2021 is going to be known as the year of non-fungible tokens (NFTs).

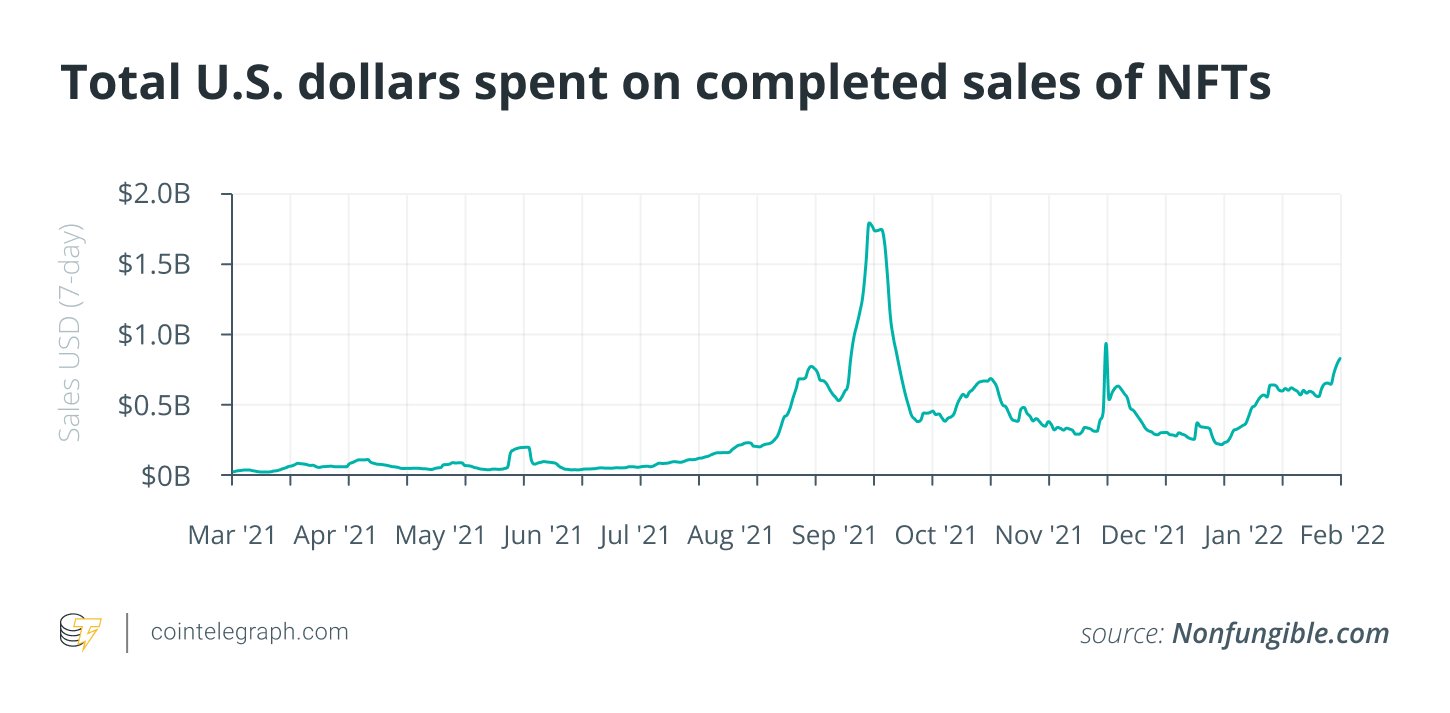

In a year where people like Beeple and Bored Ape Yacht Club were in the news, it’s thought that NFTs have made more than $23 billion in trading volume.

The rise of NFTs has led to a new group of investors who spend a lot of time on platforms like Discord and OpenSea looking for the next 100x chance.

NFT investors of today should keep tax implications in mind, but that doesn’t mean they don’t need to think about them.

Otherwise, they could make the same mistakes they did in the past.

A lot of crypto traders were in a bad situation after the big rise in prices in 2017.

During the time when the market was going up, they had a lot of tax debts. They didn’t have the money to pay them after the crash.

Many of these traders didn’t know about the tax consequences of their transactions and didn’t plan for them.

NFT investors should know about taxes in this article. If they want to take profits without getting in trouble with the IRS, they need to know these three things.

You are likely taxed when you purchase your NFT

To put it another way, buying an NFT with Ether (ETH) or another cryptocurrency is taxed.

You’ll get a capital gain or loss based on how much your crypto has changed in value since you first got it.

Many NFT traders have to pay a lot of money in taxes because the value of their coins has gone up a lot since they were first given to them.

Every time you make a trade, you should figure out how much taxes you might owe and try to save the money until tax season comes around.

You are taxed when you sell your NFT

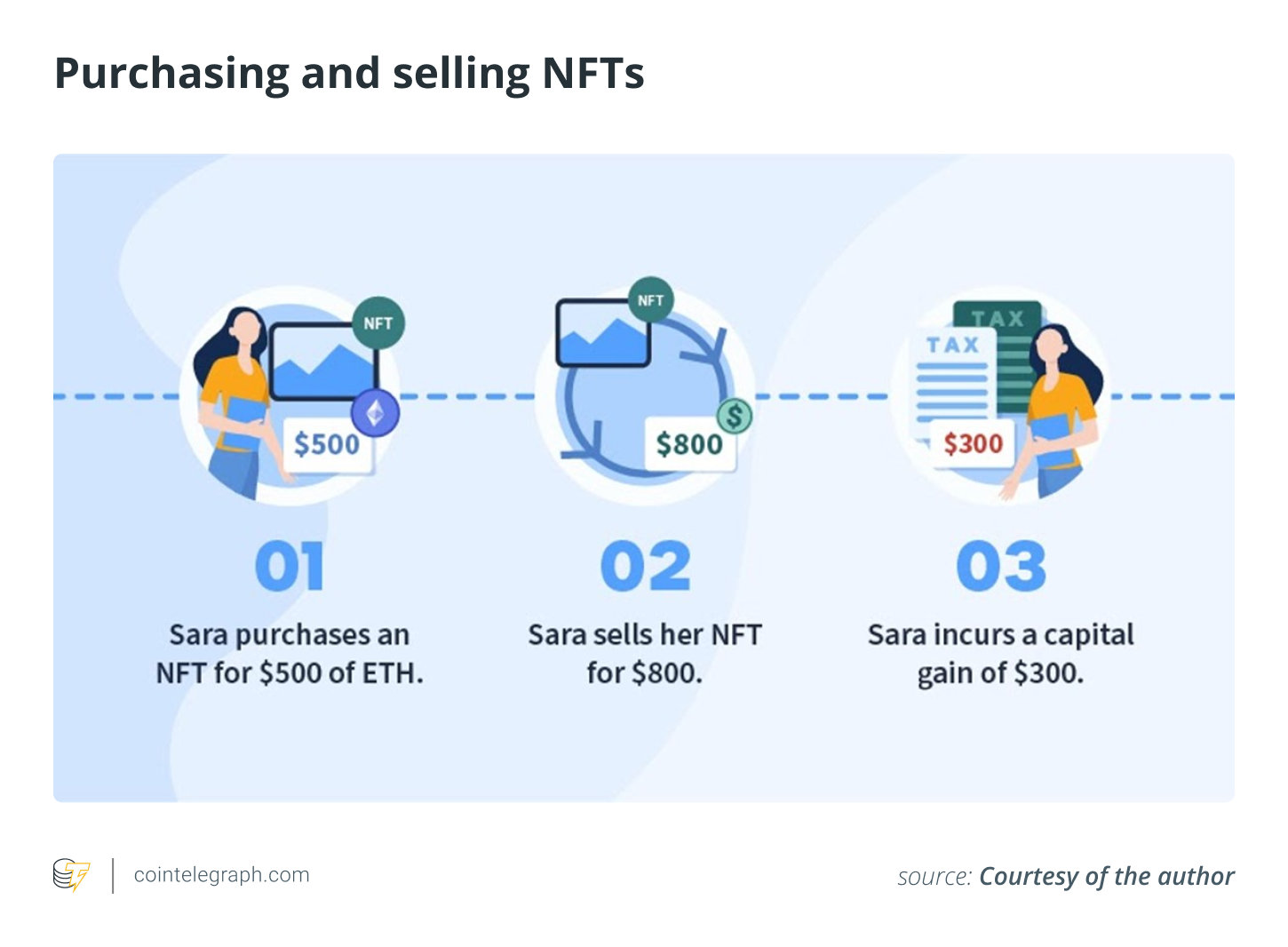

In the same way that selling your NFT is a taxable event even if you’re selling it for cash, crypto, or another NFT, you’re also selling your NFT.

NFTs are taxed like cryptocurrencies. When you sell your NFT, the difference between your original cost basis when you bought the NFT and the gross proceeds you get from selling is what you pay in taxes.

If the value of your NFT has gone down since you first got it, you can claim a capital loss and lower your tax bill if you own your NFT as an investment, not for your own use.

If you look at why you bought an NFT, you can figure out whether it’s for investment or personal use.

Do you want to make money, or do you just want to enjoy the NFT for yourself and not think about how much it will be worth?

For example, if you lose money on an investment, you can write off some of your capital gains for the year and up to $3,000 of ordinary income that year.

Expenses for things you do for yourself are not tax-deductible.

Your NFTs may be considered collectibles

Because NFTs are a new type of asset class, it can be hard to figure out how to tax them.

It’s a shame, but the IRS hasn’t yet given clear tax advice on whether some NFTs will be taxable at a higher rate.

According to tax law, some physical things are called collectibles.

Among these things are art and collections of metals, like gold, as well as stamp and baseball card collections.

A top rate of 28 percent is charged on long-term capital gains that are sold after a year. This is much higher than a standard 0% to 20% long-term capital gains rate that most people pay.

It’s logical to think that some NFT art would be taxed as collectibles.

That would likely include one-of-a-kind art, like art made by Fidenza.

Profile picture collections, like the Bored Ape Yacht Club collection, are also good for this

With more than 10,000 unique images in a „collection,“ it’s easy to see why the IRS would think they were valuable.

The problem, on the other hand, hasn’t been solved yet.

Any NFT that isn’t a piece of art is probably not going to fall under the collectible tax rules without more IRS help.

For example, it’s a good idea to think that NFTs representing Uniswap v3 liquidity positions would not be collectibles.

Some people who invest in NFTs are taking a more risky tax option.

They say that without guidance from the IRS, NFTs should not be collectibles because they are not tangible.

People who invest in collectibles are taking this approach because the tax law that applies to them talks about tangible things, which makes things more complicated.

This seems like a hard case to make to the IRS if they want to audit you.

With no guidance, it’s hard to be certain. Some taxpayers might choose to take a more aggressive tax approach because they know IRS guidance on this issue may be years away.

There is a lot to know about collectibles tax law, so it’s a good idea to talk with a tax expert about your digital assets when you’re trying to figure out if they are collectible.

Perhaps most NFT investors don’t care about this right now, but that doesn’t mean it won’t.

People who buy and sell NFTs are likely to buy and sell NFTs that have been held less than a year.

These NFTs are taxed as short-term sales, even if they aren’t collectibles or not. Even if they aren’t collectibles or not.

By thinking about the tax implications of NFTs, you can avoid having to pay a lot of money in taxes in the next year that you didn’t even know about.

People who buy and sell NFTs will most likely have to pay taxes. But figuring out whether your NFT might be a collectible for tax purposes will take a closer look.

When it comes to classifying NFTs, you may still be looking to the IRS for more information. That information may not come any time soon.

People who invest in NFTs may not pay any taxes at all in the short term.