Bitcoin dipped on Monday just after hitting a new history substantial in the previous session, pointing to a spike in earnings-using sentiment amid daytraders.

The analogy was noticeable in the data shared by an independent analyst on Twitter. The pseudonymous entity observed an 11.5 % a 12 per cent decrease in the quantity of newly-produced and lively Bitcoin addresses, respectively. On the other hand, wallets keeping much more than 1,000 Bitcoin models improved by .11 percent.

“Big dollars is buying the dip whilst the market place gets shaken out,” he extra. “As normally.”

Bitcoin addresses stats as shared by xCeaser. Resource: Twitter

Resilience Towards Bitcoin Bears

The BTC/USD trade charge surged to $49,700 on Sunday, its life time high, in advance of plunging reduce in the following sessions. Coming into Monday, the pair recognized a session very low in close proximity to $45,850, only to retrace its shift upward and reclaim $48,000.

In accomplishing so, it showed resilience versus bears primarily as they attempted to break the price underneath essential help ranges, these kinds of as the 20-working day exponential shifting average (inexperienced) and the 50-day straightforward moving regular (blue).

Bitcoin cost reclaims $48,000 subsequent a bearish rejection Monday. Supply: BTCUSD on TradingView.com

That lifted expectations that BTC/USD could make an additional bullish try to $50,000, a psychological target it has tried to realize but to no avail. Bulls feel a close above $50,000 could press the selling prices to as higher as $65,000 in the coming classes.

Another All-time Significant In advance?

Bitcoin’s transfer from reduced-well balanced wallets to wealthy types more reflected a long-phrase expansion situation in the market place. The compact traders bought their cryptocurrency holdings to safe shorter-phrase gains but handed them around to traders that would deliver tailwinds to the so-named HODLing sentiment, in which people today “hold” bitcoin for at the very least 6 months.

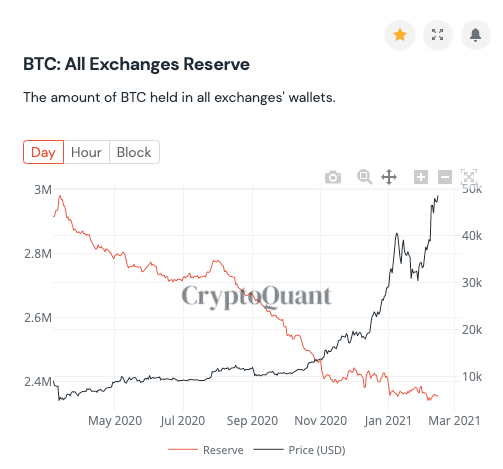

In a independent chart, blockchain analytics system CryptoQuant pointed out a drop in the selection of Bitcoin models held by exchanges.

Bitcoin Reserves throughout all exchanges. Supply: CryptoQuant

The impression higher than confirmed a stark detrimental correlation in between the bitcoin value trends and its reserves on cryptocurrency exchanges. So it seems, a absence of adequate BTC balances tends to offer bullish tailwinds to the market—and vice versa. That prompted the analyst to make upside bets for the benchmark cryptocurrency.

“Literally a promote-side liquidity crisis correct in entrance of our eyes,” he asserted. “Don’t sell Elon or Saylor your corn. At the very least wait around and sell your corn to Apple when they inevitably acquire at $200k+ future thirty day period.”