BTC (BTC) has risen over the psychological resistance at $40,000 following a run of positive news flow over the past week. The very first piece of bullish news that affected the price of BTC was a tweet by Tesla CEO Elon Musk who said the carmaker reluctantly accept BTC payments if more than 50% clean energy is used by BTC miners with a“positive future tendency.“

Another piece of news which might have boosted the recovery in BTC has been Paul Tudor Jones‘ proposal that 5% of every investment portfolio have vulnerability to BTC, that is equal to that of gold, cash and commodities. Jones has been al critical of the U.S. Fed’s view that the present growth in inflation amounts is transitory.

The new bullish news is proof that the present fall hasn’t altered the principles of BTC. Therefore, as the price stabilizes, BTC might again attract institutional investment.

Meanwhile, the MicroStrategy has completed its $500 million offering of secured notes, which the company intends to use for purchasing BTC. After deducting various expenses, the business intelligence company is left with $488 million that will be used to buy BTC. This may increase the company’s present stack of 92,079 BTC.

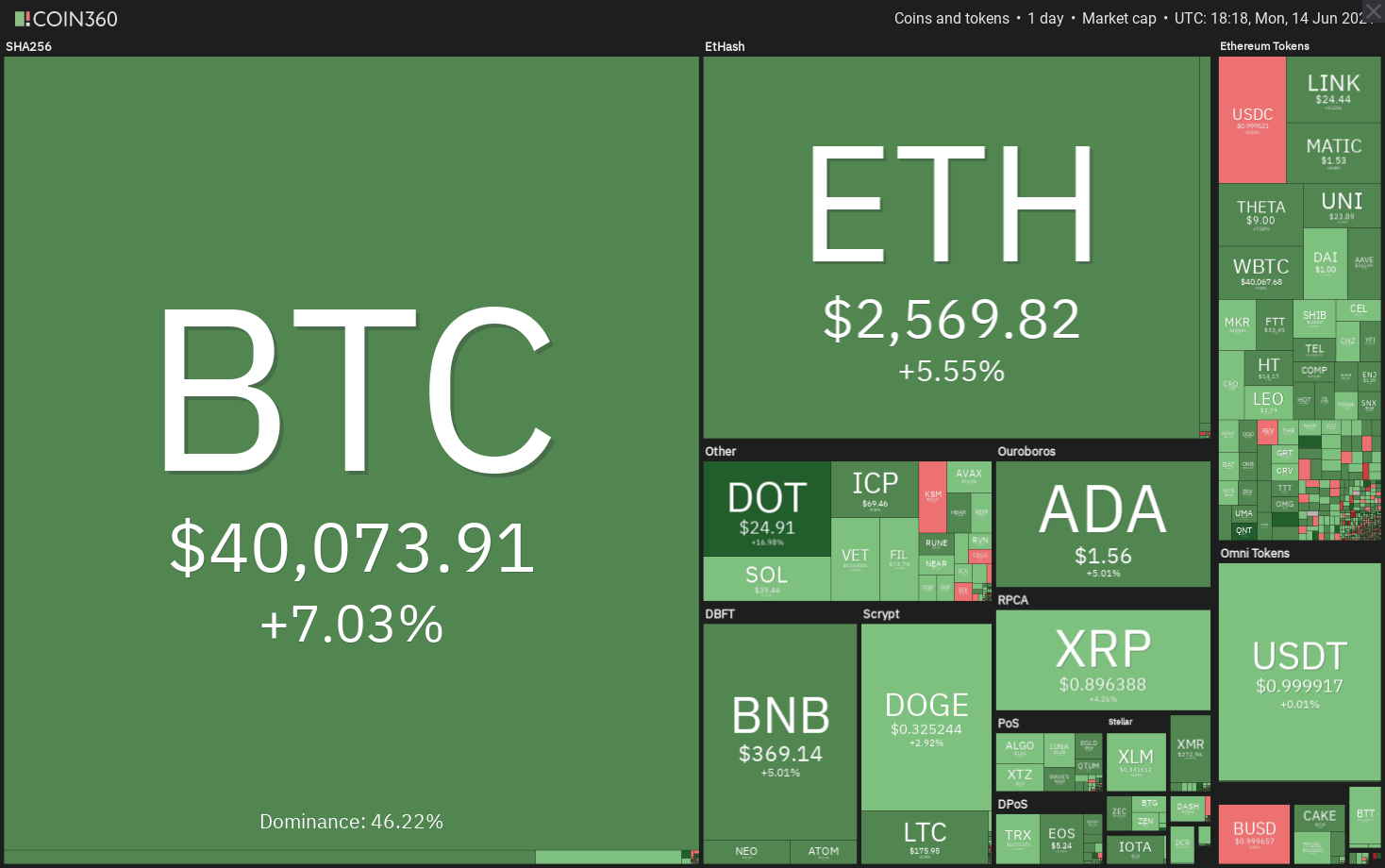

With demand likely to come back, could BTC lead the recovery from the crypto markets? Let’s examine the charts of the top-10 cryptocurrencies to discover.

BTC/USDT

BTC turned on June 13 and soared above the resistance line of the developing descending triangle pattern. This move invalidated the bearish setup, and it is a bullish sign. The buyers have lasted their buy today and pushed the price above $40,000.

The 20-day easy moving average ($36,779) has flattened out along with the relative strength index (RSI) has risen into the positive territory, indicating the selling pressure has reduced.

The BTC/USDT pair could now try a rally into the 50-day SMA ($44,571), which might work as a stiff resistance. If the purchase price turns down in the immunity but finds support in the 20-day SMA, it is going to suggest the opinion has turned bullish.

A breakout of the 50-day SMA will signal a possible shift in trend and the pair could then muster to $51,483. This bullish view is going to probably be negated if the set turns down and plummets below the 34,600.36 support. This type of move will imply that dealers are dumping their positions on minor rallies.

ETH/USDT

Ether (ETH) dropped below the support line of the symmetrical triangle on June 12 however, the bears could not maintain the reduced levels. This implies that buyers are collecting on dips.

ETH/USDT daily chart. Resource: TradingView

Should they succeed, the set could muster into the resistance line of the triangle.

A close and breakout over the triangle and the 50-day SMA ($2,940) will suggest that the downtrend is finished. The set could then move up to the 78.6% Fibonacci retracement level at $3,806.91.

This positive view will invalidate whether the set turns down in the present level or the overhead immunity and breaks below $2,200. That could open the doors for a drop to $2,079 and then $1,728.74.

BNB/USDT

This implies that the bulls are safeguarding the trendline aggressively.

When the bulls maintain the purchase price over the 20-day SMA, the BNB/USDT pair may move up to $433. This level may act as a resistance but if the bulls can push the purchase price over it, the ascending triangle pattern will complete.

This bullish installation has a target objective at $609. The gradually rising 20-day SMA and the RSI over 46 suggest the buyers are trying to make a comeback.

However, if the purchase price turns down in the present level and breaks below the trendline, it is going to imply that supply exceeds demand. The set could then fall to $291.06 and then to $211.70.

ADA/USDT

Cardano (ADA) slipped below the trendline on June 11 however, the bears could not maintain the reduced levels. This implies that the bulls are buying on dips. The altcoin rose over the trendline on June 13 and the bulls are currently trying to push the purchase price over the moving averages.

Should they manage to do this, the ADA/USDT pair could climb to $1.94 where the bears are likely to pose a stiff challenge. However, a close and breakout above this immunity will suggest the correction is finished.

Contrary to the assumption, if the purchase price turns down in the moving averages, the set could fall to $1.33. A break below this support will signify weakness and the pair could then plummet to $1.

DOGE/USDT

Dogecoin (DOGE) is attempting to rebound off the neckline of the head and shoulders pattern. This implies the bulls are attempting to defend this support.

The bears are again likely to mount a stiff resistance in the 50-day SMA. If the purchase price turns down in the immunity, the DOGE/USDT pair could fall to the neckline and remain range-bound for a few days.

The flattening moving averages and the RSI only below 46 points into a range-bound activity in the near term. This neutral view will invalidate if buyers push the purchase price over $0.45 or bears sink the set below the neckline.

XRP/USDT

XRP was trading below the 20-day SMA ($0.92) for the past few days however, the bears have never been able to sink the purchase price below the 0.75 support. This implies that bulls are accumulating at lower levels.

The 20-day SMA is flattening from the RSI is over 44, indicating the bulls are trying to make a comeback. A close and breakout over the 20-day SMA is going to be the first indication of strength. It will indicate that dealers have resumed their buys.

That could push the price to $1.10 where the bears will try to defend the level aggressively. However, if buyers thrust the price above this level, the XRP/USDT pair could climb to the 50-day SMA ($1.19). This positive view will invalidate whether the purchase price turns down and plummets below $0.75.

DOT/USDT

Polkadot’s (DOT) price action of the past few days has formed a symmetrical triangle pattern, signaling indecision one of the bulls and the bears.

The flattish 20-day SMA ($22.98) and the RSI over 48 points to a possible range-bound activity in the brief term. However, if bulls push the purchase price above the resistance line of the triangle, then the DOT/USDT pair may begin a relief rally to $31.28 and then to $41.40.

To the contrary, if the purchase price turns down in the resistance line, then the bears will probably make yet another attempt to sink the set below $19.50. Should they succeed, the set could begin its journey toward the upcoming critical support at $15.

UNI/USDT

Uniswap (UNI) is trading involving the $21.50 support along with the $30 immunity for the past few days. Even though the bears pulled the price below $21.50 on June 12 and 13, they could not maintain the reduced levels. This implies that the bulls bought the dip below $21.50.

The relief rally is likely to face stiff resistance in the downtrend line. This shows that the bears haven’t thrown in the towel yet. If the purchase price turns down in the present level, the sellers will probably make another attempt to sink the UNI/USDT pair below the $21.50 to $20.23 support.

Should they succeed, the set could fall to $16.49 and then $13.04. Contrary to the assumption, if the bulls push the purchase price above the downtrend line, the set may move up to the 20-day SMA ($25.45).

If the purchase price turns down in the 20-day SMA, it is going to suggest the opinion remains negative. However, if the bulls push the purchase price over the 20-day SMA, the set could grow to $30.

LTC/USDT

Litecoin (LTC) has failed to break above or below the symmetrical triangle as the bulls are buying on dips to the support line and bears are available in the immunity line. If the purchase price reaches the apex of the triangle without breaking out, the routine is going to be invalidated.

LTC/USDT daily chart. Resource: TradingView

The bulls are currently attempting to push the purchase price above the resistance line. Should they succeed in sustaining the price over the triangle, it is going to imply that buyers are back into the match. That could open the doors for a move to $225 and then to the 50-day SMA ($237).

Alternatively, if the purchase price turns down in the present level, the bears will probably make yet another attempt to sink the LTC/USDT set below the support line. If this happens, the pair could fall to $140 and then to $118.03.

BCH/USDT

BTC Cash (BCH) was trading within a descending triangle pattern for the past few days, which will complete on a breakdown and close below $538.11.

BCH/USDT daily chart. Resource: TradingView

If this happens, the BCH/USDT pair could witness competitive selling and might fall to $400 and then to $370. The gradually downsloping 20-day SMA ($656) and the RSI from the negative territory imply the path of least resistance would be to the downside.

This negative view will probably invalidate if the bulls propel the purchase price over the downtrend line. Such a move could grab several competitive strip off guard and might result in a brief squeeze, pushing the price to the 50-day SMA ($894).

The views and opinions expressed here are solely those of the writer and do not necessarily reflect the views of CoinNewsDaily. Every single investment and trading move involves danger. You need to conduct your own research after making a decision.

Market information is supplied by HitBTC exchange.