August turned out to be yet another successful month for cryptocurrency investors, with virtually all of the top 100 cryptocurrencies by market capitalization ending the month in the black.

In spite of the fact that bitcoin (BTC) and many other cryptocurrencies had already had a big rally during the last ten days of July, taking bitcoin from below USD 30,000 to well over USD 40,000, the gains in August were nonetheless enormous.

During the month of August, however, market participants have increasingly shifted their attention away from bitcoin and into the world of decentralized finance (DeFi) and non-fungible tokens, according to data from CoinMarketCap (NFTs). As evidence of this, we can go no farther than the price of Ethereum’s native currency, ETH, which has risen by 39 percent in the last 30 days, more than twice the 16 percent gain experienced by bitcoin.

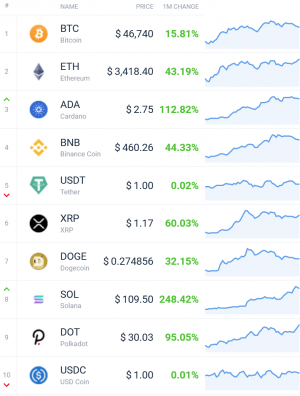

Top 10 coins in August

When you look at the top ten coins in terms of market capitalization, it is easy to say that August was a fantastic month for the crypto blue-chips in general. Although the top coins performed admirably overall, there were still significant disparities in performance amongst them, despite the outstanding overall performance.

It has already been mentioned that bitcoin, the world’s most valuable cryptocurrency by market capitalization (by value), came in last in August with a monthly rise of 16 percent, as the network’s key Taproot update neared its anticipated November deployment.

The Solana blockchain’s SOL token, on the other hand, was the best performer of the month, posting a 248 percent rise for the period under consideration. After breaking past the psychologically significant USD 100 milestone for the first time ever last month, the coin has seen a recent surge in value following its ascent into the top ten rankings by market capitalization.

As for the other currencies in the top ten, cardano (ADA) and polkadot (DOT) both experienced significant monthly gains of 113 percent and 95 percent, respectively, amid a flurry of interest in smart contract platforms that attempt to challenge Ethereum and its supremacy in the cryptocurrency industry.

The high fees on the Ethereum network, which hit their highest level since May in August, have played a significant role in drawing attention away from the platform’s primary competitors.

Perhaps most importantly, this has benefited Cardano, which has been one of the better performing major cryptoassets this year, according to CoinMarketCap.

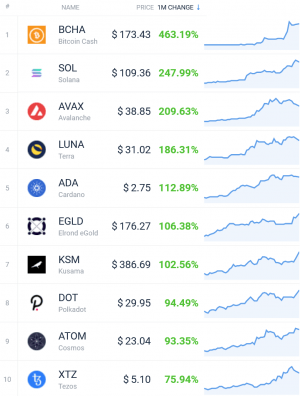

Best among the top 50 coins

When we broaden our scope to include the top 50 cryptocurrencies by market capitalization, the leaderboard for May reveals that SOL was once again at the top of the list, followed by the smart contract platform Avalanche’s (AVAX), which saw a 210 percent increase in value thanks to its new “Avalanche Rush” liquidity mining incentive program.

Terra (LUNA), which surged by 186 percent for the month, was third in the group, followed by Cardano’s ADA.

The elrond egold (EGLD) token and the Polkadot-affiliated kusama (KMT) token, both of which more than doubled in price for the month, were ranked farther down the list of the greatest performers on the top 50 list of cryptocurrencies. They were followed by polkadot, cosmos (ATOM), and tezos (XTZ), which all had increases ranging from 75 percent to 95 percent.

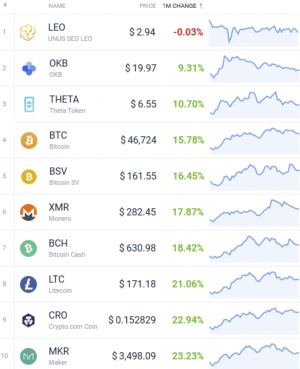

Worst among the top 50 coins

When you look at the worst performance among the top 50 currencies in terms of market capitalization, it becomes evident that August has been a relatively successful month. When stablecoins are excluded, the only token that appears to have remained somewhat steady is Bitfinex’s UNUS SED LEO token. August appears to have risen all boats.

In August, nearly all of the cryptoassets left on the „worst performance“ list saw gains of more than 10%, with nearly all of them gaining more than 20%. In particular, Bitcoin Cash (BCH) and Bitcoin SV (BSV) both performed marginally better than the original bitcoin in terms of price performance.

For the previous month, the most popular privacy-focused cryptocurrency, monero (XMR), gained close to 18 percent in value. The MKR governance token, which is used to administer the MakerDAO stablecoin issuance protocol, gained about 23 percent in value.

Winners & losers from the top 100

When we zoom out even further to include all currencies in the top 100 by market value, we can see that solana and avalanche, as well as the lesser-known smart contract platform Fantom’s FTM, continue to be the top performers. Some of the names are from coins with lesser market capitalizations, such as NEAR, the decentralized application (dapp) platform Near Protocol, and AUDIO, the streaming protocol Audius, both of which are listed here.

It’s worth noting that, despite being one of the best-performing coins for the month, the AUDIO token was first on the list of the worst weekly performers last week, with a decline of 28 percent over the course of seven days.

Safemoon, which lost more than 9 percent of its value in a single month, and Celsius Network’s own CEL coin, which lost 9 percent in a single month, were among the worst monthly performances among the top 100 cryptocurrencies.

____

Learn more:

– Bullish Options Data Fuels Speculations on New Bitcoin Rally

– EIP-1559 Three Weeks Later: ETH 100,000 Burned, Supply Grows

– Recovering Hash Rate, Improving Metrics Indicate Market Rebound – Report

– Fantom Rallies, Solana Hits USD 100 on Continued DeFi, NFT Craze

– DeFi Adoption Driven By Seasoned Traders, Investors From High-Income Countries – Report

– Regulators are Coming for the DeFi Goose and Its Golden Eggs