By now, every ETH (ETH) fan knows this blockchain is in the process of shifting from a proof-of-work (PoW) into some proof-of-stake (PoS) consensus mechanism. What’s less widely known, even among the ones from the ETH community, is what will happen to the miners that help secure this network.

Having invested plenty of capital in developing mining rigs and amenities, it appears improbable that the end of ETH mining will end in these miners leaving the business altogether. In fact, analysts expect that ETH miners will shift to another blockchain that (like Ethereum) is friendly to GPU-based mining rigs, although they can’t say which these will be.

1 thing they can say, however, is that it is improbable ETH miners will shift to mining Bitcoin (BTC), since the latter revolves more about ASIC chips (that can be single-purpose). The upshot of this is that other networks may be computationally secure in relation to Bitcoin, insofar as they’ll benefit from receiving ETH’s hashpower.

Changing networks

ETH’s miners have not been too happy about recent developments and proposals concerning the platform.

That said, it appears like they still have a future to look ahead, albeit with different blockchains.

They’re mining with GPU rather than ASIC that gives them more flexibility on the use of their computational resource, if they want to switch into another coin or use GPU for other workloads like AI or remote rendering tasks,“ he told Cryptonews.com.

ETH Foundation community manager Tim Beiko agrees with this forecast, although he notes miners using Ethereum-specific ASIC rigs will have a difficult time finding a new home.

„Many miners on ETH use GPUs and people can mine on almost any GPU-friendly series. You will find ETH ASICs, and people will probably be obsolete except if a different chain uses the same mining algorithm as ETH,“ he told Cryptonews.com.

Given that ETH ASICs are particular to ETH, there is very little doubt that ex-Ethereum miners will not be moving to Bitcoin.

„„ETH miners will not mine BTC most likely as BTC relies heavily on ASICs and rather than update their miners with ASICs they will probably want to acquire the worth of their GPUs because they are usually using rather expensive GPUs and want to get out the value,“ said Miko Matsumura.

But, according to ConsenSys‚ Lex Sokolin, it will be tough to accurately forecast which particular GPU-oriented coin(s) will entice former ETH miners.

„This is very tough to predict, since you imply, once you have a lot of hardware optimized for a particular mining activity, it’s difficult to repurpose. Different consensus algorithms also need different types of hardware optimizations, so shifting from one chain to another of an equal size isn’t trivial,“ he explained.

Picking the most popular choices for migrating ETH miners may be difficult, but we can highlight a few of the more prominent GPU-friendly networks:

As the list above shows, ETH miners are probably going to gravitate towards coins with a larger market capitalization, if just because it will be profitable to mine .

That said, while Tim Beiko confirms that some miners have been talking about a few of those networks, it will not be trivial to switch to them.

„ETH Classic and Ravencoin would be the two that I’ve heard mentioned, but I am not certain whether they will maintain a algorithm that’s compatible with ETH’s ethash,“ he explained.

Impacts and also the future

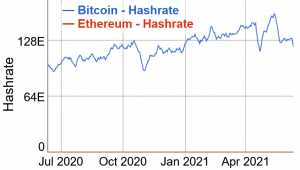

According to BitInfoCharts, ETH now boasts a hashrate of 597 Th/s, that’s the biggest of any network besides Bitcoin (which maintains a whopping 114 Eh/s).

This is a significant amount of hashpower, also will make a big difference to the stability and computational power of any chain which receives a considerable chunk of it.

For instance, ETH Classic’s hashrate is only 28 Th/s, although Monero’s is just 2.5 Gh/s (or even 0.000246 Th/s). Adding hashpower out of ETH will make a big difference to the stability of these coins, especially insofar as preventing 51% strikes are concerned.

In accordance with Crypto51.app, starting a one-hour 51% attack against Ravencoin, for instance, costs only around USD 23,300 (in comparison to USD 1.6m for Ethereum). For Aeternity, it costs just USD 329!

For a long time, analysts have pointed to Bitcoin’s massive hashrate as a sign of just how difficult it would be to undermine its security, while they have also pointed to the more compact hashrates of other coins as a sign of how fragile they are. This opinion may have possibly frees some investors from buying the corresponding cryptoassets.

With the advent of ETH 2.0 and the migration of prior ETH miners, such networks as ETH Classic, Monero and Ravencoin may discover that their reputations as secure blockchains grow.

In turn, that could result in price increases, which will be great news for those cryptoassets concerned. And good news for those miners who transition into them.

____

Know more:

– ETH Miners Will Probably Accept EIP-1559 Activation – Advisors

-‚Fiat-Like‘ Proof-of-Stake Chains Favor Centralization & Rich Players