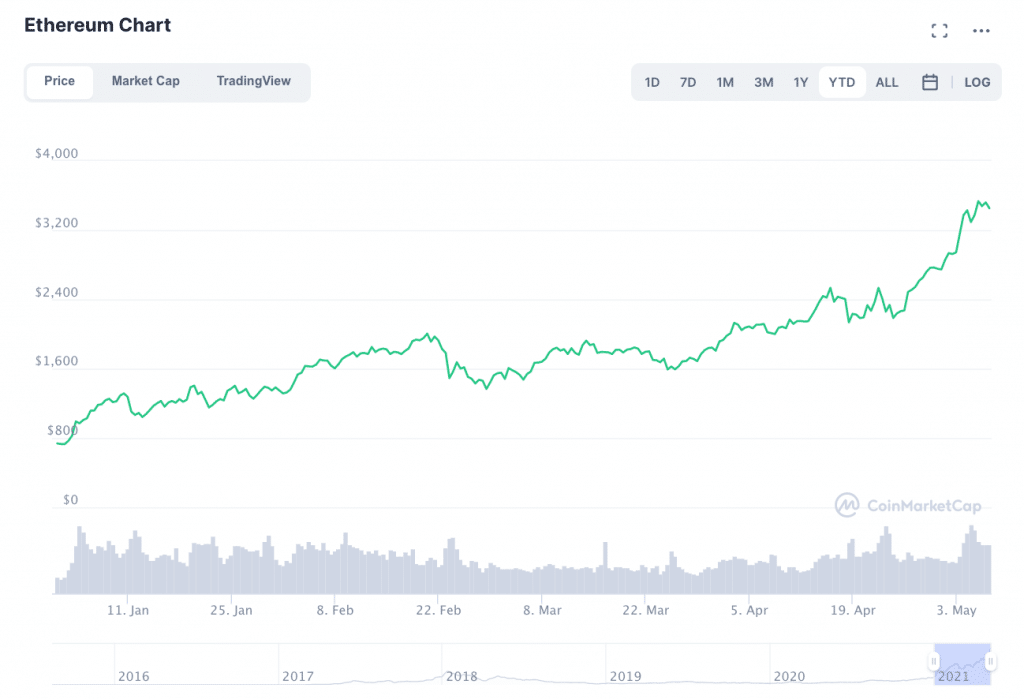

Bitcoin continued to trade sideways this 7 days as Ether and other altcoins took the spotlight. ETH’s most the latest all-time large (ATH) of $3,541.46 took location on Wednesday by Friday, the value had settled at all around $3,460.27. Dogecoin (DOGE) also hit a new ATH yesterday of roughly $.69 CoinTelegraph identified as DOGE’s increase “the major indicator for alt period.”

Matthew Unger, the Founder of iComply, advised Finance Magnates that DOGE’s rise is “the most significant information of the previous 3 months.”

Looking Ahead to Conference You at iFX EXPO Dubai Could 2021 – Producing It Materialize!

“We can anticipate to see DOGE develop into a big contender as it enters the leading 3 cryptos. The community proceeds to be underestimated because it was ‘made as a joke,” he said, incorporating that: “Fundamentally, DOGE has a good deal heading for it and that simply has not still been priced in.”

Either way, DOGE is on the transfer, and altcoin marketplaces are abuzz. Irrespective of whether or not a ‘true’, cash-A ‘Alt season’ is underway appears to be up for debate. Nevertheless, it would seem that the winds of transform are blowing.

Everybody wishes to know wherever we are at in my „Path to Altseason“ chart.

We are in the Phase 2-3 overlap. Huge caps are starting up to transfer. Phase 2 has heated up and we’re observing early signs of Phase 3. Period 3 incoming! pic.twitter.com/tCZdNx995c

— Secrets (@SecretsOfCrypto) May well 6, 2021

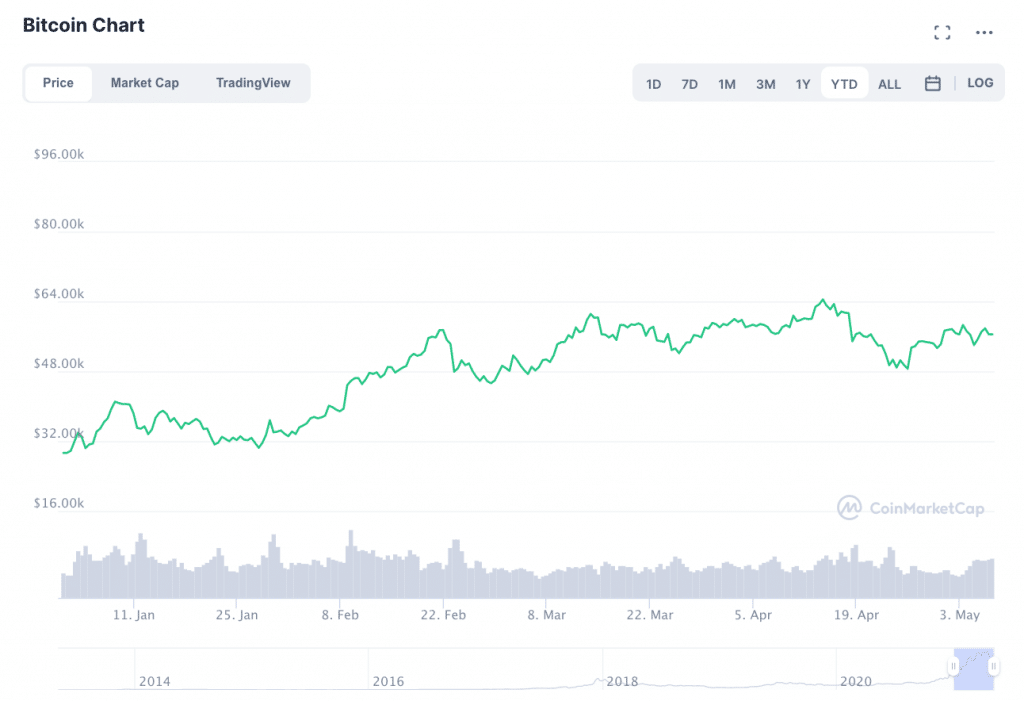

Bitcoin Dominance Is Slipping

For one particular matter, the prosperity distribution of cryptocurrency marketplaces seems to be shifting. Michael Dalesandro, Founder and Main Government of Chicago-centered RockItCoin, told Finance Magnates that he believes that: “we are starting up to see a maturing of the crypto marketplace.”

“Bitcoin’s dominance by current market cap has dropped from 75% to beneath 50% in 2021 so a lot more funds is flowing to the opportunities that exist in altcoins which have demonstrated remarkable raises,” he added. “But, I imagine this is just the common cooling-off we have noticed with Bitcoin in the past I totally anticipate it to carry on its climb.”

However, the dynamics in the industry are shifting so much so that some analysts believe that that crypto marketplaces are in an ‘alt season’. Chad Steinglass, Head of Investing at CrossTower, told Finance Magnates that: “as BTC has been having difficulties to uncover course for weeks, ETH and lots of other altcoins have taken about traders’ focus.”

“After consolidation in BTC toward the close of April, bulls got their hopes up for an announcement of a further organization incorporating BTC to currency reserves all through the heart of tech earnings period,” he said. “However, earnings reports came and went with no mention of BTC, and in reality, of the significant firms that experienced already been associated, TSLA trimmed their holdings considerably and MSTR did not increase all through the latest dip.”

Nevertheless, there was “some optimistic news for BTC this week” when NYDIG and Fidelity declared that they would be “partnering to supply crypto products and services to retail bank prospects,” a variable that Steinglass believes will “further the narrative of mass adoption.”

Bitcoin Trades Sideways as Altcoins Soak Up Trader Money in Crypto Marketplaces

Benjamin Leff, Chief Working Officer of Sheesha Finance, explained to Finance Magnates that: “Bitcoin has taken a backseat although altcoin period picks up.”

In other text, the sturdy performances of a lot of altcoins more than the past a number of months feel to have drawn an growing variety of buyers.

“People believe they can make extra cash in other cryptocurrencies and are hunting at brief-term performs in order to ride the bull sector. Bitcoin is a much much more resilient coin that people today see a lot more as a store of benefit than an prospect to flip and make a quick and hefty profit, or loss relying on what just one chooses to make investments in.”

2021 Has Been a Calendar year of All-Time Highs for ETH

What are the other cryptocurrencies that may perhaps have a higher earning probable than Bitcoin? All eyes this week ended up on Ether (ETH). The indigenous token of the Ethereum network achieved nonetheless a further all-time significant.

Suggested content

YOLO, Economical Markets and YouGo to short article >>

In truth, this complete 12 months has been a sequence of new ATHs for ETH, and, as these kinds of, ETH has outperformed BTC numerous times in excess of. Dalesandro explained to Finance Magnates that: “Bitcoin is purely a cryptocurrency, whereas Ethereum is a cryptocurrency and a decentralised software package system.”

“It also supports lots of ERC20 tokens, which I consider is drawing cash absent from Bitcoin and toward Ethereum,” he extra.

Steinglass told Finance Magnates that Ether’s increase is “definitely a combination of a lot of aspects.”

“The value of ETH that is locked in DeFi staking pools has decreased the supply of coins accessible for buying and selling, which has amplified its scarcity,” he claimed. Blended with the anticipation of the transfer to Eth2., “which will transfer the community absent from Evidence-of-Do the job and to Evidence-of-Stake and deflationary features, and quite a few traders are seeking to accumulate ETH in progress of the improvements in the community.”

“Lastly, purely from a technological standpoint, any crypto that is generating new highs is generating its very own excitement and the move can come to be a self-reinforcing phenomenon, at least for a tiny while,” Steinglass additional.

Ripple’s Court docket Battle with the SEC Carries on

As ETH carries on to surge, XRP, one more preferred altcoin, is continuing to trade sideways. Some analysts consider that this may possibly be due to the fact of the ongoing struggle that the currency’s creato, Ripple Labs, is combating in opposition to the U.S. Securities and Exchange Commission.

Certainly, Ripple’s battle with the started in December, when the Fee declared a lawsuit towards Ripple Labs. At the time, the SEC claimed that Ripple Labs experienced unlawfully offered unregistered securities (XRP).

All through the length of the case, Ripple Labs has preserved that Ripple remains a currency, and, at situations, it looks that Ripple may perhaps be primary in the authorized fight. Analysts have claimed that numerous court victories could have boosted the cost of XRP in the course of 2020: when the lawsuit strike in December, XRP’s value fell to roughly $.20. At press time, the value had enhanced to $1.58.

Even so, the result of the scenario is nonetheless unclear, and it could be that buyers are biding their time just before generating large conclusions about what to do with their holdings. Immediately after a peak of $1.91 in April, XRP has traded sideways for most of the past three weeks.

What could the upcoming maintain for XRP? Benjamin Leff, Chief Running Officer of Sheesha Finance, told Finance Magnates that: “there has been dialogue that Ripple may go public at the time the case with the SEC settles.”

Leff also pointed to the latest experiences of big buys of XRP. Citing information from Santiment, CryptoSlate described on April 29th that the quantity of addresses keeping much more than 1,000,000 XRP, colloquially recognised as ‘XRP whales’, had enhanced 1.25%. This equated to close to 19 new ‘whales’.

What is Subsequent for XRP?

Nevertheless, the destiny of XRP still hangs in the balance of what comes about subsequent in court. Steinglass described to Finance Magnates that: “XRP has had its ups and downs for rather some time, with a robust cohort of intense defenders on just one aspect, and normally the SEC and the extensive arm of the legislation on the other facet.”

“Recent sentiment that Ripple may endure its present-day lawful struggle with the SEC has bolstered the self esteem of XRP defenders. Mixed with the actuality that XRP was delisted from most major US exchanges next their authorized hassle, and it’s pretty attainable that liquidity is sparse, as well as most of the supply getting beneath the control of a smaller selection of traders. All those two elements can make for volatility spikes and significant runs both of those up and down.”

No matter of the end result of the lawsuit in the United States, Ripple Labs appears to be continuing to create its networks over and above the United states of america.

Dalesandro defined that: “outside of the US, [Ripple] has been aggressively likely right after new possibilities and new organization,” he said.

He also pointed to “recent news stories about the weak spot of the SEC’s circumstance, and that the SEC resulting in confusion as a consequence of its steps against Ripple,” he stated.

On top of that, Dalesandro pointed out that the management of the SEC changed palms following the Fee brought the lawsuit. “Now we have a relatively crypto-helpful chairman,” he mentioned. Also, he believes that: “the SEC’s the latest announcement that it may well just take enforcement action in opposition to XRP buyers makes them glimpse amateur and reinforces the perception that their circumstance is weakening.”

Do you agree or disagree? Allow us know in the opinions below.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)