After making a million dollars this cycle, you’re attempting to figure out how to convert those life-changing gains into real-world cash before market collapse, right? While you do not want to sell now, you do not want to miss out on any potential upside. So, what should you do in this situation?

The answer, according to Mati Greenspan, the originator of Quantum Economics, is straightforward: Be positive. He is not a believer in the practice of trying to time the market.

“As somebody who has been trading my entire life — I mean, way before cryptocurrencies — you’ll find that it always pays to be optimistic, and pulling out your money from the market has almost never been a good long-term strategy. Not for any market over almost any time frame.“

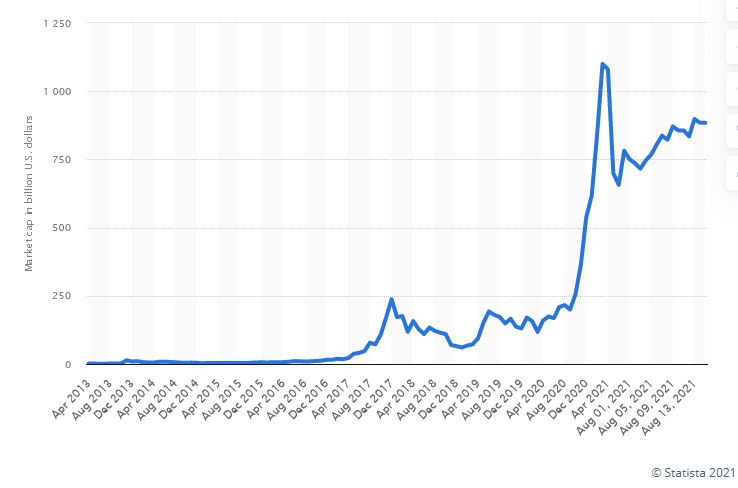

Greenspan points out that even the small number of investors who purchased Bitcoin at the height of the 2017 bull run have seen their investments grow by more than 250 percent in just three and a half years.

“Anybody who was wise enough to foresee the crypto winter and took all of their money out, when do you get back in? Nobody can time the markets to a T. The best we can do is to kind of figure out, given the information that we have, what are the best investments to make over time.“

It’s impossible to anticipate where things will go from here.

Greenspan, in contrast to Decentrader experts Filbfilb and Philip Swift in Part 1, does not believe it is possible to utilize on-chain indications to reliably predict the end of a bull run in the cryptocurrency market. Elon Musk’s remark or terrible regulatory news from China, for example, might emerge at any time, putting markets into bear mode, according to his warnings.

In order to judge where the market is headed, according to Filbfilb, effective traders don’t just look at one sort of data but evaluate on-chain analysis in the context of sentiment, cyclical data, technical analysis, and everything else.

Filbfilb mentioned: “If you’re sort of sitting around waiting for some on-chain analysis to tell you the answer, and we have a black swan event, you’re not going to do anything about it in time.” He goes on to say that even black swan events do not pose significant problems for educated traders, pointing out that the March 2020 „Black Thursday“ catastrophe had been foretold for weeks prior:

“If that kind of thing were to happen again, as a trader myself, I would have enough time to take action. I’m in and out of the market all the time.”

“For me, it’s a much more fluid situation. I’ve got other tools, like I know how to hedge. I’ve got other different ways of managing risk, which means I don’t necessarily have to sell my Bitcoin in order to get myself into a position where I can cover any downside risk.”

It goes without saying that it takes a great deal of effort, time, and training to be able to play the market as effectively as Filbfilb. What about the rest of us? What are our options?

Filbfilb advises taking a sufficient amount of profit to keep oneself pleased throughout a slump. “If you’ve made life-changing money, consider changing your life a little bit now. For me, I personally have done that — I’ve taken some money off the table,“ he says.

“What that’s allowed me to do is to sort of be able to hold on for the rest of the cycle, potentially to much higher prices.”

Profit from profit-taking

Scott Melker, widely known as „The Wolf of All Streets,“ agrees that taking profits on your trades all the way up is the key to success, whether you are trading at predefined levels or more arbitrarily based on market conditions. On the way up, he believes, people should profit from their investments, just as they should dollar-cost average into an asset on the way down.

“I am a big believer that after your investment has quadrupled, you should remove your initial investment from consideration. In other words, if the bet was $100,000, you now have $100,000 to play with, and there is absolutely no risk.”

This has the additional benefit of decreasing the likelihood that you will make a costly error by selling too soon, too late, or too much when you believe the peak has been reached in the market.

“You know, when you’re taking profits, every time you sell something you’re taking the pressure off your future decisions. Which is mentally a very good place to be.”

He does, however, state that you are permitted to have diamond hands when you have high-conviction, long-term holds in your possession. According to him, “I purchase Bitcoin for my children – I am not concerned about cycles.”

The constant process of adjustment

According to Greenspan, he makes money by taking profits when he needs it, and he moves funds away from coins that have experienced a significant rise in value and toward younger ventures that he feels will perform better in the future. He prefers to collect 10 percent profits at a time at various phases, either reinvesting them in Bitcoin or cycling them into other ventures.

“Diversification can help you reduce the downside of your portfolio while keeping upside potential,” he explains.

In spite of his doubts about whether it is even possible to predict when the market’s peak would occur, he believes it is typically very evident when you are in a bear market or a bull market, and that you should act in accordance with this knowledge.

“Prices are declining, and they are projected to continue declining: now is the time to cut exposure. “I don’t see any use in attempting to locate the very top,” he says.

“We can tell when we’re in a bear market, and that’s when we should prepare to hunker down. So, bring things in, consolidate your portfolio, and get rid of the leveraged bets,” he says further.

this JPEG of a tulip is selling for $3.2 million pic.twitter.com/7ppboKsBwO

— Turner Novak ?? (@TurnerNovak) August 29, 2021

Following the end of the 2017 bull market, Melker believes that peak enthusiasm and excessively bullish sentiment among retail rookies are the most dependable top signs.

Rather than charts, he believes that sentiment will be a stronger indicator. People who had never heard of cryptocurrency before and who still don’t comprehend it are telling you how they need to acquire it, which is something we witnessed in 2017.

He recalls a friend’s nanny purchasing „shares of Ripples“ in 2017 after viewing the cryptocurrency on CNBC. “Those are really significant top signals,” he asserts.

“If you’re looking at a chart, maybe it’s a shooting star candle on the monthly where the price went way up and comes all the way back down and had this long wick up on massive volume bigger than anything you’ve seen previously. Those are the kinds of things you look for. There’s peak euphoria and then the price not being able to advance on that euphoria.”

While the excitement surrounding dog tokens such as Shiba Inu and memecoins on Binance Smart Chain appeared to be top signals a few months ago, Melker believes that the cryptocurrency market has grown large enough for bubbles to expand and pop in various pockets of the market without tanking the entire market. He cites DeFi Summer, as well as the rise and fall — and rise again — of NFTs this year, as instances of what he is talking about. “Things like DOGE and Safemoon are their own insular bubbles, in my opinion, but I do not think that they’re indicative of a larger bubble of the entire market,” he says. “If we see that sort of behavior on Ethereum or Bitcoin, it will be time to take notice.”

Zoom out

According to Greenspan, the concentration on trying to predict the end of the cycle diverts people’s attention away from the greater picture.

As far as he is concerned, the market has been on an extended bull run since the end of the global financial crisis. Prices occasionally get ahead of themselves and come back for a short period of time, but the main trend is upward.

The same thing happened in 2014 for Bitcoin, and the same thing happened in 2018 – the cryptocurrency got ahead of itself, according to him. The extreme winters of the past two years, according to the author, are not likely to occur again.

One thing that all of the people who participated in this essay agreed on was that they did not expect an 80 percent decline followed by a protracted grind along the bottom like what happened in 2018/2019.

“I believe we will see some healthy corrections, but we will continue to rise,” Melker predicts. „I’ll be amazed if Bitcoin doesn’t reach far into the six figures during this current cycle.“

BTC is on its way to becoming a global reserve asset on par with gold, silver, and bonds, according to Bobby Lee, CEO of Ballet and author of The Promise of Bitcoin. He believes it will be valued millions of dollars and be held by governments around the world. The cryptocurrency, he believes, has a monetary value of at least $1,000,000, and possibly as much as $2,000,000, or even more.

So, if you agree with this point of view, and you hold out for a long enough period of time, you will emerge victorious. Even if you don’t, Lee warns against succumbing to the temptation of trying to sell out at the top in order to buy more at the bottom of the market.

Litecoin founder Charlie Lee, for example, did not pick the exact top at which to sell all of his holdings in 2017. „It’s not conceivable – no one can catch up with the top,“ he says, adding that not even his brother, who founded the cryptocurrency, could do so in 2017.

“If you ask my brother, I don’t believe he was able to catch the top. […] He sold his Litecoin, but he did not sell all of his cryptocurrency, according to him.

“The way to profit is to hodl all the way up to $100 trillion. But most people want to take some money off the table as it goes up. So, the prudent method is to set aside small amounts you must sell at fixed price intervals going all the way up to a million dollars.”

Maybe this time things will be different?

As mainstream acceptance approaches, more and more of crypto’s finest minds are beginning to believe that the period of four-year market cycles is coming to an end, and that the market is actually transitioning into a „supercycle.“ When it comes to financial institutions incorporating Bitcoin into their balance sheets and central banks adopting current monetary theory and printing unlimited amounts of dollars as a policy, the industry is undoubtedly entering unknown territory this time.

“There is a debate about whether we are entering a supercycle, which would mean that Bitcoin would effectively become a store of value,” Filbfilb explains. “And if that happens, we could find ourselves in a much longer cycle.”

“If the dollar continues to be debased, etc., then there’s no reason why anybody would really start dumping their Bitcoin because there’s nowhere for the value to go.”

In a macro cycle context, long term investors are still climbing towards their peak accumulation, which marks bottoms. Early signs to me that the bull market may continue into 2022 and BTC is in the process of breaking free from the 4 year internal cycle from the halvenings.

— Willy Woo (@woonomic) August 18, 2021

Melker also believes that Bitcoin may be in the midst of an extended supercycle, noting that time in the market is more important than timing the market.

“If you believe in Bitcoin one day will be six figures, if you believe it’s going to a million dollars, […] you just start buying,” he says. “If you invest money that you can afford to lose, and you do it with a long time frame in mind, then you don’t even have to be concerned about the top.“

“Like any other market in history, the best way to approach it is to slowly put money in that you will never need to touch and let it go to work for you for a long period of time. Thats how people have acquired generational wealth in the stock market since the beginning, and it should be no different with Bitcoin — except it’s accelerated.”