Bitcoin carries on to consolidate in the significant $50,000 spot, in the meantime, its fundamentals are strengthening and appear to point in direction of a rate breakout.

Analyst Ali Martinez has shared data from Glassnode to predict the timing for a new BTC cost rally. In accordance to the analyst, when the cryptocurrency surpasses the 1 million threshold in the metric Entity-Modified Dormancy Circulation, historically BTC “goes parabolic.”

Regardless of Bitcoin’s virtually 1,500% boost in a yr, it is nonetheless below this threshold. The analyst said:

Irrespective of the 1,465% surge that $BTC skilled because the March 2020 crash, the Bitcoin Entity-Modified Dormancy Movement has yet to shift past the 1M threshold. When and if it does, #BTC could enter a new parabolic stage putting up extra gains than what we have now noticed.

Conversely, Martinez stated that when the Entity Adjusted Dormancy is turned down before surpassing the 1 million threshold, Bitcoin’s cost experiences a pullback. In 2021, this has happened at minimum 2 times back in January and late February. As found below, the cryptocurrency is near to this zone.

Bitcoin in an accumulation period

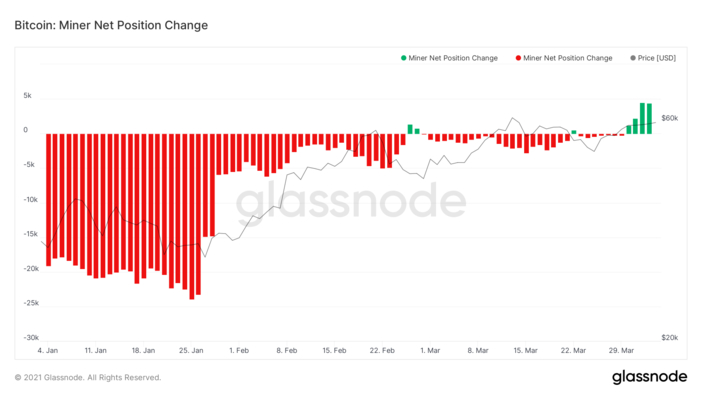

Most likely a person of the most bullish fundamentals is Bitcoin miners’ conduct. Around the past several months, this sector had been promoting substantially of its provide in BTC, raising the promoting pressure in the current market.

Even so, analyst Lex Moskovski has shown that miners have improved their place and began buying BTC to boost their reserves. Considering that late March and early April, miners have bought around 10,000 BTC. Moskovski stated:

Miner optimism doesn’t essentially predict the price but it certainly usually takes out of the equation a big selling aspect.

The above is in tandem with a reduction in Bitcoin source held on exchanges. Exploration agency Glassnode data a two-year reduced in the cryptocurrency’s source discovered on exchanges down to 2,399,090 BTC.

Analyst William Clemente has taken this details to predict a BTC provide crunch which will add to the appreciation in the selling price of the cryptocurrency in Q3 and Q4 of the latest calendar year. In the short phrase, the increase in funding price could give BTC the enhance it demands to reach a new ATH, in accordance to Jarvis Labs associate Ben Lilly:

Jet fuel to the upside. Funding premiums reset from the drop. Now the liquidity is larger, time to punch it.

BTC is investing at $58,150 with a sideways motion (-,9%) for the duration of the past working day. On the weekly chart, BTC has 4.2% gains and 19.3% in the every month chart.