Bloomberg Intelligence senior product strategist Mike McGlone believes that Bitcoin (BTC) is more inclined to muster to $40,000 than slump to $20,000. This bullish outlook seems to be shared with traders as Bitcoin pioneered a sharp comeback today.

On-chain data also indicates that long-term holders (LTH) have started accumulating Bitcoin after reserving profits during the rally from $10,000 to $64,000.

The total number of Bitcoin held from these long-term holders is 2.3 million more than that which they held at the peak of their 2017 bull market. This shows the veteran traders stay informed about the future prospects of Bitcoin.

CoinShares‘ Monday“Digital Asset Fund Flows Weekly“ report shows institutional investors pulled $141 million in Bitcoin investment goods last week. However, Ether (ETH), XRP and Cardano (ADA) products observed net inflows, implying money is exiting Bitcoin and inputting pick altcoins.

On the other hand, the outflow from Bitcoin merchandise is minuscule when compared with the massive $4.2 billion that has been pumped to them in 2021. This shows that many investors have held their ranks despite the recent collapse.

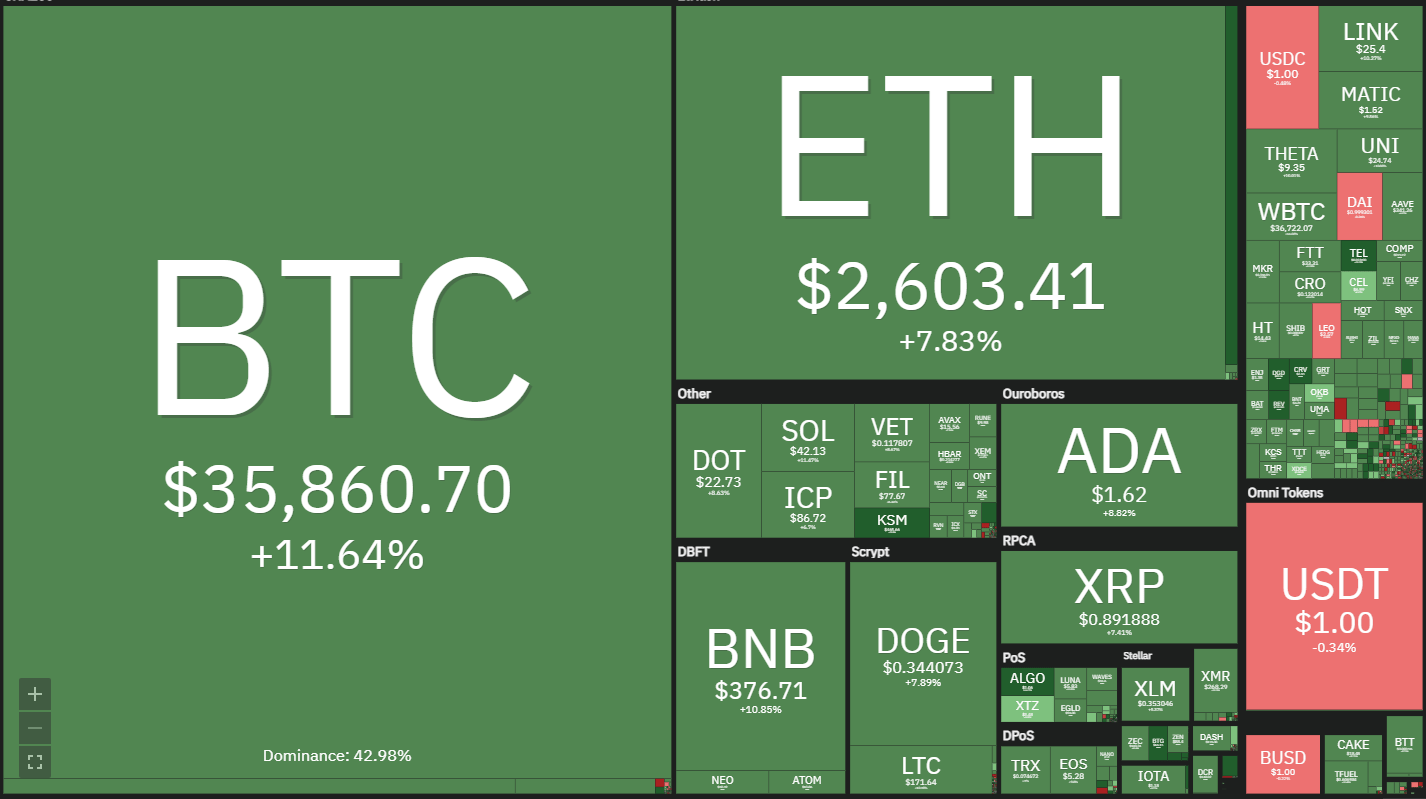

Let us examine the graphs of this top-10 cryptocurrencies to ascertain whether the correction is finished or if the prices could fall further.

BTC/USDT

Bitcoin broke under the trendline of this symmetrical triangle on June 7, indicating the uncertainty solved in favor of those bears. On the other hand, the long tail on the June 8 candlestick shows strong buying at lower amounts.

The bulls continued their purchase today, which seems to have trapped the aggressive bears who may have sold June 7. On the other hand, the BTC/USDT pair remains not out of the woods yet since the relief rally is likely to face resistance at the 20-day exponential moving average ($37,925).

In the event the price turns down from this immunity, it will suggest that the opinion remains negative and traders are selling on rallies. The next leg of this downtrend could start after the bears sink the price under the $31,000 to $28,000 support zone. Such a transfer may open the doors for a decline to $20,000.

The first symptom of strength will be a breakout and close over the 20-day EMA, which might extend the relief rally into the 50-day easy moving average ($45,896).

ETH/USDT

Ether once again turned down in the resistance line of the symmetrical triangle on June 7, indicating the bears are aggressively defending the zone between the immunity line along with also the 50-day SMA ($2,927).

On the other hand, the long tail on the June 8 candlestick shows the bulls are buying on dips to the support line of the symmetrical triangle. This implies the ETH/USDT pair could stay stuck inside the triangle for a few more days.

The following trending move could begin after the price breaks above or below the triangle. The buyers will have to propel the price over the 50-day SMA to gain the upper hand. Alternately, a break below $2,079.94 could signal benefit to the bears.

BNB/USDT

Binance Coin (BNB) broke under the trendline on June 8 but the bears could not maintain the reduced levels. The tail on the daily candlestick indicates that bulls are attempting to shield the trendline.

BNB/USDT daily chart. Source: TradingView

If buyers push the price over the 20-day EMA ($389), the BNB/USDT pair could climb to the overhead resistance at $433. A breakout and close above this level will complete a bullish ascending triangle pattern, which has a goal objective at $608.60.

Contrary to this assumption, in case the price turns down in the current level or the overhead immunity and breaks under the trendline, it will indicate that sparks have overpowered the bulls. This could produce a fall to $257.40 and then to $211.70.

ADA/USDT

The tail on the June 8 and June 9 candlestick shows strong buying at lower amounts.

ADA/USDT daily chart. Source: TradingView

The flattish moving averages and the RSI only below the midpoint indicate a balance between supply and demand.

This balance will shift in favor of the bears if the price breaks below the trendline. The ADA/USDT pair could then fall to $1.24 and then to $1.

On the contrary, if the buyers propel the price over the 20-day EMA ($1.64), the set could climb to the overhead resistance at $1.94. A breakout and close above this level could push the set to the all-time high at $2.47.

DOGE/USDT

Dogecoin (DOGE) fell under the 20-day EMA ($0.36) on June 7 and fell to the neckline of the head and shoulder pattern. The bulls are trying to defend this level as seen in the tail on the June 8 candlestick and the strong rebound today.

But unless the bulls push the price over the moving averages fast, the bears will once again try to sink the DOGE/USDT set beneath the neckline. Should they succeed, the set could decline to $0.21 and then to $0.10.

The somewhat downsloping 20-day EMA and the RSI only below the midpoint indicate a minor benefit into the bears. This negative view will probably invalidate whether the bulls drive the price over the 50-day SMA ($0.39). The set could then move up to $0.47.

XRP/USDT

XRP broke under the $0.88 support on June 7, implying supply exceeds demand. On the other hand, the long tail on the June 8 candlestick indicates that bulls are working to shield the $0.75 to $0.65 support zone.

XRP/USDT daily chart. Source: TradingView

The relief rally is likely to face stiff resistance at the 20-day EMA. In the event the price turns down in the immunity, the possibility of a break under the support zone increases.

If this occurs, the XRP/USDT pair could fall to $0.45 and then to $0.39. Conversely, if the bulls push the price over $1.10, it will indicate the buyers are back in the game and a rally into the downtrend line is potential.

DOT/USDT

Polkadot (DOT) turned down in the 20-day EMA ($24.99) on June 7 and broke under the trendline of the climbing station. This implies that the opinion remains negative and traders are selling on rallies.

If the bulls fail to push the price back into the channel over the next few days, further selling could be anticipated. The gradually downsloping 20-day EMA and the RSI in the negative land indicate the route of least resistance would be to the downside.

If the DOT/USDT pair breaks under $19.60, another stop might be the crucial support at $15. Conversely, if the set re-enters the station, it will indicate strong accumulation at reduced levels.

A close and breakout above the resistance line of the ascending station will signal that bulls are back into the match.

UNI/USDT

Uniswap (UNI) dipped below the $21.50 support on June 8 but the bears could not maintain the reduced levels. The tail on the day’s candlestick shows the bulls are defending the $21.50 level aggressively.

UNI/USDT daily chart. Source: TradingView

The buyers will try to push the price over the 20-day EMA ($26.81). Should they succeed, the UNI/USDT pair could muster into the overhead resistance at $30. This level may act as a stiff resistance and if the price turns down from it, the set could stay range-bound between $21.50 and $30 for a couple of days.

On the contrary, if the price turns down in the 20-day EMA, it will indicate the opinion is negative and traders are selling on every minor rally. This will raise the possibility of a break below $21.50. If this occurs, the pair could begin its journey toward $16.49 and then $13.04.

SOL/USDT

Solana (SOL) turned down in the 61.8% Fibonacci retracement level at $43.38 on June 7 however, the bears could not pull the price under the trendline.

The rising moving averages and the RSI in the positive zone suggest that bulls have the top hand.

If buyers push and maintain the price over $43.38, the SOL/USDT pair could go until the 78.6% retracement level at $49.97. Such a move will indicate the recent correction is finished. A break above $49.97 will clear the path for a retest of this all-time high at $58.38.

This optimistic view will nullify whether the price ends up and plummets under the trendline. A break below $33.60 can result in a decline to $25.70.

BCH/USDT

Bitcoin Cash (BCH) broke under the $616.04 support on June 7, implying the bears are in command. On the other hand, the long tail on the June 8 candlestick indicates that bulls are working to shield the 500 to $468.13 support zone.

If the bulls can sustain the price over $616.04, the BCH/USDT set could make an additional attempt to rise above the downtrend line. If this occurs, the pair could rally into the 50-day SMA ($917).

On the flip side, if the price turns down in the current level or the downtrend line, then the grips may challenge the crucial $468.13 support. A break below this level will extend the decline to another support at $400.

The views and opinions expressed here are solely those of the writer and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves danger. You need to run your own research when making a decision.

Market data is supplied by HitBTC exchange.