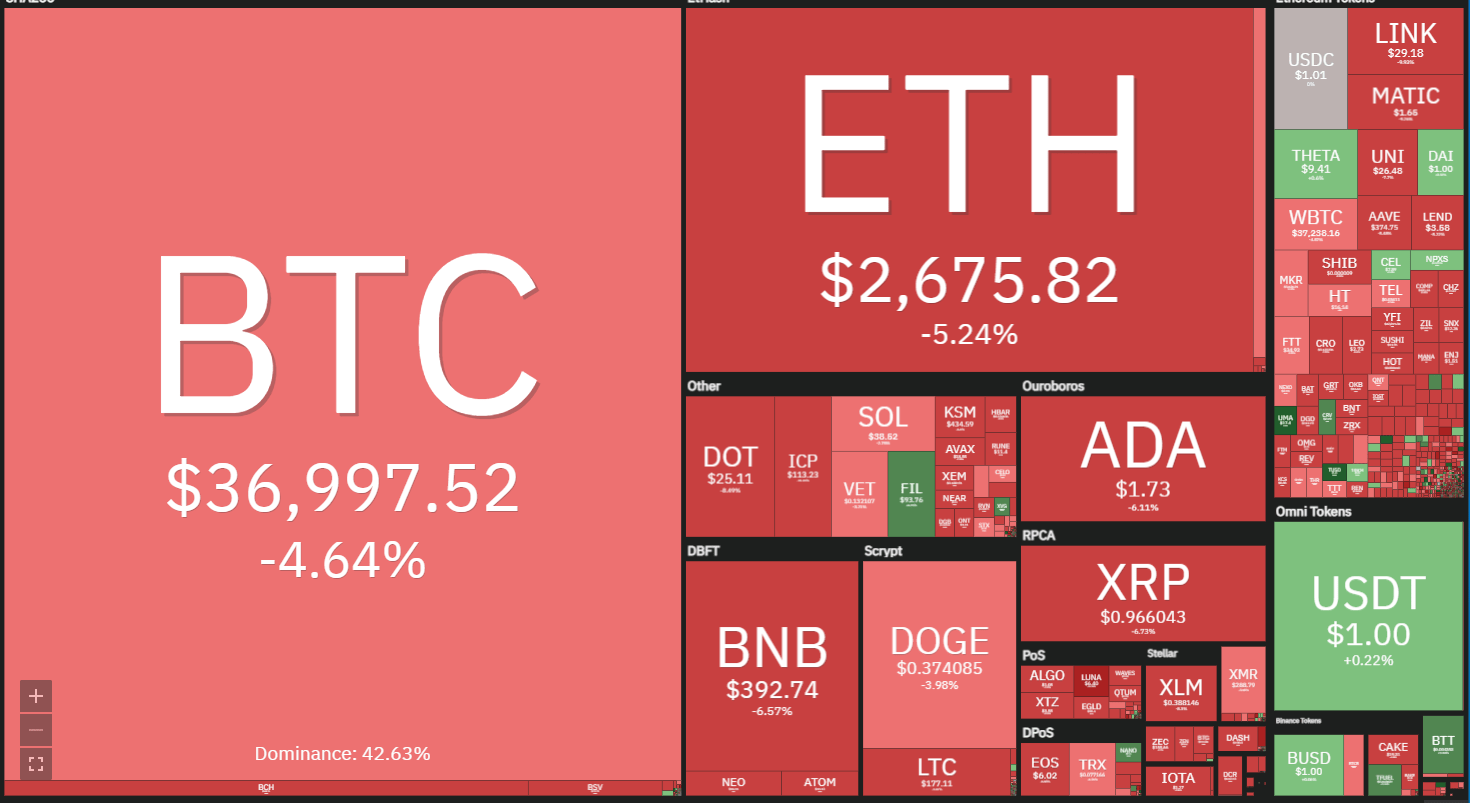

Bloomberg senior product strategist Mike McGlone considers BTC (BTC) is far more likely to turn up and muster to $100,000 rather than correct to $20,000. In the June version of this Bloomberg Galaxy Crypto Index report, McGlone said that BTC’s correction had not dented its foundation and it was“more powerful, greener and not as extended“ than in April.

While BTC has yet to witness a surge in demand, data from Coinshares show crypto funds have turned the corner and after two weeks of outflows, investors have pumped $74 million to cryptocurrency.

Ether (ETH) goods were leading the inflows with $47 million being pumped to them. Altcoins like Cardano (ADA), Ripple (XRP) and Polkadot (DOT) per seasoned more than $3 million in inflows.

Novice traders seem to be in a hurry for another leg of this bull movement to begin. However, that is unlikely to occur quickly because after the recent market reset, the transfer of assets from poorer hands to more powerful hands will require some time. The reactions to Elon Musk’s tweets reveal some froth still stays.

Even the crypto market may remain volatile as long-term investors are amassing on lesser levels but quitting their purchases at greater levels. Let us examine the charts of this top-10 cryptocurrencies and ascertain the critical support and resistance levels to watch out for.

BTC/USDT

BTC climbed above the resistance line of the symmetrical triangle on June 3 but the bulls could not push the purchase price over the 20-day exponential moving average ($39,856). This implies the sentiment remains negative and traders are selling on aid rallies.

ETH/USDT

Ether broke over the resistance line of the symmetrical triangle on June 3 but the bulls could not push the purchase price over the 50-day SMA ($2,895). This might have drawn selling from short-term traders and the cost dipped back to the triangle today.

The flat moving averages and the relative strength index (RSI) near the midpoint indicate a couple of days of consolidation. The set could remain trapped inside the triangle to get a few more days.

A breakout and close over the 50-day SMA will indicate the start of an up-move that may reach the 61.8% Fibonacci retracement level at $3,362.72. Conversely, a break below the triangle might come in a retest of this critical support at $1,728.74.

BNB/USDT

This implies the bears are protecting this level and the bulls will need to push the purchase price over it to gain the upper hand.

If the BNB/USDT pair rebounds off the trendline, it will indicate the formation of an ascending triangle pattern, which will finish on a breakout and close above $433. This bullish setup has a target objective at $586.

The flattening 20-day EMA ($400) and the RSI just below the midpoint indicate a couple of days of range-bound action. This opinion will invalidate whether the bears sink the purchase price under the trendline. That may open the doors to get a fall to $211.70.

ADA/USDT

Cardano turned down from just under the $1.94 resistance today, indicating the bears are protecting this level aggressively. However, the long tail on today’s candlestick suggests the bulls are buying on dips to the moving averages.

The buyers will make yet another effort to push the purchase price over the overhead immunity. If they succeed, the ADA/USDT pair may pick up momentum and challenge the all-time large at $2.47.

Alternatively, if bears sink the purchase price under the trendline, the ADA/USDT set may slide to $1.59 and then to $1. A strong rebound off this support will indicate the pair could exchange inside the huge range between $1 and $1.94 to get a couple of days.

The flattish moving averages and the RSI close to the midpoint also indicate a couple of days of consolidation.

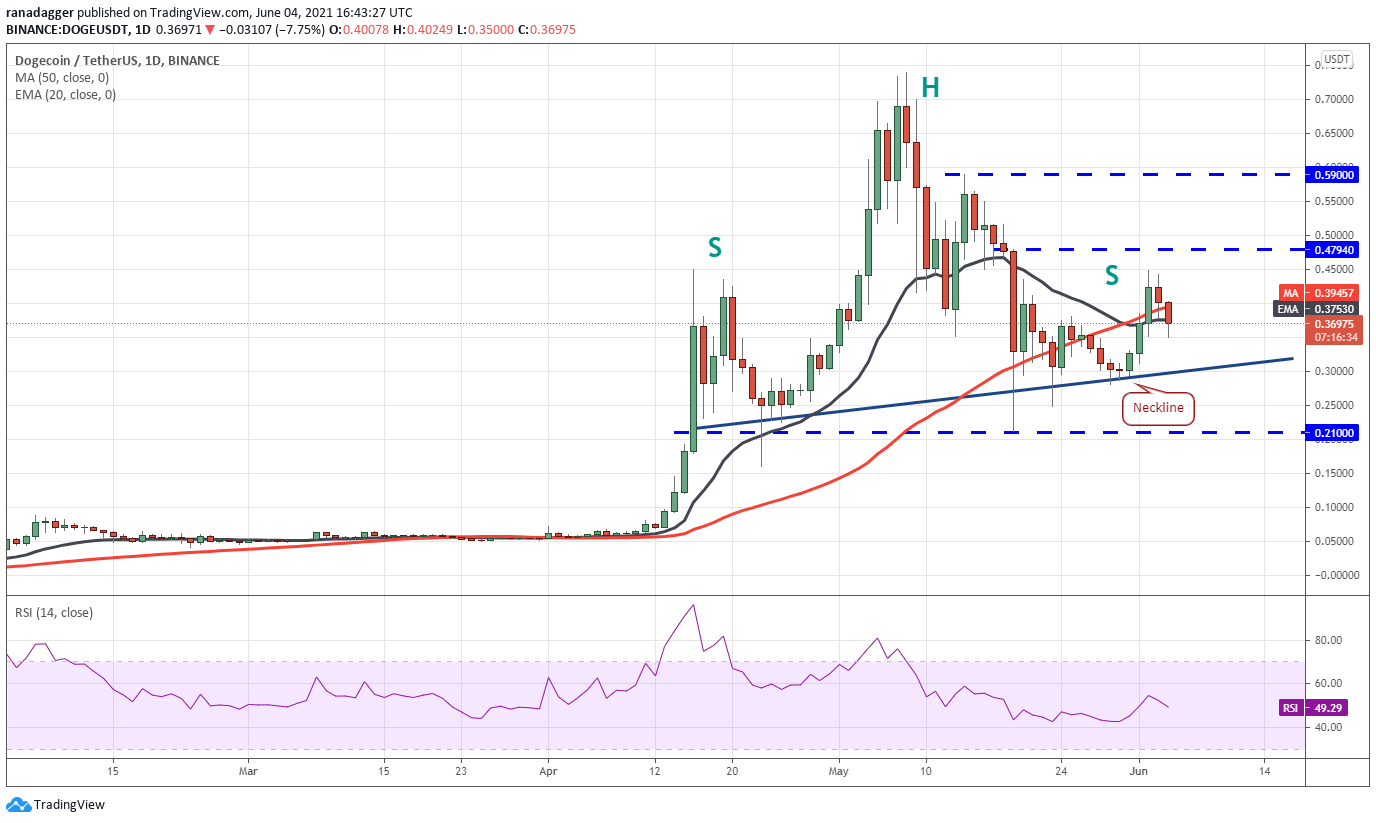

DOGE/USDT

Dogecoin (DOGE) turned down from $0.44 on June 2, implying that traders are closing their positions . The bears have pulled the cost under the 20-day EMA ($0.37) today, signaling weakness.

The flat 20-day EMA and the RSI close to the midpoint indicate a balance between supply and demand.If the DOGE/USDT pair continues its slide and also breaks below the neckline of the head and shoulders pattern, the selling could intensify. The bulls might attempt to arrest the decline at $0.21 but should they fail to accomplish this, the set may fall to $0.10.

This negative opinion will nullify whether the purchase price pops off the neckline and climbs above $0.47. This type of move will indicate the bulls are back in the driver’s seat and the set may then muster to $0.59.

XRP/USDT

XRP’s failure to rally over the 20-day EMA ($1.06) suggests the sentiment remains negative and traders are selling on rallies. If the bears sink the purchase price under the trendline, the decrease could extend to $0.79 and then to $0.65.

The downsloping 20-day EMA and the RSI under 44 indicate the bears have the upper hand. A break below $0.65 will clear the path for a fall to $0.56 and then to $0.45.

Contrary to the assumption, if the purchase price rebounds off the trendline, it will indicate strength. If the bulls push and maintain the purchase price over $1.10, the XRP/USDT pair may rise into the 50-day SMA ($1.27) and then to the downtrend line.

DOT/USDT

Although Polkadot climbed over $26.50 on June 3, the extended wick on the day’s candlestick suggested selling by traders at greater levels. The altcoin has turned down today and broken under the 26.50 level.

The bears will try to pull the purchase price down to the trendline. If this support holds, the DOT/USDT pair may again muster to $26.50. If the bulls sustain the purchase price above this immunity, the set could rise to the 50-day SMA ($32.64).

Conversely, if the bears sink the purchase price under the trendline, the set may fall to the $15 support. If the purchase price rebounds off this support, the set could remain range-bound between $15 and $26.50 for a couple of days.

The flat 20-day EMA ($26.45) and the RSI under 46 also point to a couple of days of consolidation.

UNI/USDT

Uniswap (UNI) has again turned down from the 20-day EMA ($28.14) today, indicating the bears are vigorously defending this immunity. The sellers will try to pull the purchase price down to the support at $21.50.

The bulls are likely to shield $21.50 aggressively since they’d done on May 30. A strong rebound off this support will confirm the formation of a higher . The UNI/USDT pair may then remain range-bound involving $21.50 and $30 for a couple of days.

This neutral view will be negated if the bears sink the purchase price under $21.50. That will indicate the sellers have overpowered the buyers, resulting in a fall to $16 and then to $13.04.

ICP/USDT

After trading in a tight range between $103.71 and $120 for a couple of days, Internet Computer (ICP) broke over the overhead immunity on June 3. However, the extended wick on the day’s candlestick indicates the bears used this rally to market and trap the competitive bulls.

The ICP/USDT pair turned down harshly today and the bears are currently trying to pull the purchase price under the 103.71 support. If they succeed, the set could fall to the all-time low at $86.01. This is a significant support to watch out because when it cracks, the set may fall to $60.However, if the bulls shield the 103.71 support, it will imply accumulation at reduced levels. The buyers will need to sustain the purchase price over $120 to indicate the possibility of a consolidation involving $103.71 and $168.

BCH/USDT

The relief rally in BTC Cash (BCH) turned down from the downtrend line today, suggesting the bears are hitting this level aggressively.

If bears sink the purchase price under $616.04, the altcoin could fall to $468.13. This level may work as a strong support. If the purchase price rebounds off this level, the bulls will make yet another effort to propel the purchase price over the downtrend line.If they succeed, the BCH/USDT pair may rally to the 38.2% Fibonacci retracement level at $919.60. A break above this immunity will open the doors to get a rally into the 50% retracement at $1,059.07.The perspectives and opinions expressed here are only those of the author and don’t necessarily reflect the views of Cointelegraph. Every investment and trading movement involves risk. You need to conduct your own research after making a determination. Market data is provided by HitBTC exchange.