News that lawmakers in Paraguay intend to introduce legislation to make bitcoin legal tender spread quickly on social media, boosting the price of bitcoin (BTC) in the process.

Shortly after the unconfirmed news broke on Twitter, Bitcoin’s price surged to $35,289 before dipping slightly below the key short-term resistance level of $35,500.

Congratulations Paraguay

• a bill has been submitted to make #BITCOIN legal tender

• reading likely to occur on July 14th

• they wish to be a crypto hub

• promotion of green energy mining

• some interest from Argentina & Brazil now too

— djThistle (@DJThistle01) June 24, 2021

While the cryptocurrency Fear and Greed Index still indicates a sentiment of Extreme Fear, it’s worth noting that the measure has risen from 14 on June 23 to 22 on June 24 as traders begin to view the drop below $29,000 and Bitcoin’s rising open interest as signs that the current corrective phase may have ended.

While traders‘ sentiment may have improved slightly, Cointelegraph analyst Marcel Pechman suggested that investors could be waiting for the $6 billion in Bitcoin and Ether (ETH) quarterly futures and options to expire on June 25 before making a more decisive move.

Stocks reach new record highs, altcoins rally

The cryptocurrency market wasn’t the only one to experience a surge today.

Traditional markets rose to new highs as well after U.S. President Joe Biden announced that he and the Senate had reached an agreement on a $953 billion bipartisan infrastructure spending plan, which was approved by both chambers.

The Dow gained more than 322 points on the day, while the S&P 500 and Nasdaq each rose to new intraday highs and closed the day up 24.65 and 97.98 points, respectively.

According to expectations, altcoins rose in value alongside the rise in the Bitcoin price and traditional market capitalizations.

Tron (TRX) and Celo (CLO) both gained 26 percent and 28 percent, respectively, as the cryptocurrency market regained its footing above the psychologically significant $2,000 mark.

The listing of CELO’s Celo Euro (cEUR) stablecoin on the KuCoin exchange appears to have prompted the company’s decision.

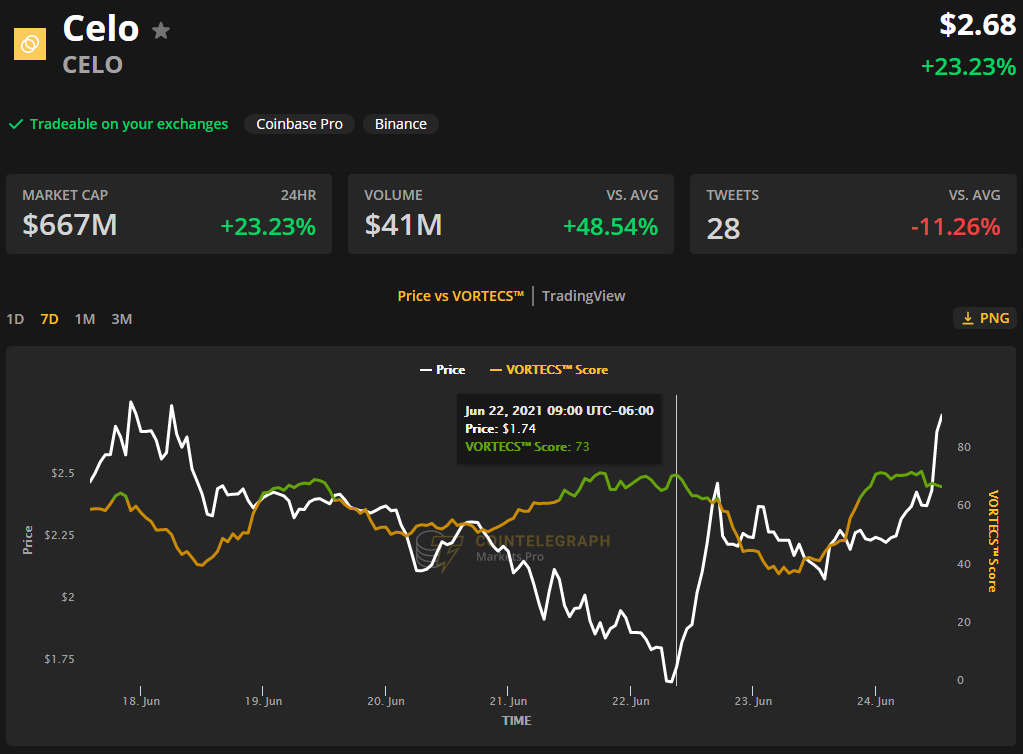

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for CELO on June 22. This was prior to the recent price increase.

As can be seen in the chart above, the VORTECS™ Score for CELO began to move into the green on June 22 and reached a high of 73 an hour later, one hour before the stock’s price began to rise 56 percent the following day.

Following another 25 percent rally in CELO, the VORTECS™ Score turned green once more on June 24. The score reached a high of 74 as CELO continued its upward trend.

The total value of the cryptocurrency market is now $1.4 trillion, with Bitcoin accounting for 46.6 percent of the total value of the market.

Unless otherwise stated, the views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily or its subsidiaries.

Risk exists in every investment and trading decision; therefore, before making a decision, you should conduct your own research.