Cryptocurrency may possibly be the most effective asset for working day trading. Not only due to the fact the market is open up 24 several hours a working day, 7 days a week, but also since the market place is unstable. Get Bitcoin as an instance. Its volatility has exceeded 10% in the past 2 times, but it has fallen by 50% in a week in March 2020. Although significant volatility may well direct to a significant variety of liquidations, on other hand, it gives traders with much more juicy alternatives to make money.

Top crypto futures investing system Bexplus presents some suggestions for working day traders to observe so they could far better defend their cash in risky markets.

Idea 1: Begin with smaller capitals

Beginning modest enables you to go a extended way. It is suggested that you divide your capitals for a number of positions. So if the market place goes against you, you can allocate a place in the opposite direction to hedge decline.

Recall, in futures trading, the obtaining electric power will drastically enlarge with the support of leverage. For instance, if you open up a situation making use of .01 BTC and 100x leverage, the placement will worth 1 BTC.

Tip 2: Practice and make improvements to your abilities and procedures

Earning money by speculating on the rate movements would seem like gambling, but it’s not. Prosperous traders are those who understand to evaluate the marketplace, continue to keep by themselves abreast of marketplace information, and maintain striving out diverse strategies. Choose a platform that delivers a designed-in investing simulator for you to practice. A excellent demo account serves as a sandbox for you to make improvements to your skills and get acquainted with the speedy-altering industry. Besides, some platforms even provide consulting expert services or own account professionals to end users.

Idea 3: Abide by a individual strategy

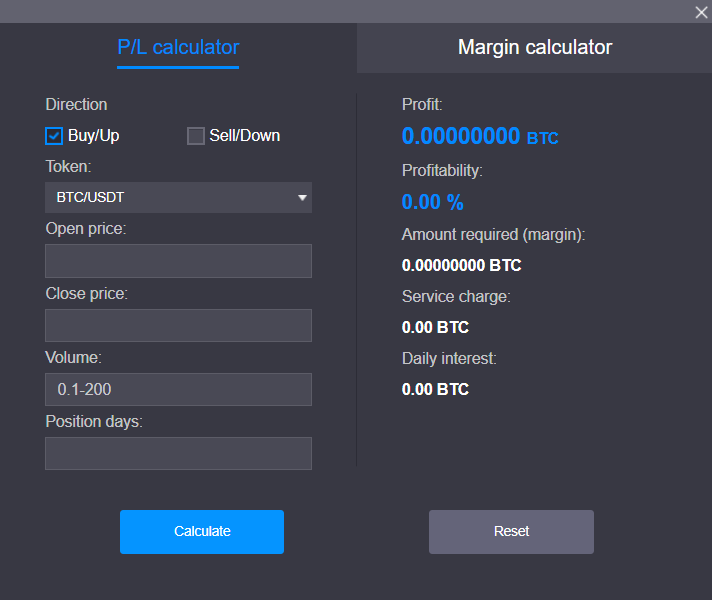

A person blunder virtually just about every trader would make in their investing career is dropping their heads. It is so quick to succumb to emotions that we fall short to exit a shedding posture or get income whilst we can. To grow to be an expert trader, you need to have a correct approach so that you know when to sell and when to obtain. It will enable you to make the conclusions that are very best for you. Aside from, you can select a platform with a P/L calculator so you can know in advance when to close your positions.

Suggestion 4:Trade on help and resistance

Assist is a put where the value tends to obtain help as it falls. This indicates that the rate is extra possible to get better from this degree as an alternative of slipping underneath it. As for resistance, it is the place the place the price has the biggest problem breaking. If the value is close to the assist at an uptrend, you could set a very long get.

For occasion, the $18,000 level is thought of as the new resistance degree of bitcoin, even though the $17,000 is the assist. If we use 100x leverage to open a very long position with .1 BTC at $17,000 and close it when the cost reaches $18,000, we will generate ($18,000 – $17,000) * 10 BTC/$18,000 = .55 BTC.

Tip 5: Maintain up with the marketplace

When it will come to investing and buying and selling, information can make or crack a trader. This is specifically genuine for Bitcoin, which is traded all around the clock and notorious for its significant volatility.

There is a selection of information web-sites concentrating on cryptocurrencies. Aside from all those, social media is a go-to supply for information, for lots of analysts and industrial elites like to share their insights on social media. Some platforms also offer you day by day market place analysis and industry news on their web site to traders.

Bexplus is a suggested leverage buying and selling system that doesn’t have to have any KYC. Registration is staying carried out by means of E-mail verification and customers can get a demo account with 10 BTC. Bexplus platform delivers its users with a 100% deposit reward, an affiliate plan with up to 50% fee reward and 24/7 shopper support.