Over the last few years, Ethereum has seen a lot of growth thanks to events like „DeFi Summer“ and the rise of nonfungible tokens (NFTs).

Ethereum’s popularity, on the other hand, may be to its downfall, as other protocols try to eat away at or completely take over its market share.

Bitcoin and the birth of Ethereum

Bitcoin (BTC) is the mother of all blockchains, and it was the first modern version of what we now call „cash.“

Since then, there have been many attempts to give users more functionality, but most of them haven’t been able to last.

That one is called Ethereum. Its Ether (ETH) coin is now the second-largest cryptocurrency in terms of market value.

Our Research has written a report about how Ethereum got to where it is now. It starts by looking at Bitcoin and how it got there, and then looks at Ethereum’s history and where it is now.

Users could make smart contracts with Ethereum in a way that Bitcoin couldn’t, which helped make Ethereum the top blockchain for DeFi.

A lot of things have been done to improve Bitcoin’s DeFi capabilities, mostly by using layer-2 solutions like the Lightning Network, the Portal, and the DeFiChain to help it grow.

Then again, Ethereum is still in the lead in the DeFi space, but can it stay there?

The current strengths and weaknesses of Ethereum

In 2021, Ethereum saw a lot of new users. In November, there were 800,000 people who used it every day.

It has real-world applications, and in 2021, there will be more than $150 billion worth of DeFi applications running on the blockchain.

Some of the things that decentralized apps on Ethereum can do for you include lending, derivatives, asset management, stablecoins, trading, and insurance.

However, due to the rise in popularity of the blockchain over the last few years, its popularity is also a curse.

Transaction costs, or „gas fees,“ go up as more people use the network. This makes the network more crowded, which means the costs go up.

There are fees in place to encourage the network’s miners to participate in the proof of work system that the network is based on, which is why they are there.

As part of what is called „Ethereum 2.0,“ Ethereum is going to switch to proof-of-stake and make other changes. This will help solve the problem of congestion and scaling.

Some of these stages of Eth2 may not go live until later, and the popularity of other smart contract blockchains may also make Ethereum lose the crown on its head.

New kids on the block

In 2021, Ethereum saw a lot of new users. In November, there were 800,000 people who used it every day.

It has real-world applications, and in 2021, there will be more than $150 billion worth of DeFi applications running on the blockchain.

Some of the things that decentralized apps on Ethereum can do for you include lending, derivatives, asset management, stablecoins, trading, and insurance.

However, due to the rise in popularity of the blockchain over the last few years, its popularity is also a curse.

Transaction costs, or „gas fees,“ go up as more people use the network. This makes the network more crowded, which means the costs go up.

There are fees in place to encourage the network’s miners to participate in the proof of work system that the network is based on, which is why they are there.

As part of what is called „Ethereum 2.0,“ Ethereum is going to switch to proof-of-stake and make other changes. This will help solve the problem of congestion and scaling.

Some of these stages of Eth2 may not go live until later, and the popularity of other smart contract blockchains may also make Ethereum lose the crown on its head.

Can Ethereum hold its position in 2022 and beyond?

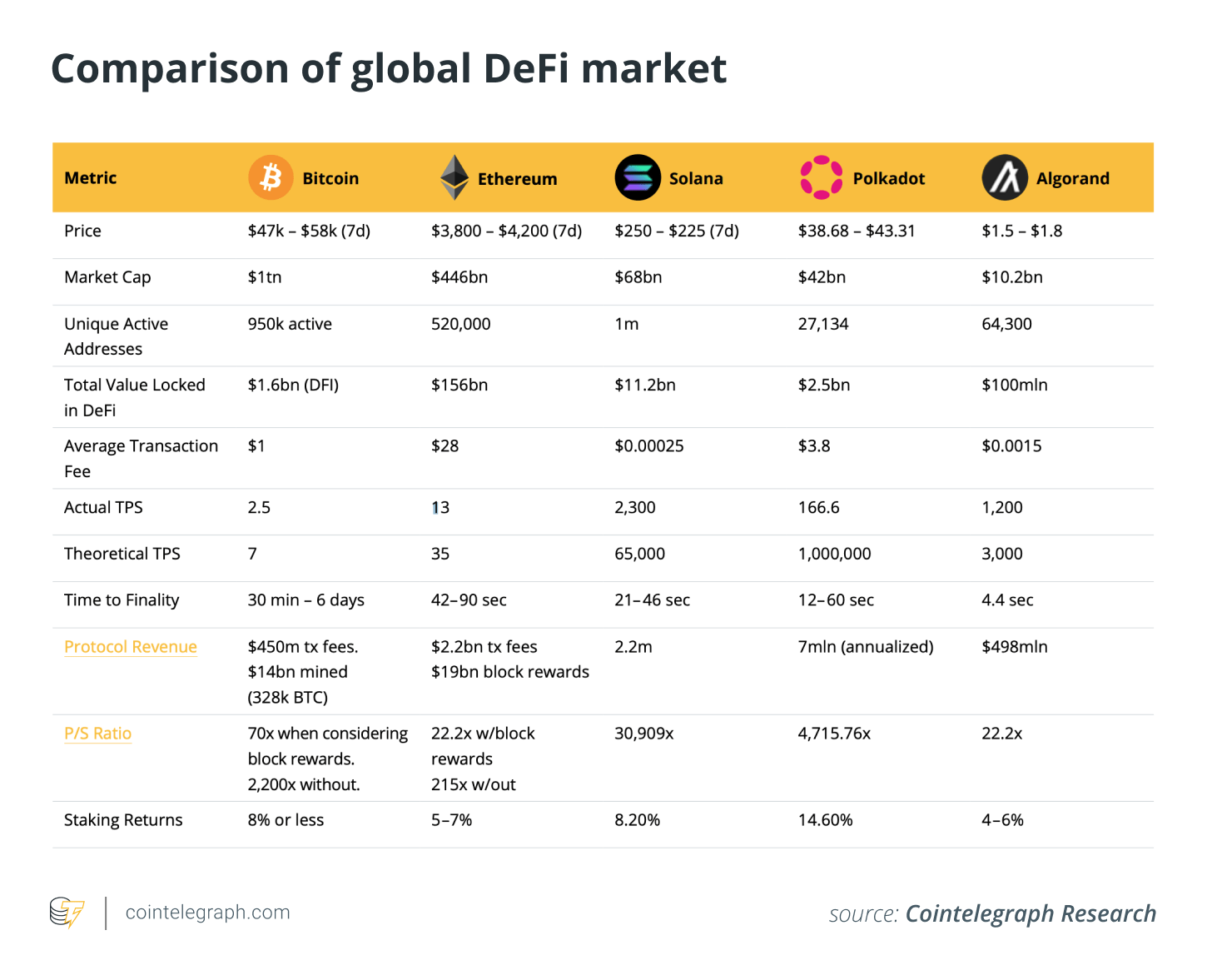

Ethereum is up against a lot of other coins, like Solana, Polkadot, and Algorand, which are all very good at what they do.

Each has a solution for Ethereum’s current problems.

This means that if the full rollout of Eth2 doesn’t go well or keeps getting pushed back, these newer protocols would be more than happy to take over for Ethereum.

This article is for information purposes only and represents neither investment advice nor an investment analysis or an invitation to buy or sell financial instruments. Specifically, the document does not serve as a substitute for individual investment or other advice.