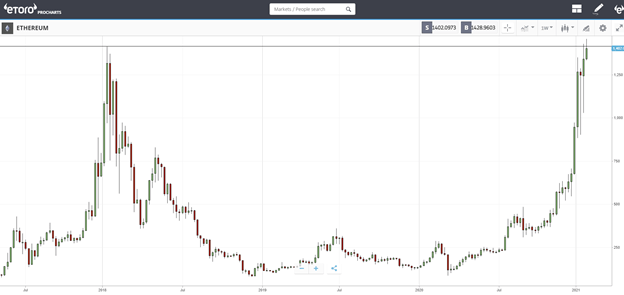

As the cryptocurrency industry recovers from a steep pullback, Ethereum is mounting out of a sea of red to hit all-time highs.

The second-largest crypto has risen 11% on the week to strike $1,480, as Bitcoin has moved in the reverse route. This follows recommendations from incoming treasury secretary Janet Yellen that lawmakers “curtail” cryptocurrency use, and promises that a “critical flaw” had been identified in the Bitcoin blockchain.

At its lowest issue, Bitcoin tapped $28K just before bouncing as specialists took to Twitter to dispel doubts over the cryptocurrency’s resilience: “Nothing strange or exterior the consensus algorithm took place.” tweeted Mastering Bitcoin writer Andreas Antonopoulos. “Bitcoin continues to get the job done precisely as it should.”

This Week’s Highlights

- Establishments undeterred by Bitcoin volatility

- Blackrock eyes Bitcoin money

Institutions undeterred by Bitcoin volatility

Though NexTech remarkably made the decision to e-book income as uncertainties in excess of the Bitcoin blockchain spooked the industry, other institutional consumers were being filling their pockets. MicroStrategy declared the buy of an additional 314 Bitcoin on Friday, using their complete hoard to 70,784 Bitcoin, while Grayscale concurrently scooped up additional than 8,000 BTC at the price cut costs.

In the more substantial photograph, on-chain details from Glassnode exhibits the variety of large accounts holding 1000 or additional Bitcoin increased as the price tag dropped, suggesting that large customers have been not deterred by industry volatility. This corresponded with a new report, commissioned by eToro that was launched this 7 days, which discusses the institutional adoption of crypto, forecasting that more establishments will warm up to crypto when the market cap hits $2T.

Blackrock eyes Bitcoin money

The world’s greatest asset manager seems to be established to wade into the Bitcoin market place.

BlackRock, which oversees $8.7 trillion, has manufactured filings with the Securities and Trade Commission (SEC) for a pair of resources that would supply clients publicity to Bitcoin by funds-settled futures.

When Blackrock CEO Larry Fink reported in 2017 that Bitcoin was an “index of funds laundering”, his sights have given that advanced. He informed Bank of England Governor Mark Carney in December that Bitcoin could “possibly” evolve into a global industry.

The week ahead

Bitcoin’s pullback to just below $30K has historic precedent, with the cryptocurrency heading via quite a few ~30% corrections in previous bull markets.

And with Ethereum presently brushing from all-time highs again, the outlook for the overall crypto marketplace remains bullish.

On Friday, a history $4 billion value of Bitcoin alternatives contracts is established to expire. This is probably to spark another bout of volatility as traders rush to unwind their positions.