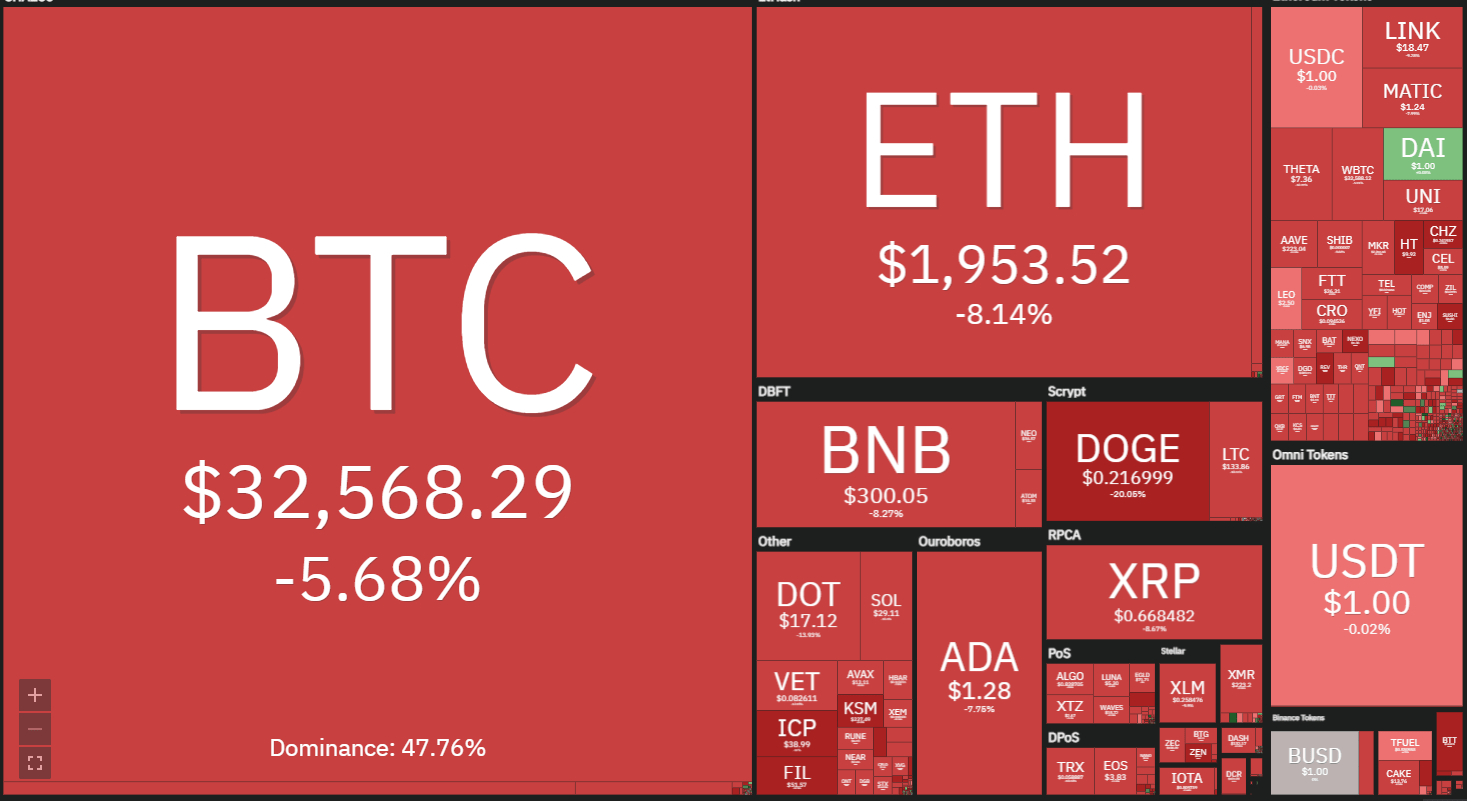

Bitcoin and altcoins are reaching significant support levels, but rather than buying the dip, traders are waiting to see if any bullish signals emerge.

In a bearish environment, traders move on to every piece of negative news and make a an excuse to market. Bitcoin (BTC) dropped over $1,000 within a few minutes as news hit the stands the third-largest Chinese bank, the Agricultural Bank of China, will not enable using its services for crypto transactions. Although the bank later deleted its anti-crypto announcement, the damage was already done. In the same way, traders have spilled on to this news that the Chinese crackdown on Bitcoin miners and this has resulted in the hash speed falling to an 8-month low.

Daily cryptocurrency marketplace functionality.

Even though this may be a drawback in the brief term, many analysts think this is a good improvement for the long run. ‚The China-dominated’ Bitcoin mining era may be coming to a conclusion,” said Alex Gladstein, chief strategy officer of the Human Rights Foundation. As mining activity shifts to other user friendly governments, the system is very likely to flourish.

BTC/USDT

Among all of the bearish news and price action, MicroStrategy has disclosed that the purchase of 13,005 Bitcoin at an average price of $37,617. This takes the company’s total holding to 105,085 Bitcoin at an average price of just over $26,000 a Bitcoin. Can MicroStrategy’s purchase attract other institutional investors and result in a relief rally? Let’s study the charts of this top-10 cryptocurrencies to find out.

Bitcoin finished the dreaded death cross on June 19 and this seems to have attracted additional selling in the bears. The vendors have pulled the price down to the critical support at $31,000 today. The bulls had successfully defended the $31,000 support on May 23 and again on June 8. Hence, the degree may again attract buying from the aggressive bulls. The relative strength index (RSI) is attempting to form a bullish divergence, which is yet another positive indication.

If the purchase price rebounds off $31,000, the BTC/USDT set will try to rise to $42,451.67. This could maintain the pair range-bound involving both of these levels for a few more days.

On the upside, the rally is very likely to face resistance in the 50-day easy moving average ($41,904). If the set turns down in the resistance, the bears will try to sink the purchase price under $31,000.

Should they succeed, the set may fall to $28,000 and when this support cracks, another stop could be $20,000.

ETH/USDT

Ether (ETH) broke below the symmetrical triangle pattern on June 18. This indicated that the consolidation of the past few days has resolved in favor of the bears.  ETH/USDT daily graph.

ETH/USDT daily graph.

The bulls will try to shield the zone involving the 200-day SMA along with the May 23 reduced at $1,728.74. If the purchase price rebounds off this zone, then the bulls will try to push the price back in the triangle. Should they have to do so, it will suggest that buyers are accumulating at lower levels. However, the 50-day SMA ($2,869) has begun to turn the RSI has dipped under 35, suggesting that bears are in control. If bears sink the purchase price under the support zone, then the ETH/USDT pair may drop to $1,536.92 and then to $1,293.18.

BNB/USDT

Binance Coin (BNB) broke under the uptrend line on June 18 and the bears are currently attempting to sink the purchase price under the $291.06 support. This is an important support to watch out for because the bulls had aggressively defended this support on May 21.If the purchase price rebounds off the 200-day SMA, the set could rise to the downtrend line. A break above this resistance could clear the path for an up-move to $379.58 and $433.

Contrary to this assumption, if the bears sink the purchase price under the 200-day SMA, the set may drop to $200 then to $126.75.

ADA/USDT

Cardano (ADA) has dropped below the important support at $1.33 today. If bears maintain the purchase price under this level, the altcoin will continue its decline and reach the next major support at $1. The bulls will shield the $1 support aggressively as the 200-day SMA ($0.98) is below this amount. If the purchase price rebounds off this amount, the ADA/USDT pair may rise to $1.33 at which the bears could mount a stiff opposition.

If the purchase price turns down in this amount, it will suggest that the opinion has become negative and dealers are selling on rallies. A break below the 200-day SMA could open the doors to get a further fall to $0.80 and then $0.68.

This negative view will invalidate if the purchase price turns up from the present level and climbs above the 50-day SMA ($1.62).

XRP/USDT

XRP bounced off the 200-day SMA ($0.72) on June 20 but the bulls could not sustain the purchase price over $0.75. Renewed selling has pulled the price back beneath the 200-day SMA today. If bears sink the purchase price under $0.65, the sale could intensify and the XRP/USDT pair may drop to another support at $0.43. The downsloping 50-day SMA ($1.09) and the RSI close to the oversold zone suggest that sellers are in command.

Conversely, if the purchase price rebounds off $0.65, the buyers will probably make an additional attempt to drive and sustain the purchase price over $0.75. Should they be able to do so, it will indicate accumulation at lower levels. The set may then rise to $0.93 and then to $1.07.

DOGE/USDT

Dogecoin (DOGE) broke under the neckline of a huge head and shoulders pattern on June 18 and has lasted lower. The bulls will now try to shield the $0.21 support aggressively. If the purchase price rebounds off $0.21, the bulls will try to push the price back over the neckline. Should they succeed, it will indicate strong buying at lower prices. The DOGE/USDT pair may then rise to the 50-day SMA ($0.39).

Conversely, if bears sink the purchase price under $0.21, the set could drop to the 200-day SMA ($0.15). Even the bulls may again try to stall the decline at this level but should they fail, the set may drop to the next major support at $0.10.

DOT/USDT

Polkadot (DOT) slipped under the support line of the triangle on June 20 but the bulls pushed the price back in the triangle. However, the sellers are in no mood to relent and they have pulled the price under the support line today.

DOT/USDT daily graph.

DOT/USDT daily graph.

The downsloping 50-day SMA ($28.22) and the RSI from the negative zone suggest that bears have the top hand. The DOT/USDT pair may now drop to the critical support at $15, which has not yet been breached on a closing basis since Jan. 16.

Hence, that the bulls will try to shield the $15 support aggressively. A strong rebound off this amount could push the price to $20 and then to the downtrend line. A breakout and close above this resistance will be the first symptom of strength.

Contrary to this assumption, when bears sink the purchase price under $15, the set could witness further reduction and selling to the next major support at $7.50.

UNI/USDT

Uniswap (UNI) fell under the 200-day SMA ($22.20) on June 18. The failure of this bulls to shield this critical support indicated the supply exceeds demand. The buyers tried to stage a recovery on June 20 but failed to push the purchase price over the 200-day SMA.

UNI/USDT daily graph.

UNI/USDT daily graph.

That resulted in renewed selling today. The downsloping 50-day SMA ($28.63) and the RSI close to the oversold zone suggest that bears are in control. If the sellers sink the price under $16.49, the UNI/USDT pair may drop to the critical support at $13.04.

The bulls will shield the $13.04 support aggressively. If the purchase price rebounds off this amount, the set may consolidate between $13.04 and $21.50 for a few days.

To the contrary, a break below $13.04 could pull the purchase price down to $10.

BCH/USDT

Bitcoin Cash (BCH) has dropped under the $538.11 support, completing the descending triangle pattern. There is a minor support at $468.13 but when this support cracks, the sale could intensify further.

BCH/USDT daily graph.

BCH/USDT daily graph.

The 50-day SMA ($844) was sloping down and the RSI is trading close to the oversold land, indicating benefit to the bears. If the sellers sink the purchase price under $468.13, the BCH/USDT set may slide to $400 and $370.

This bearish view will invalidate if the purchase price ends up and quickly rises above the 200-day SMA ($609). Such a move will suggest that the bulls aggressively bought at lower levels. The set may then rise to the 50-day SMA.

LTC/USDT

Litecoin (LTC) broke under the support line on June 18, indicating a lack of urgency among the bulls to purchase at the level. The failure to push the price back over the support line in the previous two days has attracted additional selling today.

LTC/USDT daily graph.

LTC/USDT daily graph.

The downsloping 50-day SMA ($222) and the RSI close to the oversold land indicate that bears are in control. The LTC/USDT pair may now retest the May 23 intraday low at $118.03. This amount may work as a strong support but if the bears sink the purchase price under it, the set may drop to $100 then to $70.

To the contrary, if the purchase price rebounds off $118.03, the bulls will try to push the price to the downtrend line. A breakout and close above this level are the first indication of strength. A trend change may be signaled after the bulls propel and maintain the purchase price over the 50-day SMA.

The views and opinions expressed here are solely those of the author and don’t necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves danger. You need to run your own research after making a determination. Market information is provided by HitBTC exchange.