A recent run-up in Ether (ETH) costs against its leading rival, BTC (BTC), seems to be in the risk of exhaustion, even as analysts view the second-largest cryptocurrency as the stronger of the two.

The powerful rally move revealed a spike in the capital flow in the spot ETH to see BTC marketplace. That also led analysts in Delphi Digital, an independent market research firm, to highlight Ether’s“formidable strength“ from the Bitcoin-quoted markets. They wrote:

„If you take a look at the YTD ETH/BTC chart in isolation, you probably would not guess fear in the crypto marketplace is the highest it’s been in a year“

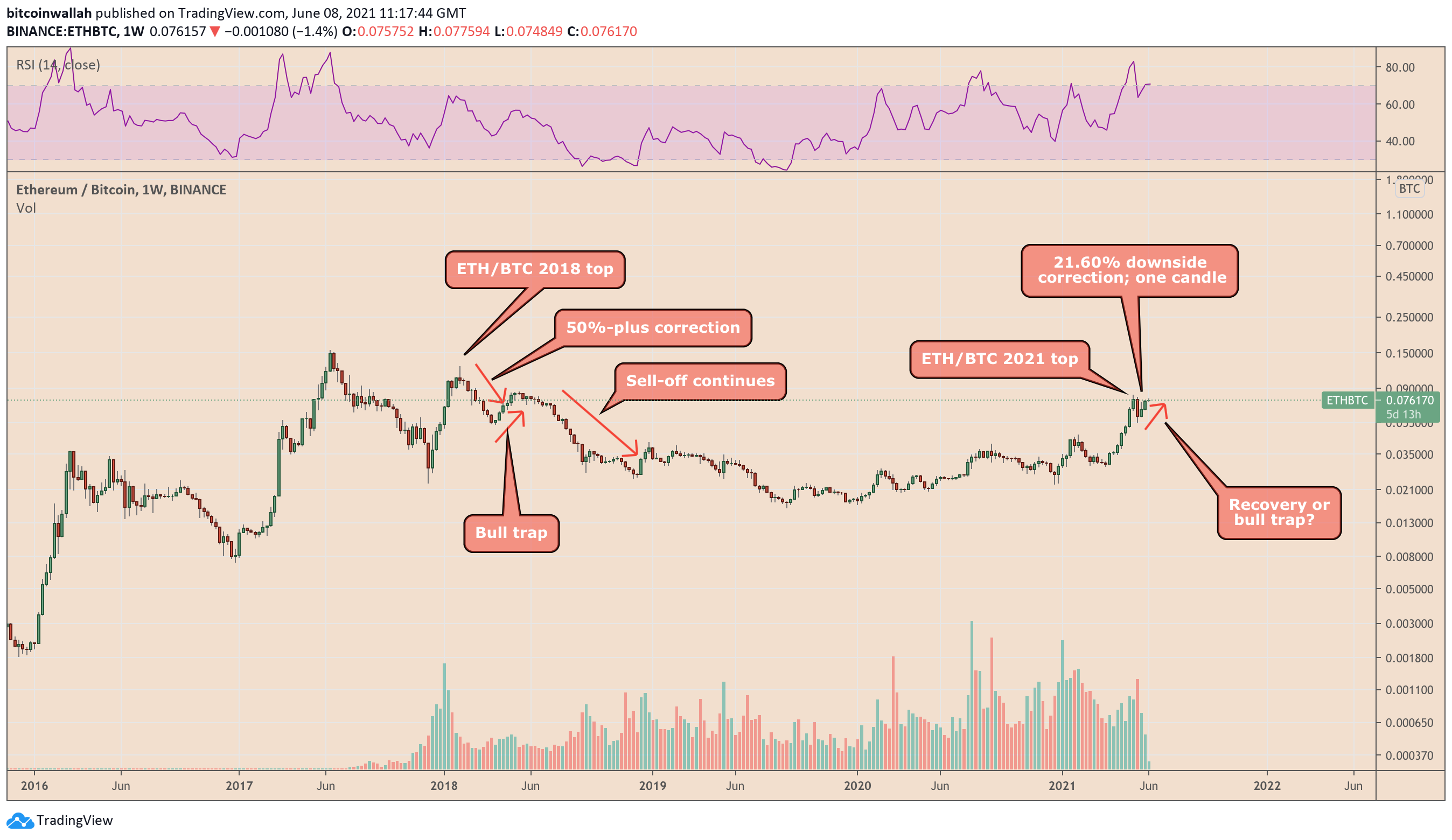

However, a closer look into the ETH/BTC chart returns signs that bullish traders might be heading into a bull trap.

Bearish wedge

ETH/BTC formed a pattern that started wide in the base and contracted as the price moved . As a result, the trading scope narrowed. Meanwhile, the volumes dropped as the costs rose and the contracting pattern evolved.

Source: TradingView

Vintage chartists refer to this structure as a rising wedge. They interpret it as a conventional bearish reversal pattern, primarily because of the reduction of this upside momentum on every successive high formation.

Rising wedges mature as the advantage reaches the level in which both trendlines converge. But bearish confirmations do not come until the price breaks below the wedge support in a convincing fashion. But if it will, the advantage risks crashing by as much as the maximum distance between the wedge’s upper and lower trendline.

Therefore, the ETH/BTC rising wedge indicator suggests a decline toward 0.0648 BTC on a negative breakout effort in the routine’s apex — the stage where the trendlines converge. Also, the 0.0648 BTC level functioned as service throughout May.

January 2018 fractal

Delphi Digital compared the responses of ETH/BTC into BTC’s cyclical tops in 2018 and 2021 to describe its bullish outlook for its group.

The firm emphasized that ETH/BTC was relatively a weaker tool throughout the 2017 cost rally than during 2021. The group topped out mid-cycle — in June 2017 — even as BTC lasted climbing and reached $20,000 by the year’s end. By then, ETH/BTC had shrunk by more than 85 percent.

But a massive correction in BTC costs in January 2018 offloaded capital into the altcoin markets, causing a short term upside correction in BTC-enabled pairs. Ether also benefited in the money flow from BTC markets, as it rebounded from 0.0231 BTC from December 2017 into 0.1237 BTC in January 2018 — a 435.44% rise.

ETH/BTC then began correcting reduced in the weekly periods as both BTC and Ether took a beating in dollar-quoted markets. The pair eventually dropped from 0.1237 BTC, and also a year-to-date shirt, to as low as 0.0246 BTC in December 2018.

But That’s Not the case with the ongoing ETH/BTC correction, noted Delphi Digital, composing:

„At the first 2018 top, ETH/BTC took a massive beating and did not recover even close to as quickly as it’s this time.“

ETH/BTC’s 2018 and 2021 top contrast per Delphi Digital’s outlook.

Whether or not ETH/BTC will experience a negative breakout seems to rely on how BTC plays in dollar-quoted markets.

The BTC/USD exchange rate dropped up to 53.77percent from the record high, near $65,000, and began consolidation afterwards. Meanwhile, the ETH/USD rate also adjusted in tandem with BTC/USD, dropping 60.59percent from the all-time high $4,384. That shows a strong linear correlation between the two electronic assets.

Nick Spanos, founder of BTC Center NYC, told Cointelegraph that Ether would need to break its correlation with BTC from the dollar-denominated markets to possess an independent ETH/BTC trend. Until then, sharp disadvantage goes in ETH/USD and BTC/USD would also signify a depressive ETH/BTC trend. He added:

„While Ethereum has great principles and updates in the works, its potential growth in the future is somewhat dependent on the operation of BTC. A breakaway from this trend has been projected by Ethereum investors. However, the present trend does not indicate the probability of the in the near to mid term.“

Yuriy Mazur, head of this information analysis department in cryptocurrency exchange CEX.IO, included that the continuing anti-inflation narrative could allow BTC to resume its uptrend. As a result, the remaining part of the cryptocurrency marketplace, including Ether, must follow suit. He told:

„ETH/BTC should benefit from a rising trend for cryptocurrencies, especially as Ethereum undergoes the London hard fork update later in July.“

The ETH/BTC exchange rate has surged by approximately 40% after bottoming out at 0.055 BTC. However, the pair seems to be heading into a bull trap.