Buterin stated that there was several internal group battles in the past five decades and as a result, he affirmed that Ether 2.0 launch is unlikely to occur before late 2022.

In a May 22 report by Goldman Sachs, analysts stated that Ether has a“high chance of overtaking Bitcoin as a dominant store of value.“ Furthermore, the report mentioned the growth of the decentralized fund (DeFi) sector and the nonfungible token (NFT) ecosystems being assembled on Ether. Coincidentally, on the very next day, Ether’s price bottomed at $1,750.

On June 14, CoinShares released its weekly fund escapes report and Ether investment products had the largest outflows, totaling $12.7 million.

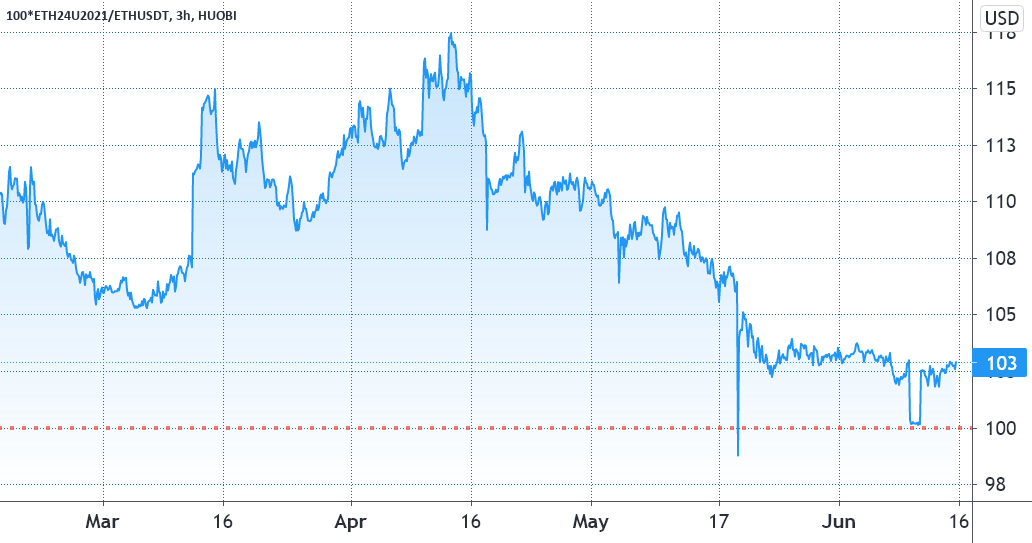

On the other hand, the forthcoming $1.5 billion options expiry on June 25 might be a turning point for Ether, based on Cointelegraph. This figure is 30% larger compared to March 26 expiry, that happened as Ether’s price plunged 17% in five days and bottomed around $1,550.

Despite flirting with $2,600 after a 12% rally over the past week, top Ether traders seem not able to change their own neutral-to-bearish positioning based on derivatives data.

Normally, Tte 3-month futures will usually trade at a premium to standard spot trades. Along with the trade liquidity risk, the vendor is postponing compensation and generally charges more.

The 6% to 17% annualized return on stablecoin lending indicates bullishness whenever the 3-month premium transactions above that range. On the flip side, when futures are trading below the stablecoin lending rate, it’s a sign of short-term bearish sentiment.

As revealed above, the 8% top — 26% annualized — disappeared on May 13, indicating extreme optimism. Since then, it’s been ranging near 2.8%, which is equal to 10% annualized. Therefore, top traders are neutral-to-bearish based on this index since it nears the lower amount of the anticipated array.

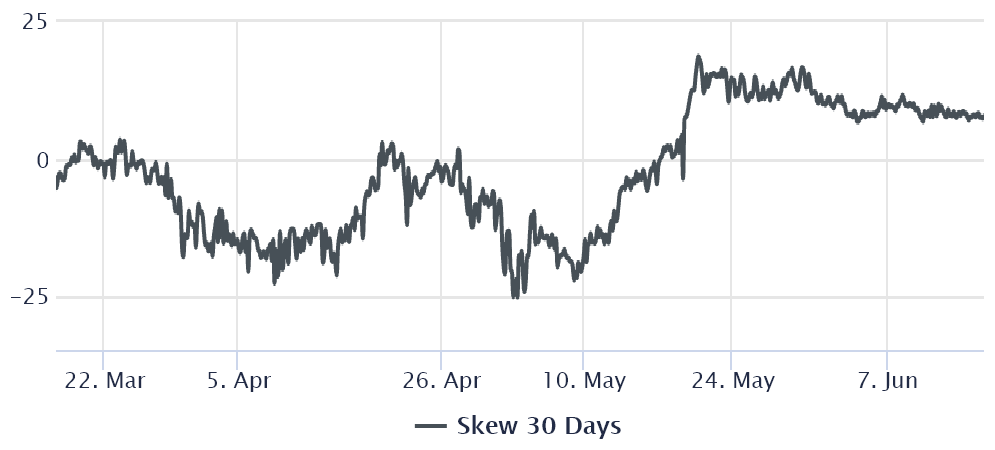

The options skew shows moderate signs of fear

The 25 percent delta skew compares similar call (purchase ) and place (sell) options and will turn positive if the protective put options superior is trading higher. Whenever this metric exceeds 10%, it’s considered that a“fear“ index.

The opposite holds when market makers are bullish and this causes the 25 percent delta skew indicator to enter the negative Selection

From May 20 to June 8, the index stood near 10%, suggesting that a higher protective put premium, which is usually a’fear‘ indicator. But over the previous week, it’s marginally improved to 7 percent, within the“neutral“ range, but nevertheless close to bearish sentiment.There’s absolutely no evidence of bullish growth in top traders‘ confidence as Ether tests the 2,600 resistance. So until those indexes flip to neutral-to-bullish, traders should act with extreme care before concluding a bull run is in place.

The perspectives and opinions expressed here are solely those of the author and do not always reflect the views of CoinNewsDaily.

Every single investment and trading movement involves danger. You should run your own research after making a determination.