Litecoin could post a healthy recovery and violation the $300 level within June

Charlie Lee, its founder, pictured a version of Bitcoin that manages payments faster and requires low energy intake to settle transactions. The cryptocurrency is, therefore, perfect for microtransactions such as paying for a cup of cappuccino.

Over time, Litecoin has grown to become a useful complementary alternative for Bitcoin. Litecoin is at the center of several fintech jobs that initially meant to integrate Bitcoin. The cryptocurrency’s stature in global fund grew even more following the core developer team adopted the unmanned system protocol. To many, the adoption signaled fantastic ambitions for Litecoin and reasserted the belief that its future as a dependable and traditional altcoin is glowing.

What is the current Litecoin cost?

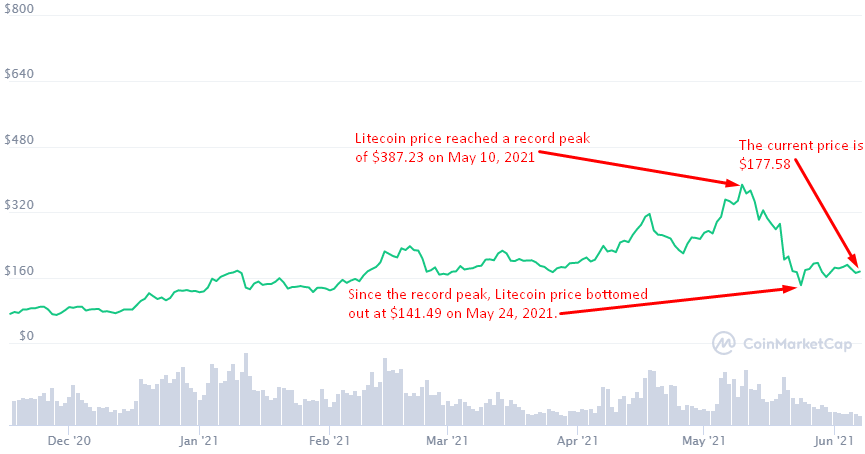

The Litecoin cost was, according to CoinMarketCap, is $177.58 at the time of writing, representing a 2.36% rise from the last close 24 hours back. Within the last 24 hours of trading, Litecoin (LTC) had touched that a base of $172.52 plus a summit of $180.02.While the LTC cost is green, it still represents a significant decline from the record evaluation of $387.23 based on May 10, 2021. Nonetheless, the current Litecoin cost is a remarkable recovery from the current underside of $141.49 touched 24 May 2021.

Litecoin cost graph.

June is an important month in the Litecoin ecosystem due to specific critical developments.

The developments will have a massive impact on the market sentiment and the cost of the crypto. Before we delve into the details, it can help to make sense of where the market stands in terms of support and resistance for Litecoin cost action.

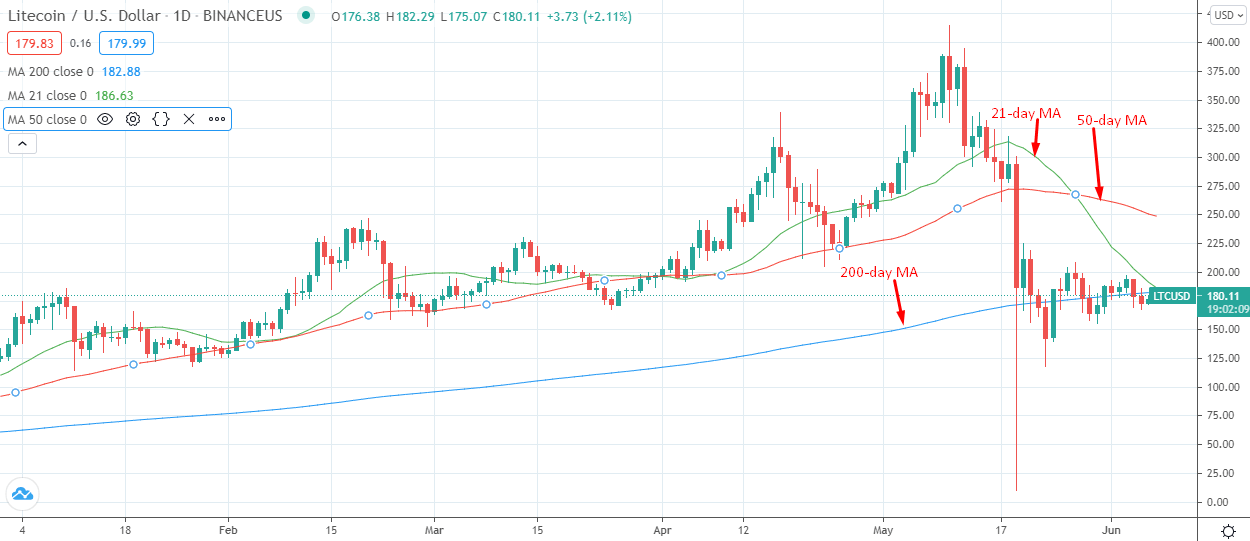

First, the resistance. The first cost point we will watch for this month will be that the $388 all-time large as the essential resistance. If the current cost action trend continues, the upcoming critical resistance level we will focus on is that the February high of $240. The cost point is critical because it’s the previous yearly high before the May breakout. Last, the April open of $200 is a point of curiosity. This price point is essential because it marks the latest open which kicked off the rally into the all-time high cost in mid-May.We will be watching the $118 yearly lows for the service amount –based on 23 May 2021. Also, the 200-day moving average of $170 is an important support level on the radar. If the Litecoin price holds over the 200-day MA, we will likely see the token progress above $200 in the upcoming few days.

Litecoin/USD cost graph.

Litecoin/USD cost graph.

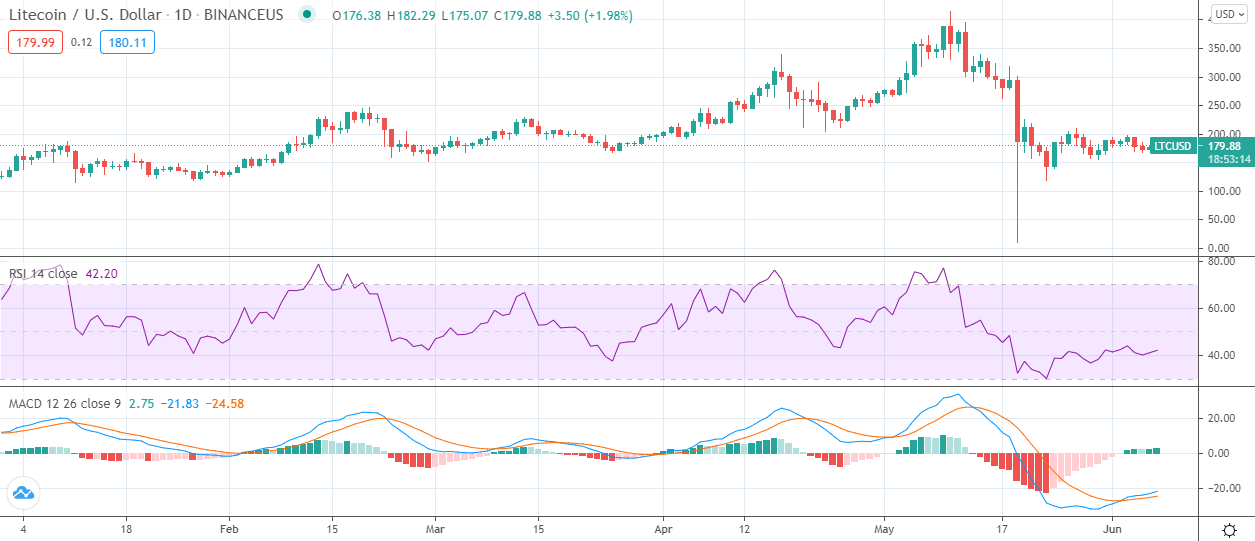

But $300 in June is a real possibility if the price breaks above the 21-day and 50-day moving averages simultaneously. Over the previous two weeks, the vendors have been thinning as more bulls put their bets on a more powerful Litecoin this month. As you can see below, the RSI has made a remarkable turnaround from 30.00 into 42.20 at the time of composing. Also, the MACD indicates the beginning of a trend out of the sharp correction of mid-May.

Litecoin/USD cost graph.

Litecoin/USD cost graph.

Occasions Which May Transfer the Litecoin Price in June

The likelihood of Litecoin breaking over the yearly high becomes more powerful when you consider the approaching privacy upgrade. Dubbed the MimbleWimble privacy protocol or MimbleWimble Extension Block (MWEB), the upgrade obfuscates transactions on the Litecoin network to prevent unauthorised access to the particulars.

MWEB will run parallel to the Litecoin network, meaning it will not have any perceivable impact on the current transaction rates. The fact that MWEB makes transactions traceable and transparent nonetheless confidential marks a critical milestone in the blockchain space. Hitherto, blockchain programmers have been unable to marry confidentiality of transactions with solitude, that has elicited a lot of people from the ecosystem.

The MWEB tool is notable in that it is very likely to attract hordes of consumers in Litecoin’s direction. The favorable market sentiment that will arise from the change will push the Litecoin cost to new records. Since Charlie Lee and his staff expect to start the MWEB instrument by September, one can’t argue against the possibility of Litecoin crossing the $500 mark permanently.

Meanwhile, investors will be looking out for regular updates about the MWEB roadmap. The latest upgrade from Litecoin lead programmer, David Burkett, indicates they are “on track for activation across the end of the year, barring no major surprises from the auditors”. Burkett revealed that the Coding & Testing period of the project was nearly complete.

Litecoin is a top Bitcoin indicator, meaning that the cost gyrations of the prior herald the upcoming changes of the latter’s cost. The opposite is also true. The slump is the most up-to-date in a string of major declines the marketplace has seen since ancient 2018. Interestingly, Bitcoin has ever attained a V-shaped recovery following each episode of decline, specifically in 2021.

Figure below shows Bitcoin cost fluctuations for the previous eight months.

Bitcoin cost gyrations in 2021. Source: Yahoo Finance

If every episode were to be symbolized by an isosceles triangle (marked in yellow), the latest slump appears to be the largest.

So far, one long side of the triangle represents a 41% decline. If the retrieval routine were to hold, there’s an opportunity that Bitcoin will recuperate by as much as 50% shortly.If the BTC recovery happens, Litecoin would also gain considerably – since one crypto is a leading indicator of the other.

Bitcoin accounts for 40.9 percent of the total cryptocurrency market capitalisation as of 7 May 2021, according to CoinMarketCap. This means whatever progress Bitcoin makes will also affect the whole remainder of the cryptoverse. On 5 June, El Salvador President Nayib Bukele disclosed that his country is currently mulling the designation of Bitcoin as legal tender. The country plans to provide the dream in partnership with Strike, a digital wallet company.

If the legislation passes the El Salvadorian congress, Bitcoin will function as the country’s primary currency.

The reports favorably impacted market opinion as Bitcoin gained as much as 0.5 percent since this news became public.

It remains to be seen exactly what the congress will state; an affirmation will surely send the cryptoverse into a fresh bull tide.

As with all other altcoins, Litecoin will surely benefit from these developments.