Apparently, one of the world’s largest automated investment firms has acquired exposure to Bitcoin (BTC) and Ether (ETH), according to recent reports (ETH).

According to a blog post published on July 29, Wealthfront, which manages $25 billion in assets, has confirmed that it has added two Grayscale funds to its existing portfolio of investment options.

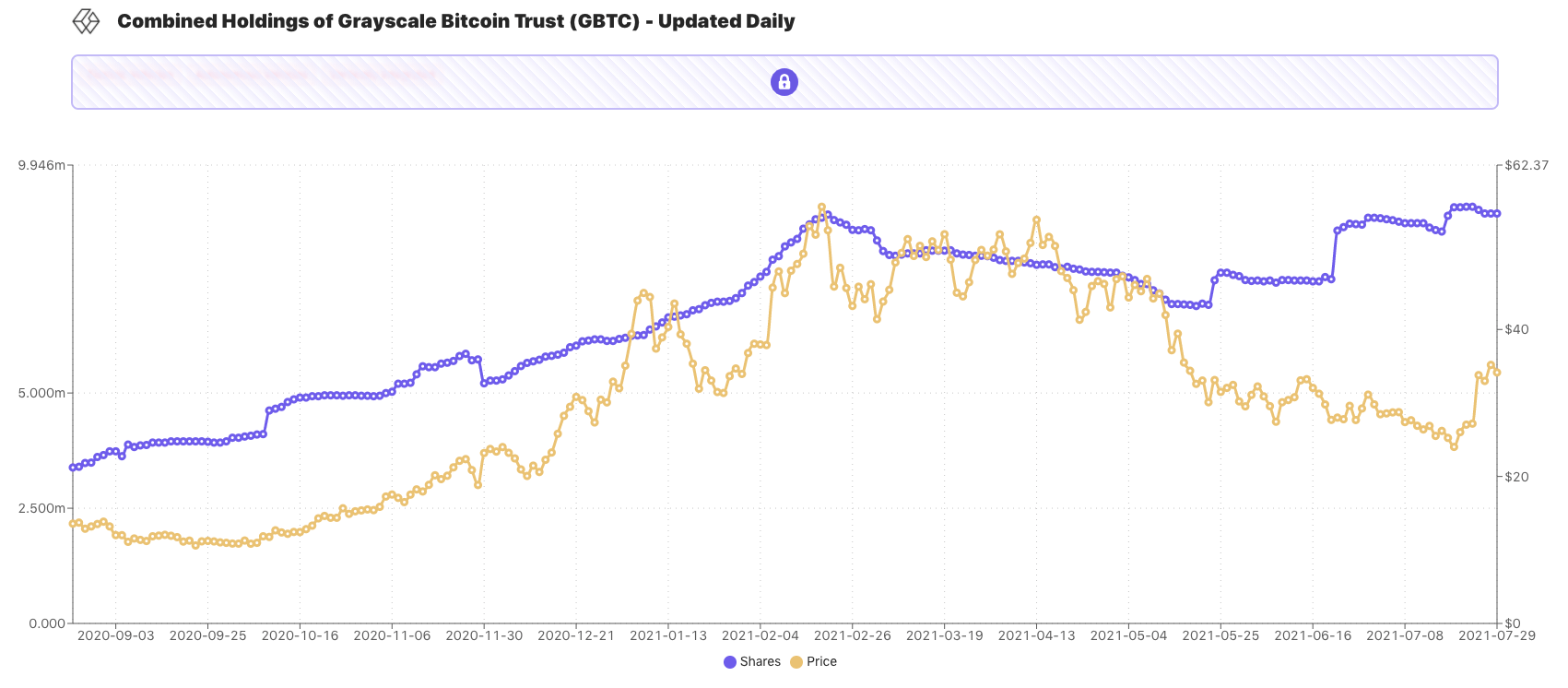

GBTC buzz returns

Recent increases in cryptocurrency prices have kept institutional products like Grayscale’s various funds in the limelight, which is good news for investors.

Investments in the Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (GET) will now be available through Wealthfront, an example of a so-called „robo advisor“ in the investment space (ETHE).

„„Buying cryptocurrency can feel intimidating — it takes time and effort to research all of the options, set up a wallet, and monitor an additional account. That’s why we’ve made it easy to get exposure to Bitcoin and Ethereum right in your Wealthfront portfolio, no wallets required,“ the blog post explains.

„Instead of buying coins yourself, you can invest in GBTC and ETHE.“

The firm says this limit is necessary because cryptocurrency products are „riskier and more volatile.“ Grayscale products will be available to clients in amounts up to ten percent of their total portfolio.

The move, however, alleviates the difficulty in gaining access to Grayscale’s funds, which are not always readily available, and imposes strict rules on the company’s shareowners, who had previously faced this problem.

In addition to Grayscale, Wealthfront has expanded its offering of exchange-traded funds (ETFs) from ARK Invest, which is itself a major shareholder in the GBTC corporation.

What unlocking?

Despite current Bitcoin prices of around $40,000, the announcement comes at a time when institutional investor interest in cryptocurrency in general and Bitcoin in particular is showing no signs of waning.

As we previously reported, exchange balances have plummeted this week as a result of increased activity on over-the-counter (OTC) desks, as well as increased activity on the exchange floor.

Following the discovery that the events surrounding the unlocking of GBTC shares had had no discernible impact on the price of bitcoin, Grayscale has been able to remove the negative narrative surrounding them from the public domain.

Remember when all the traditional analysts said the Grayscale unlock would unleash billions in selling this last week? Yeah, no.

— Willy Woo (@woonomic) July 29, 2021

Following up on his commitment made earlier in the week, Grayscale CEO Michael Sonnenshein reiterated his intention to convert all Grayscale crypto funds into exchange-traded funds (ETFs) as soon as possible, subject to any regulatory changes in the United States.