According to derivatives markets, traders in Ether (ETH) remain optimistic about the possibility of further upside, despite the 23 percent pullback on Sept. 7.

Congestion on the Ethereum network peaked on Sept. 7 when the average transaction fee surpassed $60, and has remained over $17 since then. As a result of the network’s persistent issues, investors have moved their focus to Ethereum competitors with bridge and layer-two capabilities. For example, Polkadot’s DOT stock increased by 29% in the last week, while Algorand’s ALGO stock increased by 67%.

Without a doubt, there is a search for interoperability and layer-two scaling solutions, with the goal of rapidly meeting the rising demand for nonfungible tokens (NFTs) and decentralized finance (DeFi) applications.

Whether the Ethereum network can maintain its undisputed leadership is unimportant at the moment, since the industry’s net value locked (adjusted total value locked) in smart contracts has increased from $13.6 billion in December 2020 to $82 billion at the time of writing.

Fear of regulatory action in the United States is likely dampening investors‘ enthusiasm for cryptocurrencies. According to a House committee memo posted on Sept. 13, lawmakers intend to fix a loophole that previously enabled investors to claim capital gains deductions. Currently, the Internal Revenue Service treats cryptocurrencies as property sold in „wash sales,“ exempting them from the 30-day buyback limitations.

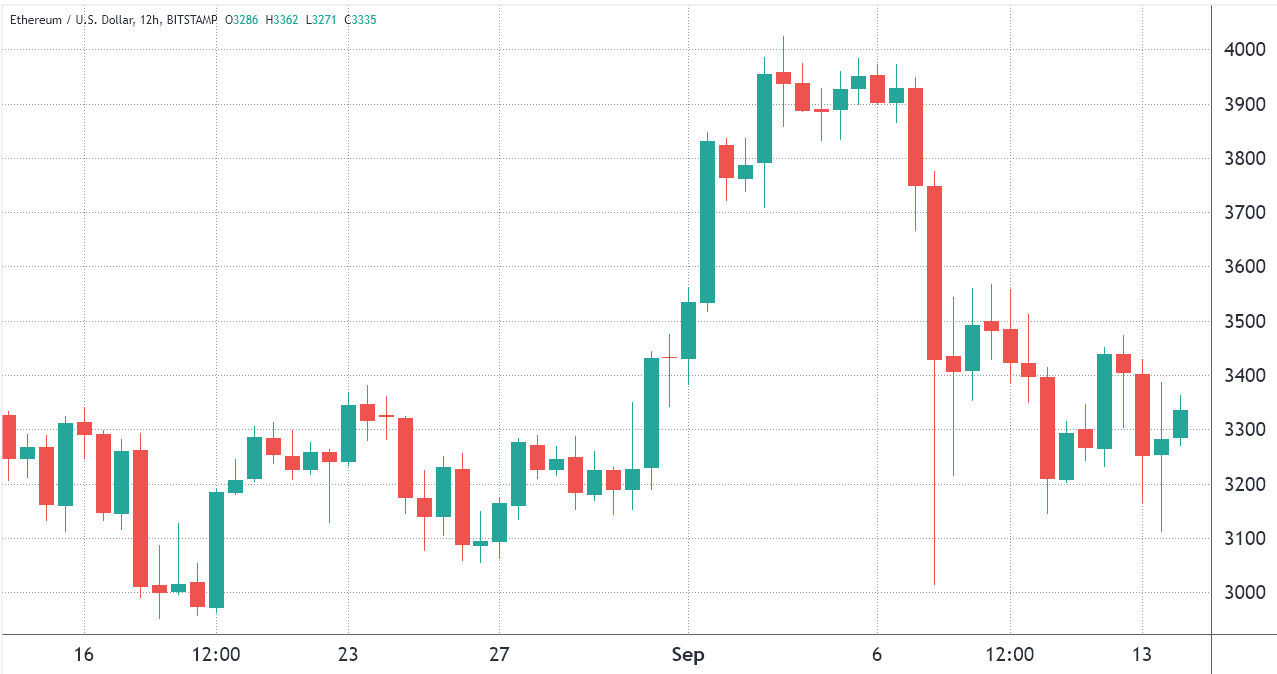

The fleeting $4,000 test on September 3 sent the futures markets into overdrive for a brief period of time. On July 20, Ether’s price had risen to $1,735 after an uninterrupted 45-day run that had resulted in a 130 percent increase. Even if bitcoin has lost 16 percent of its value in eight days, the $3,200 support level has held fast and bolstered bulls‘ confidence.

ETH futures data shows bulls are still “bullish”

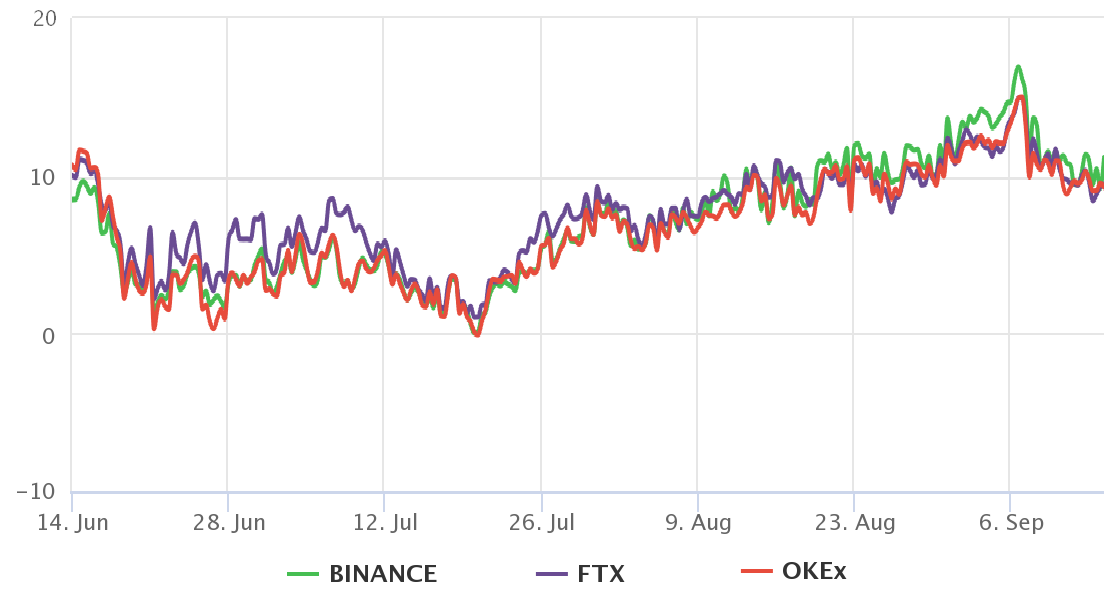

Whales and arbitrage desks love Ether’s quarterly futures contracts because they are the most liquid. The fact that they settle on a specific date and that their prices fluctuate from spot markets may make them appear difficult to regular traders. Their most significant advantage, on the other hand, is the absence of a variable financing rate.

These fixed-month contracts typically trade at a little premium to spot markets, indicating that sellers are requesting a higher price in order to defer settlement for a longer period of time. As a result, on healthy markets, futures should trade at a 5 percent to 15 percent yearly premium over the spot price. This condition is referred described as „contango,“ and it is not unique to the cryptocurrency market.

Since August 9, the premium on Ether’s futures contracts has been a respectable 8 percent, as illustrated in the chart above. With the exception of a brief spike above 15 percent on September 7, derivatives traders have maintained a cautiously optimistic outlook.

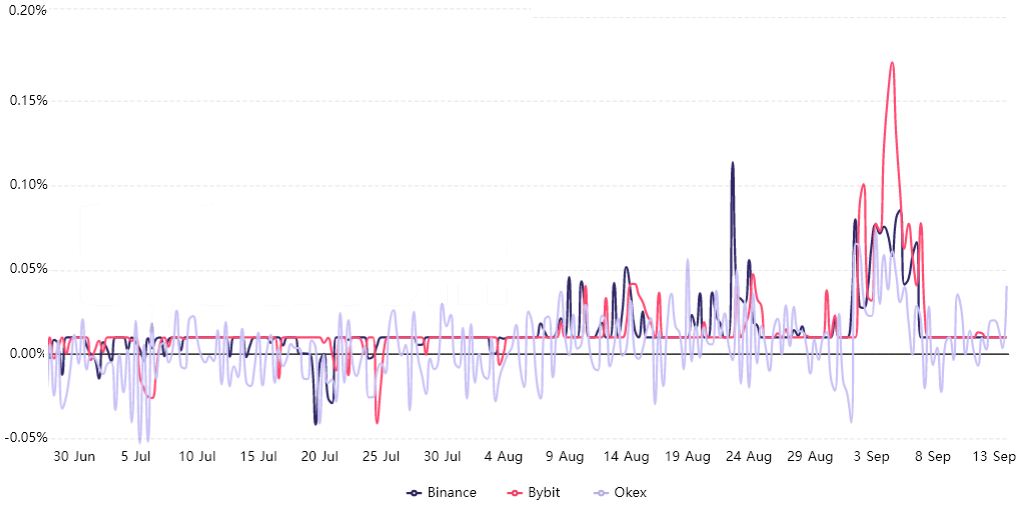

It is necessary to examine data on perpetual contracts futures in order to determine whether or not this movement was limited to those particular products. Despite the fact that longs (buyers) and shorts (sellers) are always balanced in any futures contract, the amount of leverage they have varies.

Exchanges will charge a financing rate to the side that is employing more leverage to balance their risk, and this price will be paid by the other side.

According to the data, a small amount of excitement began to grow on September 2 and lasted fewer than five days. It is clear from the positive funding rate that longs (purchasers) were responsible for paying the fees; nevertheless, the movement appears to have been a reaction to the price increase, and it disappeared as Ether plummeted on September 7.

The absence of indicators of weakening from the Ether derivatives markets might be seen as a bullish indicator at this point in time. Investors‘ attention is still focused on regulatory developments and the release of Ethereum 2.0, which everyone believes will finally solve the scalability problem once and for all.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves risk. You should conduct your own research when making a decision.