Bitcoin (BTC) bounced past $28,000 during May 12 after repeating a chart structure not seen since March 2020.

BTC seller losses spiral

Data from Cointelegraph Markets Pro and TradingView continued to track BTC/USD as it briefly fell to just under $24,000 on Bitstamp.

A strong reversal then sent the pair several thousand dollars higher in minutes, with consolidation then taking hold to see it trade at around $27,000.

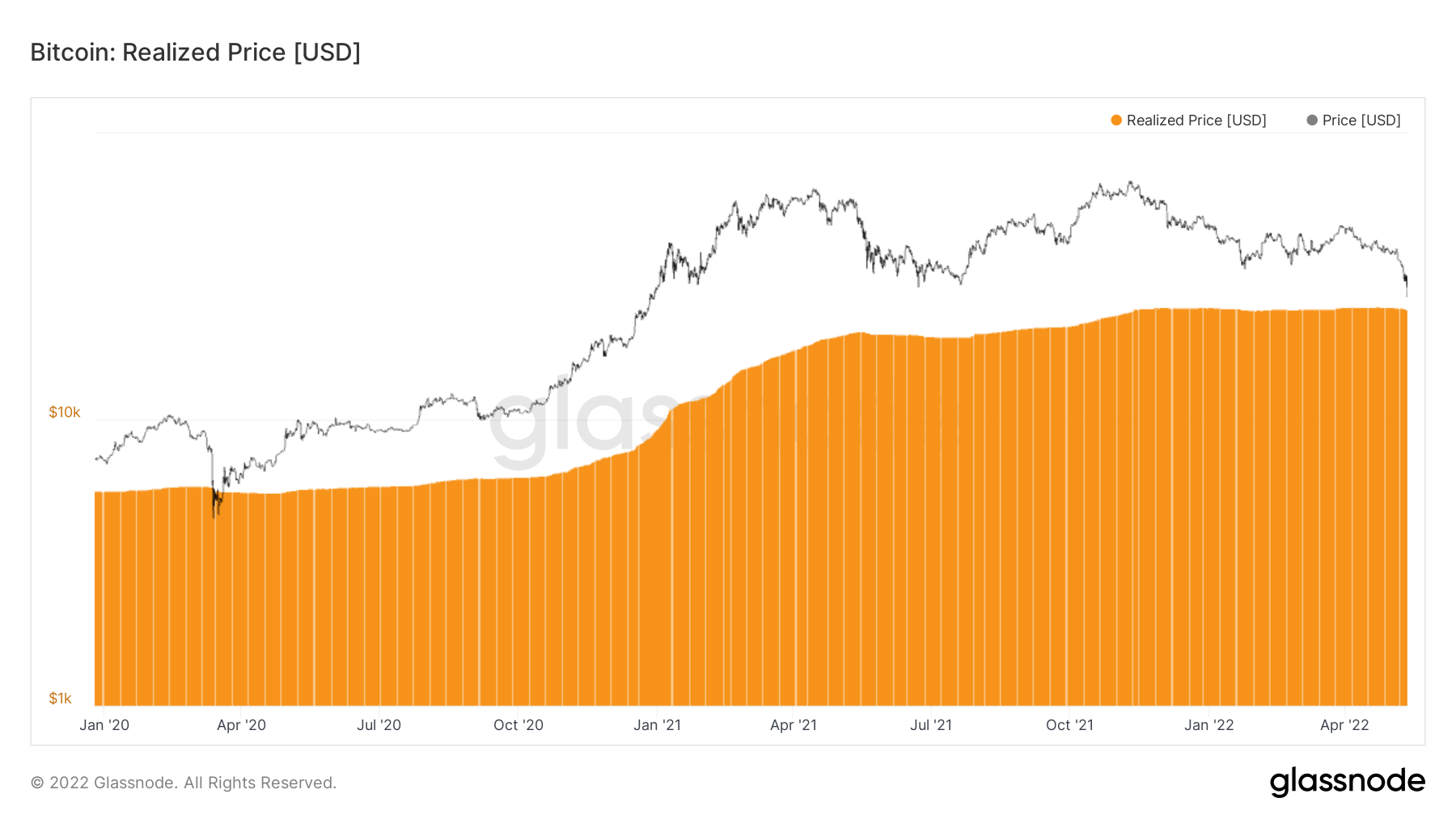

The bounce zone was significant, constituting Bitcoin’s so-called realized price — the sum total of all unspent transaction outputs (UTXOs).

The last time that BTC/USD tested realized price was during the COVID-19 cross-market crash in March 2020.

„Bitcoin basically kissed the realized price ($24k). $BTC is cheap,“ Checkmate, lead insights analyst at on-chain analytics firm Glassnode, noted on Twitter.

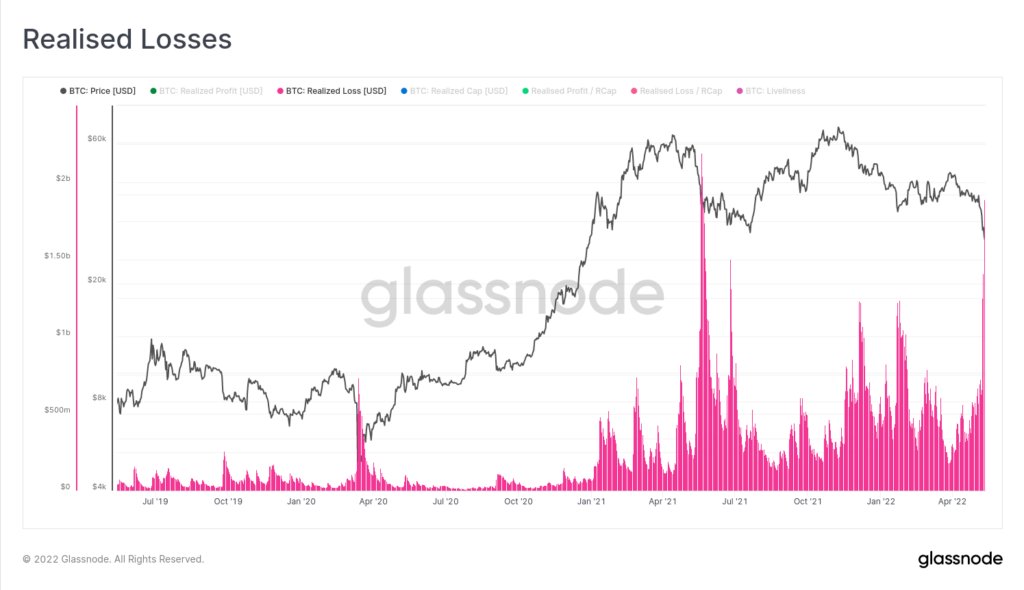

Checkmate added that realized losses — investors selling BTC while being underwater versus their cost price — had also spiked to its second highest daily levels ever at around $2 billion.

As Cointelegraph reported, liquidations had also mounted over the previous 24 hours, passing $1.2 billion across crypto.

Tether peg crawls back into view

The other main topic of the day, stablecoins, meanwhile began to divide opinion on the outlook for Bitcoin itself.

Related: Avalanche drops 30% on fears Terra’s LFG will dump AVAX next

As largest stablecoin Tether (USDT) saw its U.S. dollar peg slip, two camps emerged, one accusing Tether of malpractice and another confident that the peg would soon be restored — unlike that of imploded U.S. dollar stablecoin, TerraUSD (UST).

„The USDT peg is restoring already, which is a good sign,“ Cointelegraph contributor Michaël van de Poppe wrote in one of many tweets on the day.

„People shouldn’t compare $USDT with $UST as those are completely different, although the reaction on the markets are because of tremendous fear levels. Still looks like capitulation to me.“

Commentator WhalePanda furthered the sentiment, warning of „peak FUD“ from what he and others called „Tether truthers.“

People confusing $USDT and $UST and panicking.

People don’t understand the difference between an under collaterized algorithmic stablecoin and a backed stablecoin.

Panic dumping $USDT for $USDC and plain old $USD.Peak fud time.

Warning: this post will attract „Tether truthers“

— WhalePanda (@WhalePanda) May 12, 2022

USDT/USD traded at 2% below dollar parity at the time of writing.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The world of digital currency experienced another milestone this week as Bitcoin ‚kissed‘ the $24,000 realized price for the first time in history, hitting an all-time high after the second highest trading losses in its history.

The iconic digital asset had already soared to new heights over the course of 2020, with a steady upward trend that began in March and has continued steadily through the rest of the year. In the three weeks leading up to the all-time high, Bitcoin traded near the $19,000 mark and then broke through the $20,000 barrier on December 16, setting the stage for its longest and most significant upward rally to date.

The $24,000 milestone was realized on December 21st, a day after the second largest seller in history lost around 860 bitcoins, worth $25 million. It is speculated that this sale may have been triggered by market manipulation designed to drive the price down prior to the sale. Despite this large sell order, the price of Bitcoin has continued its bullish trend, leading to a marked increase in investor and user confidence.

The recent surge in the price of Bitcoin has also been accompanied by an increase in demand, as more and more people have begun to take an interest in digital currency. With big investors such as Paul Tudor Jones, Stanley Druckenmiller, and other heavy hitters investing in Bitcoin, the asset has gained wider mainstream appeal and has won more mainstream trust which is reflected in the price.

It is clear that Bitcoin is headed for further growth in the coming months, as more and more investors turn to this asset as a safe haven in times of geopolitical uncertainty and economic volatility. With its continued rise in the market, Bitcoin has already earned itself a place in the Financial Hall of Fame and is sure to set new records in the coming months and years.