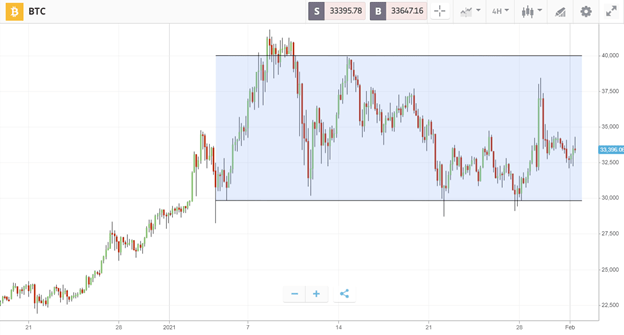

Bitcoin appeared to hitch a experience on Elon Musk’s rocket on Friday. The cryptoasset soared by 20% to hit $38K as the world’s richest gentleman additional #bitcoin to his Twitter Bio, and a history variety of alternatives contracts expired. Nevertheless, despite the spike, soon adequate the world’s major crypto was drifting again to earth.

This wild swing concluded an if not reasonably quiet 7 days in the cryptoasset sector. Bitcoin largely drifted sideways as a report revealed that Ivy League universities have been accumulating the cryptoasset, although Stellar, EOS, and other altcoins manufactured double-digit gains.

This Week’s Highlights

- Ray Dalio arrives spherical to Bitcoin

- Gamestop saga puts crypto in highlight

Ray Dalio comes round to Bitcoin

In nevertheless yet another example of crypto-skeptics shifting their tune, billionaire Wall Avenue legend Ray Dalio has arrive spherical to Bitcoin.

“I believe that Bitcoin is a person hell of an invention,” reported the former doubter in a submit on LinkedIn, prior to concluding that the cryptoasset “looks like a extensive-duration option on a very unknown long run.”

Dalio’s feedback come in the similar 7 days as two other significant-profile figures made their thoughts recognized. VISA CEO Alfred Kelly reported the corporation is “uniquely positioned to support make cryptoassets a lot more safe, valuable and relevant for payments”, and Billionaire Mark Cuban wrote on his own blog that blockchain-dependent property have “now legitimately become suppliers of worth.”

Gamestop saga puts crypto in spotlight

Mayhem strike the US stock industry this 7 days as the WallStreetBets subreddit team co-ordinated a 700% rally in GameStop’s price tag, forcing hedge fund Melvin Funds to shut their small place with billions in losses.

In reaction, a lot of buying and selling apps suspended operation — spurring the turmoil more as traders sought alternate techniques to obtain and sell.

Industry commentators took this as a beneficial omen for decentralized assets. SkyBridge Capital’s Anthony Scaramucci told Bloomberg that the saga “is a lot more evidence of idea that Bitcoin is heading to work”, and Anthony Pompliano said to CNBC that the activities will provide to “accelerate the electronic decentralized fiscal system.”

The 7 days ahead

Hunting ahead, Wall Street-impressed upheaval for the crypto market place could be on the playing cards. Crypto subreddits observed 500% growth in the past 7 days, and some propose the new traders could be on the lookout to hunt the stop losses of hedge funds shorting Bitcoin.

On Wednesday, another possible catalyst could shift the market, as 1000’s of corporate administrators appear jointly for Michael Saylor’s Bitcoin Company Strategy virtual summit. This is created to enable other firms follow MicroStrategy and increase Bitcoin to their equilibrium sheet.