If you buy the rumors, you can sell the news.

Cryptocurrencies are a type of asset that is only available on the internet, so their prices will be affected by news that quickly spreads on the internet.

Crypto traders who stay up to date on positive news can make huge gains, but it can be hard to navigate the world of crypto news.

Roadblocks: There is a lot of information that could be useful, and it can be hard to make sure you always know the news that is important first.

Extensive research shows that three types of crypto-related events move digital asset prices the most often: listing announcements, staking announcements, and big partnerships.

This information helps to narrow down the range of things that will be of most interest to traders.

What is the best way for crypto people to make sure that they get to the stories that could be important before everyone else?

There are a lot of technological ways to deal with this, from carefully organizing one’s Twitter alerts to using crypto data terminals.

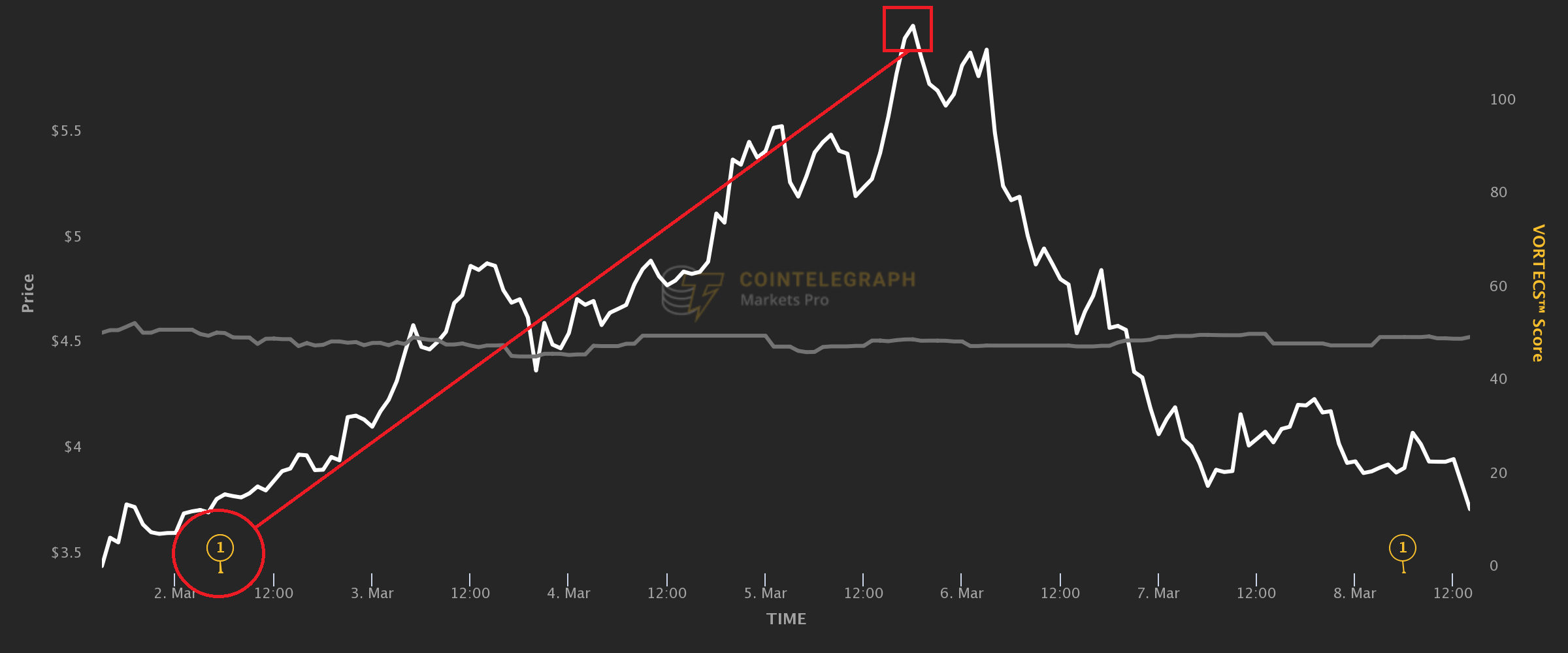

ANC: Staking program announcement kicks off a rally

Announcements about staking can move the market, but they can be even more powerful when the staking program for an asset is launched on a big platform and has good terms.

In this case, Anchor Protocol’s launch on Binance Staking with up to 40% annual percentage yield on ANC met all of our needs!

When the news broke, the token was trading at $3.79. It quickly rose in value after that.

A few days later, the value of ANC hit $4.90, then rose even more to hit $6.00 by March 5.

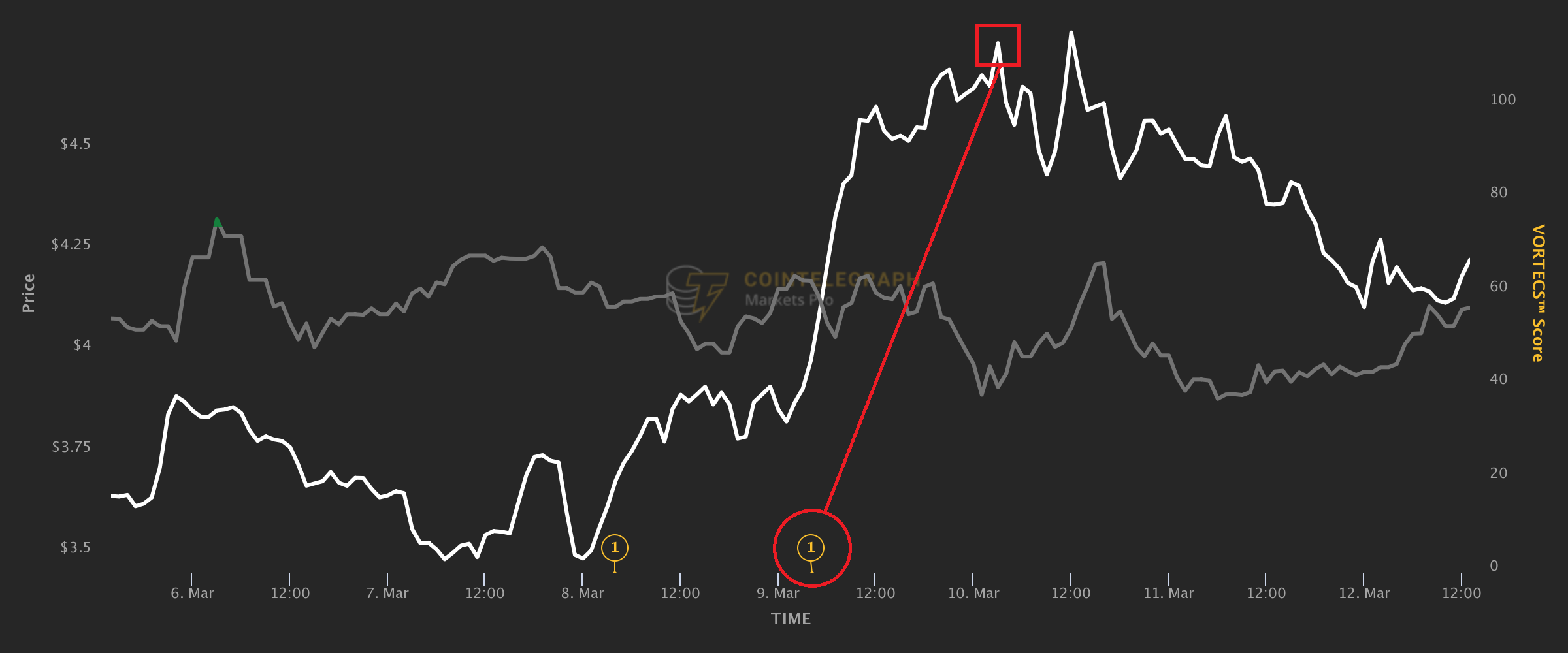

SNX: A double-barreled listing announcement

Another tweet that turned out to be bad had a big impact on the price of Synthetix Network Tokens (SNX).

The news was about SNX’s listing on Binance.US.

On March 8, the first was added to the chart. There were two Twitter announcements about the listing, but the first one didn’t make much of a splash.

People were excited about SNX trading when the red circle in the chart appeared. This news made SNX’s price jump from $3.98 to $4.77 in 23 hours, a 19.8% rise.

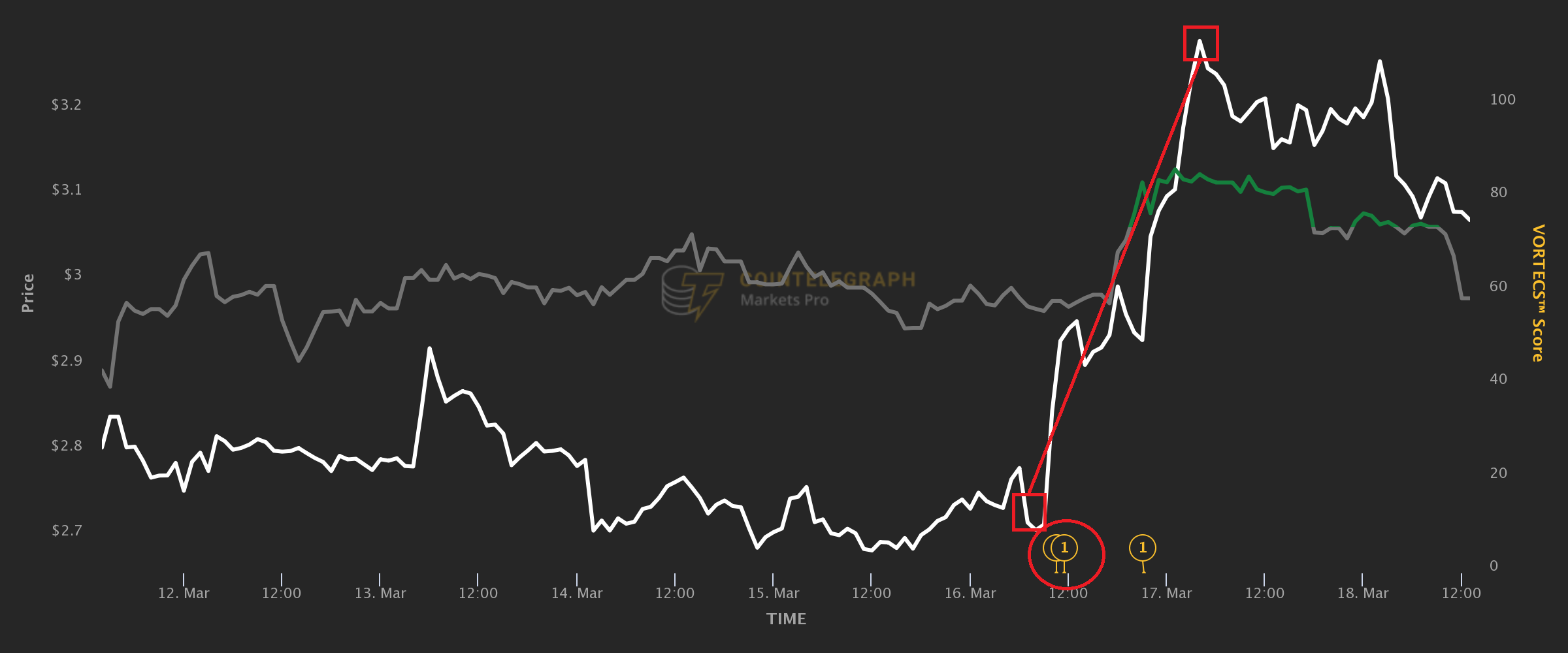

SAND: A big partnership spells big gains

Listing and staking news is more important.

A rule of thumb is that if you hear about a non-crypto company working with a crypto project, the price of the token linked to that project is likely to go up.

HSBC is a well-known banking company that most traders know about.

When it made its way into the Metaverse, thanks to the help of The Sandbox, the SAND token could see a huge rise in value.

Sure enough, the price of SAND rose almost vertically minutes after. In just 18 hours, the price went from $2.85 to $3.28 (a 15% rise).