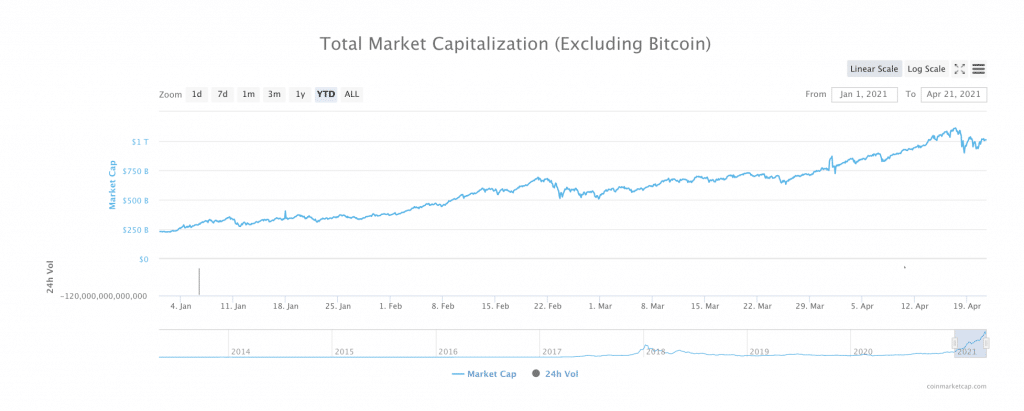

Although the 7 days may possibly have gotten off to a tough start off in altcoin marketplaces, factors feel to have taken a switch for the greater. Above the past 24 several hours, the complete current market cap of all altcoins has risen from $933 billion to $1.01 trillion, recovering some of the losses that took spot previously this week.

As such, it seems as however the correction may possibly have just been one more bump in the road or another minimal correction on the path towards altseason glory. But, has alt season definitely started?

Hunting Ahead to Assembly You at iFX EXPO Dubai Might 2021 – Making It Happen!

What Would make an Altcoin Time, Seriously?

It appears that the reply could be certainly or no, depending on who you check with. Some traders seem to be to consider that altseason has been underway for weeks (or even months) some others believe that that altseason is nonetheless some time away.

CoinTelegraph noted that Ben Lilly, crypto economist & lover at Jarvis Labs, thinks that a actual altcoin year is miles absent.

Why? In accordance to Lilly, the time period ‘altcoin season’ has lots of unique definitions. For him, a correct altcoin period is characteristically marked by “market movements that just take men and women by surprise or at least make traders rethink what is standard.”

In other text, the altcoin year definitely starts off when the predicted array of help and resistance amounts are damaged by quick price action: “the variety of action you want publicity to, assuming you’re on the accurate aspect of it,” Lilly defined.

In get to figure out exactly in which this predicted selection of help and resistance levels lies, Lilly says that it is critical to appear at Bitcoin dominance. In accordance to him, BTC dominance has been steadily trending downward, buying and selling in a ‘range of expectation’ due to the fact late 2019, with the exception of BTC’s substantial value rally at the conclude of 2020.

When that happened, Lilly claimed, “Bitcoin went on an complete tear.” Therefore, in order for altseason to certainly begin, the reverse would have to take place: “[if] we crack this envisioned range to the downside, in our point of perspective, this will signify that altcoins are the asset to be sitting down in, as they will produce outsized returns relative to Bitcoin. That is when issues will get wild.”

Crypto Marketplaces May well Not Be in an Alt-Period, but They Probable Are in an Altcoin Bull industry

Even though crypto markets may not genuinely be in an alt-time but, Lilly suggests that they are experiencing a bull run. This takes place when “investors are much more most likely to wander additional out on the hazard curve of crypto versus merely shopping for Bitcoin, not necessarily outsized gains when compared with Bitcoin.”

Therefore, an altcoin bull market could be outlined as “whenever Bitcoin dominance is falling although crypto as a complete is in a bull market.”

And, certainly, this is particularly what is going on currently. The crypto industry cap excluding Bitcoin is up 8 percent about the past 24 hours. However, when you increase Bitcoin back into the combine, the whole crypto industry cap is only up 5 per cent. At the exact same time, Bitcoin’s dominance has been steadily declining considering that the start off of the yr. At push time, BTC dominance was at 51 per cent.

Institutional Funds Is Flowing into Crypto Property

Moreover, there is proof that revenue may perhaps be flowing into altcoins from new resources. For instance, CoinTelegraph claimed that: “institutional investors have rallied about XRP this previous 7 days,” evidenced by a just about 100-p.c enhance in XRP expenditure products AUM.

Specially, Coinshares’ weekly digital asset fund flows report showed that $33 million had been placed into XRP investment decision solutions just this week, increasing the complete XRP-dependent AUM to $83 million.

The report, which was posted on April 19th, also reported that final 7 days marked the most bullish week for institutional crypto financial investment items in above a thirty day period. $65 million went into Ether (ETH) products and solutions Tezos (XTZ) saw $7 million occur in.

Recommended article content

Viberate Groups Up with Blockparty to Produce World’s Initially Dwell Function NFTGo to report >>

Simultaneously, Polkadot (DOT) observed $5, Bitcoin Funds (BCH) saw $4 million and Binance Coin (BNB) observed $3 million. Multi-asset products received $6 million in new investments. General, a total of $233 million flowed into institutional money throughout the 7 days.

Ether Is Approaching an Institutional Hey-Day

Nevertheless, even with massive quantities of cash flowing into altcoin financial investment products, the broad the vast majority of institutional income is continue to locked into Bitcoin markets. According to CoinShares’ report, Bitcoin solutions stand for pretty much 78 percent of institutional AUM, totalling $50 billion. Ether-based mostly investment decision items represent roughly 17 per cent of institutional crypto merchandise exposure. CoinTelegraph spelled out that: “All other crypto belongings signify less than 1% of cash locked in the sector.”

As time progresses, the demand for altcoin-based mostly investment solutions appears to be on the rise, while, for now, significantly of this demand looks to be minimal to Ether. Still, the growth of Ether-centered financial investment merchandise is going on quickly: last week, Canadian regulators accredited no considerably less than 3 Ethereum ETFs authorized in a single working day.

And in truth, the narrative all-around the job Ethereum plays in the crypto overall economy is evolving. Finance Magnates previously documented that Ethereum was significantly attaining the awareness of major institutional traders about the planet.

Additionally, Coinbase published a report in January detailing that its institutional purchasers increasingly noticed Ether as a shop-of-benefit investment decision: “while our institutional clientele predominantly bought Bitcoin in 2020, a growing number also took positions in Ethereum, the next-biggest crypto asset by marketplace capitalization,” the report mentioned.

“The case for owning Ethereum we hear most often from our shoppers is a blend of i) its evolving probable as a retail store-of-worth, and ii) its standing as a digital commodity that is required to electric power transactions on its network.”

Could Institutional Investors Be Trying to find Solutions to Bitcoin?

Having said that, institutional desire in Ether and other altcoins may be stemming from the exact same resource as the explanation that retail buyers are fascinated in these cash: probable.

Artem Tolkachev, the Founder of BondAppetit, instructed Finance Magnates that in retail marketplaces, “many crypto buyers appear at the rate of Bitcoin and Ethereum and wrongfully believe that have previously missed their train with potential gain. So, they glimpse for alternate options.”

“For them, altcoins are akin to penny stocks,” he reported. “But, just like penny shares, most altcoins will to zero.”

James Putra, Head of Item Technique at TradeStation Crypto, stated this same retail phenomenon to Finance Magnates earlier this 7 days: “many altcoins rallied simply just as retail investors attempt to find out the upcoming bitcoin.”

“Like penny shares, a lot of retail traders are captivated to reduced-priced cryptoassets. The downsides are altcoins tend to be even more out on the chance curve, numerous cash are still early in their developmental lifecycle, and several are however merely suggestions with an altcoin.”

Of study course, institutional traders are not acquiring into just any altcoins. These investment merchandise exist for a cause: they are a safer, more controlled way for institutions to access a extra varied team of cryptoassets with no direct exposure. Still, just like many retail traders, institutional investors may well be tempted by the lower value factors of some altcoins.

Altcoins & the Globe

The over-all trend towards greater fascination in altcoins and cryptoassets, in basic, could be indicative of a frequently shifting narrative about the role of cryptocurrencies in the economy at significant.

In fact, just as Bitcoin is progressively thought of as a retailer of benefit (or hedge against inflation), cryptocurrencies much more typically could be viewed as significantly vital to the upcoming of the economical environment.

Digital currency guide, Shaune Clarke advised Finance Magnates that: “one could say that altcoins are overbought and every person should enjoy out for a significant marketplace correction, but appear at Bitcoin. It’s been ‘overbought’ due to the fact January, and analysts ended up blowing the trumpets, announcing a floor-shaking fall even worse than the a single it endured in 2017. We haven’t found that however.”

“Crypto prices are reactions to global tendencies. Turkey will be banning cryptocurrency investing by the close of the thirty day period. Which is a $1 billion sector appropriate there,” he stated. “There have been speculations of the US Treasury charging economical institutions with dollars laundering. Chinese mining area Xinjiang suffered from a substantial blackout.”

“Crypto does not exist in a vacuum. Just due to the fact the rates are slipping does not imply that a bubble has burst, or is starting to burst. I imagine altcoins are on an upward trajectory, and while there will be momentary dips, there’s loads of area to improve.”

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)