Investors don’t usually complain about a rise in prices unless the chart shows a lot of downside risk, which is very rare.

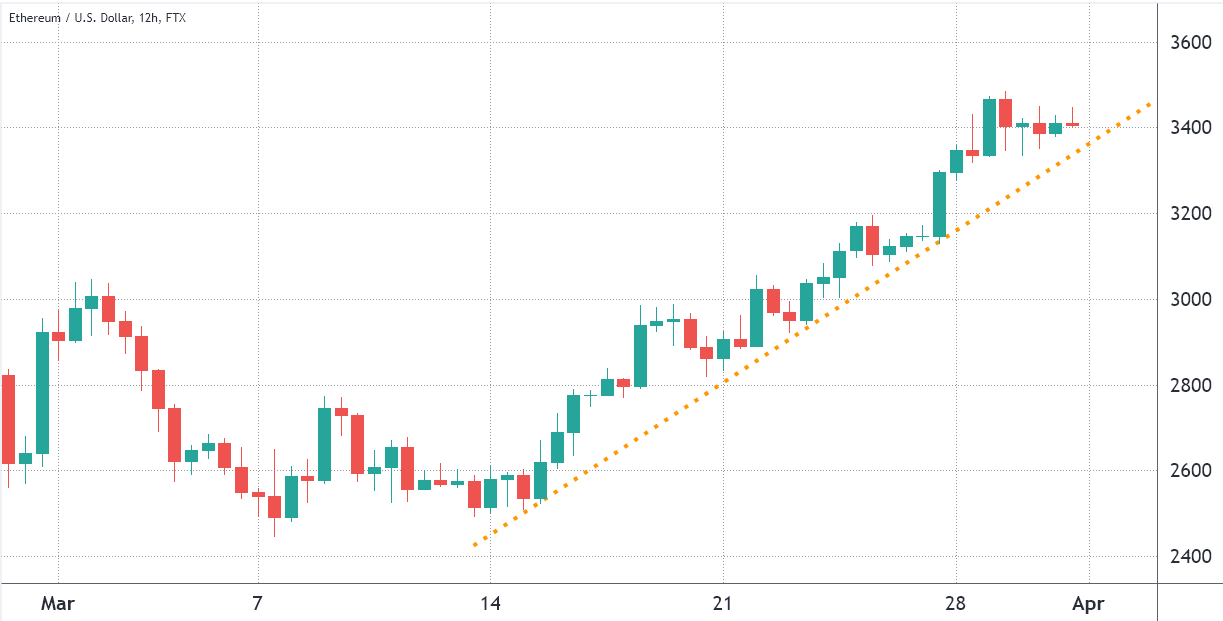

For example, looking at the current price chart of Ether (ETH) could lead someone to think that the upward channel since March 15 is too fast.

So, it makes sense for traders to be afraid that losing the $3,340 support level could lead to a retest of the $3,100 level or a 12 percent drop down to $3,000.

The way traders are positioned and the Ethereum network’s on-chain metrics will play a big role in how this turns out.

On Jan. 23, the total value locked on the Ethereum network reached ETH 32.8 million. Since then, that figure has dropped by 20%, but it still stands at ETH 32.8 million.

TVL looks at how many coins have been put into smart contracts, which include decentralized finance (DeFi), gaming, NFT marketplaces, social networks, collectibles, and high risk.

On March 16, the average transaction fee on the Ethereum network was $8, but it has since gone up to $15.

Thus, one needs to figure out if that means less use of decentralized applications (DApps) or more people benefiting from layer-2 scaling solutions.

Ether’s futures premium shows little excitement

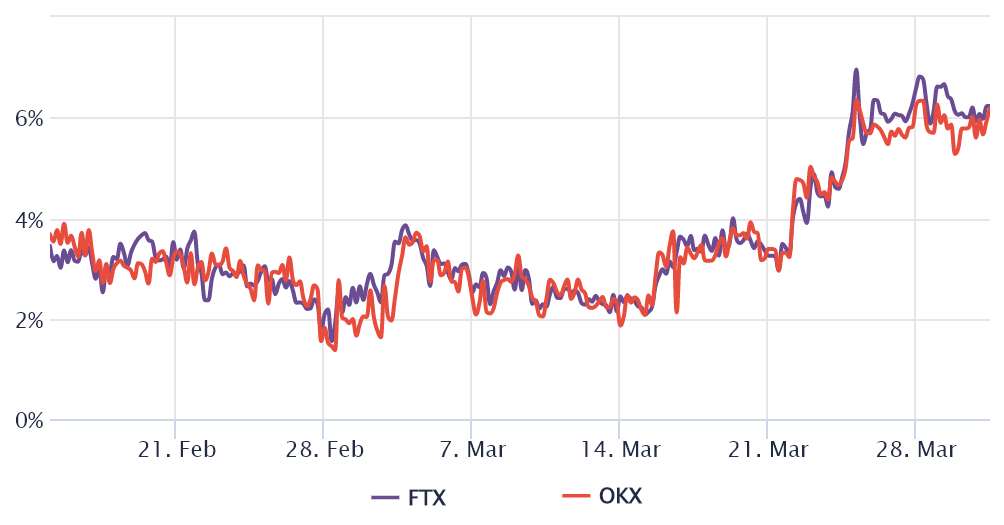

Traders should look at Ether futures market data to see how professional traders are set up.

Whales and market makers like the quarterly contracts because they don’t have the fluctuating funding rate of the perpetual futures, which they don’t like.

The basis indicator looks at the difference between long-term futures contracts and the current prices in the spot market.

People who buy Ether futures should get a discount of between 5% and 12% each year because they’re „locking in“ their money for two or three months until the contract ends.

The 6 percent Ether futures basis is just above the minimum threshold for a market that isn’t too bullish or too bearish.

Annualized futures premiums below 5% are seen as bearish, while premiums above 12% are seen as bullish.

Pro traders aren’t very excited, but in the last few months, there was a 4 percent or less basis rate, which meant that people were more bearish.

Thus, there has been an improvement, but not enough to make people want to buy a lot.

To make sure there aren’t any outside factors that could have affected derivatives data, one should look at the Ethereum network’s on-chain data.

For example, monitoring how the network is used can show us if there are enough real-world use cases for Ether.

On-chain metrics raise concerns

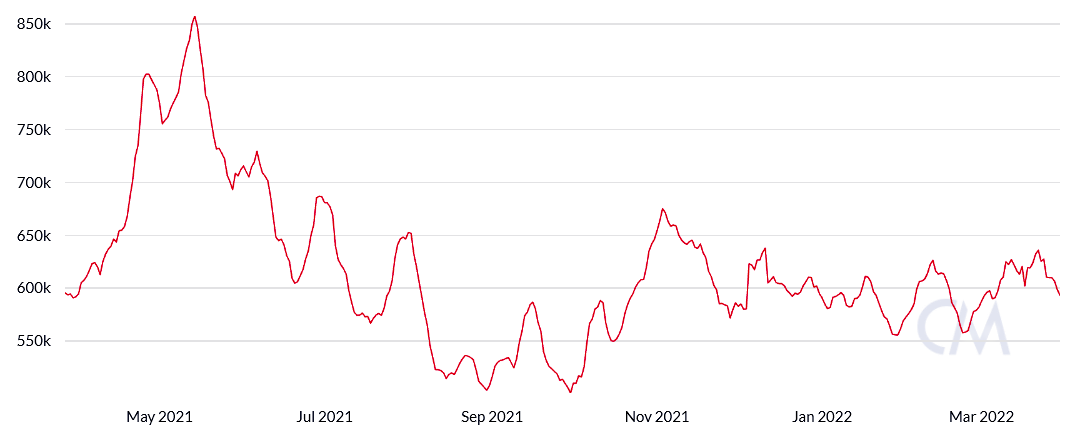

The number of active network addresses is a quick and reliable way to see how well the network is being used.

Of course, this metric could be wrong because layer-2 solutions are becoming more popular, but it’s a good place to start.

The 593,260 daily active address average is up 2% from 30 days ago, but it’s not close to the 857,520 seen in May 2021.

There isn’t a lot of growth in transactions for Ether tokens, at least on the first layer.

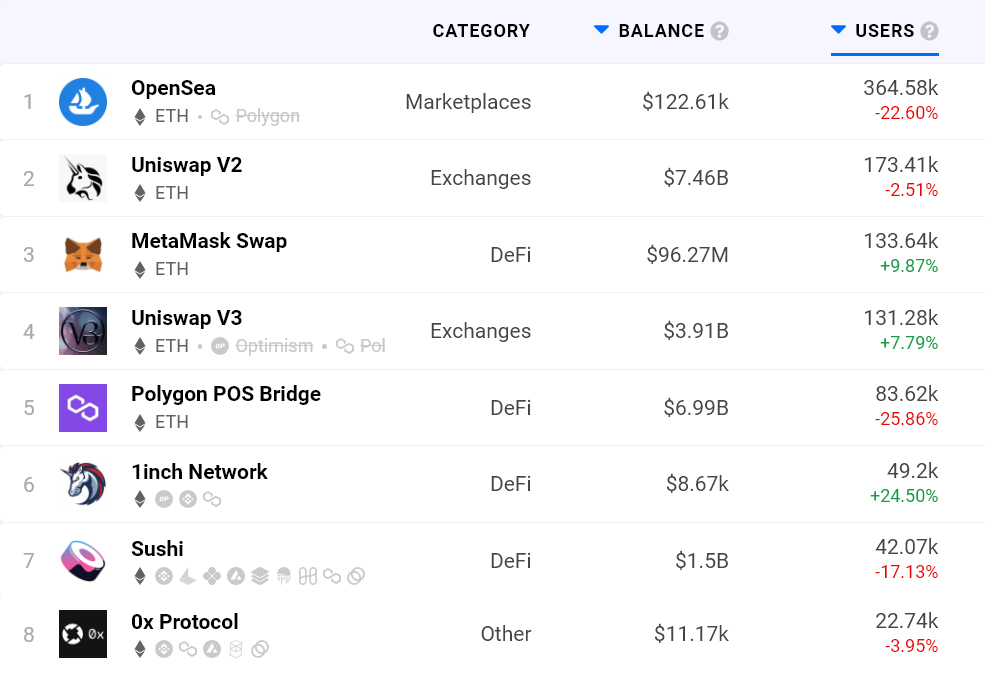

Traders should move on to DApp usage metrics, but they should not only look at the TVL because that metric is mostly used by lending platforms and decentralized exchanges (DEX). Instead, they should look at the number of active addresses.

Ethereum DApps saw an average monthly drop of 11% in the number of active addresses.

Overall, the data isn’t good because the smart contract network was made to run decentralized apps.

As a comparison, the DApps on the Polygon network grew by 13%, while Solana (SOL) saw a 6% rise in users.

If there isn’t a lot of growth in Ether transactions and the use of DApps, the $3,340 daily close support is likely to come down.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.