In the cryptocurrency world, big price changes and 100x gains get a lot of attention because they promise to make people rich quickly.

In reality, there aren’t many chances to do this in real life.

It also doesn’t help that only a few traders are able to catch these waves and get out in time to make money that could change their lives.

Fortunately, it’s not the only way for crypto investors to make money. The rise of decentralized finance (DeFi), nonfungible tokens (NFTs), and the slow adoption of crypto by the general public means there’s almost always a new investment opportunity.

People who own crypto can make money without having to trade. Let’s look at five ways they can do this.

Staking

Staking is one of the best ways to get a return on assets in a crypto-based portfolio. Staking is when users lock tokens on a protocol as collateral for transactions.

A proof-of-work consensus model will be changed to a proof-of-stake consensus model in August. Ether (ETH) holders who stake in the Eth2 contract can earn up 5.83 percent of the value of their ETH.

Locking your coins in a node on the network is a way for token holders to be involved in verifying transactions and making new blocks of data. The nodes then compete for the chance to verify transactions, make new blocks, and get the rewards that come with it.

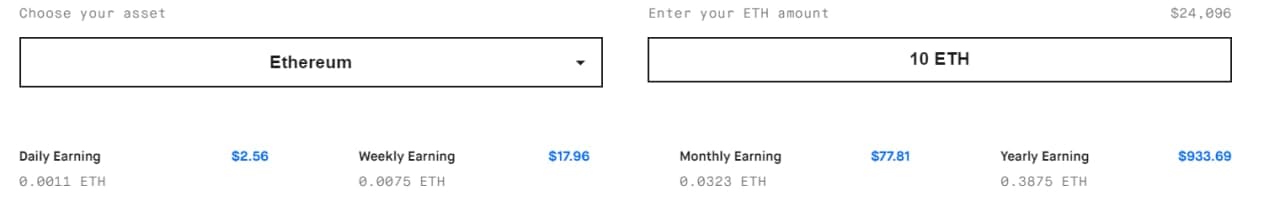

According to data from Staking Rewards, if you stake 10 Ether, you’ll earn $17.96 a week and 0.3876 ETH a year. That’s worth $933.69 at today’s prices.

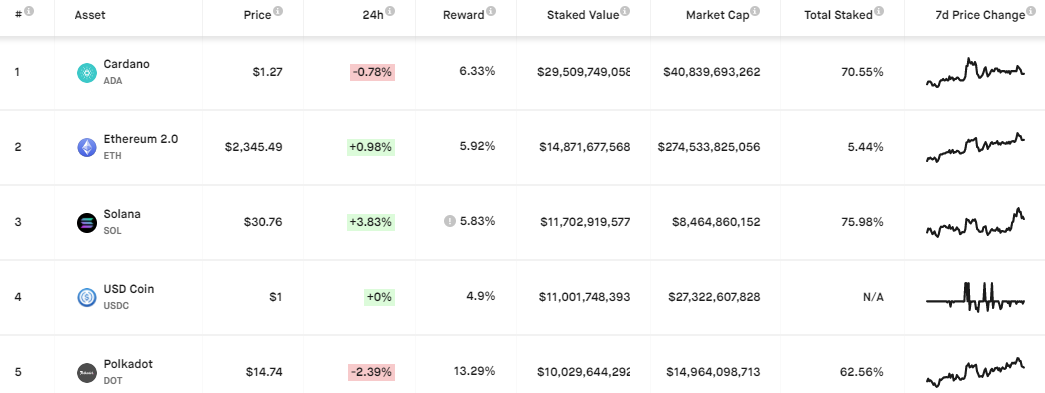

To figure out how much Ether you’ll get back for staking. Staking pays off.In the long run, the percentage yield for Ether may change because more tokens are locked in.Cardano’s ADA, Ethereum, Solana (SOL), USD Coin (USDC), and Polkadot (POL) are the top five crypto assets by staked value at the moment, but that could change (DOT).

To figure out how much Ether you’ll get back for staking. Staking pays off.In the long run, the percentage yield for Ether may change because more tokens are locked in.Cardano’s ADA, Ethereum, Solana (SOL), USD Coin (USDC), and Polkadot (POL) are the top five crypto assets by staked value at the moment, but that could change (DOT).

All things considered, staking is one of the best low-risk ways to get more crypto even if the market doesn’t do well. It also helps the network by validating transactions.

To get low-risk returns, lend crypto and get paid back in crypto.

There has been a lot of growth in this field, which has led to a wide range of crypto lending ecosystems. People can deposit their cryptocurrencies into different lending protocols and get rewards in the underlying token or other assets, like Bitcoin (BTC), Ether, and other altcoins.

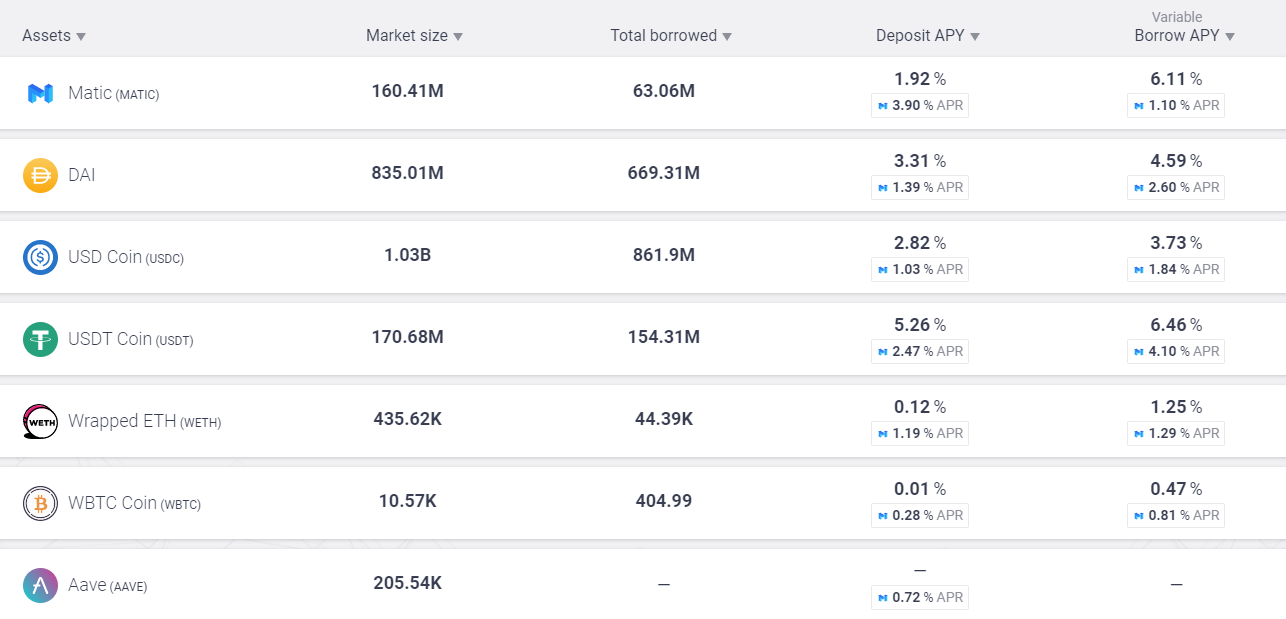

Aave is the best way to lend money at the moment. The platform allows tokens on the Ethereum and Polygon networks to earn money with its own coin, MATIC.

It shows the top seven lending pools available through the AAVE protocol on Polygon. Rewards are paid in Wrapped MATIC (WMATIC), with the current deposit annual percentage yield (APY) being 1.92 percent and a year’s estimated APY of 6.1 percent, which is what you get for your money.

Curve (CRV), Compound (COMP), MakerDAO (MKR), and Yearn.finance are some of the other top lending protocols (YFI).

lending is another low-risk way to earn a good return on tokens that don’t offer user-controlled rewards like staking. Lending is good for both bull and bear markets.

Earn money and tokens by giving people money.

Liquidity is one of the most important parts of a DeFi platform, and investors who give money to new platforms are often rewarded with high percentage returns on the money they put in, as well as a share of the fees that come from transactions in the pool.

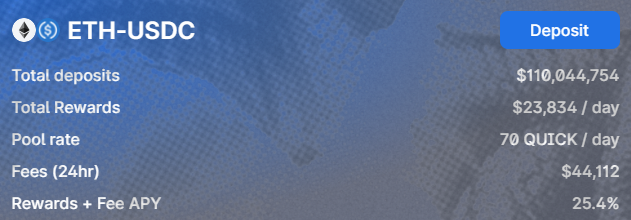

Investors who provide liquidity to an Ether/USDC pool on QuickSwap will get a share of the $23,098 in rewards that are given out each day and a fee APY of 33.81 percent.

Long-term investors should look into the pools that are available on the market. If a liquidity pair made up of good projects or even a stablecoin pair like USDC/Tether (USDT) looks appealing, it could be the blockchain version of a savings account that pays out far more money than can be found in any bank or traditional financial institution.

Yield farming is a way to make the most money.

Yield farming is the idea of putting crypto assets to work in a way that makes the most money while minimizing risk.

High incentives are given to depositors when new platforms and protocols start up. This is a way to get more money and increase the total value that is locked up (TVL) on the protocol.

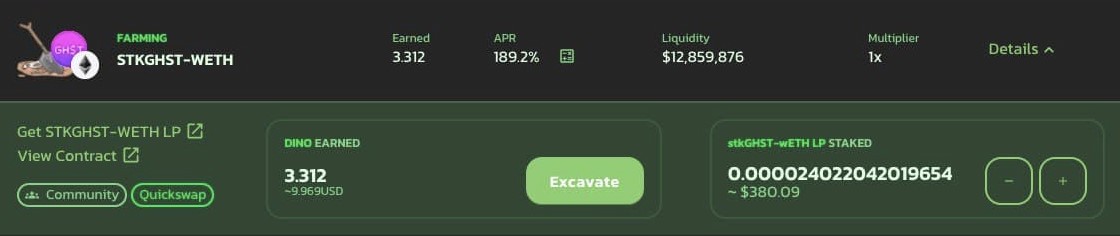

Rewards for STKGHST-WETH LP deposits on DinoSwap. Source: DinoSwap

The high yields are usually paid out in the native token of the platform, like the one shown above, where a user has deposited a liquidity pool token for a STKGHS-WETH pair that has an APR of 189.2% and has so far earned 3.312 DINO.

When you have a lot of different tokens in your portfolio, yield farming is a good way to get a taste of new projects and get new tokens without having to spend money.

This is why DinoSwap’s (DINO) TVL rose above $330 million a week after it was launched, and why it did so quickly.

NFT and blockchain gaming make it possible to „play to earn.“

Another way to make money from a crypto portfolio without having to spend more money is to play games on the blockchain and collect NFTs.

Axie Infinity is the most popular example right now. In the game, you trade, fight, collect, and breed NFT-based creatures called Axies.

In the game, Smooth Love Potion (SLP) is used to breed Axie and can also be traded on major cryptocurrency exchanges. Users can trade SLP for stablecoins that are backed by the dollar or other big-cap coins.

It says that the average player makes between 150 and 200 SLP per day, which is worth between $40 and $53.50 at today’s prices.

This is how much money a full-time job makes in some places. Because of this, Axie Infinity has seen a huge rise in users and new accounts in countries like Venezuela and Malaysia.

A lot more money can be made with crypto investing, lending, staking, and play-to-win blockchain games than with savings and checking accounts at traditional banks. People are likely to keep investing in platforms that pay them to use the blockchain protocol.

Want to learn more about trading and investing in crypto markets?

In this post, the author says what he thinks and doesn’t always agree with CoinNewsDaily. Every time you invest or trade, there is a chance you could lose money. You should do your own research before making a decision.