Anyone who has been in the bitcoin (BTC) industry for an extended period of time has probably heard that the way to go is to avoid short-term trading and instead use the dollar-cost average (DCA) method. However, what is DCA and which services are available to assist you in automating the process in order to maximize the potential of the powerful bitcoin DCA strategy?

The dollar-cost average strategy

Simply said, dollar-cost averaging, or DCA, is the technique of breaking an investment into a series of smaller purchases spread out over time, rather than making a single major purchase.

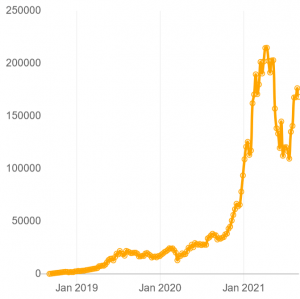

The primary premise behind this approach is that timing the market is nearly impossible for the majority of investors. As a result, by spreading purchases across a predetermined time period, an investor might leverage an asset’s volatility to his or her benefit.

Occasionally, the investor will purchase when the price is high, but he will also purchase when the price is low and the majority of other purchasers are afraid to purchase. This is especially critical when dealing with a volatile asset such as bitcoin.

And, given that the DCA strategy’s entire purpose is to continue buying when the market is fearful, the simplest approach to overcome this mental barrier is to automate the purchases so that no physical effort is required.

To assist you in beginning your own DCA journey, we’ve conducted research and compiled a list of some of the most popular dedicated auto-DCA services for BTC in various countries across the world:

Amber (USA and Australia)

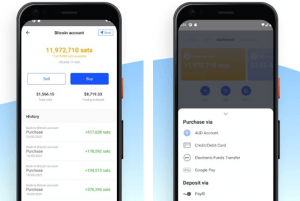

Amber, a financial startup founded in Australia in 2017, is a dedicated DCA service for bitcoin exclusively. For the time being, the service is only available to citizens of the United States of America and Australia, but the firm says it hopes to expand its reach in the future.

The primary advantage of Amber is its simplicity and uncomplicated cost structure. The company provides a smartphone application that specializes in bitcoin recurring purchases.

The disadvantage of Amber is the relatively high 2% fee on bitcoin purchases for non-paying „Basic“ users. Clients who pay a fixed monthly price of USD 18 and so qualify for „Amber Black“ membership, on the other hand, will not be charged any fees on bitcoin purchases.

Additionally, there are costs ranging from 1.2 percent to 1.8 percent for financing an account with a credit card, although this can be avoided by using the free EFT (US electronic funds transfer) funding option.

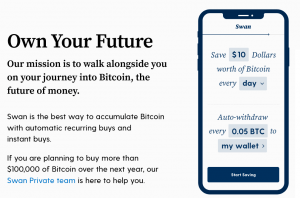

Swan Bitcoin (USA/international)

Swan Bitcoin, headquartered in Los Angeles, primarily services the US market for recurring bitcoin purchases, however it claims to cover the majority of other nations as well.

However, non-US consumers must send funds to Swan Bitcoin via international wire transfers, as the organization does not accept credit cards or major online money transfer providers such as PayPal or Wise. Unsurprisingly, this may prove prohibitively expensive for a large number of overseas consumers.

Swan Bitcoin fees, on the other hand, are more fair for US investors, ranging from 1.19 percent to 2.29 percent, depending on the quantity of the recurring buy. Additionally, the corporation charges fees ranging from 0.99 percent to 1.49 percent for monies deposited on the platform, bringing the total price to as high as 3.78 percent.

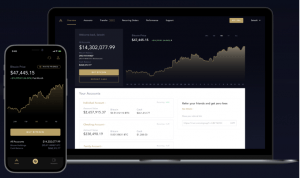

River Financial (USA only)

River Financial, based in San Francisco, is another bitcoin-only DCA service that serves the US market. The program works by requiring users to link their bank accounts and then configure regular purchases.

Perhaps the nicest feature of River Financial is the simple and affordable fees associated with recurring purchases. The company charges a flat rate of between USD 1.19 and USD 2.39 for purchases under USD 200. Meanwhile, purchases over USD 200 are subject to a percentage fee ranging from 1.20 percent for the smallest transactions to 0.64 percent for the largest transactions.

Additionally, River Financial offers an iPhone software – but not an Android app – that enables consumers to track their bitcoin purchases from their phone.

Bittr (Europe)

Bittr is a Swiss-based bitcoin-only corporation that is exclusively available in European countries that support SEPA (Single Euro Payments Area). Bittr is unique in that, rather than accumulating bitcoin on its platform, it automatically distributes the coins it purchases on behalf of a client to the client’s selected wallet address.

Given that the process of purchasing bitcoin occurs automatically whenever Bittr receives funds from a customer, a DCA method can be implemented by establishing a periodic SEPA payment from the user’s bank account.

Best of all, Bittr’s onboarding procedure is simple, with very few know-your-customer (KYC) checks. Additionally, fees are minimal, with a fixed rate of 1.5 percent applied to each deposit made to the company.

In contrast to some other DCA services, Bittr does not allow users to sell bitcoin back to the firm. However, because the coins are stored in the user’s own wallet, they may be moved and sold rather quickly.

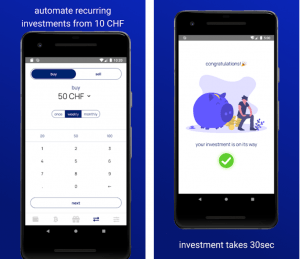

Relai (Europe)

Relai, like Bittr, is a Swiss bitcoin firm that allows users to set up recurring bank transfers for the company to purchase bitcoin. The bitcoins can then be automatically transmitted to any wallet address, ensuring that the user retains complete control of his funds.

Again, the primary advantage of using Relai is that the app requires no personal information other than the account number from which payments will be delivered. The service is available for a fixed price of 3%. Unlike with Bittr, this price includes both the company’s service fee and any bitcoin transaction fees.

A good perk of using Relai is that it enables customers to sell their bitcoins back if they desire, saving them the effort of seeking alternative venues for their bitcoin sales.

Apart from regular lump-sum purchases, the global bitcoin marketplace FastBitcoins.com also enables recurring bitcoin purchases via its auto-buy option.

The advantages of using FastBitcoins.com include the service’s global accessibility and the fact that physical currency can be used to make purchases in specific regions (primarily in Canada, Europe, and Australia), in addition to bank transfers.

Fees vary according on deposit type, with bank payments charging 2% and cash deposits charging 4%.

Despite the company’s assertion that „financial privacy is a fundamental human right,“ FastBitcoins.com will continue to require users to submit copies of government-issued identification documents such as passports or driver’s licenses.

Other options

Finally, we should highlight that several established cryptocurrency exchanges allow consumers to set up recurring purchases of not just bitcoin, but any cryptoasset they like. Although these are not dedicated DCA services, they may be helpful for users of various exchanges already. Binance, Binance.US, Gemini, and Coinbase are just a few of these.

Bear in mind, however, that fees may vary from those associated with conventional spot trading when utilizing exchanges‘ „quick buy“ functionality. To compound things, exchanges can make it impossible to determine the exact cost of recurrent purchases made via immediate buying, making the dedicated DCA services indicated above a more simplified manner of operation for the majority of investors.

_________

Learn more:

– Fiat-to-Crypto Versus Crypto-to-Crypto: How Should You Trade?

– 5 Leverage Trading Platforms (for Experienced Margin Traders) in 2021

– Top 4 Risks DeFi Investors Face

– Learn These 5 Key Crypto Terms – and Start Trading Like a Pro

– Three Solutions for Crypto Traders When Markets Get Volatile

– 3 Bitcoin Sentiment Analysis Tools: How They Work & How to Use Them

– How to Apply Forex Scalping Strategies to Crypto Trading

– How to Bet on Bitcoin Volatility Using Bitcoin Options

– 10 Dangerous Traps for Crypto Traders

– Crypto Trader’s Murder Blamed On Social Media Bragging