This week we will identify emerging-sector trends across the cryptocurrency landscape in order to broaden your understanding of market cycles and better equip readers to take advantage of the microcycles which are a regular occurrence in the bigger market structure.

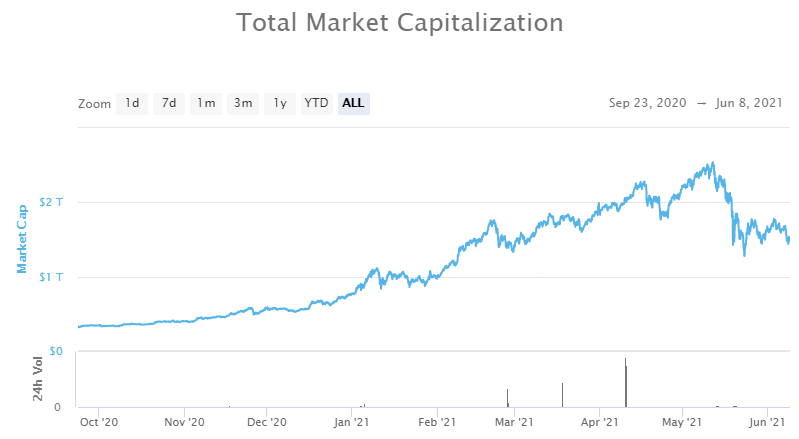

The cryptocurrency sector has a proven reputation for being explosive and fast-moving, and these characteristics were on full display in May as the accelerated decrease in the purchase price of BTC (BTC) from $60,000 to $33,000 led to a mass exodus that wiped off $1.2 trillion in value from the entire market capitalization.

While many round the ecosystem have put the blame for the recession on matters such as adverse tweets from influencers and powerful figures such as Elon Musk or still another announcement the government of China has banned BTC, more experienced traders and analysts have been warning regarding the prospect of a substantial pullback for several weeks ahead of the sell-off.

The rapid growth in costs in 2021 revealed some of the classic indications of bubble-like behaviour, together with overbought alarm bells ringing while Uber drivers and supermarket clerks were happy as punch to offer their view on what the next major mover would be.

With that said, now looks like a good time to review the various stages of a market cycle to get a better understanding of exactly what the market has gone through so far and what can potentially be anticipated in the months and years ahead.

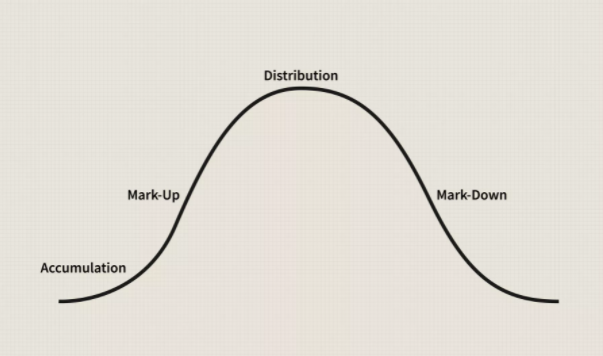

Four phases of a market cycle

The four primary phases of a market cycle, which all traders should have a fundamental understanding of, are the accumulation phase, the mark-up phase, the distribution phase and the mark-down phase.

The accumulation phase takes place after a market has bottomed out and is distinguished by the innovators and early adopters buying up the advantage because of its long-term potential before any substantial price moves.

This phase was seen from the cryptocurrency market starting around December 2018 when the cost of BTC bottomed under $3,500 and extended all the way until October 2020 when its cost began to meaningfully grow above $12,000.

The mark-up phase really began to heat up in December 2020 and expanded into January 2021 since BTC and the decentralized fund (DeFi) sector were attracting worldwide attention, together with the entire market capitalization rising to a high above $2.5 trillion in May since the supply period began to initiate.

During distribution phases, sellers start to dominate and the previously bullish opinion turns mixed, resulting in prices becoming locked in a trading range.

Some of the normal graph patterns seen during this time, as outlined by Investopedia, are double and triple shirts alongside renowned head-and-shoulders patterns, which were the warning signals presented by BTC and seen by technical analysts before the latest sell-off.

$BTC Construction Head and Shoulder pattern.

Bear market starts? #Bitcoin #Cryptocurency pic.twitter.com/E86WwcCKsX

— K A R N A (@iamrajankarna) June 8, 2021

Similar to the 2017–2018 bull market, the purchase price of BTC reached a new all-time large (ATH) and began to trend down, which resulted in capital rotating from BTC and to the altcoin market, further propelling the entire market capitalization into a record high of $2.53 trillion on May 12.

For the astute crypto dealer, this pattern was a sign that a mark-down phase was coming and it would be wise to take gains as BTC fluctuated between $40,000 and $60,000 and altcoins spiked to all time highs in planning to ride the sell-off and scoop up tokens at a reduction during the next bottom.

Deploying funds in the accumulation phase

Now that the market has undergone a substantial pullback and proceeds to search for a cost floor, it is a crucial time to monitor price movements, having a watch on searching for great entry points into workable projects.

Perhaps the most famous picture detailing the normal market cycle is Wall St. Cheat Sheet’s“Behavior of a industry Cycle.“ The pattern has emerged in markets of all sorts, from stocks and commodities to cryptocurrencies and property.

Looking at the graph for BTC, we can see a similar cost pattern which began late in 2020 with a potential“disbelief“ phase starting in November. The early run-up in January is similar in look to the“hope“ phase on the graph above and has been followed with a multimonth run-up into a euphoric all-time large in April.

The cost then dipped down from $64,000 to $47,000 before bouncing back into the $53,000–$60,000 range as complacency began to install. The sell-off in May propelled the market through the anxiety, denial, anxiety and capitulation phases, and the ecosystem response to Musk’s tweets, as well as other forces placing downward pressure in the market, elicited a substantial quantity of anger within the community.

Now comes the challenge of handling the melancholy of a considerably lower portfolio worth and trying to determine if the market has bottomed, signaling it is a great time to redeploy funds, or if the best thing you can do is sit in their hands and wait for further progress.

Major price rallies during this time are often seen with disbelief as a sucker’s rally — hence, the cycle is complete, and we’re back at the beginning.

So, does that mean that now is a good time to accumulate your favorite projects‘ tokens?

Regrettably, there is no guaranteed correct response to that query, and it’s something for every investor to decide on their own. With previously in-demand tokens currently at substantial discounts compared with only one month ago, this may be a good time to start dollar-cost averaging back to the top long-term choices in preparation for another cycle higher.

Cryptocurrency sector cycles

The normal cycle presented here can be applied to the market as a whole and to individual tokens or token businesses.

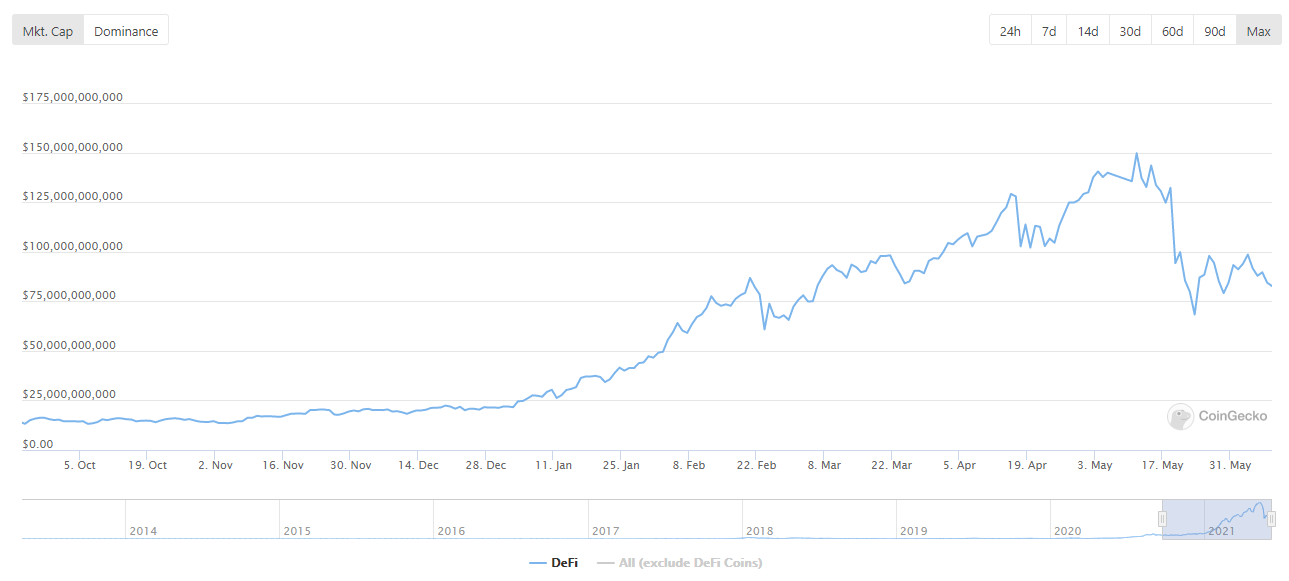

A good instance of this will be the growth of decentralized finance within the last year, which took the cryptocurrency market by storm, led by the development of popular decentralized exchanges like Uniswap and lending platforms such as Aave.

As seen from the graph above, the DeFi sector as a whole went through its own market cycle pattern which contrasts with its own increasing popularity and use across the ecosystem.A similar pattern has been seen in the increase of nonfungible tokens (NFTs) in 2021, but the timing was different, highlighting the thought that businesses move collectively and hinting at the possible advantages of a sector-based method of investing in cryptocurrencies.

Source: TradingView

In order to benefit from these opportunities, traders are sometimes pressured to embrace a contrarian strategy. The accumulation phase is often marked with decreased opinion, but the best time to sell is during the distribution period when opinion is at its highest and also a vast majority of traders are moving all-in with hopes of good riches.

In terms of the current market standpoint, it is possible that the most appropriate course of action is embracing a wait-and-see strategy while keeping some dry powder onto the sidelines to take advantage of any“flash sales“ that will come our way. Whatever you can choose, just be sure you do your own research and also have a risk management process in place, as the volatile nature of the cryptocurrency market shows no signs of abating any time soon.

Want more info about market cycles?

The perspectives and opinions expressed here are solely those of the author and don’t necessarily reflect the views of CoinNewsDaily. Each investment and trading move entails risk, you should run your own research after making a decision.