls to hold their ground. If the price moves back above this zone, the buyers will attempt to resume the rise once again.

In contrast, a break and closing below the 50-day simple moving average (SMA) will indicate a possible change in trend. After that, the DOT/USDT pair might go as low as $22.66.

The 4-hour chart reveals that the moving averages have completed a bearish crossover and that the RSI is just below the middle of the range of the moving averages. This shows that bears have the upper hand in this situation. A break and closing below $32 might entice additional selling, resulting in a drop to $28.60 or even lower.

The price rising off the current level and breaking above the downtrend line, on the other hand, will indicate that the correction may have come to a conclusion.

The pair might then rise to $37, and then to $38.77 in the following days. Once this resistance level is breached and closed above, the uptrend will be signaled to resume.

LUNA/USDT

The LUNA coin, which represents the Terra protocol, is correcting in an upswing. In recent days, the bulls have been able to hold the 20-day moving average ($34.08) support, but they have not been able to produce a significant comeback off of it. This shows that demand begins to dwindle at higher levels of inflation.

If bears are able to push the price below the 20-day exponential moving average, the LUNA/USDT pair might drop to the 50-day simple moving average ($27.21). If the market rebounds off the 50-day simple moving average, the bulls will attempt to resume the uptrend once more, but they may run into resistance near the 20-day exponential moving average.

A break and closing above the 20-day exponential moving average (EMA) will indicate that buyers have returned to the market. After that, the pair might rally to $42 and then retest the all-time high of $45,01, which would be a new record.

If, on the other hand, the price falls below the 50-day simple moving average, the correction might deepen to the important support level of $22.40.

On the four-hour chart, the pair has created a descending triangle formation, which is bullish. On a break, this setup will come to an end, and it will close below the support level of $33.62. The pattern goal for this setup is $22.23, which is a good deal. The 20-EMA is progressively sliding downward, and the RSI is below 44, indicating that bears have gained the upper hand.

If the price bounces back off the $33.62 support level, it will indicate that bulls are accumulating at lower levels of the market. The bearish pattern will be rendered invalid if the triangle is broken and closed above the midpoint. The bulls will then attempt to push the price up to $40 per barrel of oil. Buying at this level may prove to be difficult, but if investors manage to overcome the obstacle, the upward trend may resume.

ATOM/USDT

Cosmos (ATOM) broke through the firm overhead resistance on September 12th, reaching $32.32 per share. For the previous few days, the bears have attempted to push the price below the breakout level, but the bulls have refused to give up their gains. This indicates that there is high demand at $32.32.

Because both moving averages are rising in value and the RSI is in overbought zone, it appears that buyers are in command of the market. With a long tail on today’s candlestick, it appears that bulls have shifted the $38.09 support level into support territory.

The ATOM/USDT pair has the potential to climb to the psychological level of $50. Alternatively, if the price declines from its current level and falls below $38.09, it will signal the need to take profits at higher levels. The pair could then fall to $32.32 if the current trend continues.

The 4-hour chart shows that the pair has bounced off the 20-day exponential moving average, showing that sentiment is positive and that traders are buying on every little reversal in the market. Both moving averages are rising upward, and the relative strength index (RSI) is in the positive zone, indicating a buyer’s advantage.

Although the bears are now attempting to stall the advance at $44.15 per share, if the bulls do not give up much ground, the likelihood of the uptrend resuming is very strong. Unless the pair falls below the 20-EMA, this bullish outlook will be rendered meaningless in the short term.

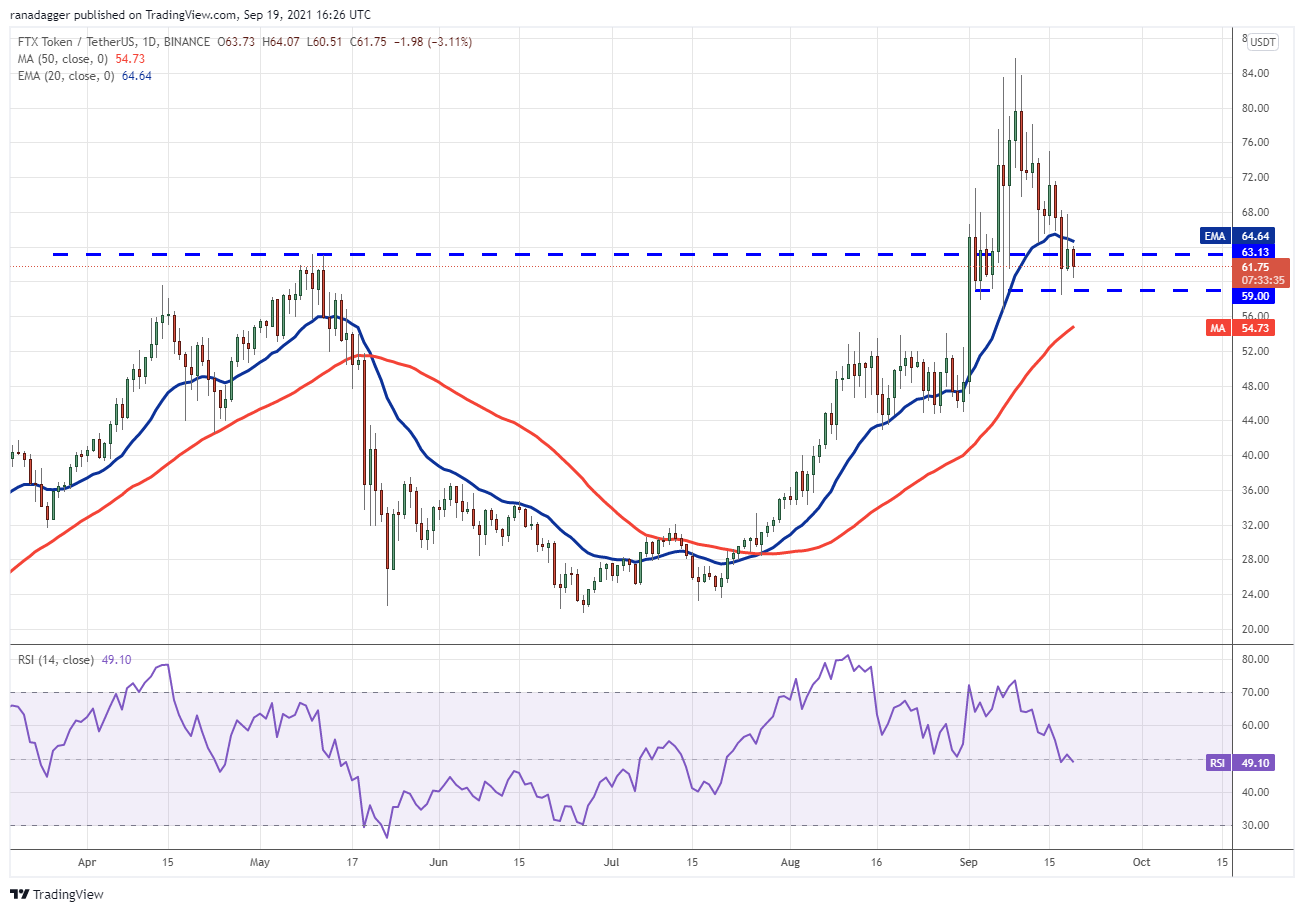

FTT/USDT

A correction in an uptrend is underway for the FTX Token (FTT), and the bulls are fighting to hold on to the support zone between $63.13 and $59. Despite the fact that the price bounced off this zone on September 18, the bears were unable to keep the price above the 20-day moving average ($64.64).

The 20-day exponential moving average has begun to decline, and the relative strength index (RSI) has fallen into the negative zone, indicating that bears are attempting to make a comeback.

If bears are successful in driving the price below the support zone, the FTT/USDT pair might fall to the 50-day simple moving average ($54.73). A break and closing below this support level could herald the beginning of a more significant decline.

If, on the other hand, the price rises from present levels or the 50-day simple moving average, it will indicate that traders are accumulating on dips. After that, the bulls will attempt to restart the upswing.. The first sign of strength will be a close above $68.20 and a break above that level. A likely rally to $75 will be paved in advance of this.

Both moving averages are sliding downward, and the Relative Strength Index (RSI) is in the negative zone, indicating that bears are in control. Alternatively, a break and close below $59 might exacerbate selling and drive the market down to $54.

Because this level was previously used as strong resistance, bulls will attempt to convert it into support at some point in the future. During the ascent, a breakthrough and closure above the downtrend line will serve as the first indication that sellers may be losing their hold on the market.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.