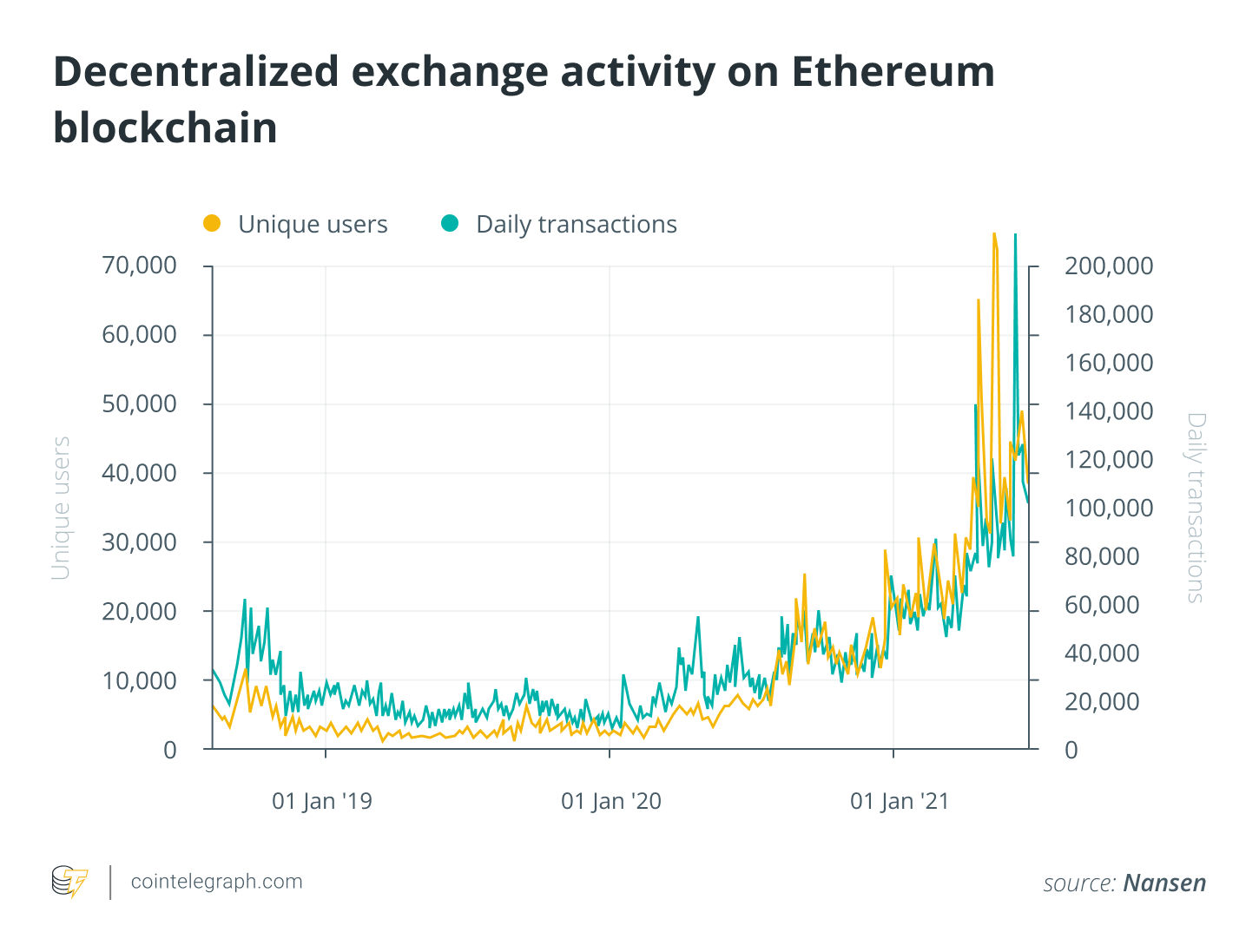

This is because the rise of decentralized finance and non-fungible tokens makes it seem like crypto apps are finally taking off. But is there really a rise in users, or are the same people moving from one hyped market to the next? It was our goal to figure out this mystery and figure out what it meant for the future of new ideas. There has been a lot of growth in DeFi and NFTs. Let’s look at that a little more closely.

It’s possible that DeFi is the most common use of smart contracts today. Machines that make trades, algorithmic stablecoins, and strategies for getting money from farming are the talk of the town. The media called it the „DeFi Summer“ when it started in early to late 2020. Then, SushiSwap did its liquidity mining attack, Yearn.finance set up the first „yield farm,“ and Uniswap did a retroactive airdrop.

Next, we look at 2020’s DeFi craze: The best, the worst, and the fishiest projects in crypto.

We saw the strongest communities form around protocol tokens, which led to a positive feedback loop that made the value of DeFi assets go up and up.

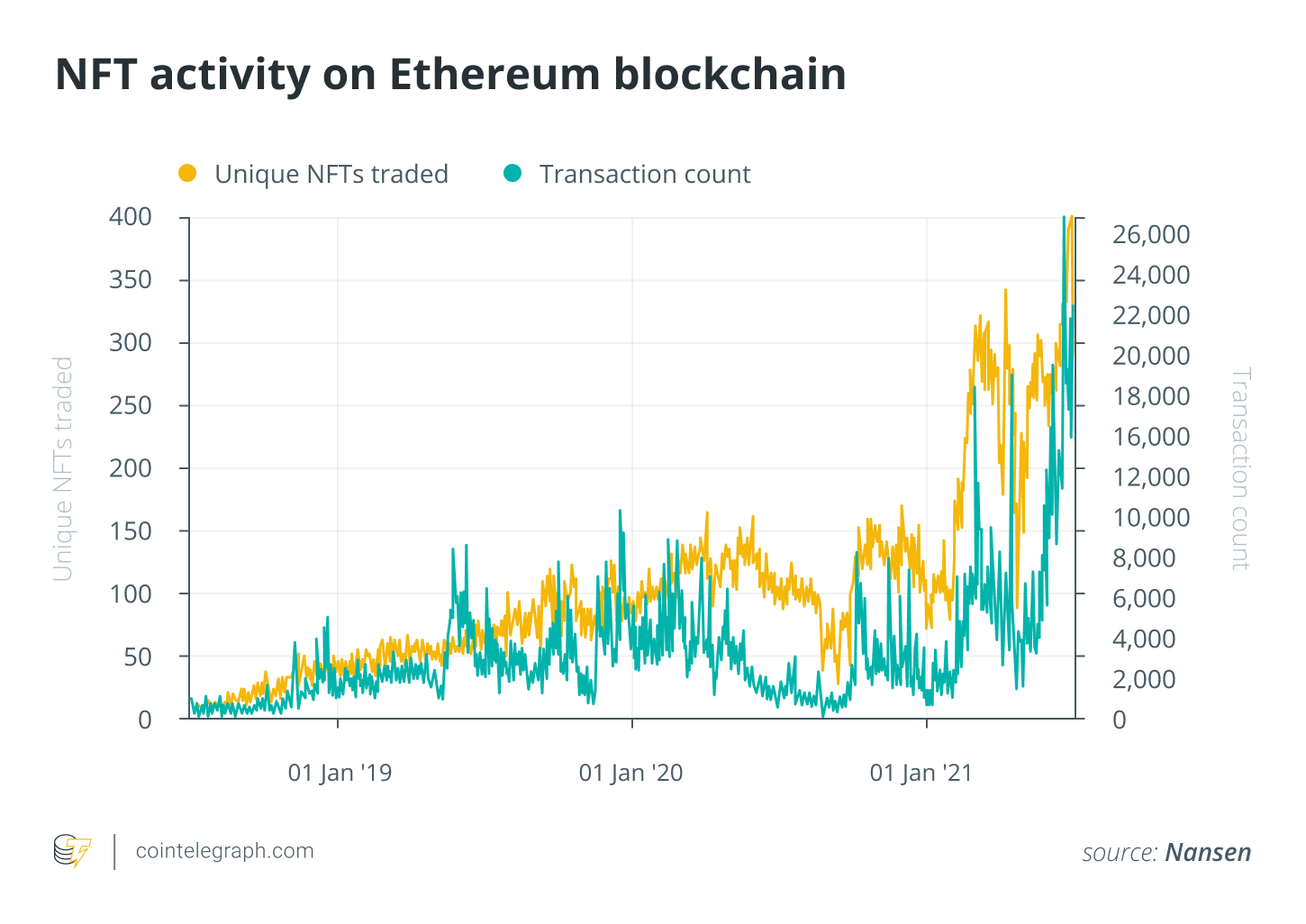

NFTs have become more and more popular thanks to the now-iconic CryptoPunks. They’ve taken over more and more of Ethereum’s network activity. Fast development has led to a wide range of active market segments for NFTs. These include projects that let people be avatars, art that is made on the chain and sports collectibles, virtual land, and games that let people play and earn money. It has also been a goal of public figures, like Andy Murray, to get a foothold in the NFT market. Contemporary artists like Damien Hirst have also wanted to get in on the act!

In the same vein, British artist Damien Hirst is using NFTs to blur the lines between art and money.

They are hard to dismiss as a new asset class because they have grown in popularity and there has been a lot of activity on the blockchain with them.

NFT and DeFi users

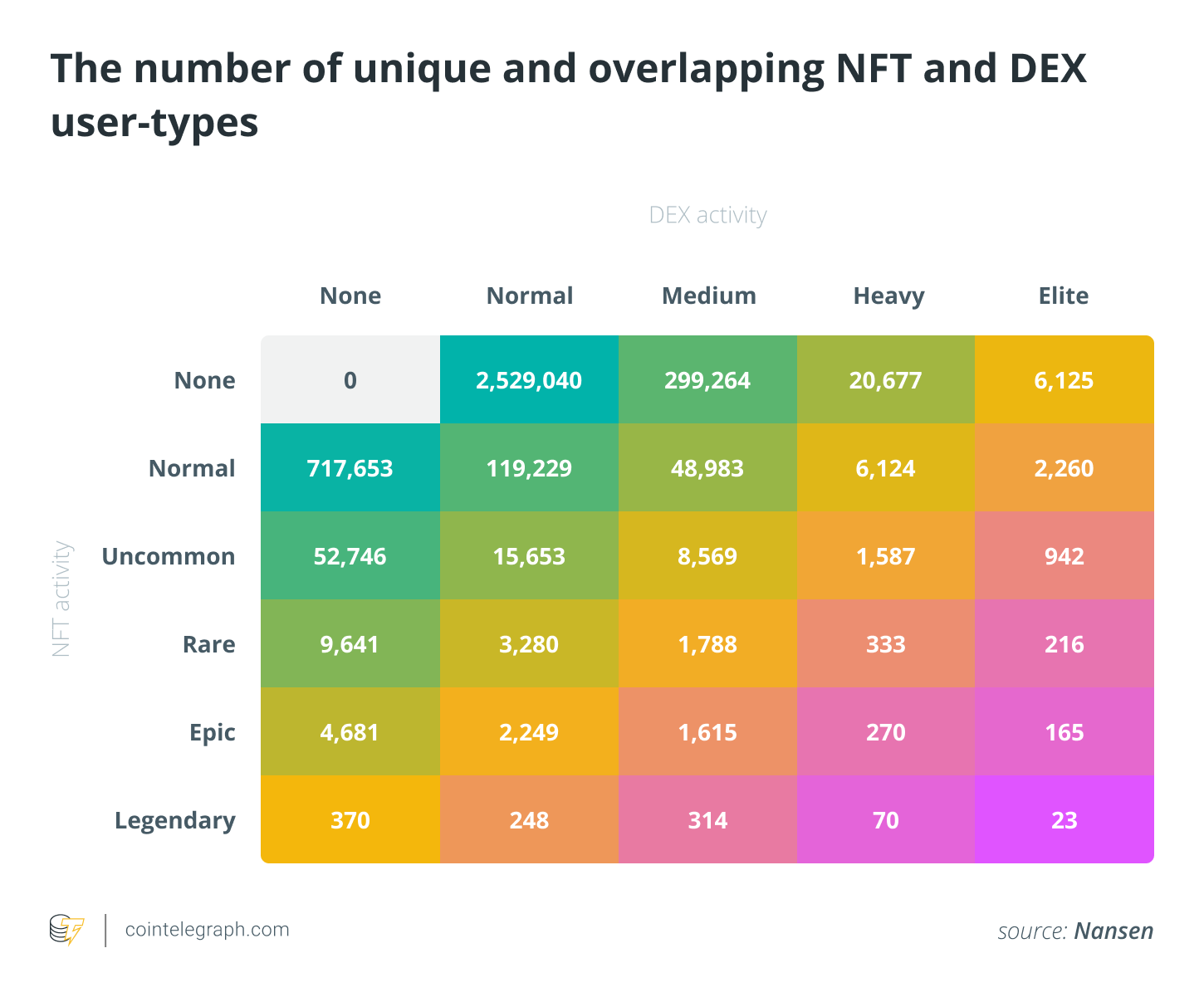

This is how we tell you about wallets that are active in the DeFi and NFT space. Legendary NFT Collector: This person is in the top 0.1% of all NFT transactions. Elite DEX trader: This person is in the top 1% of all DEX transactions.

NFT collectors and DEX traders are two different groups of people who use these labels. NFT-DEX power users are a new type of user, and they have a lot of power. As of this writing, the number of power users who are both Legendary NFT collectors and Elite DEX traders is 23. People who trade a lot in DeFi are more likely to be NFT collectors.

People at DeFi need to talk about what they want to do NFTs and NFTs need each other. DeFi

Even though DeFi has grown up, it isn’t enough to be able to be thrown away and reused. Asset ownership can become so personal, or be optimized to such a fine level, that it would be better to use NFTs instead of real things. In Uniswap v3, users can set their own price ranges for liquidity positions in a new automated market maker design that lets them set their own price ranges.

In the same way, automated market makers are no more.

The world of NFTs is also quickly merging with the world of the DeFi. As a result of protocols like NFT20 and NFTX, NFTs are becoming more valuable as tokens linked to DEX-based liquidity pools. Users can now see digital art collections without having to buy each piece. Changes are being made to the very definition of nonfungible because NFTs and DeFi are being combined. What comes after?

Products that use both DeFi and NFTs will win.

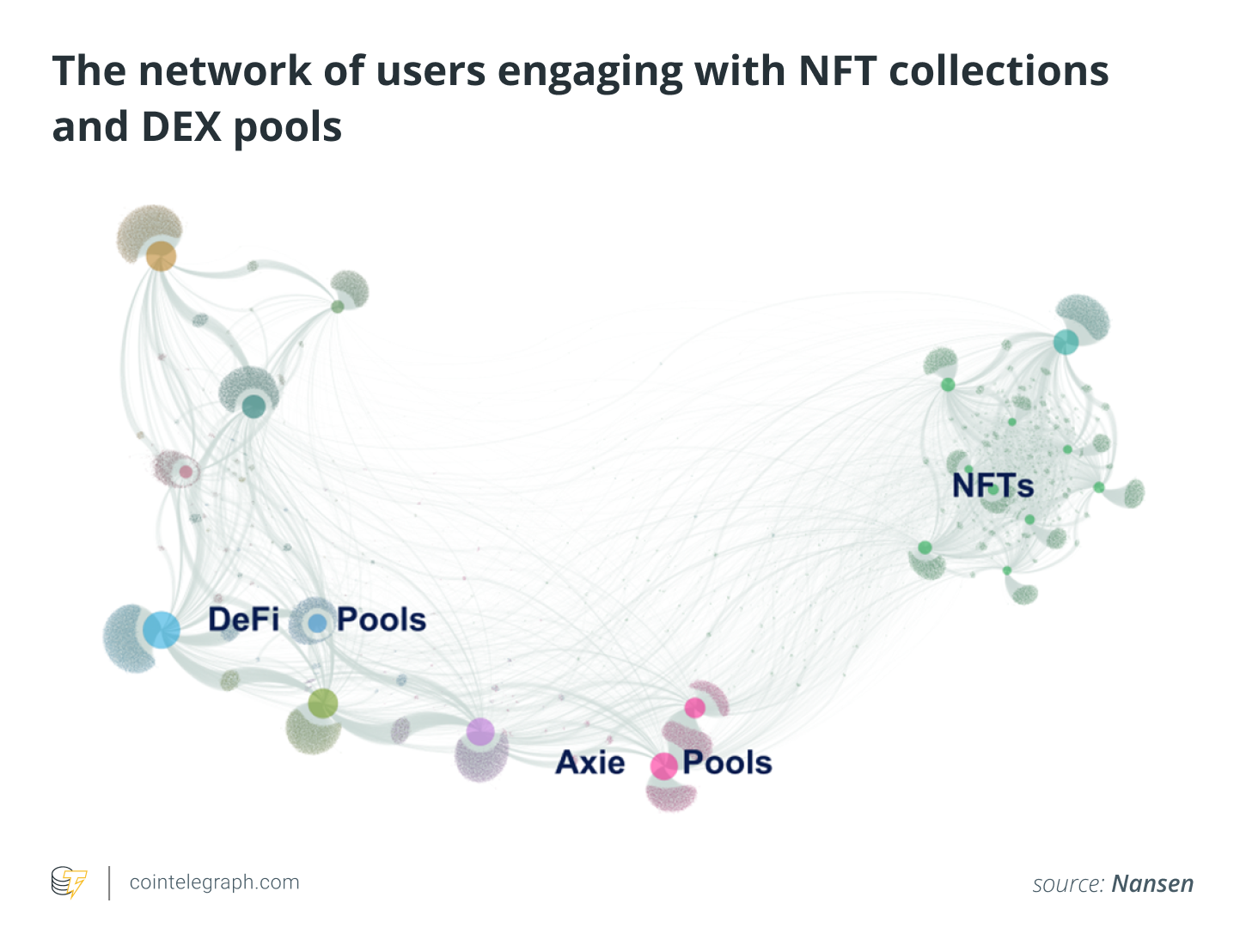

NFTs and DeFi look like they’re going to meet. As an example, Axie Infinity is a great one to study. Axie is one of the biggest revenue-generating blockchain products. It combines a play-to-win game based on scarce NFTs with liquidity pools for in-game items, making it a true NFT-DeFi hybrid game.

Related: Play-to-win games are the reason the stock market is going up right now.

A network view of Ethereum transactions shows how Axie can connect the DeFi and NFT communities. It will be important for future crypto products to be able to connect with both NFT and DeFi users in order to be successful. Based on transactions made on the Ethereum network over a seven-day period, Axie’s pools are able to connect the DeFi and NFT groups.

The future

Growth in groups like DeFi and NFT shows that people are more interested in long-term innovation for Ethereum and the rest of the crypto world. Tokens, apps, and products that can be used by people who are both new and experienced will be the first to get the money.

If you believe that having a wide range of users makes value more stable, then you might think that the markets are ready for a robust growth phase. The wide range of applications for both DeFi and NFTs has made crypto ready to handle both big projects and small-scale applications. There is a lot of growth in the number of people who use crypto, which means that new value-creation in crypto will continue to outpace traditional finance and art.

Young Loon and Paul Harwood wrote this piece together.

This article does not give you advice on how to invest or what to do. When making an investment or trading decision, readers should do their own research to make sure they’re making the best choice.

It doesn’t mean that Cointelegraph agrees with or agrees with the views and opinions of the people who write these words or thoughts.

When you work at Nansen, a blockchain analytics platform, Young Loon does research. Young is going to be a student at the London School of Economics next year. Economics are his favorite subject. He is the expert on decentralized finance at Nansen, where he works.

There is a blockchain analytics platform called Nansen that Paul Harwood works for. His job is to teach and help people in South West England. He’s also working on a doctorate. He is good at NFTs, crypto, and social capital.