Finance blogger The FI Explorer didn’t invest in cryptocurrency in order to retire early — but unlike many of the newly minted crypto rich, he did set out to retire early.

The FI Explorer, aka Jason, is a member of the FIRE community — financial independence, retire early — in which adherents save up to 80% of their income during their twenties and thirties in order to either retire early or pursue their passions.

Jason spent the majority of his 20-year journey toward his FIRE target of $1.64 million (USD) — which was chosen to generate $65,000 in annual income for the remainder of his life — investing in sensible investments such as exchange-traded funds, stocks, and gold.

However, after listening to a Bitcoin-focused podcast in 2015, he decided to take a chance and invested around $3,000 in the cryptocurrency — or about 0.5 percent of his portfolio at the time.

Bitcoin’s meteoric rise since then has seen the allocation grow to nearly a third of his portfolio at its peak, assisting him in sailing past his FIRE target of December 2020 much sooner than expected.

“That’s incredible,” he tells Magazine. “Previously, I had a goal that was laboriously calculated with lots of curves and linear extrapolations, but late last year, I kind of hit it accidentally.”

When compared to saving and investing in index funds, cryptocurrency has provided some members of the FIRE community with a faster path to financial independence. However, cryptocurrency remains controversial, as it is perceived by some as an illegitimate and risky path to financial independence.

According to Captain FI, a podcaster and blogger, stories of windfall gains both attract and repel supporters of the FIRE movement in equal measure.

“It’s insane, and I think that’s what drives a lot of the FOMO in the FIRE community,” he says. “You know, there is jealousy, like ‘holy shit.’ Of course. I’m jealous of people that have built a $1.5 million [portfolio] overnight.”

“Look, I shouldn’t use the word jealous. I’m impressed. I’m amazed. But I’m also highly suspicious, or skeptical, because easy come, easy go. I’ve put money into crypto, and I’ve seen a net loss so far.”

So, can cryptocurrency ever be a sensible part of an early retirement plan?

What is FIRE?

Although the anti-consumerist movement’s central concepts were first articulated in the 1992 bestseller Your Money or Your Life, FIRE gained prominence as a result of the popularity of the „Mr. Money Mustache“ blog.

Written by Canadian-born Peter Adeney, it inspired millions to follow in his footsteps by detailing how he retired at the age of 30 from his job as a software engineer by slashing his spending and investing the majority of his $67,000 salary in index funds.

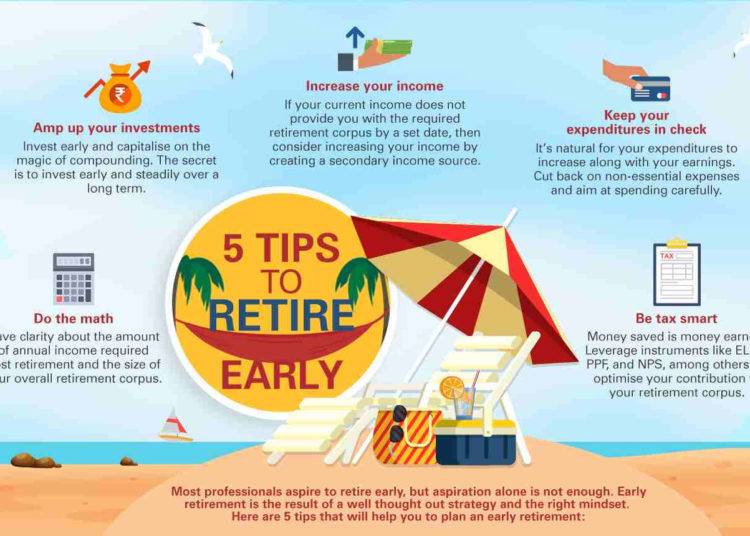

The FIRE theory is quite straightforward: multiply your annual expenses by 25 to determine how much money you’ll need to retire (based on the 4 percent annual withdrawal rule).

A person spending $50,000 per year will need to accumulate approximately $1.25 million.

Ironically, Adeney now earns significantly more money blogging about early retirement than he would have earned with his $600,000 in retirement savings.

FIRE is about approaching this goal rationally and methodically, explains Captain FI, who recently semi-retired at the age of 30 from his job as a pilot after years of saving around 80% of his income.

“It’s essentially about making a few wiser choices early in life so that you can reap the rewards later,” he tells Magazine, comparing it to saving for a down payment on a house.

“Essentially, what FIRE does is that you continue doing that, perhaps for another five to ten years, in order to accumulate assets that generate enough cash flow to cover your living expenses.”

While this is diametrically opposed to the get-rich-quick mentality of some in crypto, the key demographic is virtually identical:

“A lot of people in the FIRE community do tend to be — if we’re going to stereotype — 25- to 35-year-old white males that work in tech. I don’t know whether we’re all somewhere on the spectrum…”

Despite making as much money from Bitcoin as Mr. Money Mustache retired with, Jason understands why FIRE followers are wary. “The common take is highly skeptical,” he says. “I think that’s probably healthy in a way.” He adds:

“The FIRE community has largely been around low-cost, predictable, but well-diversified portfolios, and really has emphasized that issue of dollar-cost averaging and saving over a long period and compounding [returns]. So, I think cryptocurrency is the antithesis of that. It presents at first blush like the kind of get-rich scam that people are forever warning other people about.”

FIRE and crypto don’t mix

Mr. Money Mustache is a one-trick pony when it comes to cryptocurrency.

In March, he published an article claiming that cryptocurrency was a bubble and that “This whole situation is just the age-old game of stock speculation based on price momentum — which is in turn just another form of gambling.”

Another writer highly regarded by the Australian FIRE community is Scott Pape of the Barefoot Investor, who also frequently warns against cryptocurrency.

He recently argued in a column that crypto is entirely based on the „greater fool theory“ and that „You only win when some greater fool buys in at a higher price.“

“If you’re persuaded to sell your boring index funds and lay down with dogs, I can almost guarantee you’ll eventually end up with financial fleas,” he added.

Financial commentator Tom Ellison used to write Pape’s „Barefoot Blueprint“ and claims they discussed crypto internally but quickly decided against it for consumer protection reasons.

“My views probably align with Scott Pape’s,” says Ellison, who later founded The Naked Investor, a financial education service.

“And that is: It’s not a currency. It’s not a financial investment under the terms of the Australian legislation. But there’s no doubt that it has created wealth for a lot of people.”

Getting rich quickly

A slew of crypto-based “get rich quick” schemes have been perpetrated, ranging from Bitconnect-style Ponzi schemes to “rug pull” scams on Uniswap — not to mention the sheer irresponsibility of inexperienced investors who put their money into memecoins simply because they feature the same breed of dog as Dogecoin.

However, what distinguishes cryptocurrency from the majority of get-rich-quick schemes is that people genuinely do become wealthy — and quickly.

So wealthy, in fact, that many people find themselves in a position to retire early even if they are not actively pursuing that goal.

Included in this group is Mike Palmeter, a former Oracle database product manager who „accidentally“ stepped down earlier this year.

During an interview with Magazine, he explains that he had been interested in Bitcoin for years but had been put off by the warnings of critics such as economist Nouriel Roubini, who has been insisting that it is a bubble on the verge of bursting for years.

However, after reading Andreas Antonopoulos‘ Mastering Bitcoin in 2017, he became convinced that there was much more to bitcoin than he had previously realized.

“The very first epiphany that I had is that this is way bigger and way more complex than I can handle. I haven’t had the time to do nearly enough homework, but the price is moving.”

He began investing money as quickly as he could, and by the end of the year, Bitcoin and related investments, such as Bitcoin mining companies and payments or trading platforms such as Circle, Robinhood, and Square, accounted for half of his total portfolio value.

The price of Bitcoin plummeted by 170 percent at the start of 2018, causing his portfolio to suffer a 50 percent loss. He had made a 170 percent profit.

Palmeter claims he was too embarrassed to sell during the period that became known as „crypto winter,“ so he instead focused on learning as much as he could about blockchain.

It left him convinced that Bitcoin was „the highest-value application of blockchain technology,“ and that he should pursue it further.

Despite the fact that it was difficult to accurately value, he was confident that it would increase in value:

“I studied, and my ego and my arrogance and refusal to admit defeat brought me to a place where I actually thought I’d accidentally made the right decision. So, I kept it, and then I started buying more because I thought, ‘This is a long-term play.’”

He also learned his lesson from the 2018 market crash and began taking profits regularly following each significant price increase, rebalancing his portfolio to ensure it was split 50/50 between Bitcoin investments and dividend-paying stocks.

Even after accounting for the effects of crypto winter, he has averaged a 79.67 percent annual return over the last five years.

In March, after rebalancing the Bitcoin proportion from 77 to 50%, he realized that the income from his stock dividends had surpassed his salary after taxes, regardless of how Bitcoin performed.

He left Oracle in April.

“I had no particular interest in retiring right up until the day I realized that I wasn’t enjoying my job enough to justify doing it. Since I didn’t need the money, why keep doing it? Why not just not do it? That’s freedom.”

Selling up is hard to do

Palmeter is an outlier, and anecdotal evidence suggests that while many crypto holders do end up with paper profits sufficient to retire, few actually do.

Most players continue hoping for a rise — or because they’ve developed an addiction to the game and don’t want to leave.

It’s one of the most perplexing aspects of cryptocurrency:

Cashing out entails foregoing massive potential upside, while failing to sell entails risking life-changing wealth.

This happened to so many in 2017, millionaires on paper and never hit the sell button to take out profits, and thus they watched their millions become thousands https://t.co/rGP3bUzydH

— Lark Davis (@TheCryptoLark) June 21, 2021

It’s odd that Jason, the FI Explorer, did not cash in his Bitcoin when he reached his $1.64 million target for early retirement last year, nor did he take the plunge and leave the workforce.

To account for inflation and other factors, he did, however, raise his target to $1.94 million from $1.92 million originally.

He expresses satisfaction with his job and has revised his objectives to include financial independence rather than early retirement as a long-term goal.

However, he has been bitten by the Bitcoin bug as well:

“It’s one of the most common questions: Well, why don’t you sell out? Or why don’t you de-risk? And that’s really because I do think it’s got an exciting future. I don’t necessarily want to rely on crypto for my FIRE. So for me, I’m sort of interested to follow it and see where it goes.”

Jason points out that if he’d followed the conventional, sensible financial advice around asset allocation and de-risking, “I would have sold out years ago and left about A$500,000 or more on the table.”

Captain FI

Captain FI recently reached his personal retirement goal and is now only required to work two days per week.

The 30-year-old did it the hard way, as well, by saving more than 80 percent of his income and investing in index funds on a dollar-cost-averaging basis.

According to him, it would take 51 years to retire if you save 10% of your income, and 22 years if you save 20% of your income to achieve financial independence.

Captain FI completed his mission in just 11 years, and as we speak, a moving van arrives to transport his belongings from Sydney to South Australia, where he will live out the rest of his days in leisure.

He explains that he used to be a skeptic of cryptocurrency.

“I was very against cryptocurrencies because I didn’t understand them,” he tells Magazine. “My idols in the investment community — Warren Buffett, Charlie Munger and Kevin O’Leary — were all very dismissive of Bitcoin.”

Curiously enough, it was a bad joke he made about preferring chocolate coins to Bitcoin on a podcast — at least you can still eat the chocolate when the price goes to zero — that was responsible for his conversion. “I thought that was a bit of a funny joke that I got absolutely smashed by all of the crypto people,” he laughs. “I was like, shit, maybe I better look into it.”

He invited Bitcoin proponent Stephan Livera onto his podcast, who helped convince him of Bitcoin’s potential value and that it was a risk worth taking. He now has a small cryptocurrency portfolio split between Bitcoin and Ether.

“Crypto — I definitely see it as an asset with an asymmetric risk profile, right? So yes, there’s a risk that it’s going to go to zero. But also, there’s a risk that it could, you know, 10x or 100x, which is really cool.”

Captain FI intends to eventually allocate around 1% of his portfolio to crypto. “If it does go massive, then that will drag the rest of the portfolio up with it,” he says, adding further:

“I’m willing to take a somewhat-educated punt on it. Because it is really interesting. It has solid fundamentals, I can see the application of it.”

Retirement plans

The retirement industry, for its part, appears to be wary of cryptocurrency.

401(k) plans in the United States that allow for cryptocurrency investments are few and far between, with the exception of a recent partnership between ForUsAll and Coinbase.

In Australia, the equivalent of a 401(k) is referred to as „superannuation,“ and the vast majority of funds are opposed to cryptocurrency investments.

The ability to set up self-managed superannuation funds (SMSFs) to manage their own investments, on the other hand, is becoming increasingly popular among cryptocurrency enthusiasts.

According to Caroline Bowler, CEO of BTC Markets, the number of SMSF accounts trading on the exchange increased fivefold last year, and the value of their balances has increased exponentially.

“Where previously we would have seen investments come in in the tens of thousands of dollars for SMSFs, we’re now seeing it move into the low hundreds of thousands,” she says, adding that the typical user isn’t near retirement age.

“It would be people in their thirties who are actively taking control because they are crypto conversant — they’re familiar with it, they’re comfortable with it.”

Don’t do it, but if you do …

Ellison is a licensed financial advisor who has spent much of the past two decades advising people on retirement planning and has written two books on the topic. His advice often boils down to “spend less than you earn, […] and put aside what’s left, and accumulate that over a long period of time in assets that compound in value.” He invariably directs people to the four main asset classes — stocks, property, cash and fixed interest — and believes most investments outside these are risky.

So, he definitely thinks crypto is far too hazardous to gamble your retirement on. “In terms of my retirement, it’s not something I would consider remotely, even if there was a chance that it was going to go up a hundredfold or thousandfold,” he says, adding:

“If somebody wants to do that, then as I’ve written before, that’s gambling. It’s pure speculation. Whether somebody is prepared to speculate and risk their future retirement, I guess that’s a matter for them.”

He explains that one of the first things advisers do when they take on new clients is assess their risk tolerance.

“With all those risk assessments, nobody really knows how you’re going to feel or react when you’ve lost a lot of money,” he says. “The only way to actually find out your real risk tolerance is still to lose some money or go through one of those once-in-a-decade activities like the ‘87 crash or the GFC [global financial crisis], or last year’s crash.”

Given that market-wide drawdowns of 30 percent to 50 percent occur every few months, you’ll be able to determine your risk tolerance fairly quickly with cryptocurrency.

The price of Bitcoin reached a high of $65,000 in April, and it has since dropped by nearly half, to a current level of closer to $35,000, according to CoinDesk.

Every week, individual coins lose and gain significantly more than that.

As a result, it is only really suitable for investors who are able to withstand such a stomach-churning experience.

According to Ellison, a prudent approach for highly risky or speculative investments is to allocate only a certain percentage of a portfolio to them.

“For most people, the highly risky, totally speculative part of a portfolio certainly shouldn’t exceed 10% — and that’s for an aggressive investor,” he tells Magazine, adding that investors who are more risk-averse might set the limit between 1% and 2%. While he points out that the vast majority of speculative investments fail, if a gamble does pay off, he encourages investors to take profits rather than hold on. Jason gives similar advice:

“Never put in more than you can afford to lose, and probably don’t rely on it as the vehicle for your FIRE goals because it’s very speculative. I’d never advise anybody to follow that pathway. But I think people are doing that anyway.”

He adds that there’s a difference between being cautious with money and being closed off to new opportunities:

“I think a lot of that is always a sign of a really good financial education being drummed into people over years and years and years. And it’s maybe just that new possibilities are opening up which you just need to have an open mind about, without necessarily becoming a full-blown believer.”

One person who is no longer taking Ellison’s investment advice is his son: “I put him into a stock two years ago, and he made five times his money on it. And he sold it one cent from the top, and he put it into Dogecoin,” Ellison says, referring to Elon Musk’s favorite memecoin.

Ellison’s son now thinks he’s an investment genius and that his old man should retire and hand over the reins. “He says I should just let him take over,” laughs Ellison.