The best (and worst) quotations, regulation and adoption highlights, top coins, predictions and much more — weekly.

Best Stories This Week

„Largest BTC occasion in history“ kicks off in Miami

Sun, sea and satoshis were on the agenda as the largest BTC occasion ever kicked off in Florida.

Organizers were expecting a massive turnout for its sold-out occasion, with some calling that there would be over 50,000 attendees.

Day saw MicroStrategy CEO Michael Saylor show more about his expertise in the crypto area up to now. He explained: „I understood that I bought BTC one year ago yesterday, and thus that really is the end of my rookie year.“

He told the convention:“We don’t require the financial institutions that we have today“ — and for money to be made for the planet, it has to be developed globally.

One especially eye-opening on-stage conversation came from Brian Brooks, a former regulator turned CEO of Binance.US. He explained: „If you have never worked in a huge bank, you have no clue just how bad the problem is.“

It is Mati Greenspan vs the Maxis at „Shitshow“ 2021

For most, BTC 2021 in Miami is the primary physical occasion for most since the coronavirus outbreak started, allowing actors, cryptographers and CEOs to rub shoulders. Alas, you can not please all of the people, all of the time.

Quantum Economics founder Mati Greenspan had tweeted an innocuous comment about how BTC 2021 was defined as the“Largest crypto convention ever!“

However he was immediately set directly by the likes of BTC Magazine editor Pete Rizzo, who stated: „It is a BTC conference, about BTC. BTC is the subject and hence why it’s used as an adjective.“

To be fair, organizers were crystal clear that it is a Bitcoin-only occasion, meaning no altcoins are allowed.

But as DeFi Pulse’s founder Scott Lewis pondered…is it really possible to go for two days without speaking about Ethereum?

That stated, Bloomberg Intelligence’s Mike McGlone says that there are still lots of reasons to be bullish.

In his newest Bloomberg Galaxy Crypto Index reporthe explained BTC is“stronger, greener and less extended“ than during the peak of the rally in April.

He also maintained that BTC’s bull market seems to be complete, using a $100,000 cost goal more likely than a retrace to $20,000.

Alas, not everybody agrees with McGlone’s prognosis after the worst May for BTC’s cost in a decade, with JPMorgan strategist Nikolaos Panigirtzoglou writing in a research note that diminished institutional demand could drag BTC under $30,000.

Dogecoin — likened by some to“digital plastic“ this week — has enjoyed a significant surge of late. The joke cryptocurrency’s cost climbed 40 percent in one day, driven by Coinbase declaring it would open its door to DOGE residue on June 1.

DOGE’s spike totaled out over $16 million worth of bearish leverage in one hour, using the altcoin almost returning to some pre-crash high.

One analyst, @HsakaTrades, declared that a“exhausted market“ was gravitating to DOGE and rotating out of different altcoins.

NFT sales down 90% since market peak

We have become familiar with the endless declarations surrounding the passing of BTC. Currently, with the sale of nonfungible tokens sinking 90% since they appeared in early May, some are sounding the death knell for NFTs.

Following $102 million worth of NFTs were marketed in one day on May 3, just $19 million values were sold in the past week. More than $170 million worth of NFTs were marketed in the window on both sides of the market top, equating to a close 90% decline ever since then.

The amount of NFT pockets revealing any signs of activity on a daily basis is also down 70 percent since early May, after falling from 12,000 to 3,900.

NFT sales and pocket motions were down throughout the whole selection of token categories, spanning gaming, decentralized fund, collectibles, artwork, utility, metaverses and sports.

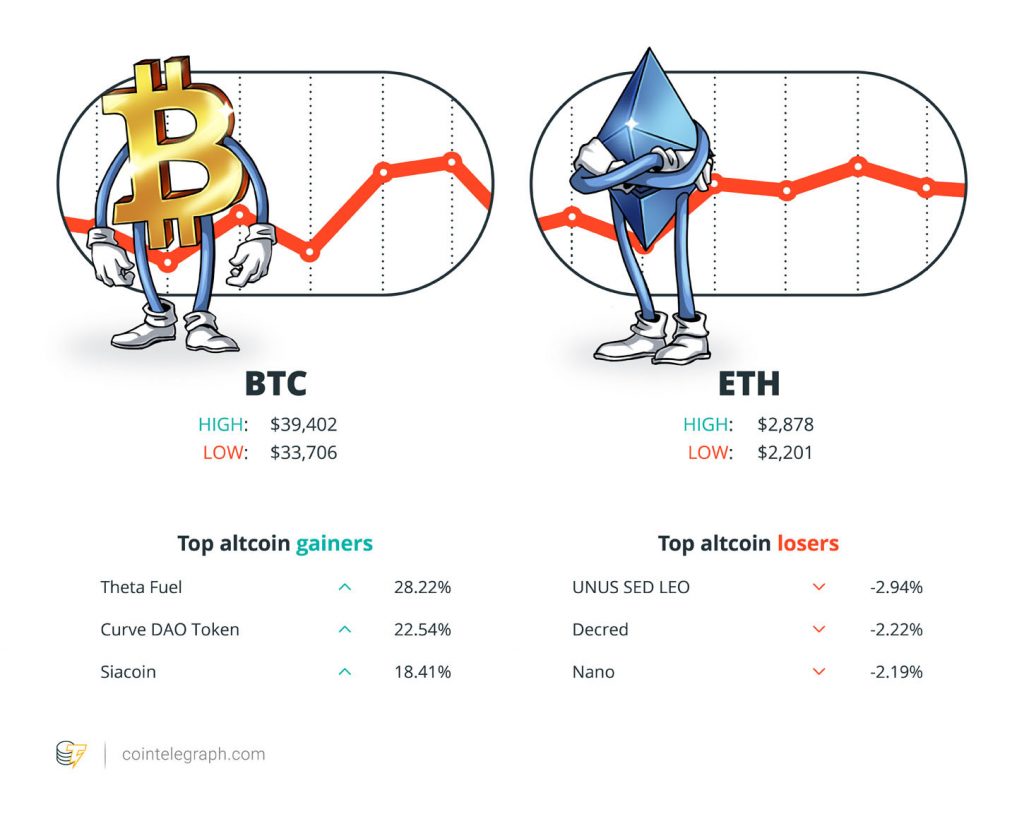

Winners and Losers

The top three altcoin winners of the week are UNUS SED LEO, Decred and Nano.

For more information on crypto prices, make certain to read Cointelegraph’s market evaluation .

Most Memorable Quotations

David Gokhshtein, Gokhshtein Media founder

„BTC is much more likely to resume enjoying $100,000 resistance instead of sustaining under $20,000.“

Bloomberg Intelligence

„Right now, if you purchase and sell gold, you get it taxed, they’re able to do that. If you create a gain in BTC, you read stories about people being taxed on it. You can not tax money, you don’t tax it.“

Ron Paul, former presidential candidate

„„Digital currencies aren’t substitutes for gold. If anything, they would be a replacement for copper, they are pro-risk, risk-on assets. They’re a substitute for risk-on inflation hedges, maybe not risk-off inflation hedges.“

Jeff Currie, Goldman Sachs global head of commodities research

„When something becomes large enough, things such as customer interests and money laundering come into play. So there is good reason to believe that [regulation] will happen.“

Stefan Ingves, Sveriges Riksbank governor

Prediction of the Week

BTC bulls give“conservative“ 10-year quote for hyperbitcoinization to hit

Back to Miami now, in which an eye-opening panel suggested that we might just be 10 decades away from“hyperbitcoinization“ — signaling that the moment BTC takes over international fund.

Make no mistake, this would be no simple feat. It would involve billions of new users being onboarded by 2031. Then again, BTC has already attracted hundreds of millions of users within the previous 10 decades.

Unchained Capital’s Parker Lewis is one of those with high hopes. He explained: „I believe that according to how BTC has been adopted historically and based on the trillions of dollars that the Fed will need to print in the coming months to decades, that it would potentially be conservative to say that Bitcoin’s a unit of consideration in 10 decades.“

He predicts it’ll take 16 years…or four more halving cycles.

And Kraken’s Dan Held considers hyperbitcoinization is at least a decade off…unless fiat currencies endure“rapid devaluation.“

FUD of the Week

Even Vitalik Buterin is astonished at just how long Eth2 is shooting

Ethereum co-founder Vitalik Buterin has confessed that the long-awaited move to some proof-of-stake consensus mechanism is taking a lot longer than he expected.

Speaking partly in Mandarin at a summit in Hong Kong, he explained: „We thought it would take 1 year to do the proof-of-stake, but it actually takes six decades. If you’re doing a complex thing that you believe takes some time, it’s actually very likely to take a lot more time.“

Buterin added that there had been quite a few internal team battles in the five years it’s taken Ethereum for to where it is today.

„Among the biggest problems I’ve found with our endeavor is not the technical problems — it’s problems related with people,“ he explained.

The most recent roadmap quotes that Eth2 might not have the kind of scalability that large-scale enterprise software enjoy until overdue 2022.

Google lifts 2018 ban on crypto exchange, wallet advertisements

Google has lifted a three-year-old policy banning crypto exchanges from using its ad services.

But the new policy won’t open the doorway to the vast majority of crypto associations as“advertisements for initial coin offerings, DeFi trading protocols, or promoting the purchase, sale, or trade of cryptocurrencies or associated goods“ all continue to be illegal.

Google’s policies around crypto advertisements have frequently been contradictory and, at points, specialists have decried them as unjust.

Expect a struggle among the likes of Binance.US and FTX as they vie to split out stateside market share.

Apple co-founder Steve Wozniak loses BTC scam case against YouTube

YouTube is not in charge of crypto-related scams posted on its platform, according to a recent court judgment.

Apple co-founder Steve Wozniak failed to support his suit against YouTube within an advert with his image to advertise a bogus BTC giveaway.

Best Cointelegraph Features

Death knell for Chinese crypto miners? Rigs about the move after government crackdown

The newest events in China have pushed crypto miners to reevaluate domestic threat as they may now seem toward global expansion.

We tracked down the original BTC Lambo man

That is the story of Jay, who made a meme by purchasing a Lamborghini with BTC. He went from poverty-level existence to a well-off lifestyle — although not without needing to be worried about his family’s safety.