As if it were the start of a new year, Bitcoin (BTC) starts the new week and the new quarter at $46,000.

Hodlers will be in for a shock when they see that BTC/USD is almost at the same level it was on January 1, 2022.

Price action has been quiet recently, but there are signs that the market is working hard to figure out what its next move should be behind the less volatile prices.

With Bitcoin’s yearly open price as support, there are a lot of things you should keep an eye on in April. From macro to on-chain, there are many things to keep an eye on.

If you want to know how BTC prices will do over the next week, let’s look at five of these things:

Inflation meets fresh money printing

Ending „easy money“ after COVID has been talked about a lot. This will have an effect on things like Bitcoin, which have a lot of risk.

As the US Federal Reserve says it will cut its record-high balance sheet and keep raising key interest rates, some people have warned that this could send a shockwave through the crypto market.

So far, there doesn’t seem to be a big change taking place. This week, though, it looks like the opposite is true in Asia.

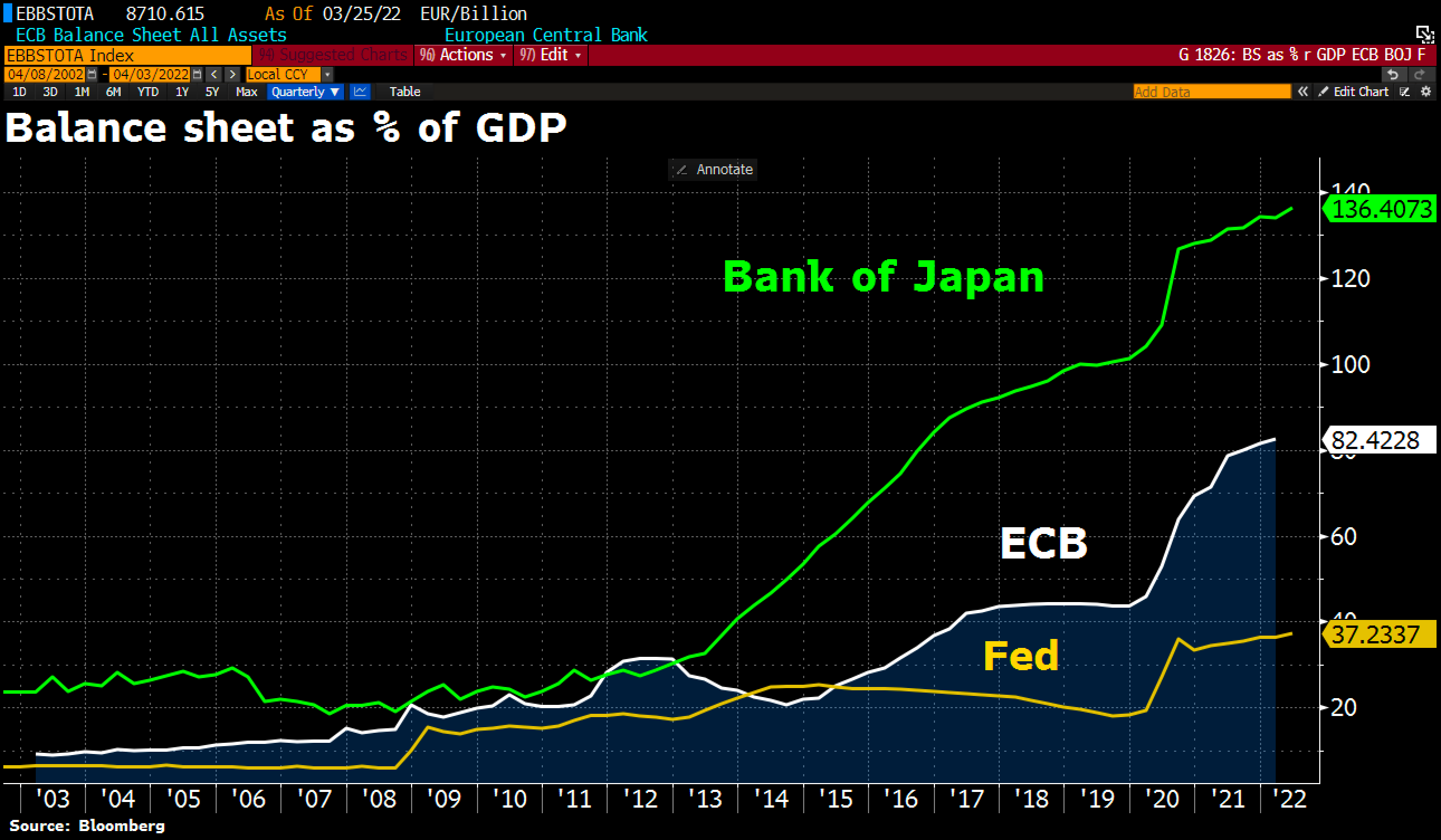

Holger Zschaepitz, a market commentator, said that the Bank of Japan (BoJ) has added to its balance sheet, which means it has printed even more money.

A lot more money is going into the Bank of Japan’s account than it was before. It now has a balance of 136 percent of GDP.

He says this is more than just a surprise. It could be „the biggest monetary experiment in history.“

A man said that in comparison to the ECB and the Fed, they look like amateurs, and they should not be in charge.

If more printing leads to more good times for risk assets, not everyone is even sure that the balance sheet cuts that have been talked about for a long time will last.

Soon, central banks will be forced to start giving out money again, they say.

There has never been a government that didn’t want to print money to pay its bills and make its people happy.

The government will never go bankrupt on its own.

This is a given.

Ex-BitMEX CEO Arthur Hayes wrote in a blog post in March: „I challenge you to show me that I’m wrong.“

“Therefore, if your time horizon is in the years, it’s time. If you mess with the bull, you get the horns. Remember: it’s not gold or Bitcoin that is increasing in price, it’s a decrease in value of the fiat currency in which they are priced.”

As shown by last week’s yield curve inversion, there is now a high risk of a recession in the U.S., which means that rate hikes are in conflict with that risk. This should hurt both Bitcoin and stocks.

Spot bulls aim for $50,000

People are talking about the lack of volatility in Bitcoin as April 4 starts.

During the weekly close, there was a lot of excitement, but it quickly faded. The bears were still unable to take the yearly open away as support, data shows.

BTC/USD 1-week candle chart (Bitstamp). Source: TradingView

BTC/USD 1-week candle chart (Bitstamp). Source: TradingView

There, BTC/USD is in the same place it was three months ago, but short-term price signals show that some are already calling for a rise.

TechDev, a well-known analyst, is one of them. On the 12-hour chart, he saw Bitcoin’s first „volatility squeeze“ since January.

12H $BTC volatility squeeze forming.

First since January. This one is during green trend bars.

Breakout arrow will indicate direction when it occurs. pic.twitter.com/5QZDl92p7f

— TechDev (@TechDev_52) April 4, 2022

There are a lot of indicators TechDev used, like the Bollinger Bands measure of volatility. BTC/USD is now riding the middle of the channel with a slight lean to the right.

Odds are already high for a Bitcoin attack on the $50,000 mark, which would be the first this year.

April, on the other hand, has a lot to live up to. This month has been good for Bitcoin in the past, and this year is no different.

Buyers usher coins out of exchanges in March

A lot of Bitcoin has been leaving exchanges this year. The most recent data shows how the supply squeeze is working out.

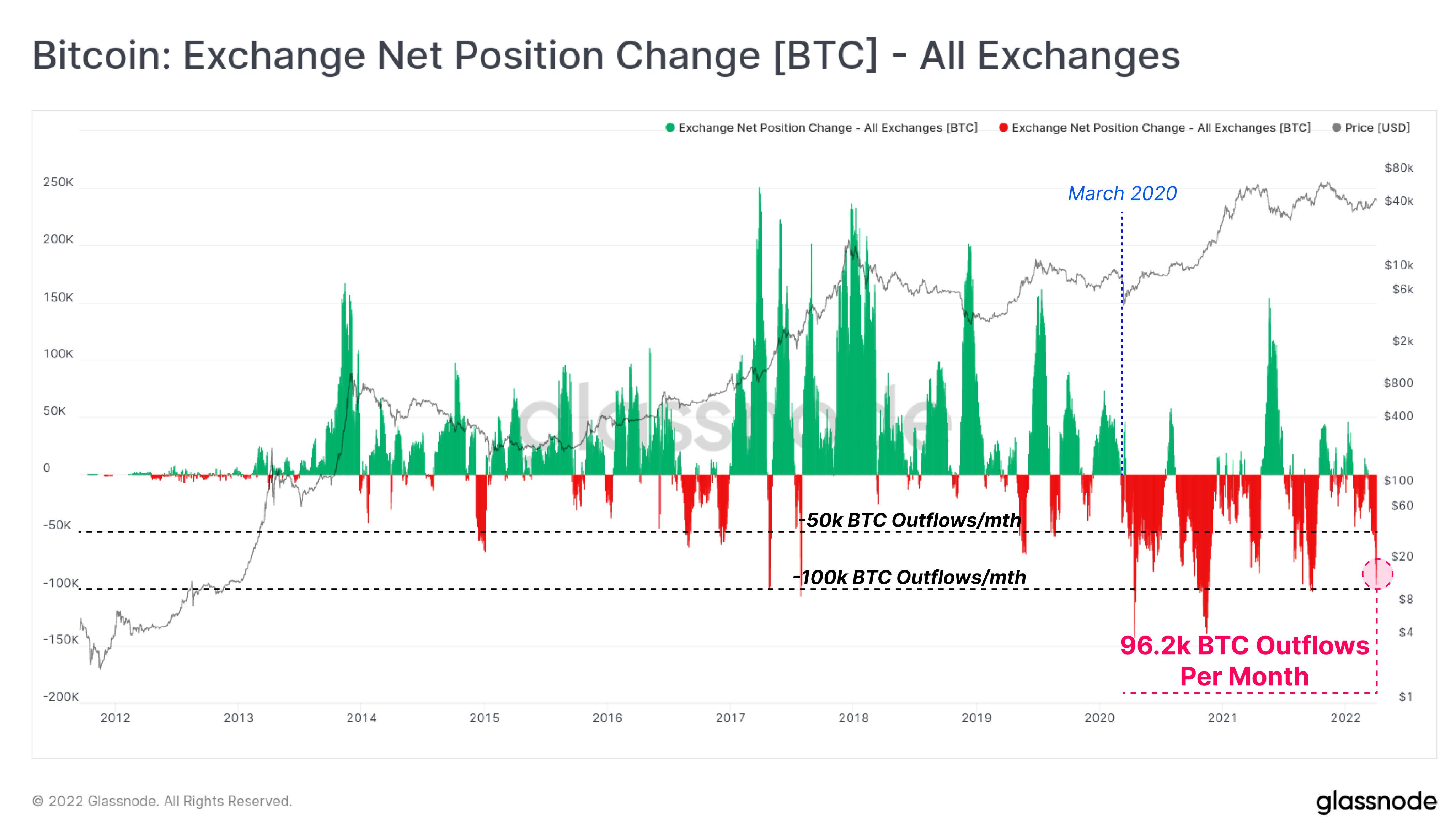

According to an on-chain analytics firm called Glassnode, last month saw a lot of outflows from exchanges. Exchanges are down by the equivalent of almost 100,000 BTC.

There have only been two times in the history of Bitcoin when outflows surpassed 100,000 BTC, making March’s one of the highest.

There have been only a few times in history when „aggregate exchange outflows of this magnitude“ have been seen, most recently after the March 2020 liquidity crisis. Glassnode tweeted a chart with an annotated version of the graph.

Do you think that investors should do the same thing they did when COVID-19 crashed? If so, the consequences should be clear, but it might be a while before they do.

BTC/USD rebounded in 2020, but only in Q4 did prices start to change.

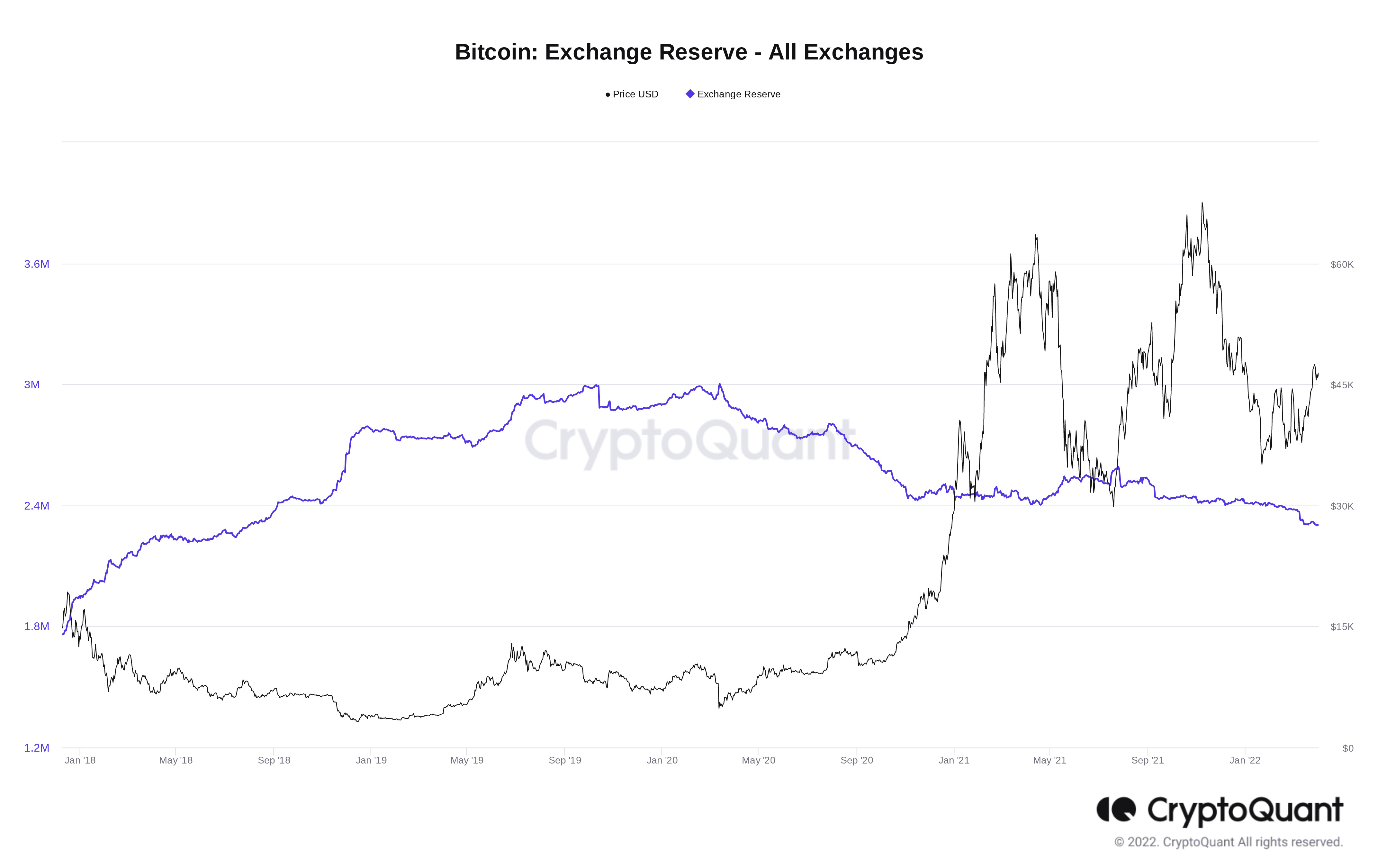

CryptoQuant, which tracks the balances of 21 major exchanges, also shows that overall BTC stocks are at their lowest level since August 1, 2018, when there were 2.303 million BTC in total. This is the lowest level since August 1, 2018.

In March, the start of a long-term downtrend in 2022 got going. A total of 77,000 BTC was moved to private wallets.

Never mind the altseason

An unusual thing has happened when it comes to the relationship between Bitcoin and other types of coins.

This is the first time in more than a year that the combined open interest and volume on altcoin derivatives markets has topped that of Bitcoin.

This was noticed by the crypto analysis tool Coinalyze, which said that the „altseason,“ which has been talked about for years, may be here.

#ALTSEASON ? pic.twitter.com/O0rv3ttwMl

— Coinalyze (@coinalyzetool) March 31, 2022

Founder Gabriel Dodan said in private comments: „It could be that it’s altseason, which means that money is going to alts now.“

Such a view is in line with data that showed a lot of people bought altcoins last week, which one commentator said showed that people were more willing to take risks.

To put it another way, taking the spotlight away from BTC may not be bad for BTC’s performance. That’s because volatility will also be less.

That makes BTC „pretty stable“ because it’s not „over leveraged,“ he said. „It’s a good floor for BTC.“

Hash rate hits new all-time high

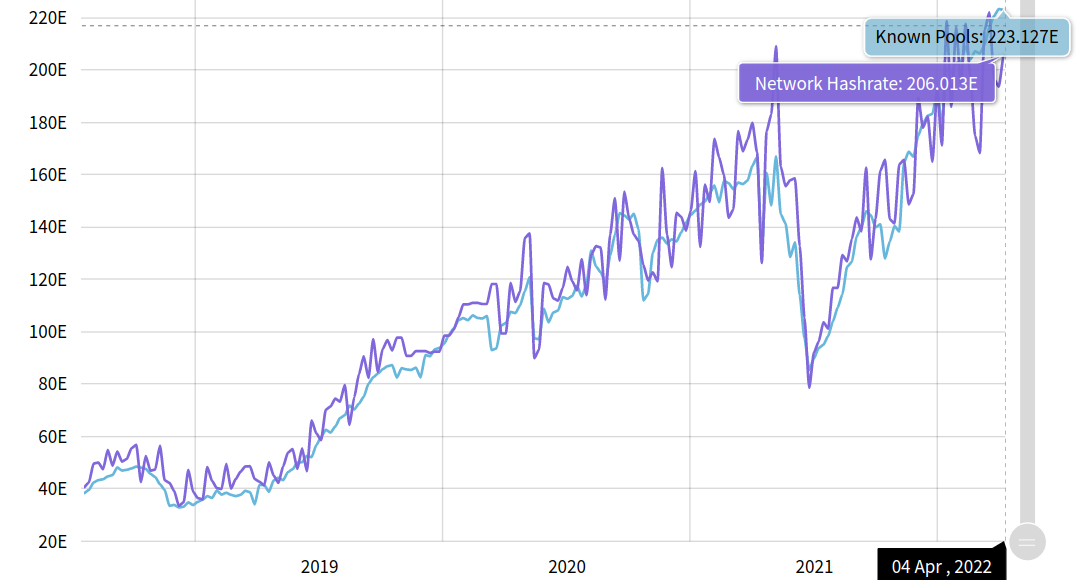

The hash rate for the Bitcoin network hit new all-time highs right after it set a new record for how hard it was.

Coins to keep an eye on this week: Bitcoin (BTC), Ethereum (ETH), Rune (RUN), and AAVE (AVE).

According to a data source called MiningPoolStats, the hash rate now stands at 223 exahashes per second (EH/s). This shows that miners believe that the network will be profitable in the long run.

In the past, the hash rate has never been higher than it is now.

According to proponents, Bitcoin will keep growing even if other people try to „regulate“ it.

Francis Pouliot, CEO of payment processor Bull Bitcoin, said in a well-known blog post about Bitcoin hash rate and energy consumption last year that „Bitcoin mining is pretty much the most anti-fragile system that man has ever come up with.“ This is what he meant.

“Any attack on Bitcoin is guaranteed to make Bitcoin stronger, which itself implies a higher price, a higher hashrate, and higher energy consumption.”

Bitcoin vs. energy is still a very hot-button issue. Many well-known people have taken the time to explain what they think is a logical fallacy: that Bitcoin uses „too much“ energy.

Bitcoin doesn’t waste energy, they say. Instead, they say, it turns it into something more useful, like the best money ever made.

The hash rate, no matter what the story is, keeps going up, which shows that investing in Bitcoin is a good idea.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.