Coming every Saturday, Hodler’s Digest can help you track every single significant news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, top coins, predictions and much more — a week in 1 link.

Top Stories This Week

Bill to create Bitcoin legal tender moves in El SalvadorEl Salvador has formally become the first country on earth to adopt Bitcoin as legal tender. A law outlining the proposals, introduced by President Nayib Bukele, passed with a”supermajority,” bringing 62 out of 84 votes. Under the so-called Bitcoin Law, merchants must accept Bitcoin in addition to U.S. dollars — and they will be expected to provide rates for products and services in both currencies. The government will be releasing a formal crypto wallet for consumers to work with, but they are able to rely on private providers if they prefer. Permanent residency will be available for people who spend 3 BTC in the country, and today, a 90-day implementation period has begun. Since the 90-day implementation period starts, the president has asked a state-owned geothermal electric company to examine plans”to offer amenities for Bitcoin mining with really cheap, 100% clean, 100% renewable, zero-emissions energy” — by its own volcanoes. Unsurprisingly, reaction from regulators has not been overwhelmingly positive. One executive at the Bank for International Settlements has predicted El Salvador’s move an”interesting experiment” — but cautioned that BTC has not passed the test of being a way of payment.

The International Monetary Fund has also cautioned the decision could have major legal and fiscal ramifications. El Salvador’s plans were first announced during a keynote address at Bitcoin 2021 in Miami, but the markets seemed to pay little notice.

Matters changed on Wednesday — the day Congress passed the legislation. Although there are many reasons to celebrate, Stack Funds’ head of research Lennard Neo has cautioned there was little in the manner of expressing reactions from so-called”smart” investors. Bringing the bulls back down to Earth, he cautioned: “We shouldn’t expect a significant influence on Bitcoin for a country with a GDP per capita less than 7% the U.S., with its economy enduring the worst crash in decades this past year.” The powerful move helped save the bulls during Friday’s alternatives expiration, because any amount under $34,000 could have wiped 98% of call options. MicroStrategy earns $1.6 billion in requests in junk bond offeringMicroStrategy has attracted $1.6 billion value of orders in a recent junk bond offering — four times greater than what the business intelligence firm originally sought.

Waste bonds are debt offerings by companies without investment-grade credit ratings and typically offer investors greater returns while carrying greater risk. Although this has been translated as bullish news, alarm bells started sounding after the junk bond that has been announced — the latest in a string of debt raises to buy more Bitcoin. MSTR stock fell after the information. MicroStrategy closed the week at $516.44, off the year-to-date high of $1,315 which was seen in February. In a recent article, analyst Juan de la Hoz said MicroStrategy would be in danger of bankruptcy if Bitcoin prices fell, including: “MicroStrategy is a rare high-risk low-reward investment opportunity, and a strong market” Bitcoin 2021 attendees’ positive COVID-19 evaluations are going viralSome of those who attended Bitcoin 2021 in Miami have tested positive for COVID-19, leading to a wave of negative press coverage and speculation that it might have been a more”superspreader event”

Thousands of people went to the two-day occasion, which did not require evidence of vaccination or apply the wearing of masks. There was little in the way of social distancing either as folks packed into crowded auditoriums. One influencer on Crypto Twitter, Mr. Whale, estimated that there were over 50,000 traffic at the function.

He noted that this was the first important in-person conference because the pandemic began, and said dozens of participants have tested positive.  Vitalik Buterin has made $4.3 million from his $25,000 investment in Dogecoin… up to now Ethereum co-founder Vitalik Buterin has revealed that he invested $25,000 into DOGE in 2016… and has made a pretty penny as a outcome. His initial concern was how he would tell his mother — not least because”the only interesting thing about this particular coin is a logo of a dog someplace.” Buterin told Lex Fridman’s podcast that he was caught off-guard from the speculative frenzy which resulted from Elon Musk’s fascination with the joke cryptocurrency. He remembered being in lockdown in Singapore when the cost of DOGE taken up 775 percent from $0.008 to $0.07 within the course of one day, thinking: “Oh my god, my DOGE is worth, like, a lot!” Buterin added:“I sold half of the DOGE, and that I got $4.3 million, given the profits to GiveDirectly, and a couple of hours after I did this, the cost dropped back from around $0.07 to $0.04.” Assuming he held on to the rest 50 percent of his DOGE stash, he would currently be sitting on tens of millions of dollars in paper profits.

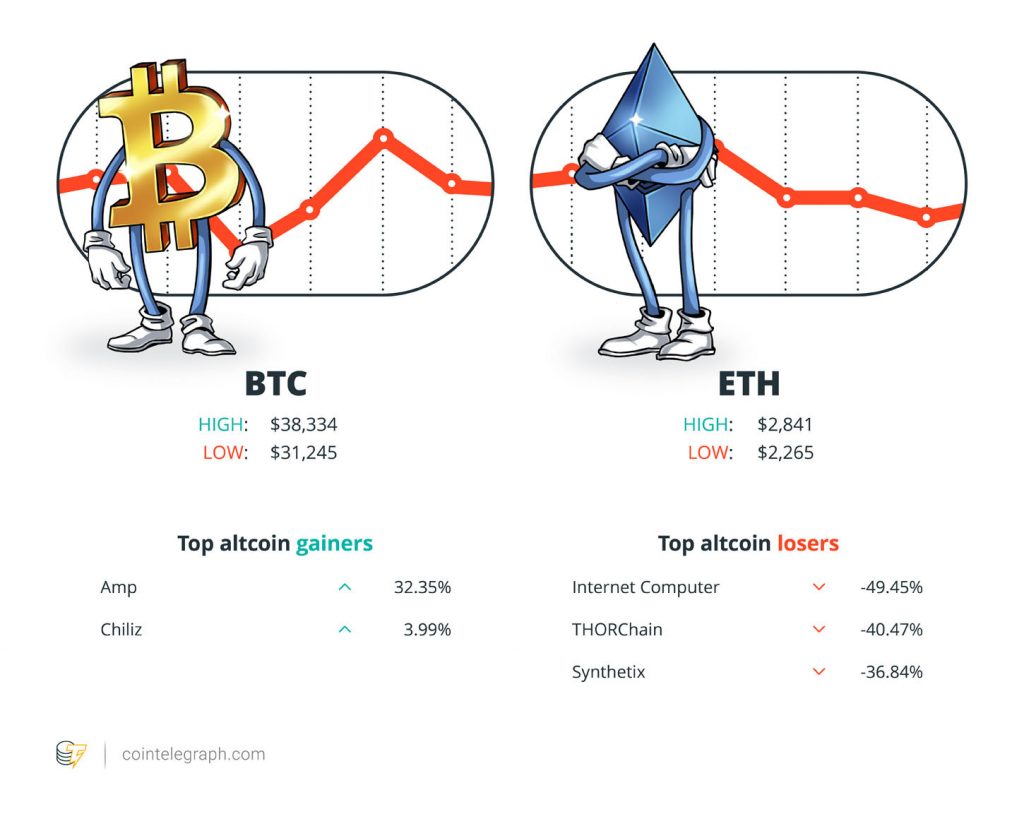

Vitalik Buterin has made $4.3 million from his $25,000 investment in Dogecoin… up to now Ethereum co-founder Vitalik Buterin has revealed that he invested $25,000 into DOGE in 2016… and has made a pretty penny as a outcome. His initial concern was how he would tell his mother — not least because”the only interesting thing about this particular coin is a logo of a dog someplace.” Buterin told Lex Fridman’s podcast that he was caught off-guard from the speculative frenzy which resulted from Elon Musk’s fascination with the joke cryptocurrency. He remembered being in lockdown in Singapore when the cost of DOGE taken up 775 percent from $0.008 to $0.07 within the course of one day, thinking: “Oh my god, my DOGE is worth, like, a lot!” Buterin added:“I sold half of the DOGE, and that I got $4.3 million, given the profits to GiveDirectly, and a couple of hours after I did this, the cost dropped back from around $0.07 to $0.04.” Assuming he held on to the rest 50 percent of his DOGE stash, he would currently be sitting on tens of millions of dollars in paper profits.  The entire market cap is at $1,493,755,186,500. The top three altcoin losers of this week are Internet Computer, THORChain and Synthetix. For more info on crypto prices, be sure that you read our market evaluation . “Regulatory clarity empowers companies like BlockFi to continue innovating. It empowers investors and consumers to participate in this sector with the utmost assurance.”

The entire market cap is at $1,493,755,186,500. The top three altcoin losers of this week are Internet Computer, THORChain and Synthetix. For more info on crypto prices, be sure that you read our market evaluation . “Regulatory clarity empowers companies like BlockFi to continue innovating. It empowers investors and consumers to participate in this sector with the utmost assurance.”

“The ~$38,000 area for BTC is the one to see right now.”

Rekt Capital

“Cryptocurrencies demonstrate all the hallmarks of’bad money’: uncertain origin, uncertain evaluation, unethical trading practices.”

“Investors need to consider the volatility of Bitcoin as well as the Bitcoin futures market, in addition to the lack of regulation and potential for fraud or manipulation in the underlying Bitcoin market.”

“@davidguetta knows what is up. His Miami pad is for sale. Can buy with #Bitcoin or even #Ethereum. Generally, not a good idea to part w/ disinflationary #crypto that always outperforms property… but smart folks like Guetta love to take it from you.”

@ShaokyCinemaBTC

“Adoption of Bitcoin as legal tender raises numerous macroeconomic, financial and legal issues that require very careful analysis. We are following developments closely, and we’ll continue our consultations with the authorities.”

Sotheby’s

“Stablecoins are not launching us off into some brave new world […] The key here is to ensure that just because something is packaged in shiny technology we don’t somehow treat the risks it poses differently.”

Christina Segal-Knowles, Bank of England

“Digital currency from central banks has good promise. Legitimate digital public currency could help drive out fraudulent digital personal money.”

“I don’t believe @michael_saylor is familiar with Murphy’s Law. Imagine if #Bitcoin crashes under $20K? Will #MicroStrategy sell inventory at depressed prices to shore up its balance sheet? Will it sell Bitcoin to raise money? If MicroStrategy goes bankrupt will creditors HODL its own Bitcoin?”

“I should’ve purchased a good deal more — which was my mistake”

FUD of the Week  U.S. officials regain $2.3 million in crypto from Colonial Pipeline ransomOfficials with a U.S. government taskforce have captured over $2 million in crypto paid in ransom following an assault on the Colonial Pipeline system, which caused fuel shortages for many folks in the U.S.The Bitcoin in question was connected to Russia-based DarkSide hackers, and about 63.7 BTC has been clawed back. Although there’s little doubt that this is a good thing, Bitcoin’s cost really ended up falling because of worries over the way the FBI really was able to grab the cryptocurrency.

U.S. officials regain $2.3 million in crypto from Colonial Pipeline ransomOfficials with a U.S. government taskforce have captured over $2 million in crypto paid in ransom following an assault on the Colonial Pipeline system, which caused fuel shortages for many folks in the U.S.The Bitcoin in question was connected to Russia-based DarkSide hackers, and about 63.7 BTC has been clawed back. Although there’s little doubt that this is a good thing, Bitcoin’s cost really ended up falling because of worries over the way the FBI really was able to grab the cryptocurrency.

Coinbase has refuted suggestions that it was included. Mati Greenspan, the creator of Quantum Economics, has said that the recovered ransom is really bullish for Bitcoin, as most had anticipated U.S. politicians to use crypto as a scapegoat for its assault and apply a few heavy-handed regulations.

Proposed New York Bitcoin mining prohibit watered down to allow green jobs A proposed crypto mining prohibit calling for a pressured three-year hiatus on all mining operations in New York continues to be watered down — and will currently allow green jobs. If the bill is passed there, it’ll be sent to Governor Andrew Cuomo to approve or veto the proposed legislation. The initial New York Senate Bill 6486A sought to halt all crypto mining for three years so as to conduct environmental impact reviews on mining operations in the tri-state area. But, the bill was amended in the senate to get it on the line, and also the revised 6486B bill is currently focused solely on any firm which utilizes carbon-based fuel resources to power proof-of-work crypto mining. Alleged $3.6 billion crypto Ponzi’s victims still Feel the exchange is legit. Victims of an alleged $3.6 billion crypto Ponzi scheme in South Korea are reportedly hampering the progress of a police investigation and a joint lawsuit — since they still believe in the job and also hold out hopes of getting a return on their investments. A notice on the organization’s website claims that it simplifies the”false” claims and has filed a complaint with authorities ”for defamation and obstruction of company.”

If Global is found guilty, it might possibly be among the biggest crypto-related Ponzi schemes on record, in a similar manner to the notorious multi-billion Ponzi scheme from OneCoin in 2015.  Pronouncements in the G-7 allow green fintech to flourishthe need to reduce climate change involving the COVID-19 pandemic have become the worldwide economic agenda. Miami bets the promise to become the planet’s Bitcoin and crypto capital.

Pronouncements in the G-7 allow green fintech to flourishthe need to reduce climate change involving the COVID-19 pandemic have become the worldwide economic agenda. Miami bets the promise to become the planet’s Bitcoin and crypto capital.

Miami includes a dynamic mayor, tons of VC money and is coming off the largest-ever crypto extravaganza, but is that sufficient without legal permission? More IRS crypto coverage, more dangerThe U.S. authorities are becoming seriously interested in crypto, making unreported crypto much more dangerous.