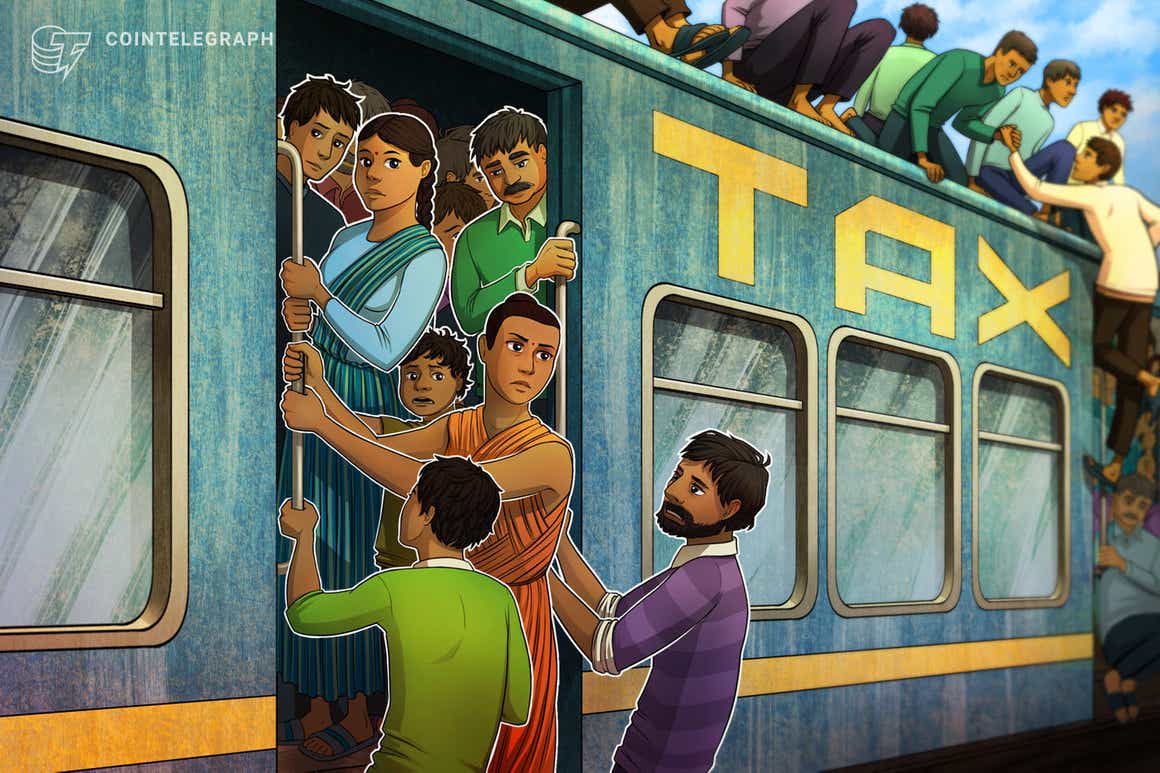

In February, Indian Finance Minister Nirmala Sitharaman proposed taxing the relatively unregulated digital asset market.

The idea taxes crypto earnings at 30% and crypto exchanges at 1% on transactions over 10,000 Indian rupees ($133).

The declaration came during the legislative budget session for 2022, and the government has already given crypto exchanges until April 1 to comply.

An official from India’s Central Board of Direct Taxes refuted the widely reported adoption of the crypto tax as legal recognition of cryptocurrencies in India.

Sitharaman told Parliament a few days later that the government will simply tax digital assets‘ profits and not recognize them legally.

The legitimacy of the crypto market will be decided following the enactment of relevant laws.

„Banning or not banning will come subsequently when the consultation gives me inputs but then would you rather have me not tax & allow the profits to be there. „

„I will tax because its sovereign right to tax.“

-FM Nirmala Sitharaman on Crypto pic.twitter.com/VUSmaODR7Z

— Crypto India (@CryptooIndia) February 11, 2022

30% crypto tax would do more harm than good

The crypto tax rate of 30% is roughly double the corporation tax rate of 16%.

Some exchanges welcomed the move as a step toward recognizing the unregulated crypto market, while many traders termed it retrograde.

Representatives of Indian crypto exchanges met with senior Finance Ministry policymakers to urge them to reconsider the proposed tax laws.

Small dealers would be discouraged and assets would be transferred to overseas exchanges, according to The Economic Times.

They also explained how difficult it would be to collect TDS on foreign exchange transactions with no data to trace.

The group discussed the difficulties of applying the tax without clear regulations.

However, despite the government’s insistence that taxes does not imply legal acceptance of cryptocurrencies, Sumit Gupta, co-founder and CEO of Indian crypto exchange CoinDCX, said the proposal was a historic step that gives digital asset markets more validity.

Gupta stated of the high tax level and associated complexities:

“There have been some discussions regarding the 30% taxation figures, with some suggesting that it is a huge percentage bracket that may potentially deter greater innovation in the sector and serve as a barrier to investors and digital finance users.”

Beyond the high tax rate, there are also ambiguities, especially about tax deductibility at source.

TDS certain areas remain vague, slowing crypto adoption.

However, we must remember that this is only the beginning of crypto’s journey, and we look forward to more regulatory advancements that will help build and support the future of finance.”

Some say the tax idea was hurriedly revealed, with the government aiming to tax profits but leaving losses to traders.

Small traders may be discouraged by the high tax rate, leading to an exclusive market.

Crebaco CEO Siddharth Sogani said:

“Such a tax framework indirectly discourages anybody to enter into crypto since a 30% tax, 1% TDS, and goods and services tax of 18% is levied on every transaction (on the brokerage/service fee). This becomes heavy on the pockets as well as very difficult to comply with since, in crypto, there are thousands of transactions per user every month. Previously, before this framework was announced, many paid taxes under the income from other sources under the payable tax slab. Losses, if any, got carried forward. In crypto, a bear market can last for a couple of years, and hence, losses (if any) should be allowed to be carried forward.”

Retail traders have already reacted angrily to high taxation in several countries.

South Korea had to postpone its 20% crypto tax proposal due to unclear legislation, while Thailand had to withdraw its 15% tax proposal due to retail trader opposition.

The Indian government should take heed of global regulatory changes to create a balanced framework.

Crypto exchange CEO Nischal Shetty hailed the taxes as a great step.

He said:

“India is finally on the path to legitimizing the crypto sector in India. So, it’s phenomenal news for everyone to learn about the GOI’s [Government of India’s] forward-looking approach toward crypto while we deliberate on the finer details as an industry. We believe that potential crypto investors sitting on the sidelines are now ready to access and participate in crypto. Therefore, pioneers in the space want to build a conducive ecosystem for crypto and are collectively deliberating on the implications of the current tax regime proposed at the grassroots level.”

Crypto taxes could deter foreign investment

Despite regulatory uncertainties, the Indian crypto industry has thrived for three years.

However, despite the fact that the Indian government has yet to approve a draft crypto bill, global venture capital firms and crypto exchanges have been eyeing the large Indian market.

Several Indian crypto exchanges have become unicorns (worth $1 billion or more) in recent years, attracting Wall Street investment.

However, recent complex tax policies may derail their goals.

Sogani stated:

“I got a call from one of the top three crypto exchanges in the world, who are considering entering India, but after yesterday’s announcement, they seem to be holding back the idea. Just because of the complexity involved around the taxation of crypto. Clearly, a complicated tax framework will discourage international companies from investing and starting operations in our country. India is a huge potential market for crypto due to the population strength we have.”

TDS compliance and a high tax rate appear to be deterring multinationals and exchanges from setting up shop in the country.

Crebaco has estimated that around 10,000 young Indians are currently employed by Indian exchanges and crypto-focused businesses. Also, Indian coders are getting many freelance chances from all over the world, and new tax restrictions are encouraging “brain drain”.

India’s crypto taxation policies are now a contradiction.

However, the government maintains that legal recognition of crypto can only be determined if the necessary legislation are introduced.

It has only complicated things for India’s crypto traders and entrepreneurs.