In recent months, cryptocurrency firms have been increasingly hiring former regulators and lawmakers.

While the official stated goal of such appointments is to assist the crypto industry in better understanding the regulatory landscape, it is just as likely that the appointees have been enlisted to assist firms in more effectively lobbying government and regulatory authorities.

Former regulators and lawmakers aren’t the only ones joining cryptoasset companies; former executives from the legacy financial system are also jumping on board.

Together with former officials, these executives are not only helping to improve the quality of crypto leadership, but they are also assisting crypto in stepping up its lobbying game.

And, according to lobbying data available in the United States, major corporations and trade associations are on track to break spending records in 2021.

This could be good news for the entire industry if trade associations‘ claims that they represent the interests of all participants are true.

Coming to the crypto side

In 2021, the list of ex-regulator/lawmaker appointments in crypto has been steadily growing.

Here’s a quick rundown of some of the most notable recent hires, including former financial executives:

- Bybit hires Daniel Lim, former head of legal and compliance at Singapore-based investment bank Daiwa Capital Markets, on March 9.

- Binance hires former Montana Senator Max Baucus to “provide high-level guidance on the organization’s government and regulatory efforts, including building strong relationships with US authorities and regulators” on March 11.

- Toshihide Endo, former commissioner of the Japanese Financial Services Agency, joins Japanese exchange DeCurret on March 23.

- Binance hires former Financial Action Task Force executives Rick McDonell and Josée Nadeau to advise on regulatory and compliance issues on March 25.

- March 29 – Former US Securities and Exchange Commission (SEC) chairman Jay Clayton joins One River Digital Asset Management’s advisory council.

- April 20 – Binance hires Former US Acting Comptroller of the Currency Brian Brooks has been appointed CEO of the US, effective May 1.

- May 24 – Coinbase hires Faryar Shirzad, a former Goldman Sachs executive, to help it “navigate the evolving global regulatory environment and work with governments around the world on critical issues surrounding the cryptoeconomy.”

Crypto companies have been increasingly appointing former authorities and lawmakers lately. While the officially stated goal of these appointments is to aid crypto industry better understand the regulatory landscape, it’s equally as possible that the appointees have been enlisted to assist companies lobby government and regulatory authorities more efficiently.

But it’s not just former authorities and lawmakers who are joining cryptoasset companies, together with former executives in your legacy financial system jumping on the bandwagon. Together with former officers, these execs aren’t merely helping enhance the quality of direction from crypto, but are also helping crypto to step up its lobbying game.

And according to lobbying data available in the United States, the big companies and trade institutions are on course to divide their spending records in 2021. This might be great news for the entire sector if we presume that claims by trade institutions that they pursue the interest of all participants are true.Coming to the crypto side The listing of ex-regulator/lawmaker appointments in crypto has been rising fairly steadily in 2021.

Here’s a quick rundown of a few of the most notable recent appointments, such as hires of former financial executives:These are just the most notable appointments, nevertheless they create the impression that crypto is actually ramping up its efforts to secure positive regulatory results.Based on Ekaterina Anthony, a board member of this Switzerland-based Crypto Valley Association, these cross-sector appointments demonstrate that the crypto industry is beginning to mature.

“As the market picks up, it is going to lead to industry leaders, such as people who work for regulators, being on the side of new disruptive technologies. Undoubtedly, these leaders can accelerate the process of regulatory and calling adaptation,” she informed Cryptonews.com.

Also, other industry participants suggest that the majority of the above appointments are about making sure the fullest potential compliance with regulations.

”More likely such appointments have been created from a compliance standpoint — to help companies understand and more efficiently navigate an ambiguous and ever-evolving legal and regulatory framework,” said Gabriella Kusz, a member of the board of directors of this US-based International DCA (International Digital Asset and Cryptocurrency Association).

“Identifying and such as former authorities and legislators helps better understand, anticipate and guarantee compliance with present and potentially future legal and regulatory requirements for crypto businesses.”

While he agrees that there is likely some lobbying rationale behind at least some of the current appointments, he also supposes that lots of the hires are motivated by a desire to boost leadership and to enlarge.

”While these hires might enable a business better understand the path from idea to coverage or new regulatory actions, I would presume that the principal feature that these companies are looking for is if a new hire will help them grow their own core business. Brooks, particularly, has profound knowledge in crypto, as well as a fantastic comprehension of the government’s regulatory machines following his stint in the [Office of the Comptroller of the Currency],” he informed Cryptonews.com.

Lobbying intensifies Nevertheless, it’s clear from lots of the press releases accompanying recent hires that a lobbying motive is very much current. Together with McDonnell and Nadeu’s appointments, for instance, Binance, which is now reportedly being researched in the united states, said that one of the principal aims was”to support its overall goal to build stronger connections with regulatory and law enforcement figures worldwide.”In other words, lobbying. And this premise is supported by the most recent data on lobbying in the united states, as compiled by OpenSecrets.org.

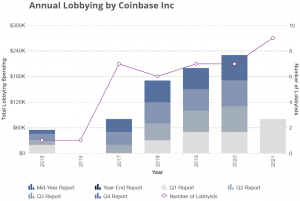

If you have a look in Coinbase’s entrance in OpenSecrets’ database, you see that it’s on course to spend a record amount on calling in 2021. Its lobbying spending has been rising consistently every year because 2017, and though it has data just for Q1 2021, this shows a noticeable increase over Q1 2020.

Source: OpenSecrets.org

Source: OpenSecrets.org

An increase is also visible with the Blockchain Association, whose members comprise Binance.US, Blockchain Capital, BlockFi, Circle, Digital Currency Group, eToro, Grayscale, Ledger, Polychain Capital, Ripple, Stellar, Uniswap, along with numerous others. Its Q1 2021 spend also surpasses that for Q1 2020, standing in USD 130,000 (its total spend for 2020 was only under USD 500,000).

As stated by the Blockchain Association’s Graham Newell, what many crypto organizations and companies are lobbying to get is clearer, more transparent regulation.”it is a misunderstanding that endures in much of the mainstream press and legacy financial worlds that crypto is an unregulated wild west. There are plenty of regulations in place that cover the crypto industry, both for individual consumers and large corporations. What we, and many others, would like to see is further clarity on important problems, like securities laws, custody provisions, and tax policy,” he explained.Likewise, the Global DCA says it’s pursuing honest regulation.

“Our focus and our job are easy: balanced regulation. Balanced regulation — which nurtures innovation and allows for further development of the sector while at the exact same time protecting consumers and the general public,” said Gabriella Kusz.

Since CoinNewsDaily.com reported at the past, there is a stress that lobbying may be run from the perspective of bigger crypto companies, with any consequent regulation harming smaller companies. However, pretty much every transaction association says that it intends to represent all members of this market, large and small.

The CVA’s Ekaterina Anthony explains, ”In our association, we listen to the view of market participants, which we predict the personal industry, and we frequently inform the regulator of our combined opinions and requirements. We also work together with different nations and institutions that bring together crypto startups and large businesses, and many participants have very similar expectations and intentions .”